Formato Dui El Salvador

Description

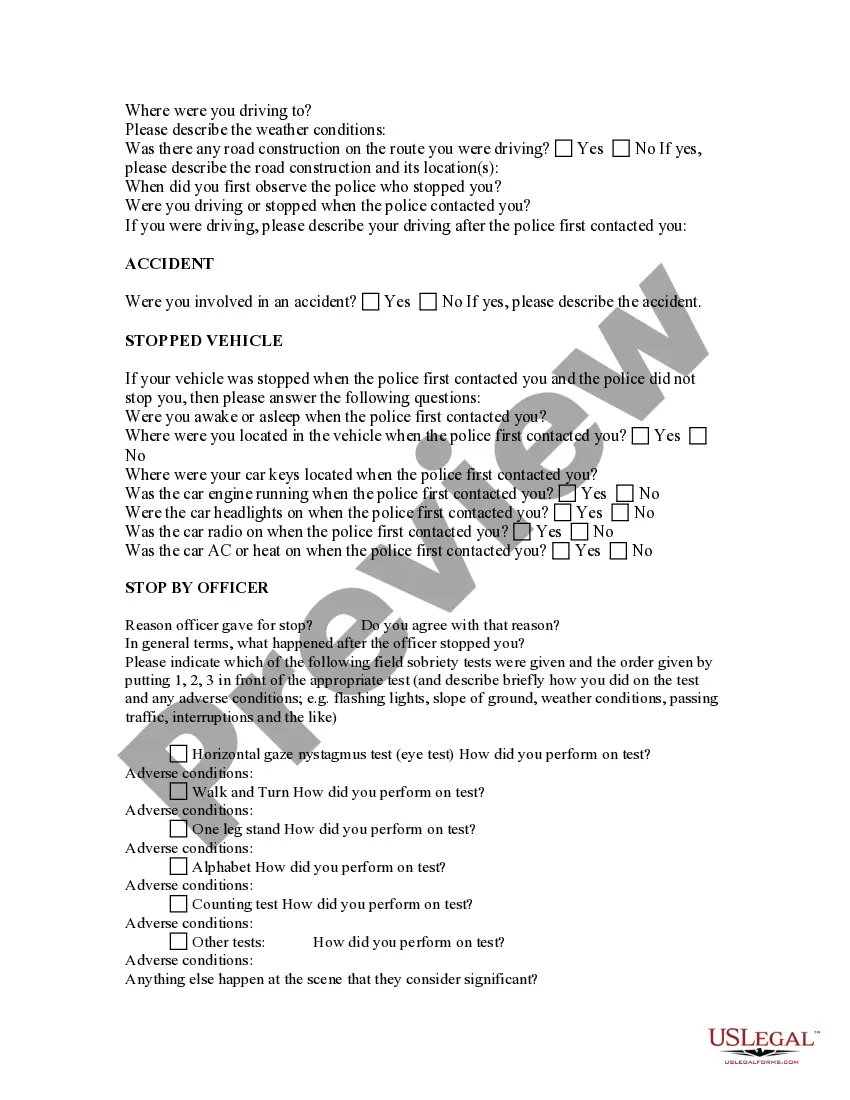

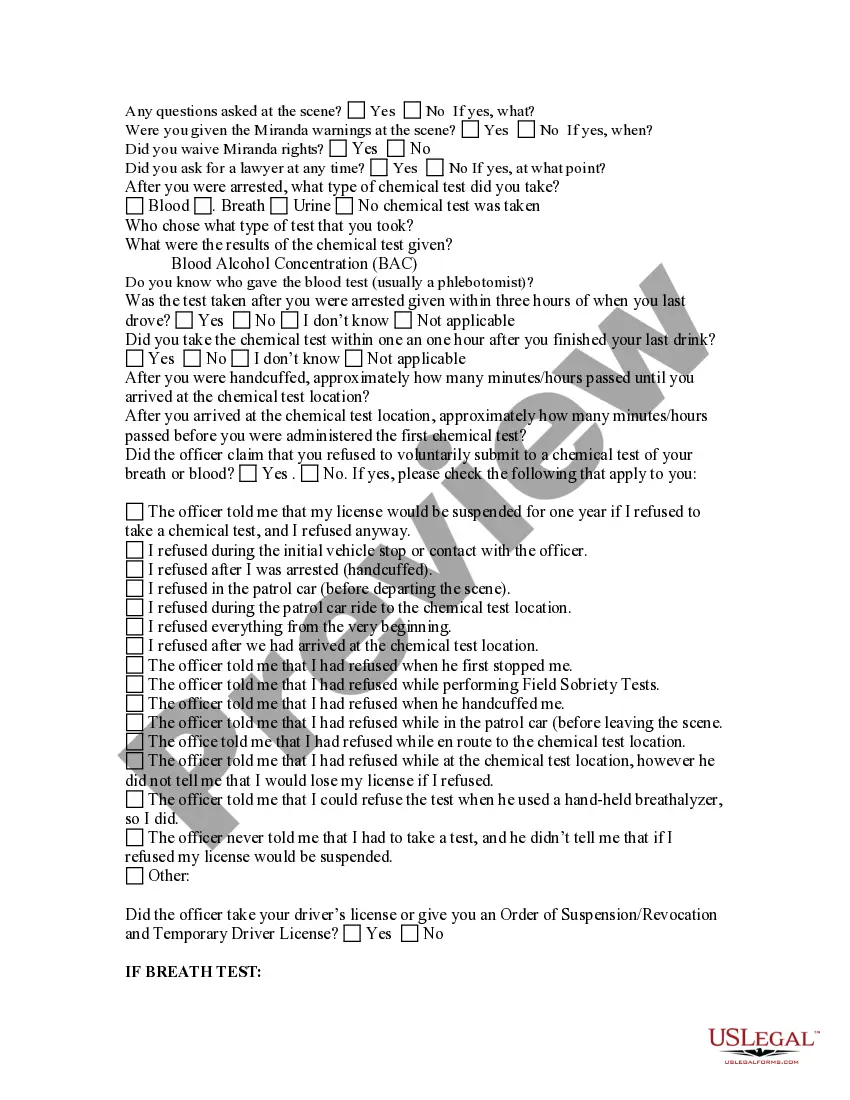

