Secretary Certificate Resolution For Sole Proprietorship

Description

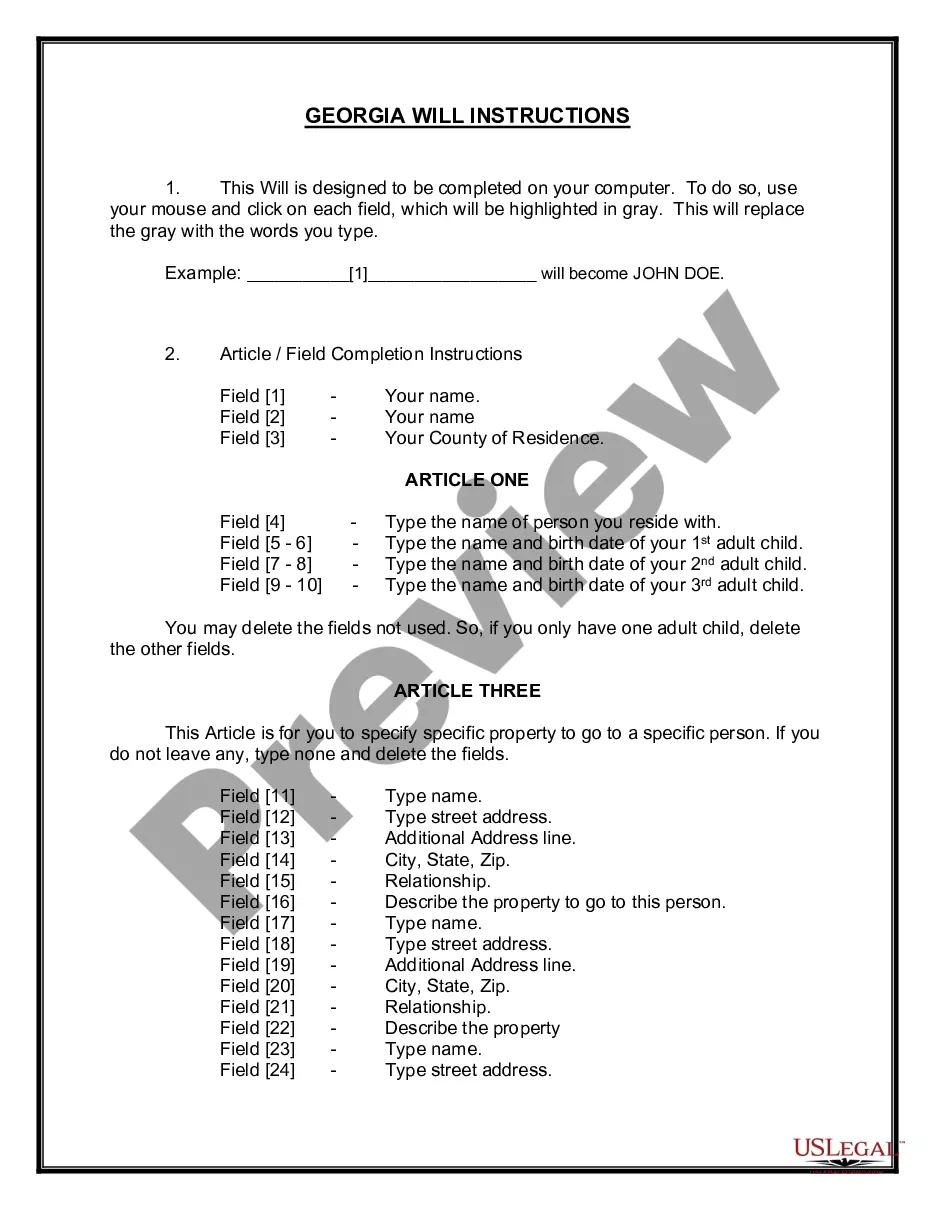

How to fill out Form Of Secretary's Certificate Of Resolution?

Bureaucracy necessitates accuracy and meticulousness.

If you do not routinely handle tasks like completing documentation such as Secretary Certificate Resolution For Sole Proprietorship, it may result in some misunderstandings.

Selecting the appropriate template from the beginning will ensure that your document submission proceeds smoothly and avert any issues of resending a file or starting the entire process anew.

If you are not a registered user, locating the desired template will require a few additional steps: Locate the template using the search bar. Ensure that the Secretary Certificate Resolution For Sole Proprietorship you found is applicable to your state or district. View the preview or read the description that provides details on the template’s usage. If the result meets your needs, click the Buy Now button. Choose the suitable option from the offered pricing plans. Log In to your account or create a new account. Complete the purchase using a credit card or PayPal. Download the form in your preferred file format. Obtaining the correct and up-to-date templates for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic worries and streamline your paperwork.

- You can always find the right template for your documentation at US Legal Forms.

- US Legal Forms is the largest online repository of forms, containing over 85 thousand samples across various domains.

