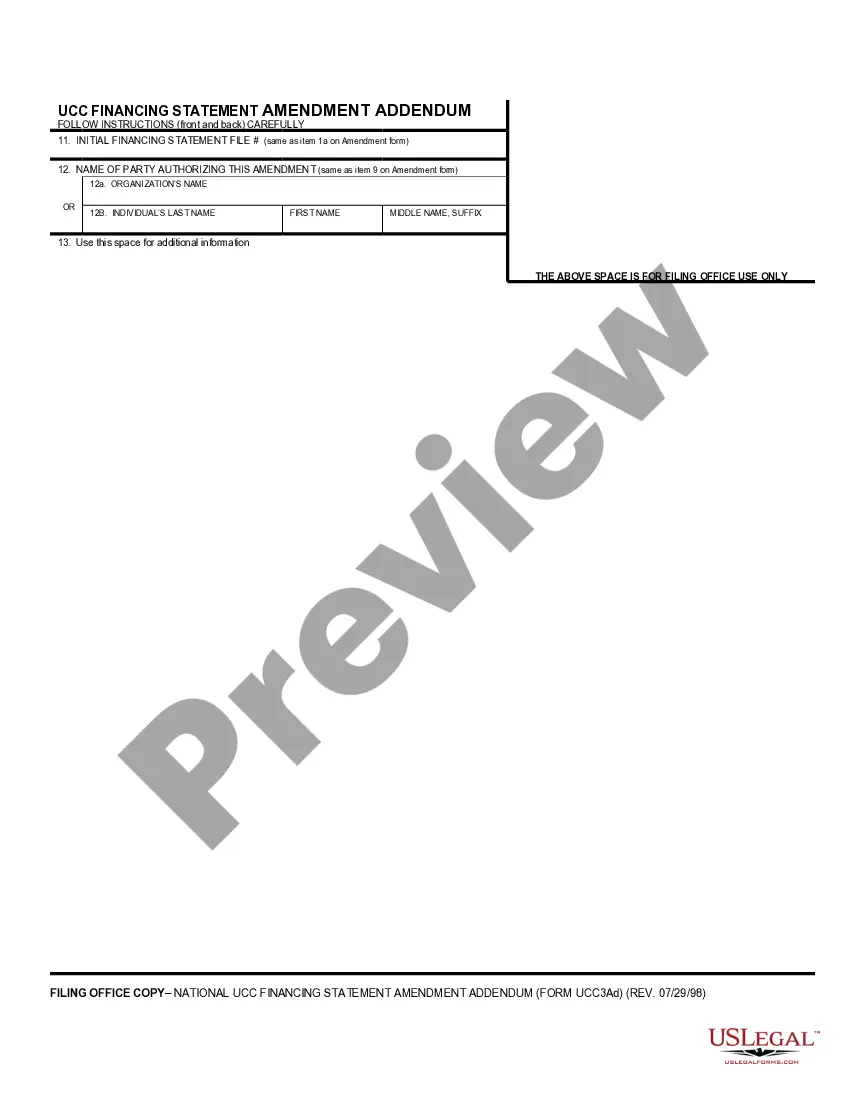

Ucc3 Form Ohio

Description

How to fill out UCC3 Financing Statement Amendment?

The Ucc3 Form Ohio displayed on this page is a versatile legal template created by qualified attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has delivered individuals, enterprises, and legal practitioners with over 85,000 validated, state-specific documents for any business and personal situation. It’s the fastest, simplest, and most reliable method to obtain the forms you require, as the service assures the utmost level of data protection and anti-malware safety.

Register with US Legal Forms to have verified legal templates for all of life’s situations readily available.

- Search for the document you require and review it.

- Browse through the template you looked for and preview it or check the form details to confirm it meets your requirements. If it doesn’t, utilize the search bar to find the appropriate one. Click Buy Now once you’ve located the template you need.

- Register and Log In.

- Choose the pricing option that fits you and set up an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

- Select the format you desire for your Ucc3 Form Ohio (PDF, DOCX, RTF) and download the document to your device.

- Fill out and sign the document.

- Print the template to complete it manually. Alternatively, use an online multifunctional PDF editor to swiftly and accurately fill out and sign your form with a valid signature.

- Download your documents again.

- Utilize the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously saved documents.

Form popularity

FAQ

Through Ohio Business Central, you can file your UCC-1 and UCC-3 statements online, obtain and request publications and search existing filings. If you have further questions regarding corporate filings, please call 877.767. 3453 or email business@OhioSoS.gov.

Possessing the Collateral to Perfect the Security Interest As a secured party, you can perfect your security interest in some types of collateral by possessing it. The types of collateral where the security interest can be perfected by possession are: goods. negotiable instruments (such as promissory notes and checks)

There are five ways a creditor may perfect a security interest: (1) by filing a financing statement, (2) by taking or retaining possession of the collateral, (3) by taking control of the collateral, (4) by taking control temporarily as specified by the UCC, or (5) by taking control automatically.

1. Ask the lender to terminate the lien upon payoff. When you pay off a loan, a good rule of thumb is to immediately submit a request with the lender to file a UCC-3 form with your secretary of state. The UCC-3 will terminate the lien on your company's asset (or assets) and remove the UCC-1 filing.

Now, for example, let's say you want to take a second mortgage with Bank#2. Bank#2 will search the Secretary of State records and find that Bank#1 has already lent you money. Bank#2 will not get its money back until Bank#1 has been paid in full so its interest is referred to as "subordinated".