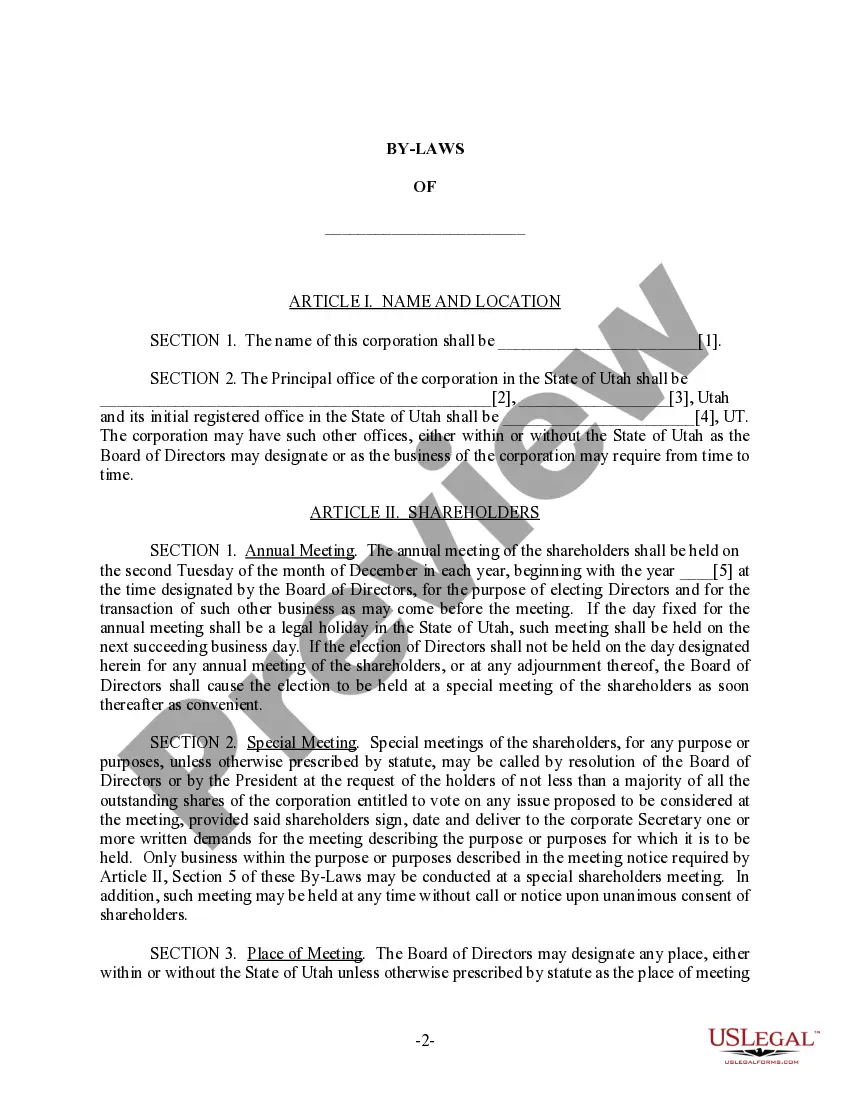

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Utah Corporation Business Formation

