Rental Application Form Utah Withholding

Description

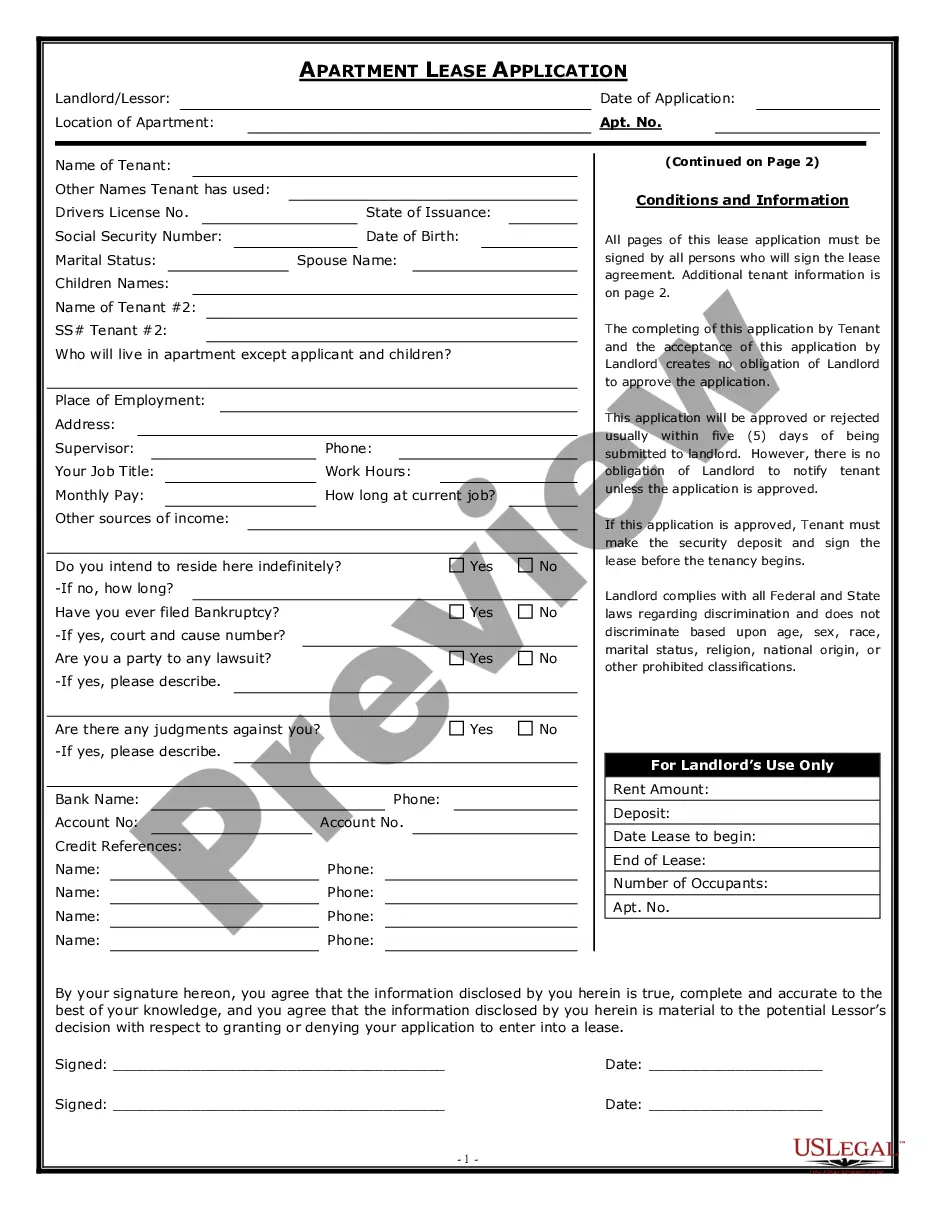

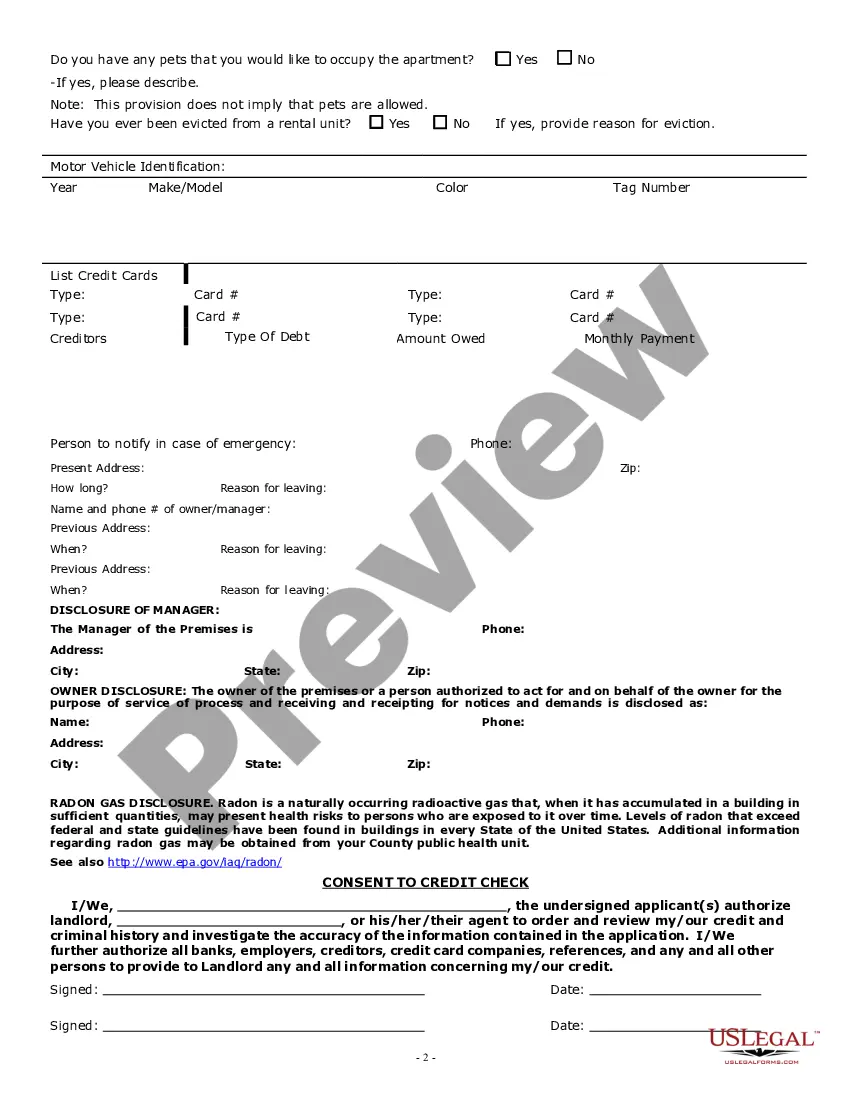

How to fill out Utah Apartment Lease Rental Application Questionnaire?

What is the most reliable service to obtain the Rental Application Form Utah Withholding and other current editions of legal documents? US Legal Forms is the answer!

It's the largest assortment of legal papers for any purpose. Every template is professionally crafted and confirmed for adherence to federal and local regulations. They are organized by region and state of use, making it easy to find what you need.

US Legal Forms is an ideal solution for anyone who needs to handle legal documentation. Premium users can access even more features since they can complete and sign previously saved documents electronically at any time using the built-in PDF editing tool. Explore it today!

- Experienced users of the platform only need to sign in to the system, verify if their subscription is active, and click the Download button adjacent to the Rental Application Form Utah Withholding to obtain it.

- Once saved, the template will be accessible for future use in the My documents section of your account.

- If you do not yet have an account with our repository, here are the steps you must follow to create one.

- Form compliance verification. Prior to obtaining any template, you need to ensure that it meets your usage requirements and complies with your state or county regulations. Review the form description and utilize the Preview if available.

Form popularity

FAQ

To register for a Utah withholding account, visit the Utah State Tax Commission website and complete the employer registration application. The Rental application form utah withholding simplifies the process, offering step-by-step guidance to ensure you provide all necessary information correctly. Once registered, you can efficiently manage your employee withholding tasks.

You can file your Utah TC 40 either online through the Utah State Tax Commission website or by mailing a physical copy to the specified address. Ensuring that you submit all required documents and forms correctly is crucial, and the Rental application form utah withholding provides clear guidelines for filling out and submitting the TC 40 accurately.

Filing withholding tax in Utah involves filling out the appropriate tax forms and submitting them to the state. You can conveniently file your taxes online or by mail, depending on your preference. The Rental application form utah withholding on US Legal Forms offers resources to guide you through this filing process to ensure accuracy and compliance.