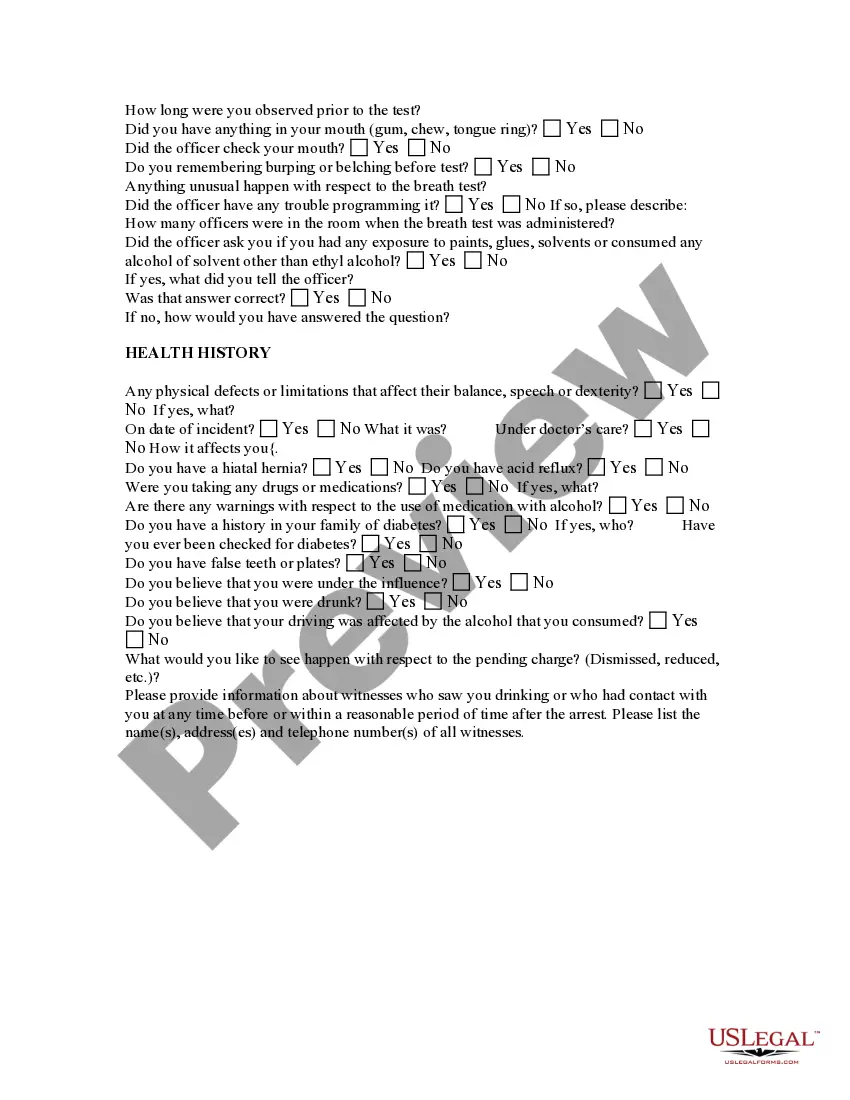

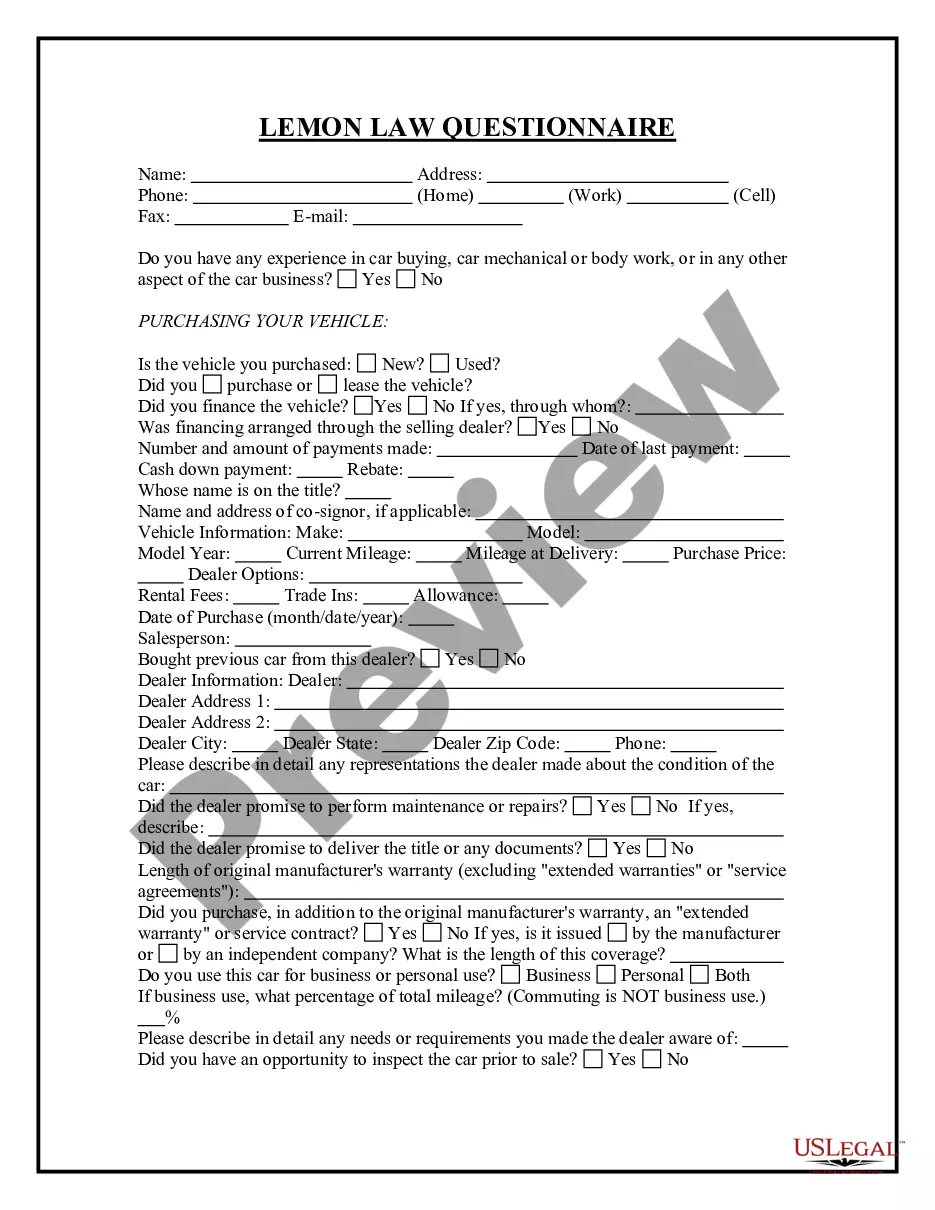

