Utah Foreign Corporation Registration Withholding Tax

Description

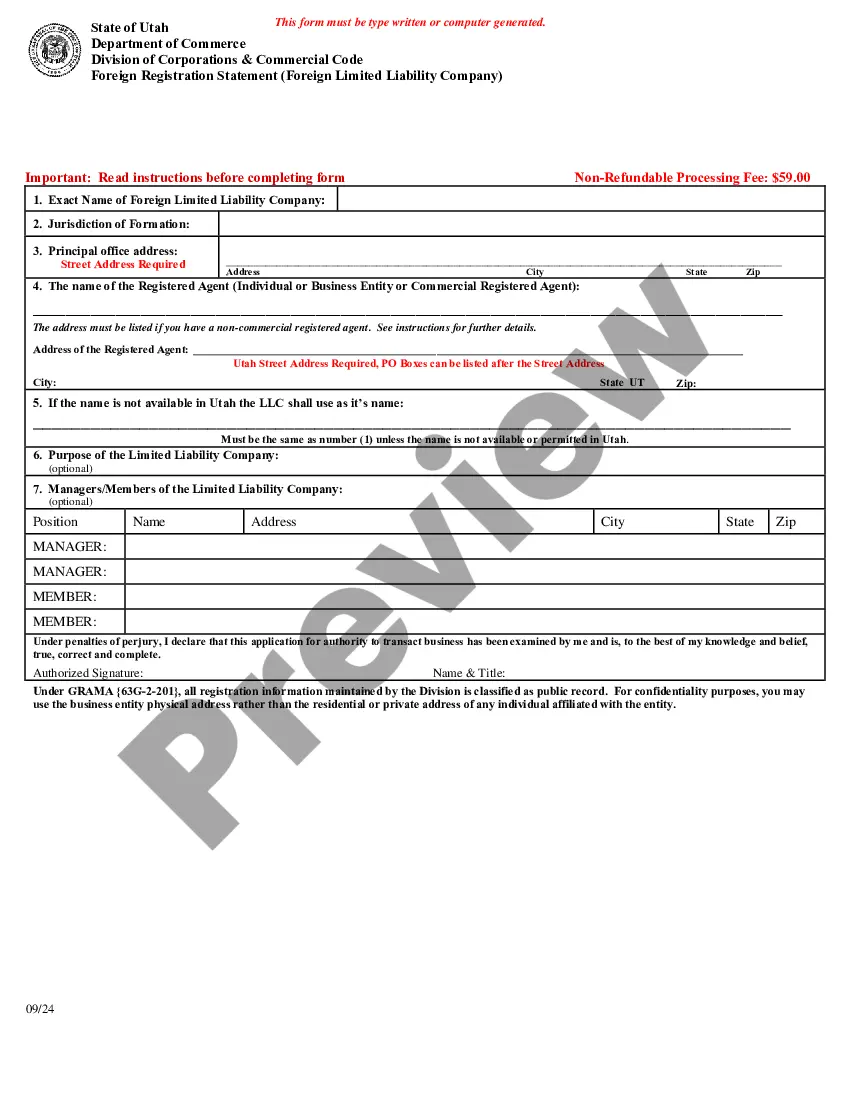

How to fill out Utah Registration Of Foreign Corporation?

Using legal templates that comply with federal and local regulations is essential, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the appropriate Utah Foreign Corporation Registration Withholding Tax sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal situation. They are easy to browse with all files arranged by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your form is up to date and compliant when getting a Utah Foreign Corporation Registration Withholding Tax from our website.

Getting a Utah Foreign Corporation Registration Withholding Tax is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, follow the instructions below:

- Examine the template using the Preview feature or through the text outline to make certain it meets your requirements.

- Browse for another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the right form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Utah Foreign Corporation Registration Withholding Tax and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc.

How to File and Pay. You may file your withholding returns online at tap.utah.gov*. You must include your FEIN and withholding account ID number on each return.

The Utah State Tax Commission has updated Publication 14, Withholding Tax Guide to reflect a reduction in the income tax withholding rate from 4.85% to 4.65%. The revised withholding rate is effective for wages paid on and after June 1, 2023.

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are ?WTH.? Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

A copy of the IRS letter of authorization, ?Notice of Acceptance as an S Corporation,? must be at- tached to the S Corporation Franchise or Income Tax Return, TC-20S, when filing for the first time. and Tax Commission Master File Maintenance 210 N 1950 W Salt Lake City, UT 84134.