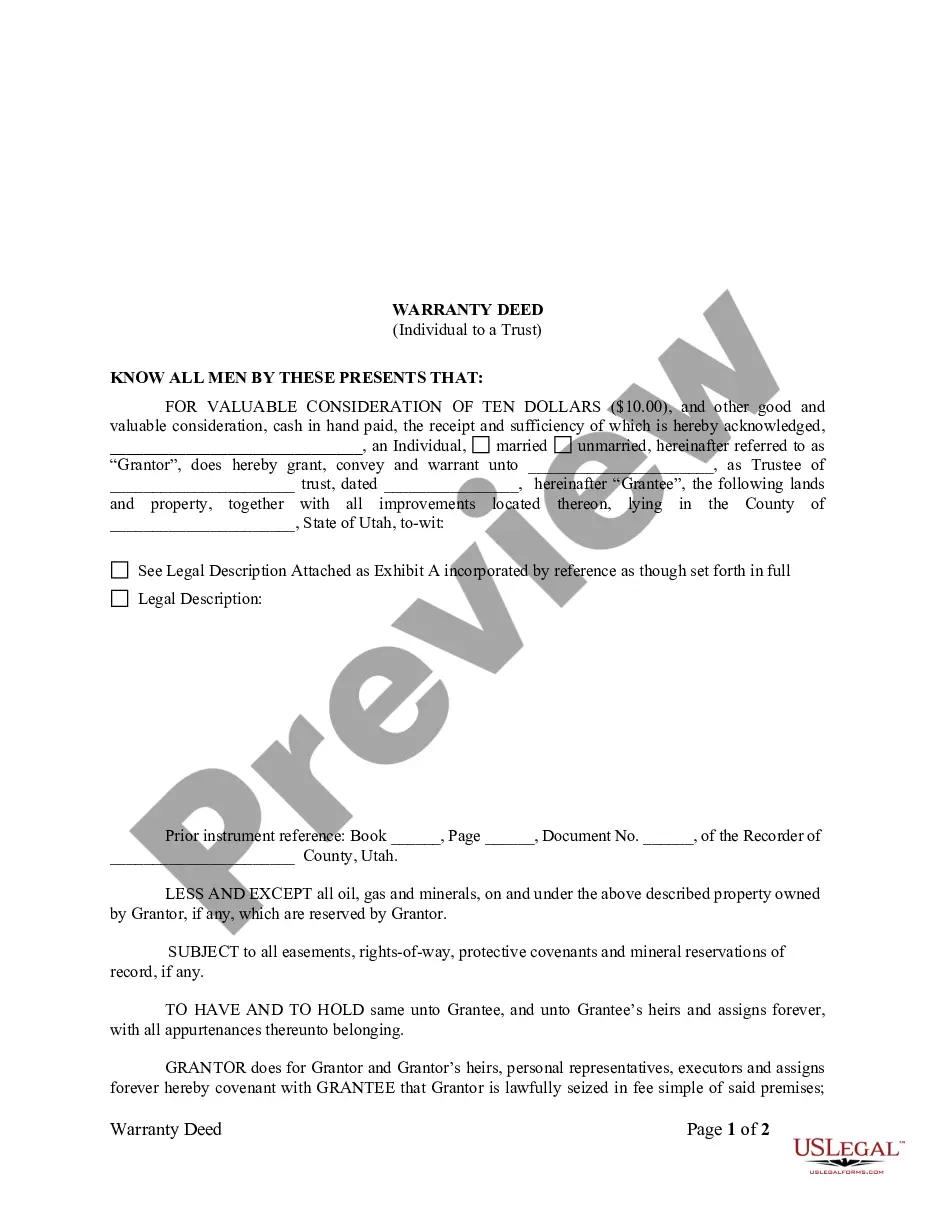

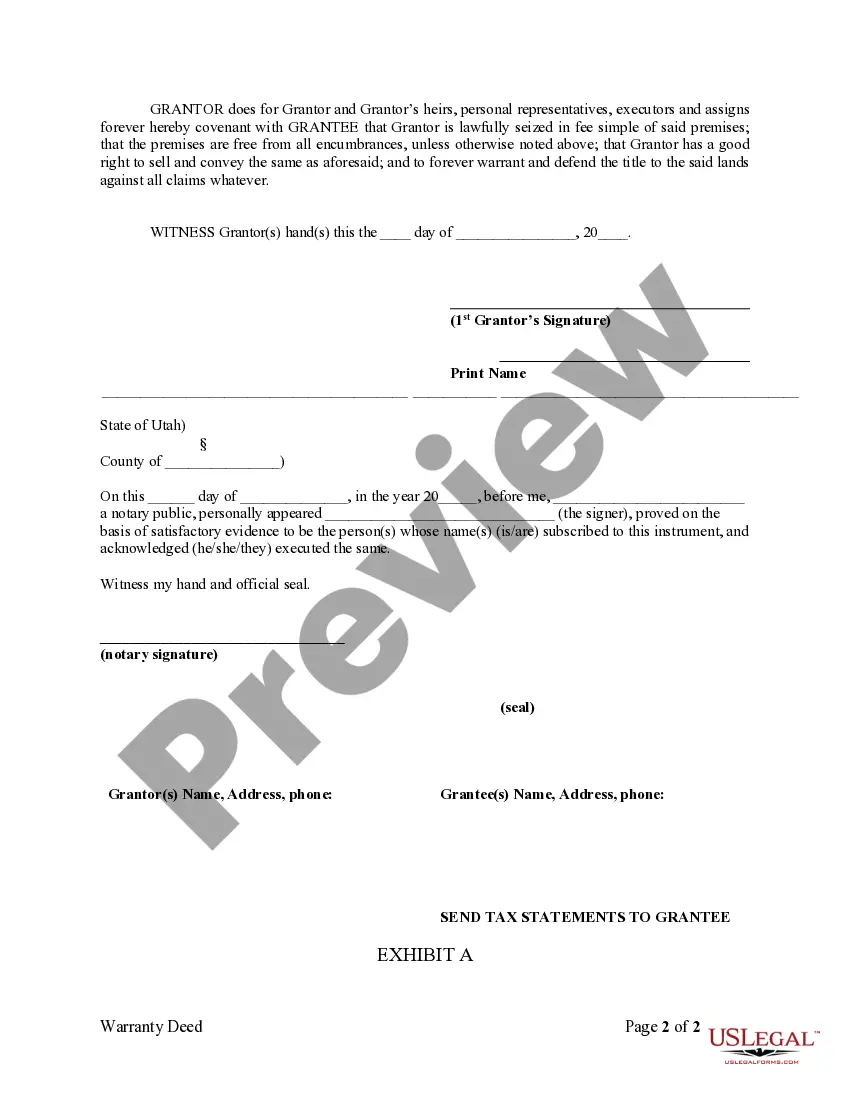

This form is a Warranty Deed where the grantor is an individual and the grantee is a trust. Grantor conveys and warrant the described property to trustee of trust less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

Utah Family Trust Form

Description

Form popularity

FAQ

Transferring property into a trust in Utah involves filling out a Utah family trust form that specifies the property you wish to include. You will then need to sign a deed transferring ownership from you to the trust. Make sure to record this deed with the county clerk's office to finalize the transfer. Using a service like US Legal Forms can simplify this process and ensure all necessary documents are properly completed.

To set up a family trust in Utah, you need to fill out a Utah family trust form. This form requires details about your assets, beneficiaries, and the individual who will manage the trust, known as the trustee. After completing the form, you must sign it in front of a notary to ensure its validity. It's often helpful to consult a legal professional to guide you through the process and ensure all legal requirements are met.

Setting up a family trust in Utah involves a few straightforward steps. First, you need to create a trust document that outlines the terms, beneficiaries, and assets involved. It is essential to have the document notarized and, in some cases, recorded in the county where the assets are located. To ensure everything is done correctly, utilizing a Utah family trust form can provide you with a solid foundation to build your trust efficiently.

Filing taxes for a family trust requires understanding the tax obligations specific to trusts. Generally, the trust must obtain an Employer Identification Number (EIN) and file Form 1041 annually. The income generated by the trust is typically reported on the tax returns of the beneficiaries. To simplify this process, consider using a Utah family trust form to guide you through the necessary steps and documentation.

