Utah Incorporation Withdrawal

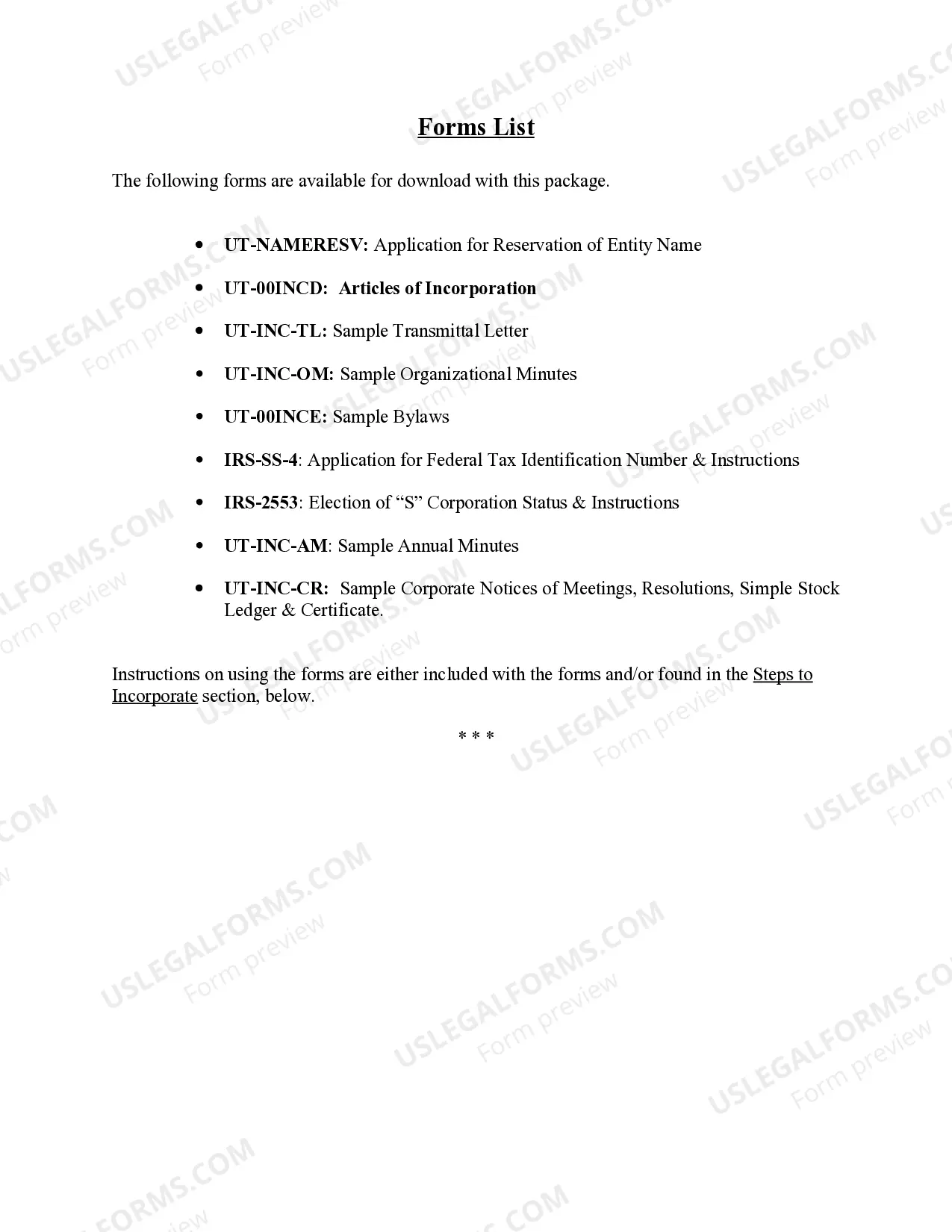

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

Legal administration can be exasperating, even for seasoned professionals.

When you are interested in a Utah Incorporation Withdrawal and lack the time to search for the accurate and current version, the processes can be challenging.

Access a valuable repository of articles, guides, and manuals pertaining to your situation and needs.

