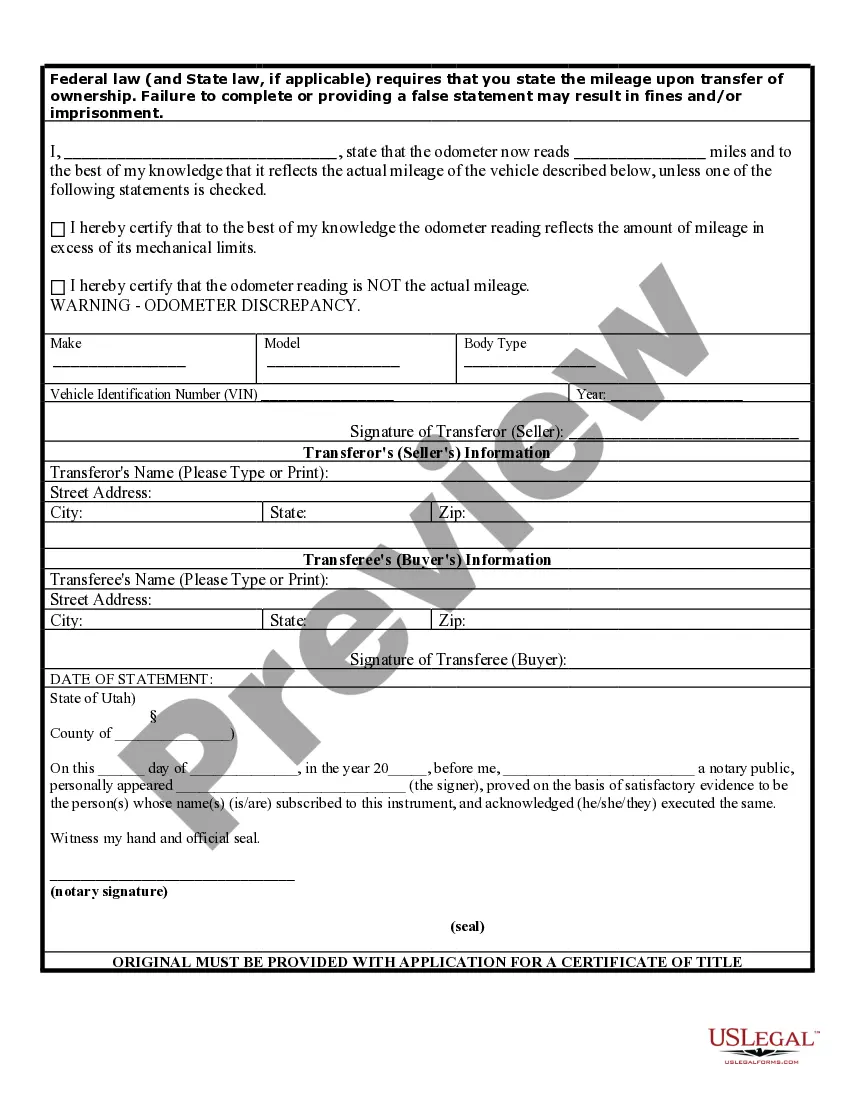

Utah Odometer Statement Without License Plate

Description

How to fill out Utah Bill Of Sale Of Automobile And Odometer Statement For As-Is Sale?

Whether for commercial objectives or for individual issues, everyone must handle legal circumstances at some point in their life.

Filling out legal paperwork requires meticulous care, starting from selecting the correct form template.

With a comprehensive US Legal Forms catalog available, you don’t need to waste time searching for the suitable template throughout the internet. Utilize the library’s intuitive navigation to find the right template for any circumstance.

- Obtain the template you require via the search bar or catalog navigation.

- Review the form’s details to confirm it suits your situation, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong form, return to the search tool to locate the Utah Odometer Statement Without License Plate template you need.

- Acquire the template if it fulfills your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- In case you do not have an account yet, you can procure the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the file format you desire and download the Utah Odometer Statement Without License Plate.

- Once it is saved, you can fill in the form using editing software or print it and complete it by hand.

Form popularity

FAQ

To get a mileage record, you can request it from your state's Department of Motor Vehicles (DMV) or similar agency. Additionally, some online services, like uslegalforms, allow you to securely obtain a Utah odometer statement without a license plate, giving you complete access to your vehicle's mileage history.

Odometer mileage disclosure statements do not need to be given for vehicles having a gross vehicle weight rating of 16,000 pounds or more, vehicles 20 years old or older, or vehicles sold directly by the manufacturer to any agency of the United States Government (UCA §41-1a-902).

