Utah Business Corporation Withdrawal

Description

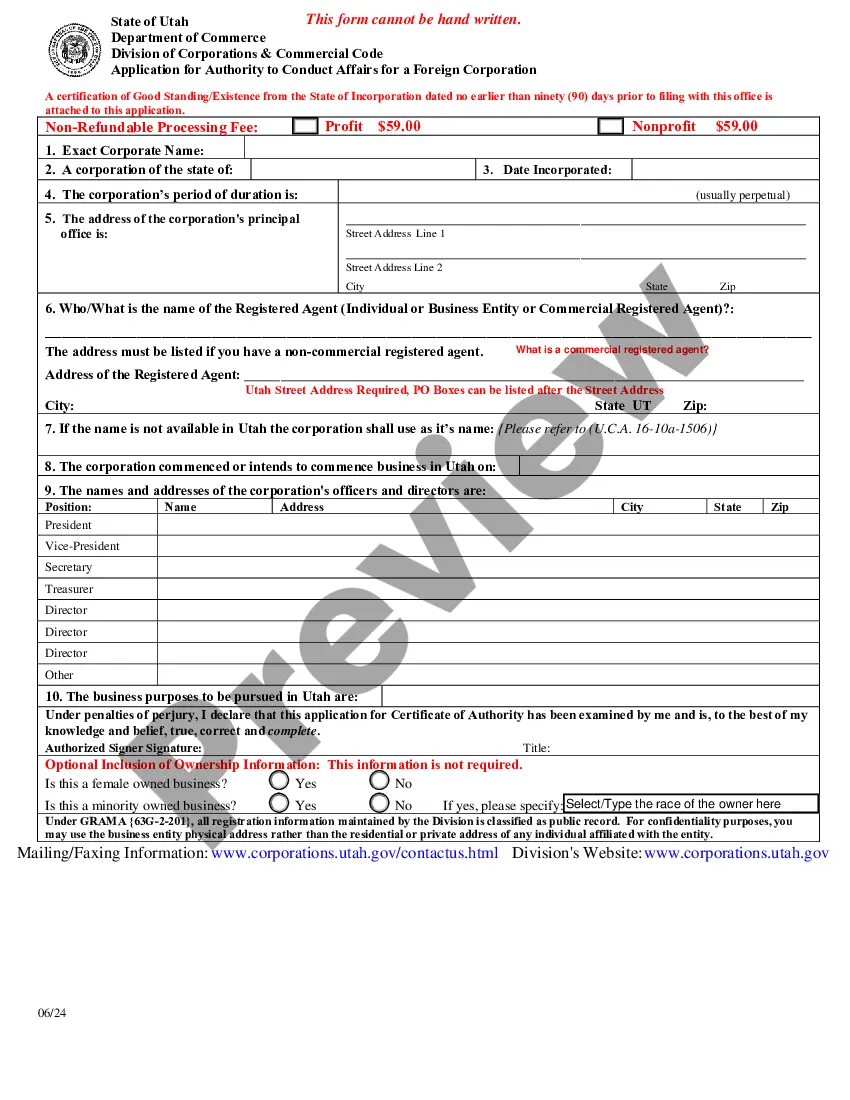

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

Drafting legal documents from scratch can often be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of preparing Utah Business Corporation Withdrawal or any other paperwork without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online catalog of more than 85,000 up-to-date legal forms addresses virtually every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant templates carefully put together for you by our legal experts.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Utah Business Corporation Withdrawal. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and navigate the library. But before jumping straight to downloading Utah Business Corporation Withdrawal, follow these tips:

- Check the document preview and descriptions to make sure you have found the document you are looking for.

- Make sure the form you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to purchase the Utah Business Corporation Withdrawal.

- Download the file. Then complete, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us now and transform document execution into something simple and streamlined!

