Lemon Law Form Ford

Description

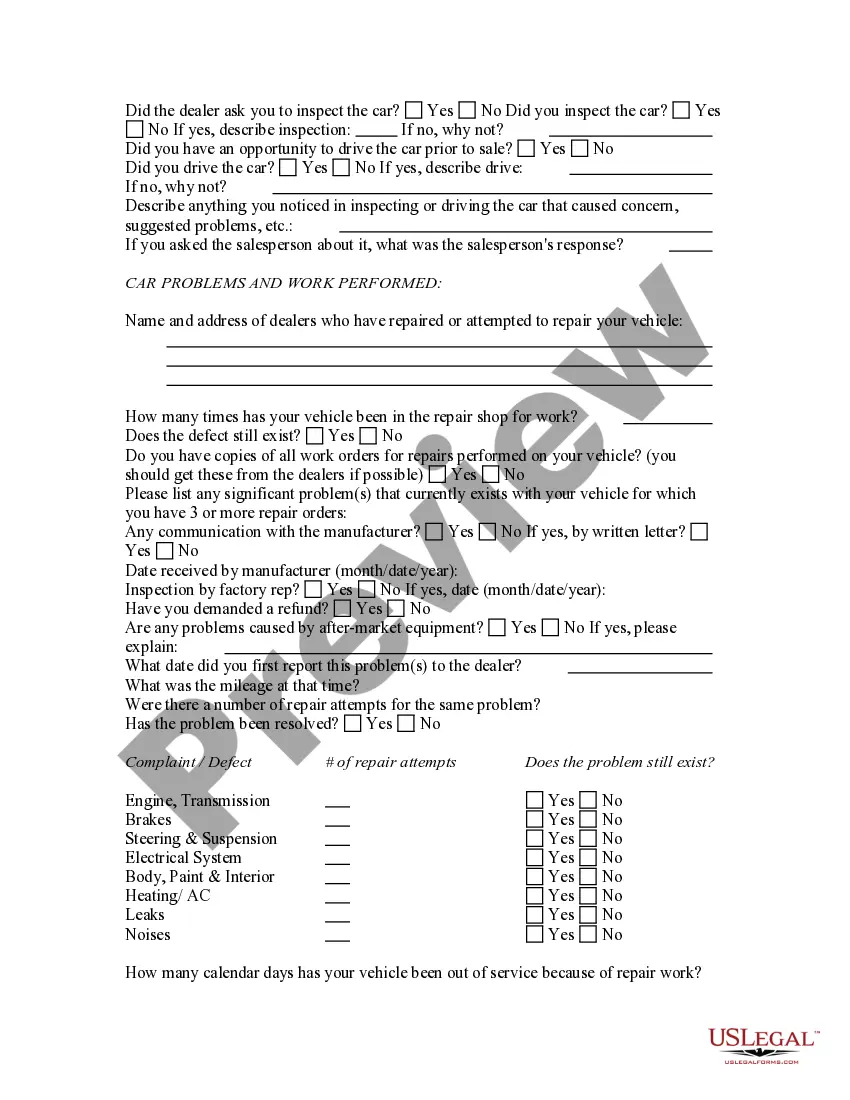

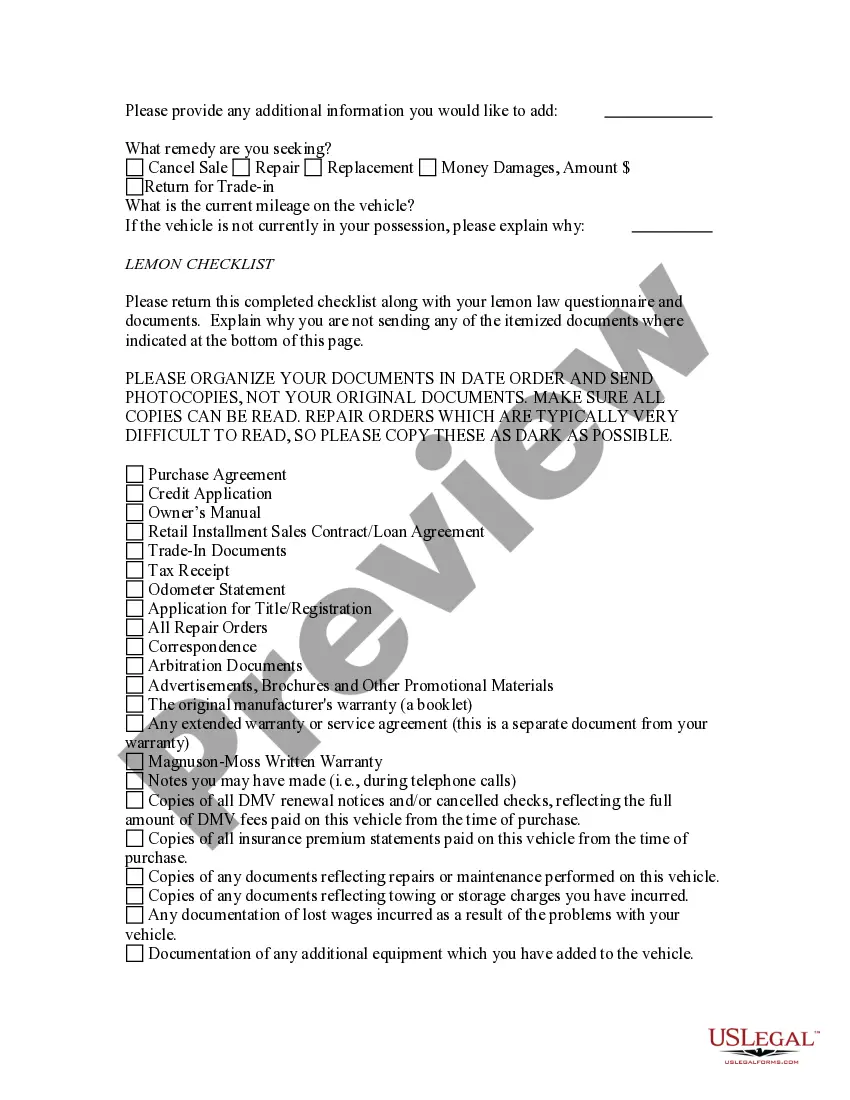

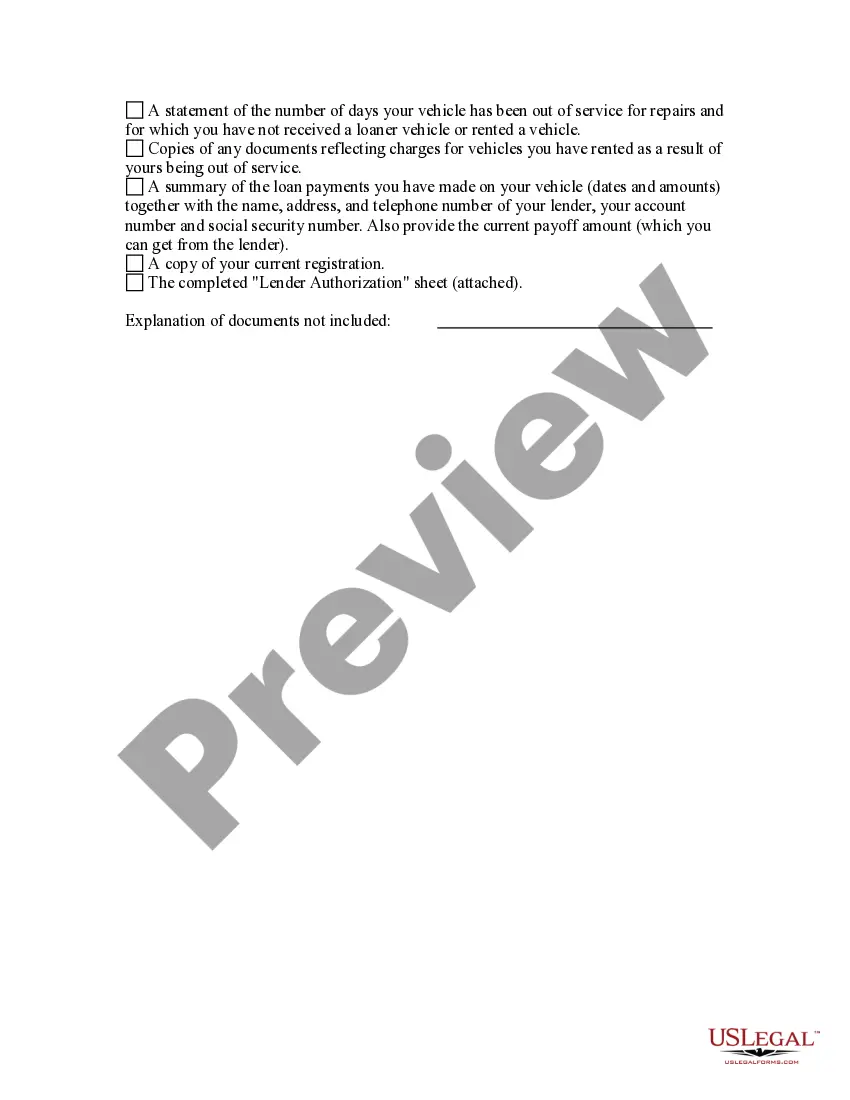

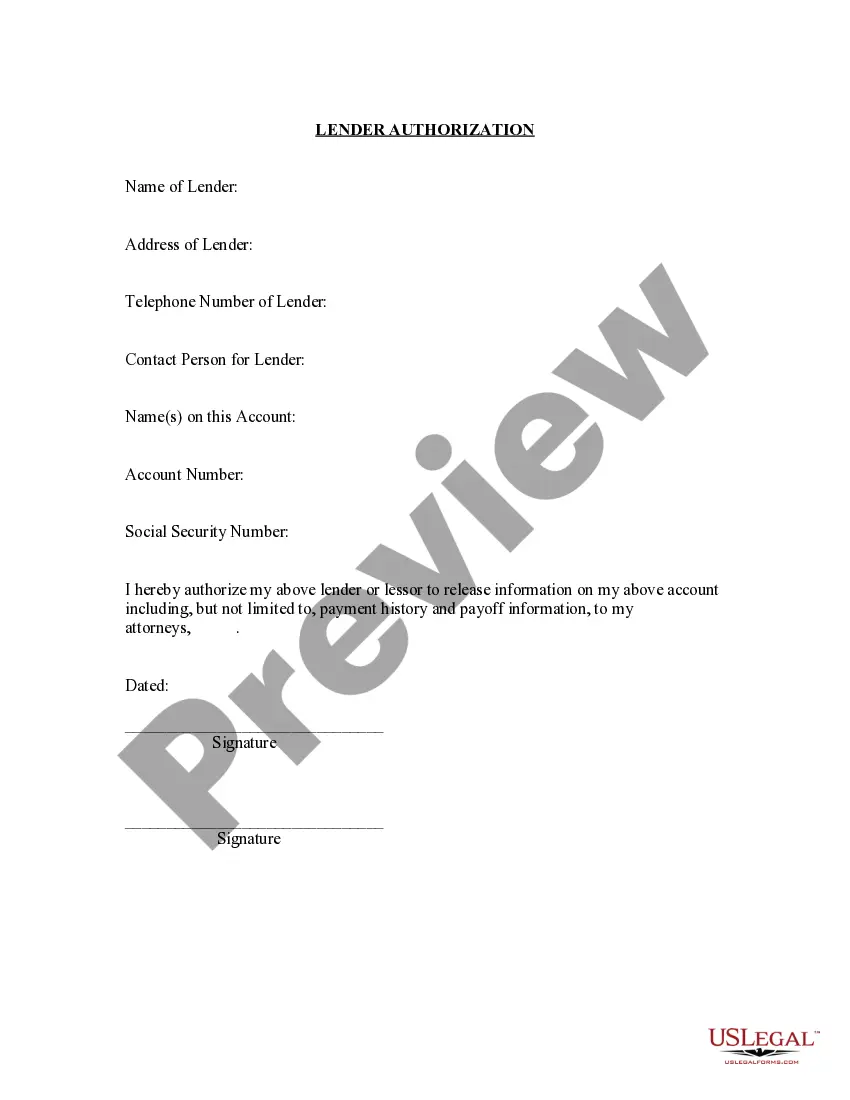

How to fill out Automobile Lemon Law Questionnaire?

Creating legal documents from scratch can occasionally be overwhelming.

Certain cases may entail extensive research and significant financial investment.

If you’re looking for a simpler and more budget-friendly method to prepare Lemon Law Form Ford or any other paperwork without unnecessary complications, US Legal Forms is readily available for you.

Our online collection of over 85,000 current legal forms encompasses almost every aspect of your financial, legal, and personal affairs.

Before downloading Lemon Law Form Ford, consider these suggestions: Review the form preview and descriptions to ensure you have the correct document. Ensure the template you choose complies with your state and county laws. Select the most appropriate subscription option to purchase the Lemon Law Form Ford. Download the file, then complete, sign, and print it. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form completion simple and efficient!