Information contained in the odometer mileage disclosure statement includes the following: The odometer reading at the time of transfer, The date of transfer, The transferor's name and address or the transferor's authorized agent's name and address if the transferor is a company,

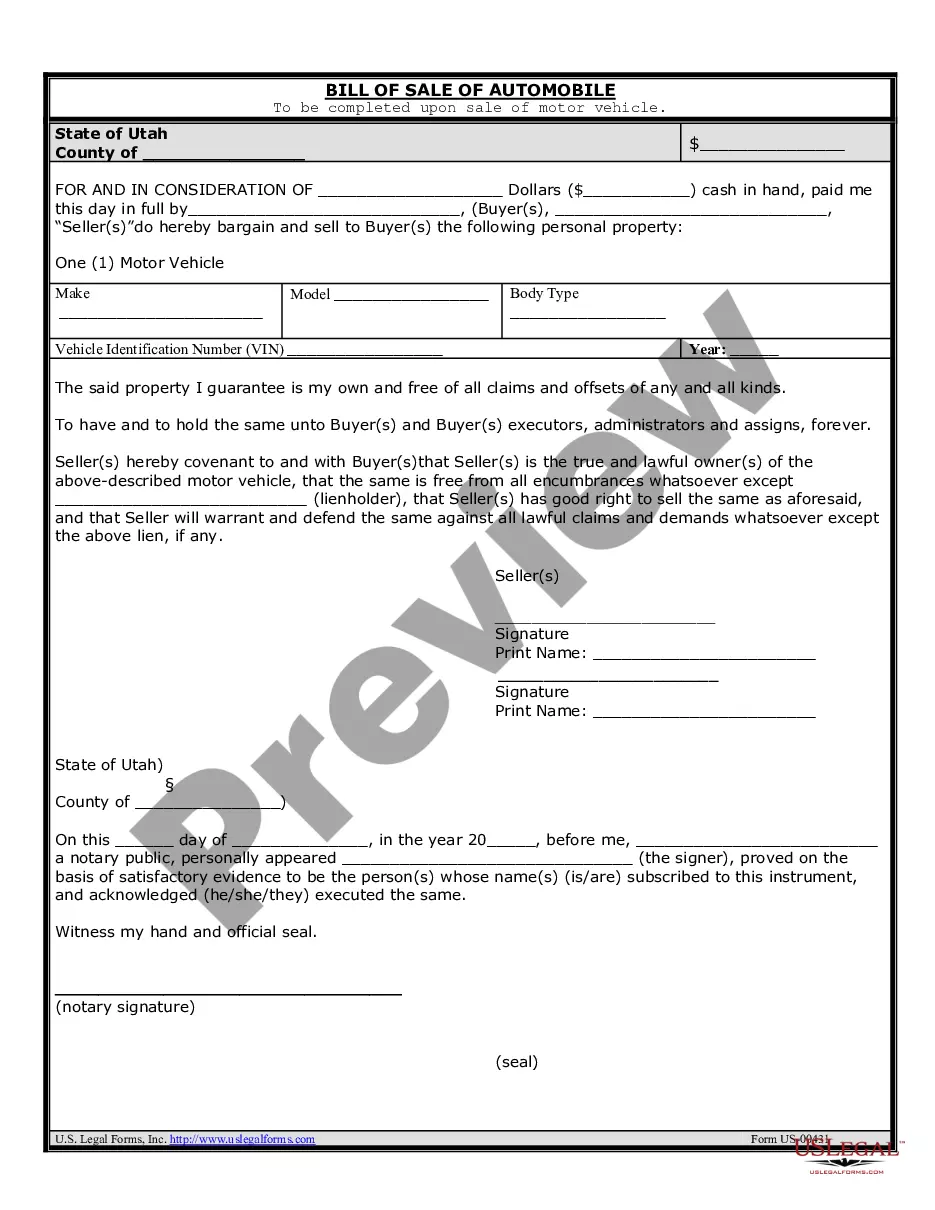

The bill of sale should contain: name and address of the buyer; name, address and signature of the seller; complete vehicle description, including the Vehicle Identification Number (VIN); description of trade-in, if any; purchase price of the vehicle; trade-in allowance, if applicable; and. net purchase price.

City State Zip code Street address Date of statement Transferee's signature Federal and State law require that you furnish to the transferee a written odometer disclosure statement upon transfer of ownership.