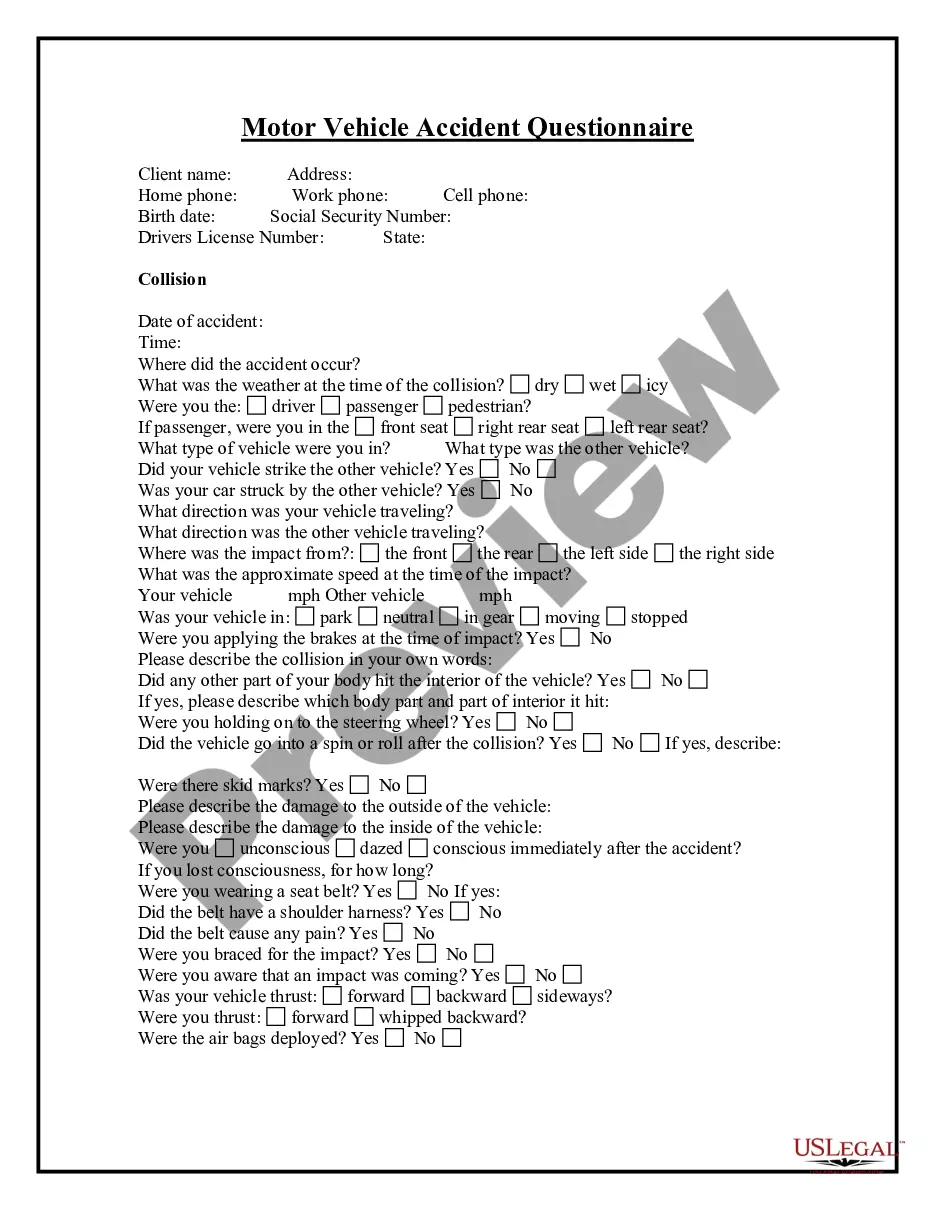

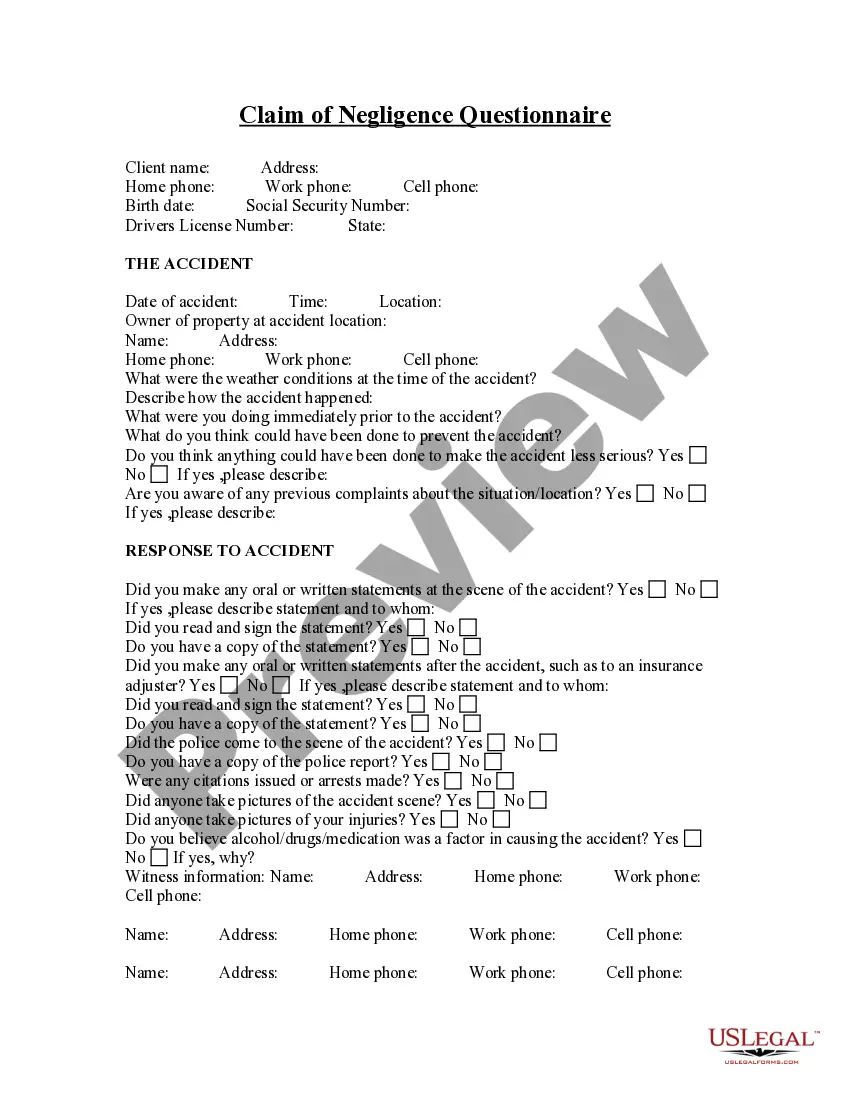

How to fill out Driving Under The Influence - DUI - Questionnaire?

Creating legal documents from the ground up can occasionally be daunting.

Certain situations may require extensive research and significant financial investment.

