Bridge Financing Agreement With Example

Description

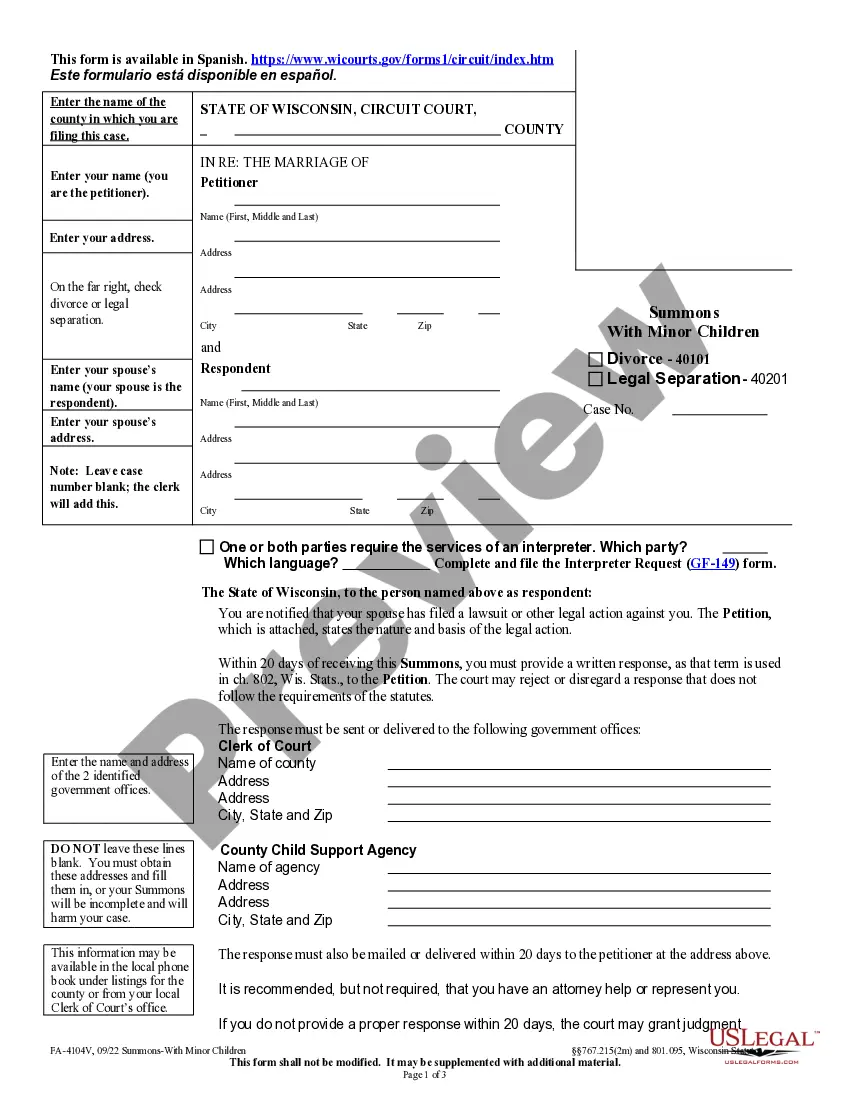

How to fill out Security Agreement For Bridge Financing?

When you need to present Bridge Financing Agreement With Example that adheres to your local state's rules, there can be numerous options to select from.

There's no necessity to examine every form to verify it satisfies all the legal requirements if you are a US Legal Forms subscriber.

It is a reliable resource that can assist you in obtaining a reusable and current template on any subject.

Acquiring proficiently drafted official documents becomes effortless with US Legal Forms. Moreover, Premium users can also take advantage of the robust integrated solutions for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most extensive online library with an archive of over 85k ready-to-use documents for business and personal legal needs.

- All templates are authenticated to conform with each state's laws and regulations.

- As a result, when downloading Bridge Financing Agreement With Example from our site, you can be assured that you possess a valid and current document.

- Obtaining the necessary sample from our platform is quite simple.

- If you already have an account, just Log In to the system, check your subscription to ensure it's active, and save the chosen file.