Form popularity

FAQ

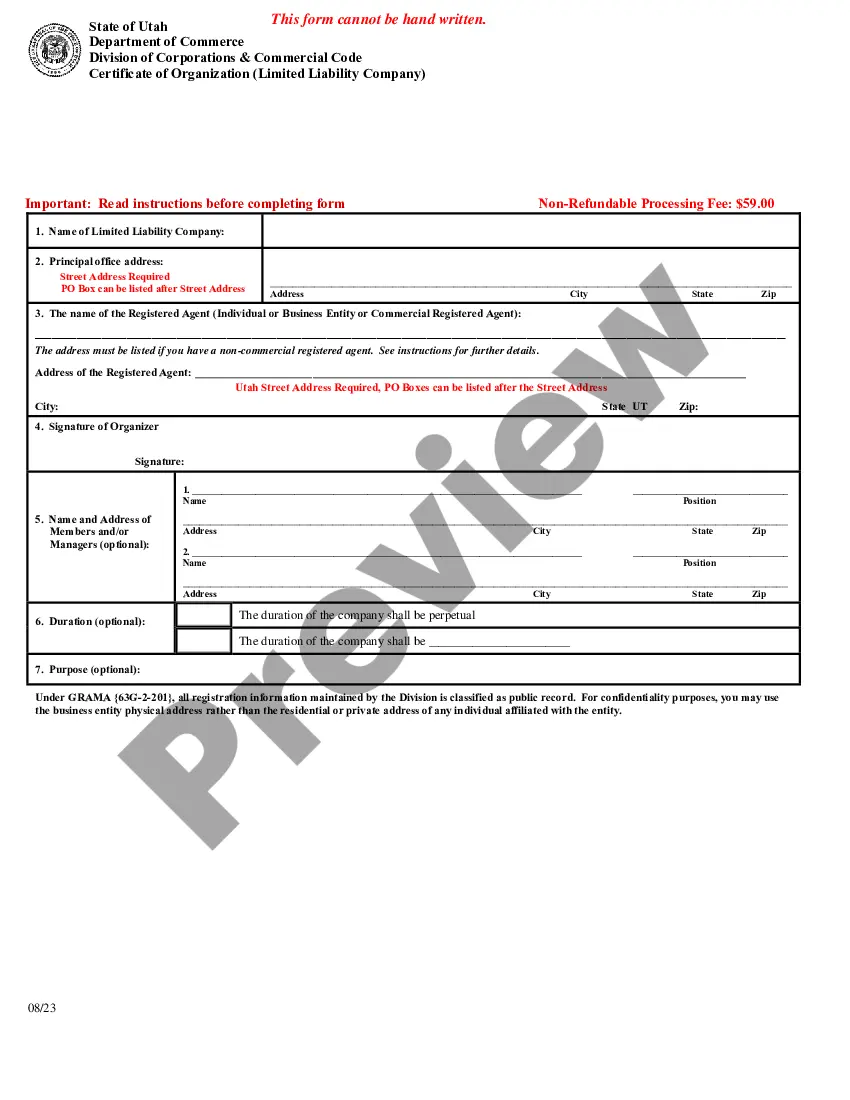

There are some basic steps to dissolving an LLC in Utah. Step 1: Vote to dissolve the LLC. Review your company's operating agreement. ... Step 2: File articles of dissolution. You must file the articles of dissolution within 90 days after performing step 1. ... Step 3: Winding-up. ... Step 4: File the final tax return.

To dissolve your corporation in Utah, you must provide the completed Articles of Dissolution (After Issuance of Shares) form to the Division of Corporations & Commercial Code by mail, fax or in person. File it in duplicate if you need a returned copy along with a prepared envelope.

SPECIAL NOTE: Utah law requires corporations seeking withdrawal to submit a Tax Clearance Certificate with the Application for Withdrawal. Please inquire with the Utah State Tax Commission at 210 N 1950 W Salt Lake City, Utah 84134. Phone: (801) 297-2200 or Toll Free: (800) 662-4335.

You can dissolve a Domestic Limited Liability Company in Utah by completing the Articles of Dissolution of Limited Liability Company form and delivering it to the Division of Corporations & Commercial Code by mail, fax or in person. If faxing the articles, include the Fax Cover Letter.

On March 23, 2023, Utah enacted Senate Bill 203, allowing unlimited carryforward of NOLs from taxable years beginning on or after Jan. 1, 2008. NOLs carried forward to a taxable year beginning on or after Jan. 1, 2023 are limited to 80% of Utah taxable income.