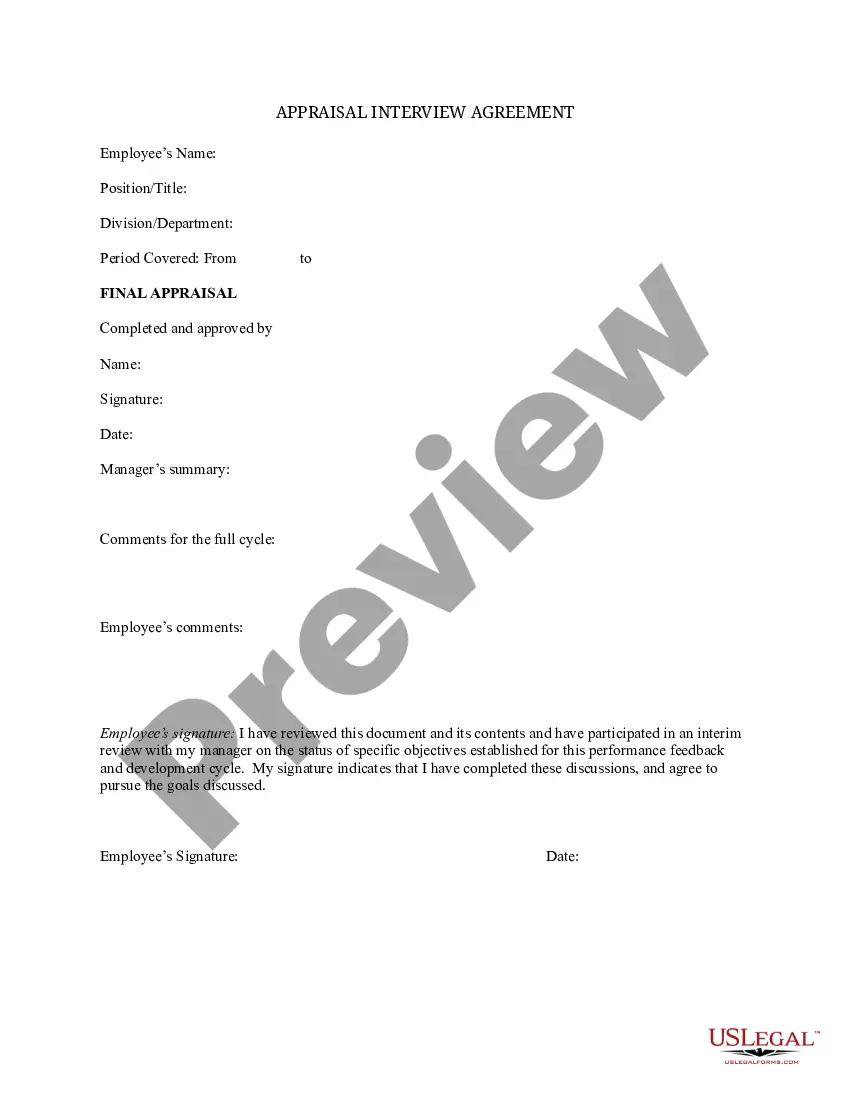

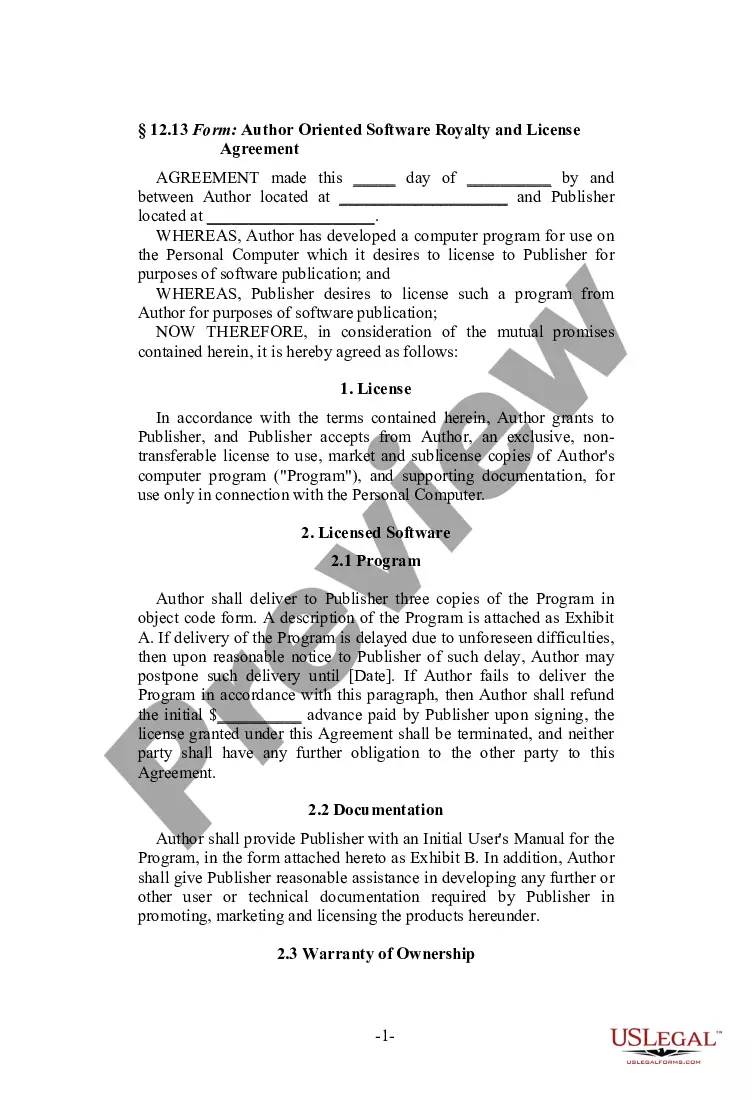

If you’re seeking a more straightforward and cost-effective method for preparing Formato Dui El Salvador or any other paperwork without the hassle, US Legal Forms is always available to assist you.

Our online catalog of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal concerns.

But before you dive into downloading Formato Dui El Salvador, consider these suggestions: Review the form preview and descriptions to ensure you have the correct document. Ensure the template you choose complies with the laws and regulations of your state and county. Select the most appropriate subscription option to purchase the Formato Dui El Salvador. Download the document, then complete, sign, and print it. US Legal Forms boasts a flawless reputation and over 25 years of experience. Join us today and simplify the form execution process!

- With just a few clicks, you can swiftly find state- and county-specific forms carefully assembled for you by our legal professionals.

- Utilize our platform whenever you require dependable and trustworthy services to easily find and download the Formato Dui El Salvador.

- If you're familiar with our services and have created an account before, just Log In to your account, select the form, and download it immediately or retrieve it later in the My documents section.

- Not registered yet? No issue. Setting it up and navigating the library only takes a few minutes.

Form popularity

FAQ