Description

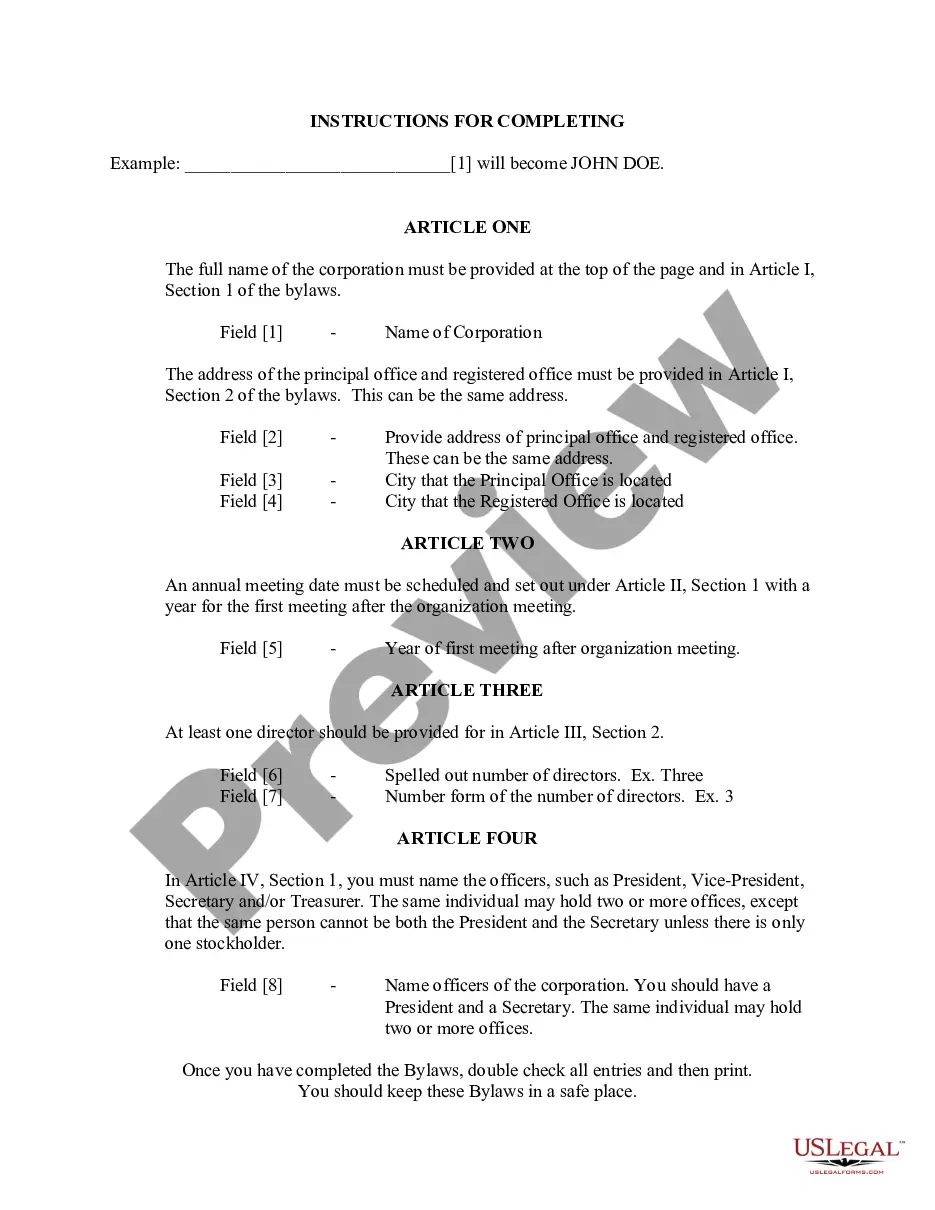

How to fill out Utah Bylaws For Corporation?

Managing legal documents can be difficult, even for the most experienced professionals.

If you are seeking a Utah Corporation Business Setup and lack the time to invest in finding the accurate and current version, the tasks may be challenging.

US Legal Forms caters to any needs you might have, from individual to business documentation, all in one location.

Utilize sophisticated tools to complete and oversee your Utah Corporation Business Setup.

Here are the steps to follow after acquiring the necessary document: Validate that it is the correct form by examining it and reviewing its description.

- Access a wealth of articles, tutorials, and manuals pertaining to your circumstances and necessities.

- Conserve time and energy searching for the forms you require, and leverage US Legal Forms’ advanced search and Review feature to locate Utah Corporation Business Setup and obtain it.

- If you possess a membership, Log In to your US Legal Forms account, search for the document, and procure it.

- Check your My documents tab to view the documents you have previously downloaded and manage your folders accordingly.

- If this is your initial visit to US Legal Forms, establish an account to gain unlimited access to all platform advantages.

- A comprehensive online form repository could transform the experience for anyone aiming to handle these matters efficiently.

- US Legal Forms is a leading provider in the domain of online legal documents, offering over 85,000 state-specific legal forms at your fingertips.

- Access state- or county-specific legal and business documents with ease.

Form popularity

FAQ

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one. Why? Because it helps you determine if the debt is actually yours and if there's anything fishy going on behind the scenes.

Effective January 1, the small loan act applies to loans under $10,000 and not just $5,000 and certain other restrictions on scope are loosened. The anti-evasion provisions are also expanded. § 58-15-3(D). As of January 1, 2023, a fee of 5% of the principal may be charged for a loan of $500 or less.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

If you've been contacted by a collection agency, the collectors are required to send you a written notice within five days of the first contact. If you have not received a debt validation letter, you have the right to request one by writing a debt verification letter, or a debt dispute letter.

However, they're required to send a debt validation letter within five days of first contacting you. If you don't receive a debt validation letter within 10 days of initial contact, you can submit a complaint to the Consumer Financial Protection Bureau.

A debt validation letter is a letter that debt collectors must provide that includes information about the size of your debt, when to pay it, and how to dispute it. A debt collection letter essentially proves you owe the debt collector money.