Utah Business Corporation With The Irs

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

Legal management can be frustrating, even for knowledgeable professionals. When you are interested in a Utah Business Corporation With The Irs and don’t get the time to commit in search of the right and up-to-date version, the procedures could be stressful. A strong web form catalogue might be a gamechanger for everyone who wants to handle these situations effectively. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available whenever you want.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and business forms. US Legal Forms handles any requirements you may have, from personal to organization paperwork, all in one place.

- Use innovative tools to complete and manage your Utah Business Corporation With The Irs

- Access a resource base of articles, instructions and handbooks and materials highly relevant to your situation and requirements

Save time and effort in search of the paperwork you will need, and employ US Legal Forms’ advanced search and Preview feature to find Utah Business Corporation With The Irs and get it. In case you have a membership, log in to your US Legal Forms account, look for the form, and get it. Take a look at My Forms tab to view the paperwork you previously downloaded and also to manage your folders as you see fit.

If it is your first time with US Legal Forms, create an account and get unlimited usage of all advantages of the library. Here are the steps for taking after getting the form you want:

- Verify this is the correct form by previewing it and looking at its description.

- Be sure that the sample is accepted in your state or county.

- Choose Buy Now when you are ready.

- Choose a monthly subscription plan.

- Pick the file format you want, and Download, complete, sign, print and send out your papers.

Enjoy the US Legal Forms web catalogue, backed with 25 years of experience and reliability. Enhance your everyday papers managing into a smooth and intuitive process right now.

Form popularity

FAQ

Your LLC must file an IRS Form 1065 and a Utah Partnership Return (Form TC-65). LLC taxed as a Corporation: Yes. Your LLC must file tax returns with the IRS and the Utah State Tax CommissionSTC to pay your Utah income tax. Check with your accountant to make sure you file all the correct documents.

If you are taxed as a C-Corp, you need to file a Form 1120, you must file it by the 15th day of the forth month following the close of the tax year, which for most taxpayers is April 15 or the next business day if it falls on a weekend or holiday.

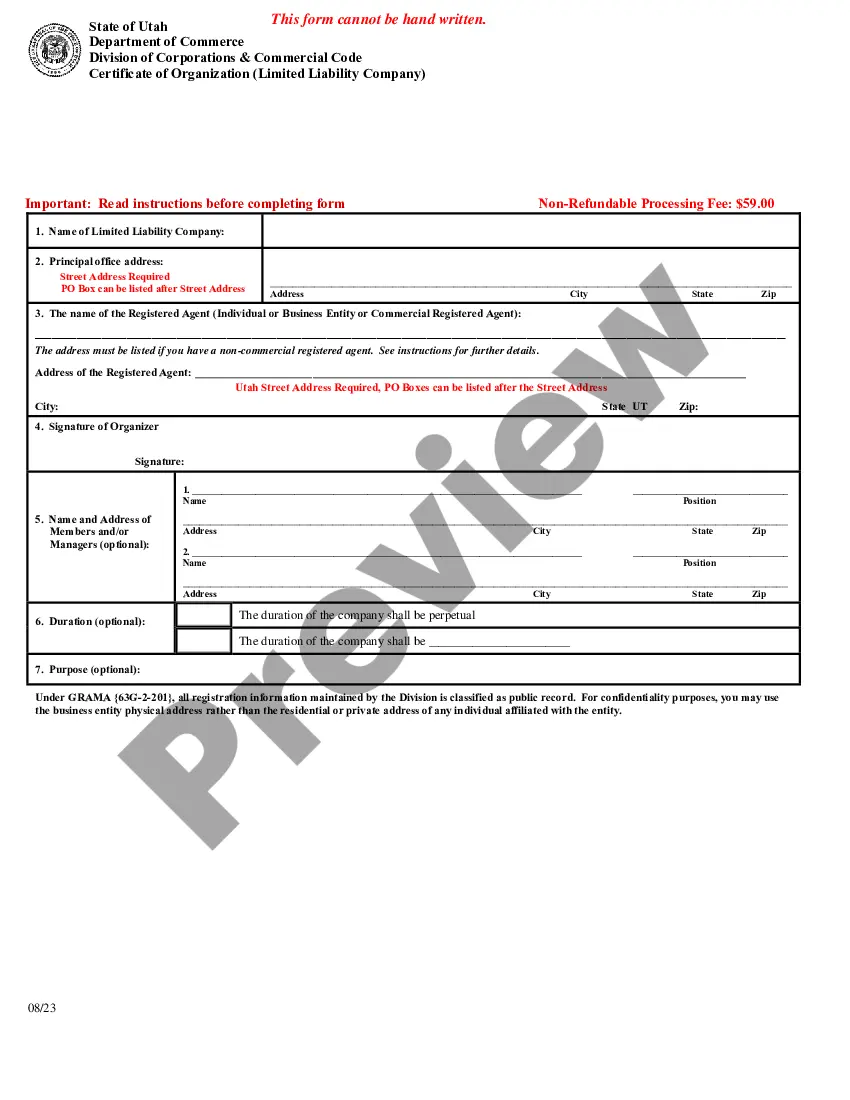

Follow these five steps to start a Utah LLC and elect Utah S corp designation: Name Your Business. Choose a Registered Agent. File the Utah Certificate of Organization. Create an Operating Agreement. File Form 2553 to Elect Utah S Corp Tax Designation.

How to File as an S Corp in Utah in 6 Steps Step 1: Choose a Business Name. ... Step 2: Appoint Directors and a Registered Agent. ... Step 3: File Certificate of Organization. ... Step 4: Create an S Corp Operating Agreement. ... Step 5: Apply for an Employer Identification Number. ... Step 6: File Form 2553 for S Corporation Election.

How to fill out Form 1120 Employer Identification Number (EIN) Date you incorporated. Total assets. Gross receipts and sales. Cost of goods sold (COGS) Tax deductions. Tax credits. Capital gains.