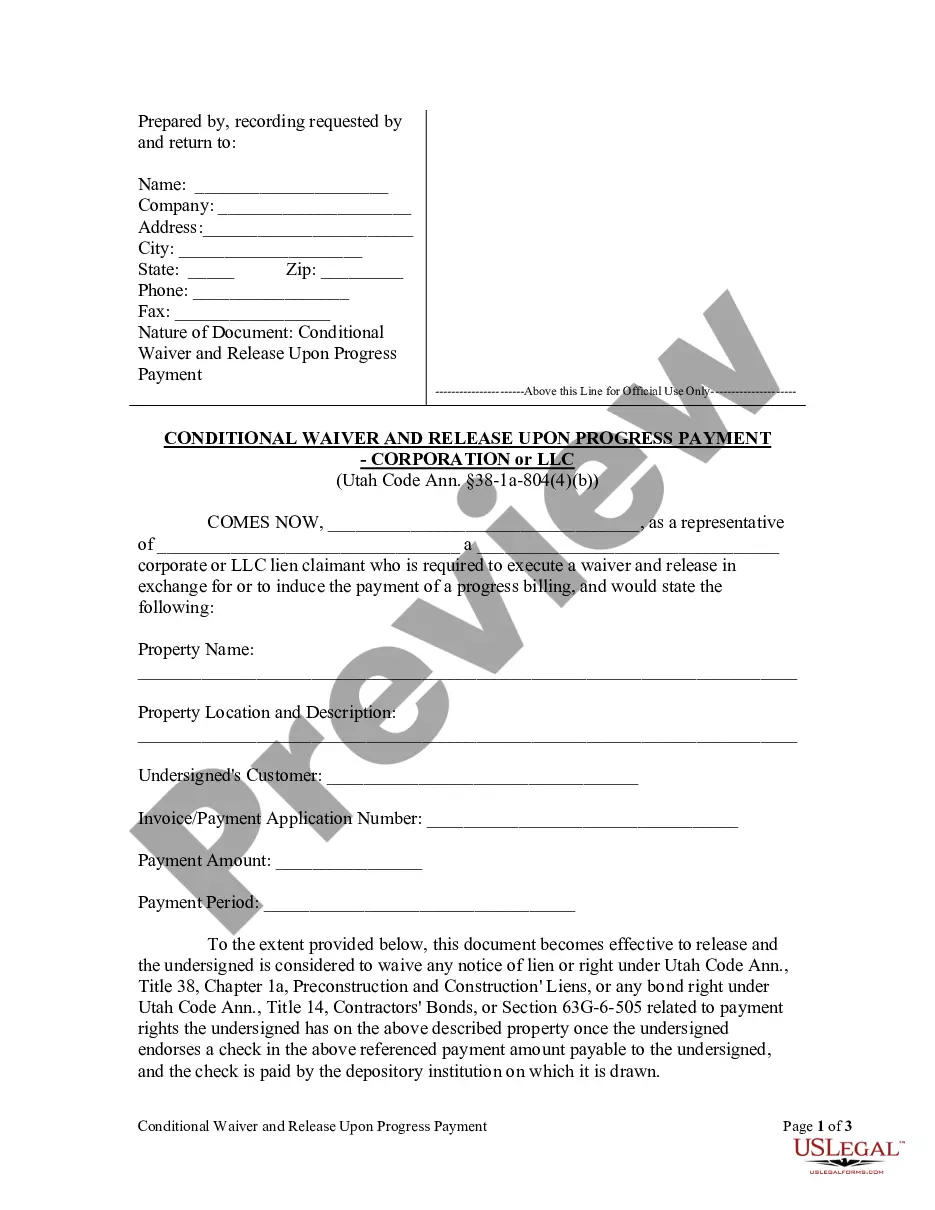

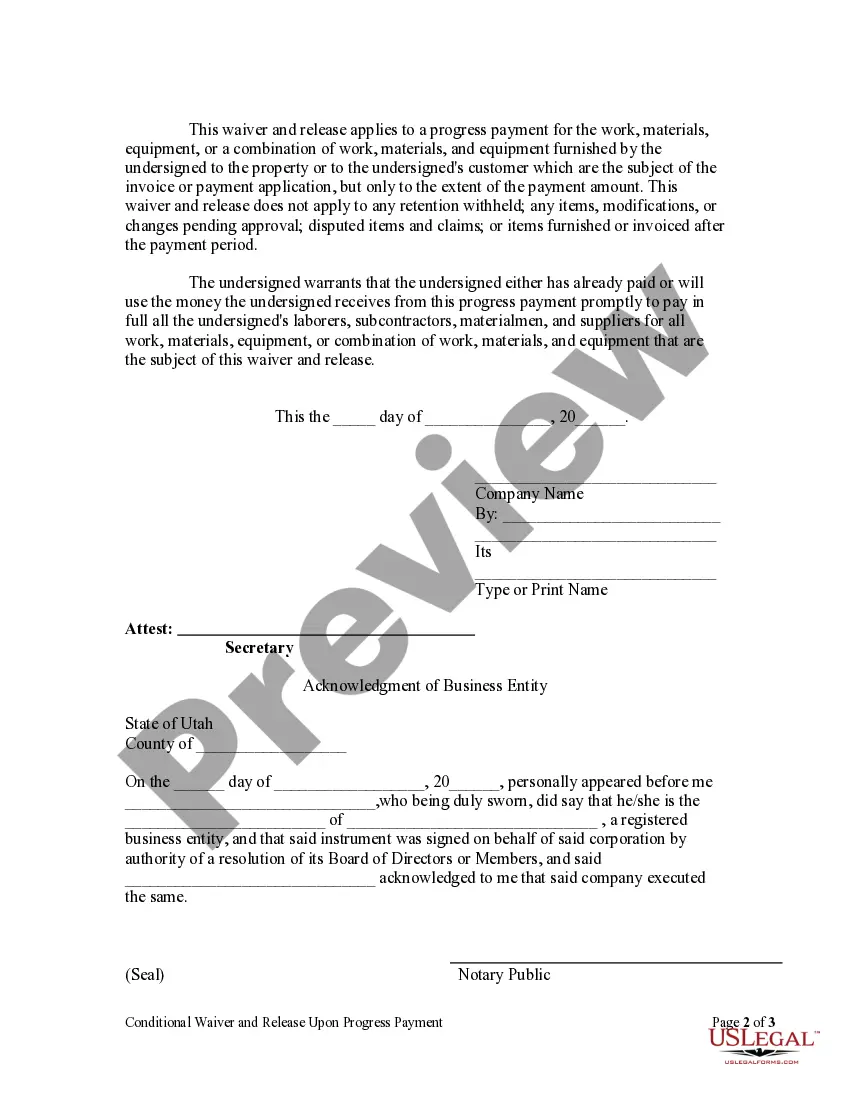

This Conditional Waiver and Release Upon Progress Payment form is for use by a corporate lien claimant who is required to execute a waiver and release in exchange for or to induce the payment of a progress billing to provide information, including the property name, the property location and description, the customer, the invoice payment application number, the payment amount, and the payment period. This waiver is effective to release and the lien claimant is considered to waive any notice of lien or right under Utah Code Ann., Title 38, Chapter 1, Mechanics' Liens, or any bond right under Utah Code Ann., Title 14, Contractors' Bonds, or Section 63G-6-505 related to payment rights the lien claimant has on the property once the lien claimant endorses a check in the referenced payment amount payable to the lien claimant, and the check is paid by the depository institution on which it is drawn.

Utah Conditional Lien Waiver With Notary

Description

Form popularity

FAQ

To enforce a lien in Utah, you must first file the lien properly and then follow up with an enforcement action if the debt remains unpaid. This often involves filing a lawsuit within a certain time frame, usually six months from when the lien was recorded. Additionally, it’s beneficial to use a Utah conditional lien waiver with notary during the initial agreement, as this can help streamline enforcement if disputes arise. Utilizing resources from uslegalforms can help you navigate the enforcement process more smoothly.

In Florida, construction lien waivers do not necessarily need to be notarized, but utilizing a Utah conditional lien waiver with notary can provide added security. Notarization serves as a verification of the signatures and protections for all parties involved. Always check local regulations to ensure compliance, as requirements may vary by jurisdiction. You can find specific waiver templates that meet Florida's requirements on uslegalforms.

To place a lien on a property in Utah, you must file a notice of lien with the county recorder where the property is located. Ensure you include all necessary information such as the property owner's name, a description of the property, and the amount owed. It’s important to use a Utah conditional lien waiver with notary for any agreements or waivers to avoid potential disputes. Using a platform like uslegalforms can simplify this process by providing the necessary templates and guidance.