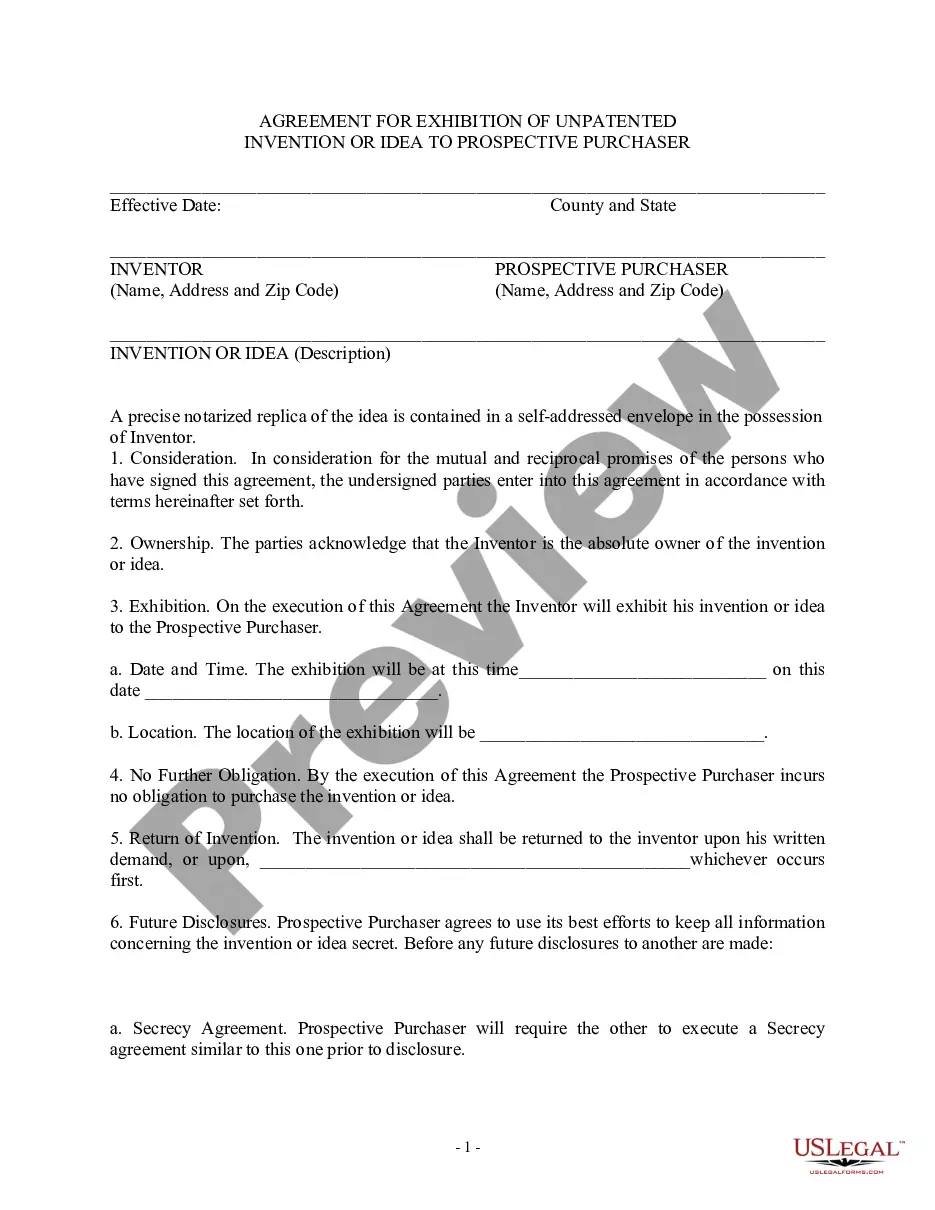

Save time and effort searching for the documents you need, and use US Legal Forms’ advanced search and Preview tool to find and download Utah Incorporation Withdrawal.

Ensure that the version is authorized in your state or county. Choose Buy Now when you are ready. Opt for a monthly subscription plan. Determine the format you require and Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online library, backed by 25 years of experience and dependability. Streamline your routine document management into a straightforward and user-friendly process today.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to review the documents you've previously saved and manage your files as desired.

- If it’s your first encounter with US Legal Forms, create a free account to gain unlimited access to all platform benefits.

- Here are the steps to follow after downloading the desired form.

- Verify it is the correct form by reviewing and checking its details.

- Utilize state- or county-specific legal and business forms.

- US Legal Forms accommodates all necessities you may have, from personal to business documents, in one location.

- Employ sophisticated tools to complete and manage your Utah Incorporation Withdrawal.