- Afterward, you can open the My documents tab in your profile and gain access to the Bridge Financing Agreement With Example at any time.

- If this is your first time on our website, please follow the instructions below.

- Browse the suggested page and verify it aligns with your requirements.

Form popularity

FAQ

Example of how a bridge loan is usedYou have $150,000 left on the mortgage. You take out a bridge loan for 80 percent of your current home's value, which is $200,000. This amount is used to pay off your current mortgage and give you an extra $50,000 for your new home's down payment.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

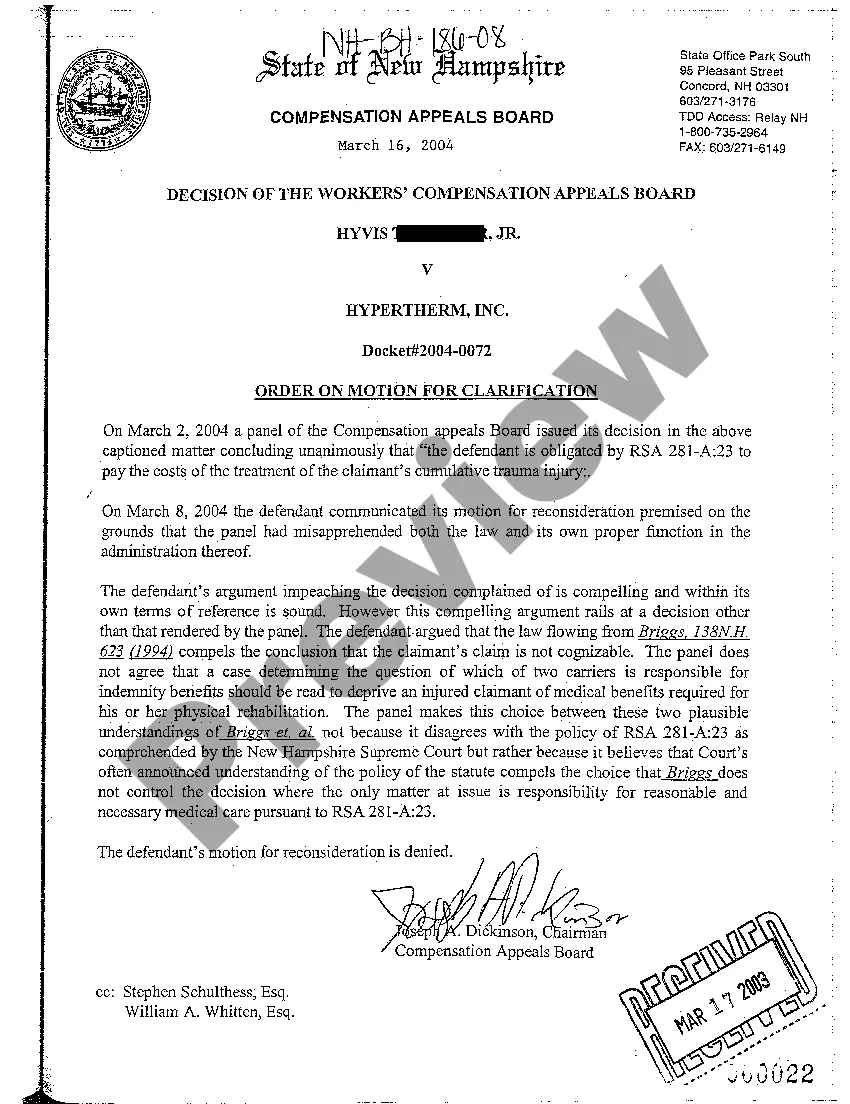

A bridge loan is a short-term loan used until a person or company secures permanent financing or removes an existing obligation. It allows the user to meet current obligations by providing immediate cash flow.

Example of Bridge FinancingA new biotech company needs $50 million during the next year to fund its research into a potent new anti-virus medication. A private equity firm lends it the money, but only at a 15% interest rate, because of the risks involved.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties. You may choose to keep a copy in your county recorder's office if you wish, though it's not legally necessary. It's sufficient for both parties to store their own copy, ideally in a safe place.