- You can get the most up-to-date and pertinent version of the Secretary Certificate Resolution For Sole Proprietorship by simply searching for it on the site.

- Locate, store, and save templates in your account or refer to the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can easily gather, store in one location, and navigate the templates you save to access them with just a few clicks.

- While on the website, click the Log In button to sign in.

- Next, go to the My documents section, where the history of your documents is stored.

- Review the form descriptions and save the ones you require at any time.

Form popularity

FAQ

One of the most significant issues with owning a sole proprietorship is the lack of personal liability protection. Any debts or legal claims against the business can directly affect personal assets. Therefore, understanding the importance of documented decisions through something like a secretary certificate resolution for sole proprietorship can help establish legitimate business practices and may mitigate risks in some instances.

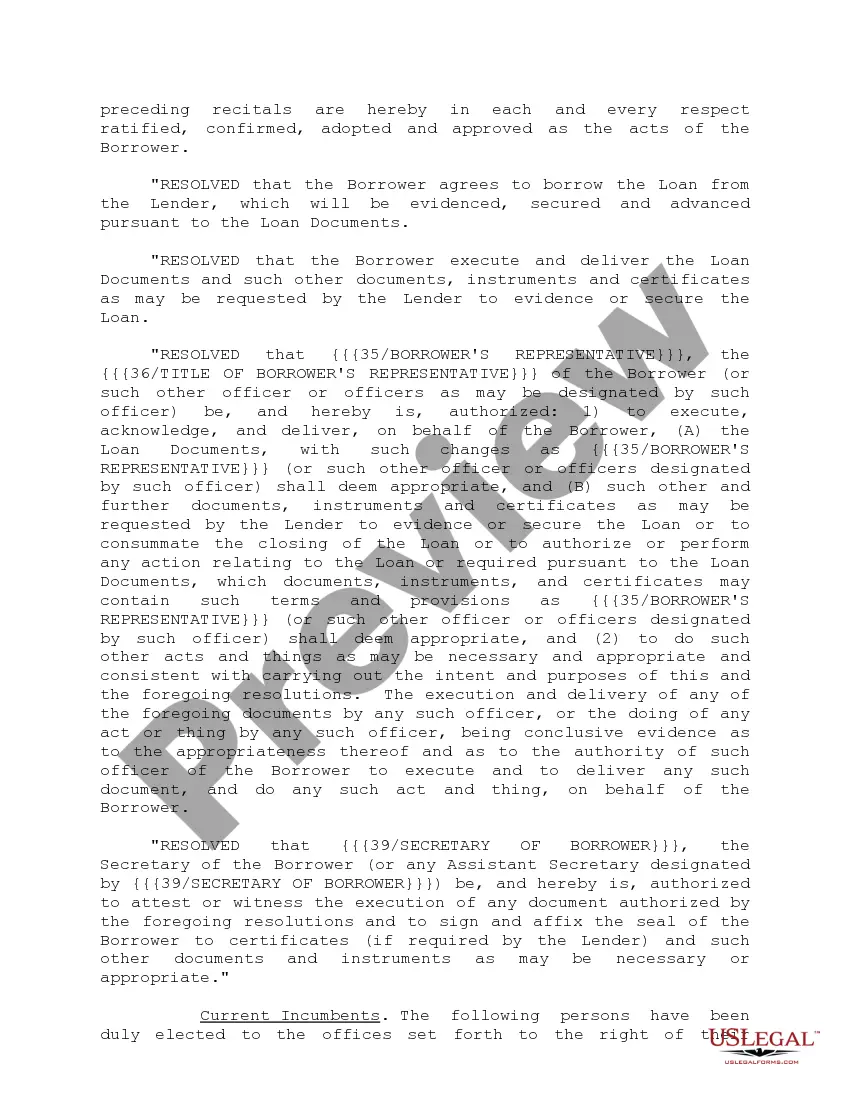

A certificate of the secretary is a formal document that attests to the authenticity of resolutions or decisions made within an organization. In the context of a sole proprietorship, this certificate verifies actions taken by the owner, acting as a safeguard for the business’s legal standing. Utilizing a secretary certificate resolution for sole proprietorship not only provides legitimacy but also adds a layer of professionalism to business operations.

A business resolution for sole proprietorship is a specific type of documentation that outlines significant decisions made by the sole proprietor. This can include decisions about banking, business operations, or any actions requiring formal approval. Crafting a secretary certificate resolution for sole proprietorship helps solidify these decisions and can be crucial during audits or legal inquiries.

A business resolution is a formal decision made by an organization, documented to reflect the meeting and actions taken. It provides official recognition of critical decisions, such as changes in policy or management. Using a secretary certificate resolution for sole proprietorship establishes a record of these decisions, aiding in transparency and accountability.

