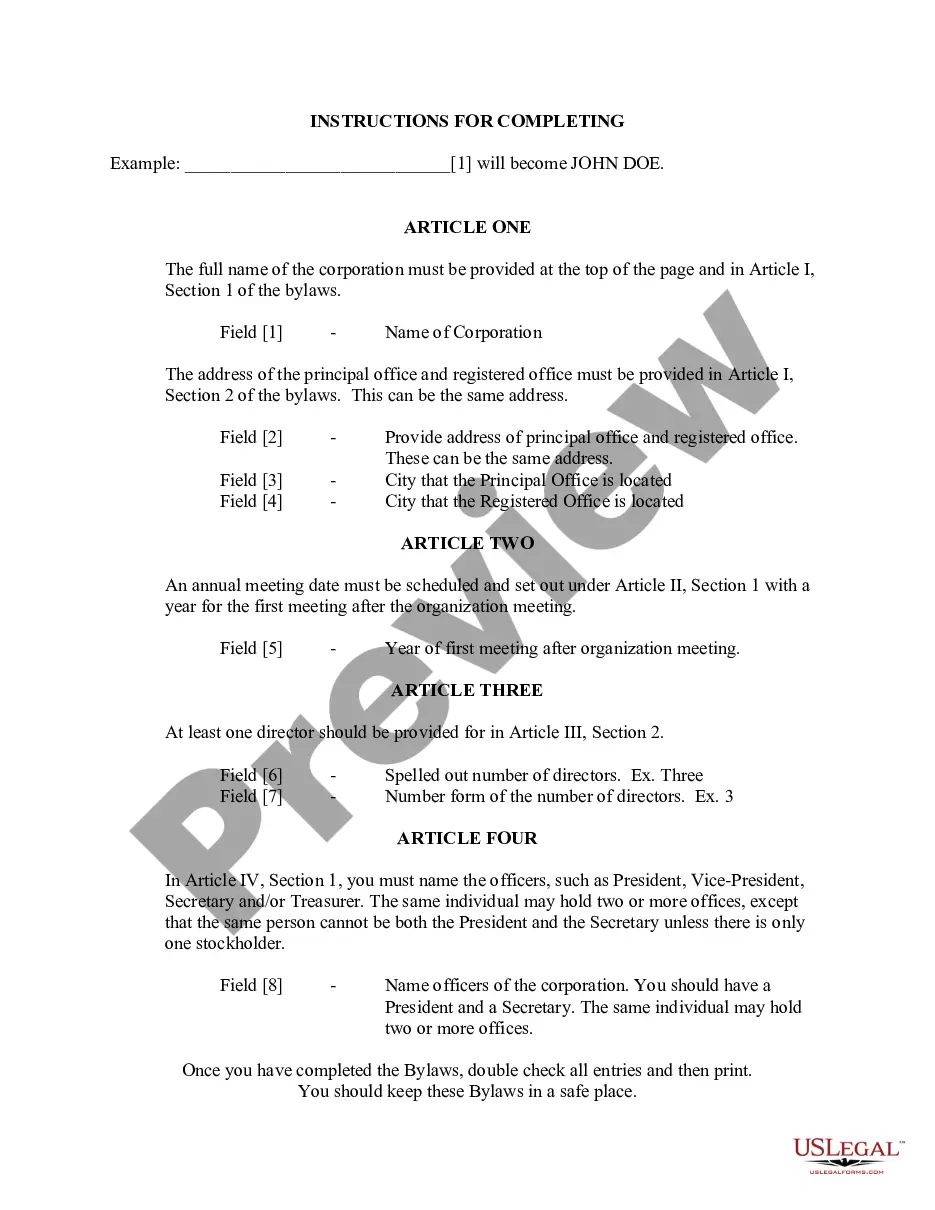

This form is By-Laws for a Business Corporation and contains provisons regarding how the corporation will be operated, as well as provisions governing shareholders meetings, officers, directors, voting of shares, stock records and more. Approximately 9 pages.

Corporation In Utah With Hookups

Description

How to fill out Corporation In Utah With Hookups?

Regardless of whether you handle documents frequently or need to file a legal report sporadically, it is crucial to obtain a resource where all the examples are interconnected and current.