Certain assets are typically unsuitable for a trust, including retirement accounts and personal property that may require specific handling. It’s important to consider how these assets are treated for tax purposes and inheritance laws in Utah. Keeping some assets outside the trust can provide flexibility in managing them. For guidance on what to include or exclude, consult the details available in the Utah family trust form through US Legal Forms.

The primary danger of a family trust lies in the potential for mismanagement. If a trustee does not understand their responsibilities, it can lead to misuse of trust assets. To mitigate this risk, using a Utah family trust form from uslegalforms can provide clear guidelines for administrators. This clarity helps ensure that your assets are handled properly and according to your wishes.

One of the biggest mistakes parents make when setting up a trust fund is failing to fund the trust properly. If assets are not transferred into the trust, it cannot serve its intended purpose. A Utah family trust form can help outline how to fund the trust correctly and ensure that it operates as desired. Taking this step seriously is crucial for securing your family's financial future.

Utah has specific rules regarding the creation and management of trusts. For a trust to be valid, it must be in writing, specify the trust property, and name a trustee. Utilizing a Utah family trust form ensures that you meet these requirements effectively. By following the guidelines, you can establish a trust that serves its intended purpose.

The primary downside of a family trust is the ongoing maintenance it may require. Trusts need to be updated with life changes such as marriage, divorce, or the birth of a child. While the Utah family trust form helps set things up initially, regular reviews are necessary to keep your wishes aligned. Nevertheless, this proactive approach can provide peace of mind.

Yes, you can write your own trust in Utah. However, it's crucial to ensure it meets all legal requirements to be valid. Using a Utah family trust form from uslegalforms can help guide you in drafting your trust correctly. This way, you can feel confident that your trust will hold up in court and effectively manage your estate.