Setting up a withholding account in Utah begins with completing the appropriate application form, typically available on the Utah State Tax Commission’s portal. Utilizing the Rental application form utah withholding simplifies this process by providing clear instructions and necessary forms. After submitting your application, you will receive confirmation and details to manage your account effectively.

To obtain a Utah employer registration number, you can register online through the Utah State Tax Commission's website. The process involves filling out an application form, which is streamlined by using tools like the Rental application form utah withholding. Once your registration is processed, you will receive your employer number, allowing you to manage your employee's withholding obligations efficiently.

Choosing the right withholding percentage depends on your income, dependents, and overall tax situation. Typically, you will want to estimate your total tax liability and choose a rate that prevents underpayment penalties. For precise guidance, many individuals find it helpful to consult Utah's withholding guidelines or utilize the resources available through the Rental application form utah withholding feature on US Legal Forms.

The TC 75 form is a Utah state tax form used for various tax reporting purposes. This form is especially relevant for businesses and individuals who need to report their withholding and tax liabilities. If you are managing rental properties, the Rental application form Utah withholding will be beneficial for integrating the necessary information with your TC 75 filings. Always stay up to date with the latest requirements to ensure smooth tax operations.

Yes, Utah has several state tax forms that you must complete for various tax obligations. One important form is the Rental application form Utah withholding, which is essential for landlords and property managers who need to manage state withholdings effectively. By completing these forms correctly, you can ensure compliance with state regulations. It's advisable to check the Utah State Tax Commission's website for the latest forms and instructions.

To secure an apartment in Utah, you need a completed rental application form in Utah withholding, proof of income, and identification. Many landlords also consider your credit history and rental references during their selection process. Therefore, having all your documents ready can make a significant difference in how quickly you can finalize your rental. Moreover, being prepared to present additional information showcases your reliability as a tenant.

Yes, there is a specific Utah withholding form that employers must use when reporting withheld taxes. This form captures necessary information to ensure compliance with state tax laws. As a landlord, ensuring that you have the correct rental application form in Utah withholding helps keep your financial records accurate. It’s important to stay updated with any changes to these forms to avoid penalties.