The initial step you should take with a Corporation In Utah With Hookups is to confirm that it is the latest version, as this determines if it can be submitted.

If you wish to streamline your search for the newest document samples, seek them out on US Legal Forms.

Utilize the search feature to locate the form you need. Examine the Corporation In Utah With Hookups preview and description to ensure it is exactly what you are looking for. After verifying the form, simply click Buy Now. Choose a subscription plan that suits you. Create an account or Log Into your existing one. Use your credit card information or PayPal account to complete the transaction. Select the document format for download and confirm it. Eliminate the uncertainty associated with legal documentation. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents containing nearly every sample you may need.

- Look for the templates you need, assess their applicability immediately, and learn more about their function.

- With US Legal Forms, you have access to over 85,000 document templates across a diverse range of fields.

- Find the Corporation In Utah With Hookups samples in just a few clicks and store them anytime in your account.

- A US Legal Forms account will enable you to access all the samples you need with greater ease and less hassle.

- Simply click Log In in the website header and navigate to the My documents section to have all the forms you require at your fingertips, eliminating the need to spend time searching for the right template or verifying its legitimacy.

- To acquire a form without an account, adhere to these instructions.

Form popularity

FAQ

To set up a corporation in Utah, you need to file Articles of Incorporation with the state. This involves selecting a unique business name, appointing a registered agent, and providing relevant details about your corporation. Moreover, using US Legal Forms can simplify these steps, providing templates and guidance to ensure your corporation in Utah with hookups is compliant with state regulations.

Incorporating in Utah offers several benefits, including a favorable business climate and competitive tax rates. The state supports new businesses through various programs and incentives, making it an attractive option for entrepreneurs. Additionally, forming a corporation in Utah with hookups can provide legal protections for personal assets. You can also benefit from US Legal Forms’ resources to navigate this process effectively.

Setting up an LLC in Utah typically takes about two to three weeks. This timeframe includes preparing and filing the necessary documents, such as Articles of Organization, with the state. If you choose to expedite the process, you might receive approval in a matter of days. Utilizing US Legal Forms can help streamline this process, ensuring your corporation in Utah with hookups is established smoothly.

In Utah, corporations must file Form TC-20 to report their corporate income tax return. This form is essential for corporations in Utah with hookups to document their income and calculate their taxes accurately. Filing this form on time ensures compliance with state regulations and helps avoid penalties. Utilizing platforms like USLegalForms can simplify this process by providing the necessary forms and guidance.

Starting a corporation in Utah with hookups can be an excellent choice for many entrepreneurs. Utah boasts a friendly business environment, with low fees and a straightforward registration process for LLCs. Additionally, the state offers various resources and support networks that make it easier to launch your business. With a growing economy and a thriving community, starting your LLC here can lead to significant opportunities.

Yes, you can set up an S Corp yourself in Utah, provided you meet the necessary eligibility requirements. Once established as a Corporation in Utah with hookups, you will need to file Form 2553 with the IRS to elect S Corporation status. While doing it yourself can save on costs, consider using resources like USLegalForms to simplify the process and ensure compliance.

The cheapest way to start a corporation in Utah involves minimal costs associated with filing your Articles of Incorporation and paying the required minimum tax. Utilizing platforms like USLegalForms can help streamline the process, providing templates and guidance specific to the Corporation in Utah with hookups. Ensuring you know all fees upfront can help you budget effectively.

Yes, you can start a corporation by yourself in Utah as a single shareholder. This type of setup is common and straightforward, especially for those looking to establish a Corporation in Utah with hookups. However, it is wise to understand your responsibilities, as you will handle the necessary filings and compliance to ensure your corporation runs smoothly.

All corporations doing business in Utah must file a corporate tax return, including both for-profit and non-profit entities. If your business operates as a Corporation in Utah with hookups, you must ensure you meet all filing requirements. Additionally, even if your corporation does not generate revenue, filing remains necessary to maintain your good standing with the state.

The minimum tax for corporations in Utah is $100, regardless of income. This applies to all corporations operating in the state, including those formed under the Corporation in Utah with hookups framework. It's important to be aware of this tax requirement when establishing your corporation, as it helps you stay compliant and avoids any penalties.