Form popularity

FAQ

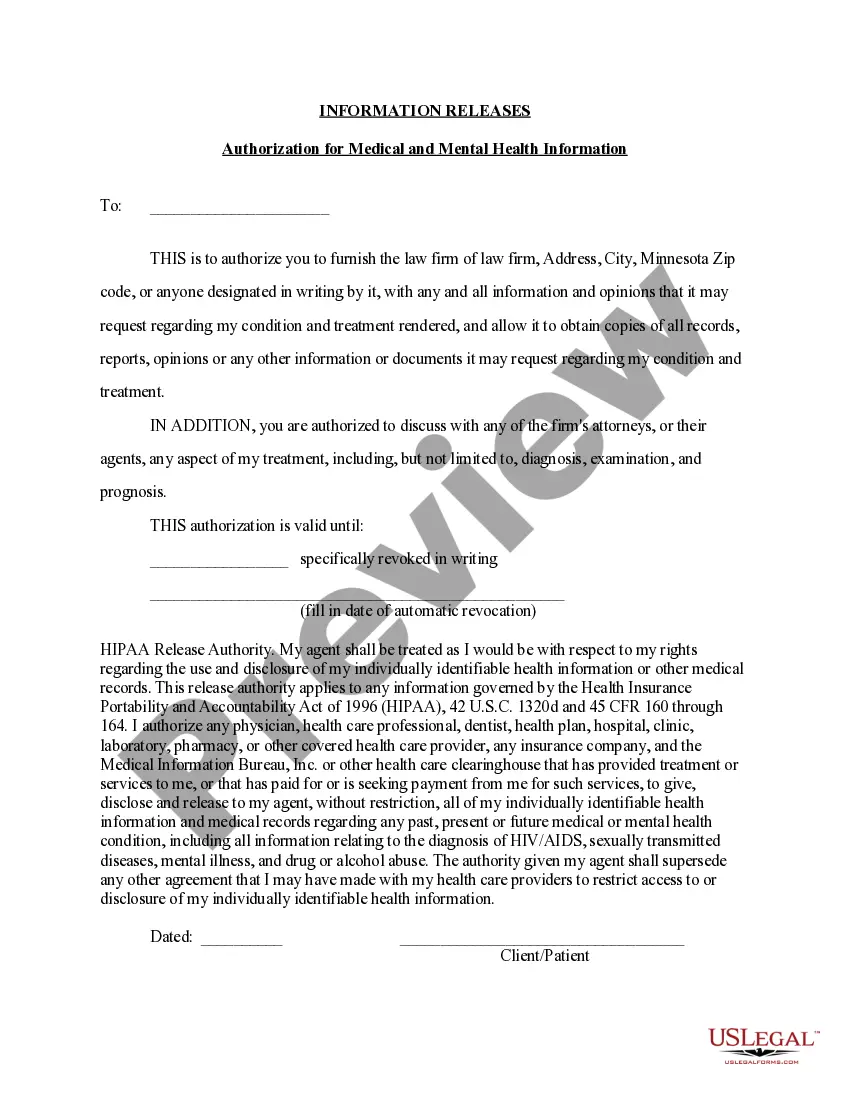

To cancel your business in Utah, you must file the Articles of Dissolution with the Utah Secretary of State. First, ensure that all your business debts are settled, and notify your employees and creditors about the dissolution. Once the Articles of Dissolution are approved, your Utah incorporation withdrawal is complete. For a smooth process, consider using the services of US Legal Forms to guide you through the necessary steps.

To dissolve a corporation, you need the consent of the owners, a completed Articles of Dissolution form, and, depending on the corporation’s status, a tax clearance may be necessary. Properly managing these requirements is essential for a smooth Utah incorporation withdrawal. Platforms like USLegalForms can facilitate the document preparation process.

Dissolving a business means officially ending its legal status, while terminating typically refers to closing down operations. Dissolution is part of the Utah incorporation withdrawal process, as it involves formal legal steps to dissolve the entity. Ensure both processes are clearly understood to avoid confusion.

The TC 40 form is a critical document in the Utah incorporation withdrawal process. This form is used to dissolve a corporation or limited liability company officially. Filing the TC 40 with the state helps ensure that the dissolution is recognized and that you are no longer responsible for business debts.

Dissolving a corporation in Utah involves a few straightforward steps. Start by obtaining consent from the corporation’s owners. Then, file the Articles of Dissolution with the state, which is part of the Utah incorporation withdrawal process. It’s critical to fulfill any remaining legal and financial obligations during this time.

To dissolve a corporation in Utah, begin by securing approval from the corporation’s members. Next, you must file Articles of Dissolution with the Utah Division of Corporations and complete the necessary paperwork for the Utah incorporation withdrawal. Ensure that all debts and obligations are settled prior to submitting your dissolution.

To remove yourself from an LLC in Utah, you generally need to check the operating agreement for specific procedures. If the agreement does not outline the process, you should notify the other members and file a form with the state as part of the Utah incorporation withdrawal. It's best to consult legal resources, such as USLegalForms, for guidance.

Dissolving a corporation involves several key steps. First, the owners must agree to dissolve the corporation through a formal vote or resolution. Then, you need to file the necessary documents with the state of Utah to officially initiate the Utah incorporation withdrawal process.