Limited Liability Company With One Member

Description

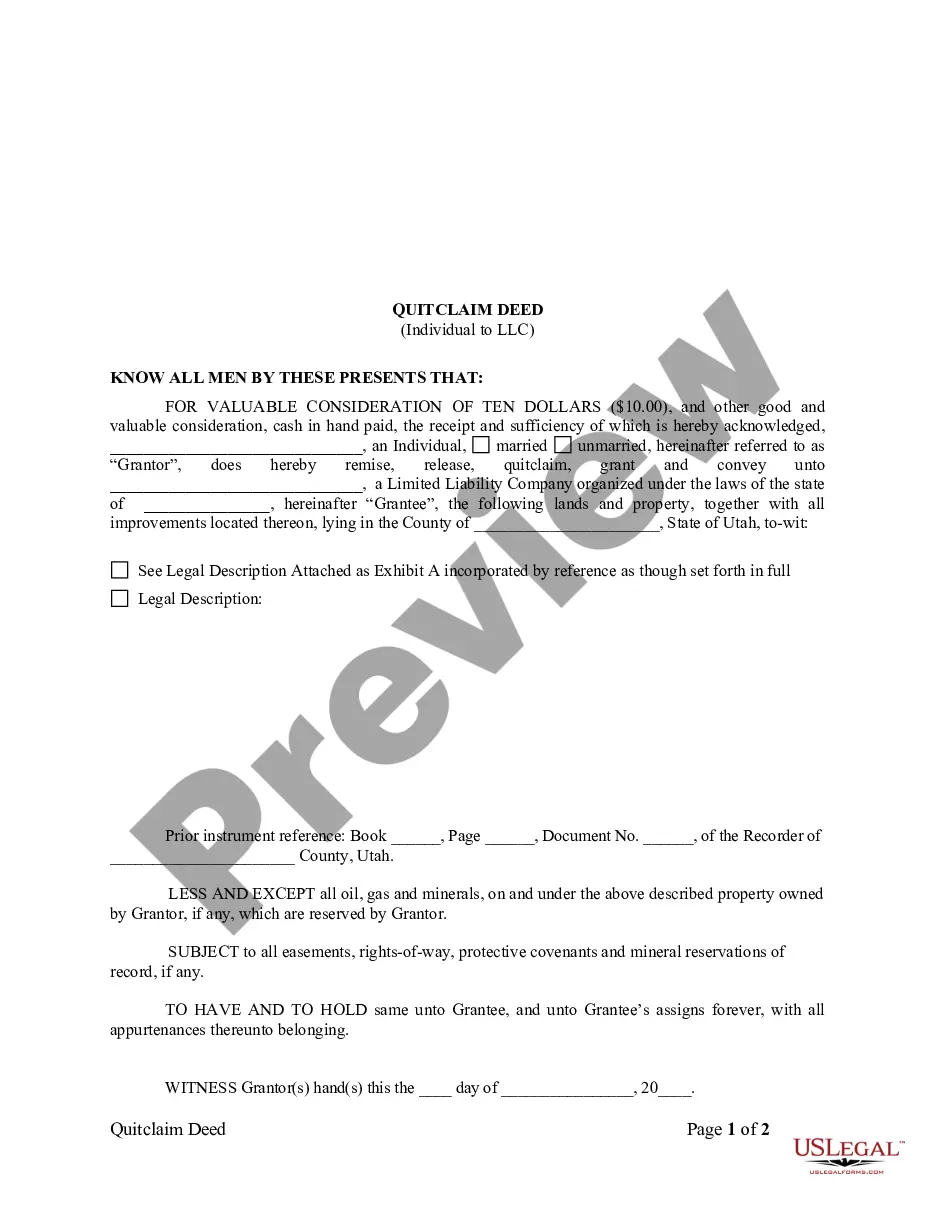

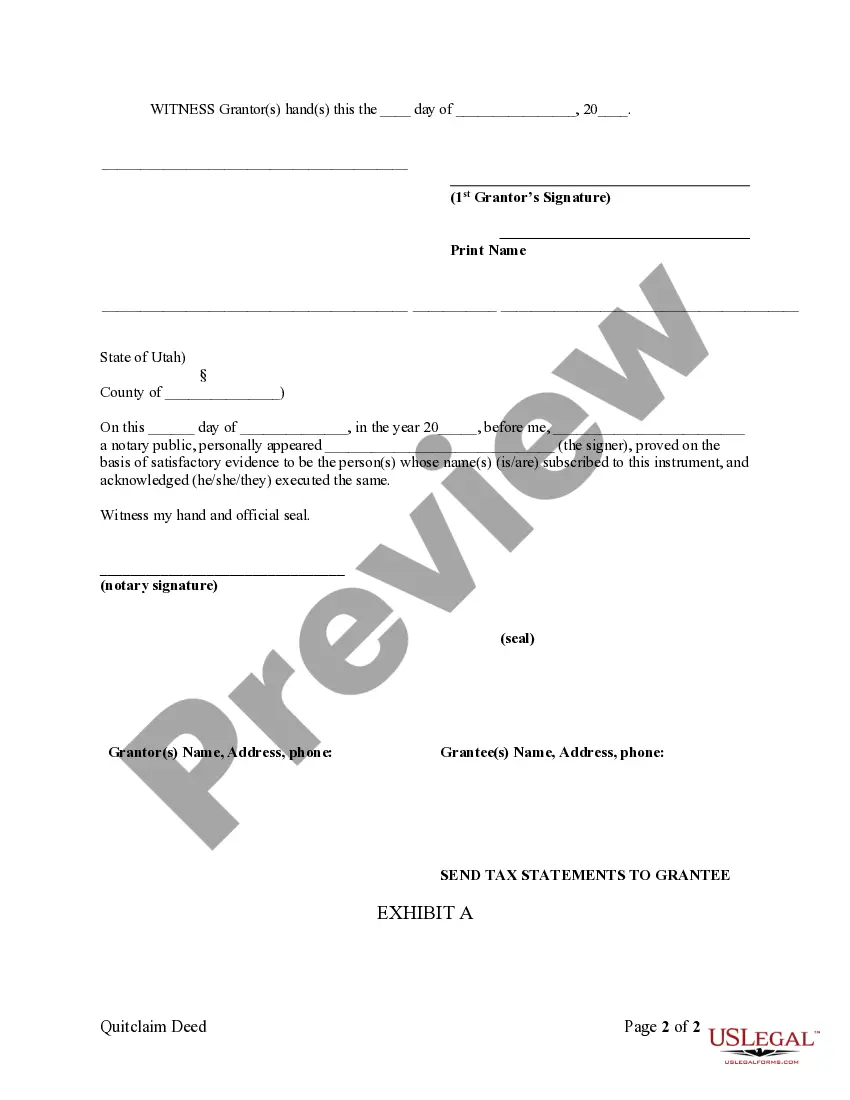

How to fill out Utah Quitclaim Deed From Individual To LLC?

- Log in to your US Legal Forms account if you are a returning user, or create a new account if this is your first time.

- Browse through the document library, utilizing the Preview mode to understand each form's specifics and ensure it matches your needs.

- If you need an alternative template, utilize the Search feature to find the right documents tailored to your local regulations.

- Select your preferred subscription plan by clicking on the Buy Now button and proceed to register if necessary.

- Complete your purchase securely using credit card or PayPal to gain immediate access to your forms.

- Once purchased, download your document to your device and find it anytime in the My Forms section of your profile.

With US Legal Forms, you can confidently navigate the complexities of forming your limited liability company with one member. Their user-friendly interface and access to legal experts help ensure that your documents are accurate and compliant.

Don't hesitate to take the next step in forming your business. Visit US Legal Forms today and equip yourself with the right tools to succeed.

Form popularity

FAQ

To establish a limited liability company with one member, start by choosing a unique name that complies with your state’s requirements. Next, file the necessary formation documents with your state’s business filing office, typically the Secretary of State. Additionally, create an operating agreement, even if not required, to outline ownership and operational procedures. Using platforms like US Legal Forms can simplify this process by providing the necessary documentation and guidance.

Filling out a W-9 for a limited liability company with one member involves several crucial steps. Begin with your LLC name followed by your name if applicable, check the LLC box, and input your EIN or SSN. Finally, perform a review for accuracy and sign the form to validate it.

To fill out a W9 for your limited liability company with one member, start with your LLC's name in the first line. Choose the 'Limited Liability Company' box and enter your EIN or SSN in the appropriate field. Make sure to sign and date the form at the bottom to certify the information is correct.