The main difference between conditional and unconditional lien waivers lies in their terms regarding payment. A conditional lien waiver ensures that rights are waived only after payment is made, while an unconditional waiver releases those rights without any payment conditions. Choosing the right type of waiver is essential for protecting your financial interests. Utilizing tools like the Utah conditional lien waiver with notary ensures clarity and safety in transactions.

An unconditional release is a document that waives all lien rights on a property without any conditions tied to it. This means that once signed, the party relinquishes their right to file a lien, regardless of whether they receive payment. It is important to approach unconditional releases with caution, particularly in the context of a Utah conditional lien waiver with notary to ensure all parties are adequately protected.

In North Carolina, you typically encounter two main types of lien waivers: conditional and unconditional. A conditional lien waiver releases lien rights but only upon receiving payment. An unconditional waiver, however, relinquishes those rights immediately, regardless of whether payment is made. Understanding these differences is crucial when dealing with contracts, especially in relation to the Utah conditional lien waiver with notary.

In Utah, lien waivers generally do not require notarization, but having them notarized can enhance their credibility and provide legal protection. Notarization serves as an assurance that the parties involved have willingly signed the document, minimizing the risk of future conflicts. It is wise to use a Utah conditional lien waiver with notary for optimal legal safety.

In California, lien waivers typically do not need to be notarized to be enforceable. However, notarization can strengthen the validity of the waiver and may help prevent disputes. When engaging with a Utah conditional lien waiver with notary, it’s beneficial to consider this extra step for added security.

For property owners, a conditional lien waiver is often the best choice, as it assures that contractors will relinquish their lien rights upon receiving payment. This type of waiver protects owners against potential claims while ensuring payment issues are managed effectively. Utilizing a Utah conditional lien waiver with notary provides an added safeguard, reinforcing the agreement's validity.

A conditional waiver of lien is a document that allows a contractor or supplier to relinquish their right to file a lien for payments due, provided they receive the agreed payment. This form of lien waiver protects property owners while also providing assurance to contractors that they will receive their payment. It’s crucial to consider proper notarization to uphold the integrity of this waiver.