- With just a few clicks, you can quickly acquire state- and county-specific templates carefully crafted by our legal professionals.

- Utilize our website whenever you require a dependable and trustworthy service to easily find and download the Lemon Law Form Ford.

- If you’re already familiar with our services and have set up an account, just Log In, select the form, and download it or retrieve it later in the My documents section.

- Not yet registered? No worries. It only takes a few minutes to sign up and explore the catalog.

Form popularity

FAQ

What is the cost of a storage unit in Minnesota? SizeLowestAverage5x5$10$495x10$30$7810x10$42$12610x15$58$1681 more row

Perhaps you store tools, supplies, or other equipment to properly run your business. If you run a business with legitimate storage needs as a typical requirement, you can write off your storage fees as a standard business expense deduction.

Nontaxable Items Nontaxable SalesAdditional InformationCamp fees - when the exemption requirements are metAdmissions and Amusement DevicesCaskets, urns for cremains, and burial vaultsFuneral Homes, Mortuaries, Crematories, and CemeteriesCigarettesLicense Requirements for RetailersClothingClothing55 more rows ?

Furthermore, services are not taxable unless specifically included by law. Examples of taxable services include lodging, laundry and cleaning services, pet grooming, lawn care, digital downloads, and telecommunications. A remote seller is a retailer that does not have a physical presence in the state.

Minnesota sales and use tax is due when a business buys storage or warehouse services for its tangible personal property, except as noted below. ?Tangible? refers to property that can be seen, weighed, measured, felt or touched. The tax does not apply to digital storage services.

Fees and other charges are taxable unless an exemption applies. Fees and other charges by lodging facilities are taxable unless an exemption applies. See the table below for examples of taxable sales. For more information, see Admissions and Amusement Devices.