Yes, as a single-member LLC, you can hire employees or independent contractors. This structure allows you to manage payroll and offer benefits if needed. Hiring helps expand your business’s capabilities while maintaining limited liability protection.

To fill out a W9 as a single-member LLC, first include the name of the LLC in the 'Name' field, and your name in the 'Business name' section if it's different. Then, provide your EIN or SSN as required. Make sure to check the box indicating that you are a limited liability company with one member.

When completing a W9 for a limited liability company with one member, it is generally advisable to use an Employer Identification Number (EIN) instead of a Social Security Number (SSN. An EIN offers tax benefits and helps protect your personal information. However, if you do not have an EIN, you may use your SSN.

Yes, a limited liability company with one member can indeed be owned by another company. This means that a corporation or another LLC can hold ownership of a single-member LLC. This structure can provide beneficial liability protection and operational flexibility, making it an attractive option for business owners.

Yes, a limited liability company can indeed have only one member. This structure allows individuals to operate a business without the complexities of a partnership. Many entrepreneurs choose this option for its simplicity and the liability protection it offers, making it a popular choice among solo business owners.

The tax benefits of a limited liability company with one member include pass-through taxation, meaning the business income is reported on your personal tax return. This structure generally avoids double taxation at the corporate level. Moreover, you may qualify for various deductions that can reduce your overall taxable income, enhancing your financial flexibility.

A limited liability company with one member can be a wise choice for sole entrepreneurs. It combines liability protection with simplicity in management. If you're looking for an effective way to manage your business and protect your personal assets, this structure often meets those needs well. Nevertheless, consider your specific business goals and consult with a legal expert to confirm its suitability.