In a sole proprietorship, the owner is personally liable for all business debts and obligations. This means that if someone sues your business, you could lose personal assets. Because a secretary certificate resolution for sole proprietorship does not separate personal and business liability, it is crucial to be aware of the risks involved when operating a sole proprietorship.

Writing a business resolution involves clearly stating the purpose of the resolution, outlining the proposed actions, and indicating who is authorized to act on it. Begin with the title, 'Resolution of Company Name', followed by a statement detailing what is being resolved. A secretary certificate resolution for sole proprietorship ensures the document not only defines the action but also serves as formal evidence of the decision made.

An officer certificate and a secretary certificate, while both used in corporate governance, serve different purposes. An officer certificate is usually issued by an executive officer and confirms actions taken or decisions made by the company. In contrast, a secretary certificate resolution for sole proprietorship is specifically created by the company secretary to document resolutions or decisions, providing formal proof of the authority behind the actions taken.

Filling out a corporate resolution form involves collecting necessary details about the business decisions being documented. Start by clearly stating the resolutions, along with dates and necessary signatures. For sole proprietorships, a secretary certificate resolution guides you through this process, ensuring all required information is included. Consulting with resources from US Legal Forms can enhance your understanding of completing this form accurately.

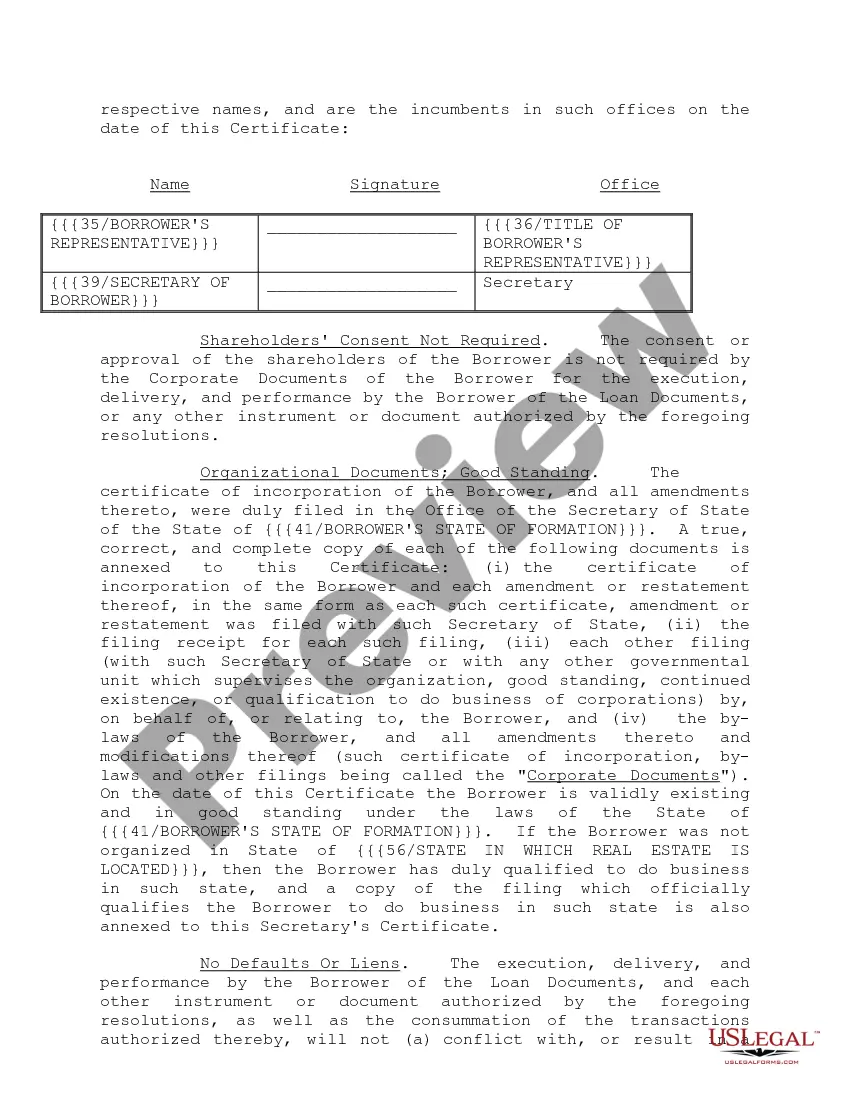

The secretary certificate needs to be signed by the secretary of the business or the sole proprietor. This signature verifies that the resolutions are legitimate and recorded properly. Ensuring that the right person signs the document adds credibility and authenticity. Platforms like US Legal Forms provide templates and guides to help you understand the signing process.

An officer certificate is typically issued by an officer of the company and confirms specific corporate actions, while a secretary certificate resolution for sole proprietorship validates the roles and decisions made within the business. Essentially, the secretary certificate focuses on recording the resolutions passed and the authority of individuals involved. Understanding this distinction helps you choose the right document for your business needs.