Note: If you are at least 65 years old or blind, you can claim an additional 2023 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status).

Montana Tax Rates, Collections, and Burdens Montana has a 6.75 percent corporate income tax rate. Montana does not have a state sales tax and does not levy local sales taxes. Montana's tax system ranks 5th overall on our 2023 State Business Tax Climate Index.

(1) A standard deduction equal to 20% of adjusted gross income is allowed if elected by the taxpayer on a return. The standard deduction is in lieu of all deductions allowed under 15-30-2131.

Call Us. To speak to a Citizen Service Representative, call our Call Center: Phone. (406) 444-6900.

15. Rights of Persons Not Adults. The rights of persons under 18 years of age shall include, but not be limited to, all the fundamental rights of this Article unless specifically precluded by laws which enhance the protection of such persons.

Montana offers a standard deduction that's 20% of your adjusted gross income (AGI), but the amount is subject to a lower and upper limit.

Amendments to this constitution may be proposed by any member of the legislature. If adopted by an affirmative roll call vote of two-thirds of all the members thereof, whether one or more bodies, the proposed amendment shall be submitted to the qualified electors at the next general election.

For the 2022 tax year, seniors filing single or married filing separately get a standard deduction of $14,700. For those who are married and filing jointly, the standard deduction for 65 and older is $25,900.