Application For S Corporation

Description

How to fill out Small Business Startup Package For S-Corporation?

Identifying a reliable source for obtaining the most up-to-date and pertinent legal documents is a significant part of navigating bureaucracy.

Finding the appropriate legal forms requires precision and meticulousness; hence, sourcing Application For S Corporation samples from trustworthy outlets, such as US Legal Forms, is crucial.

Eliminate the stress of your legal paperwork. Explore the comprehensive US Legal Forms library to locate legal templates, assess their relevance to your case, and download them instantly.

- Utilize the library navigation or search function to find your document.

- Access the description of the form to verify if it meets the criteria of your state and county.

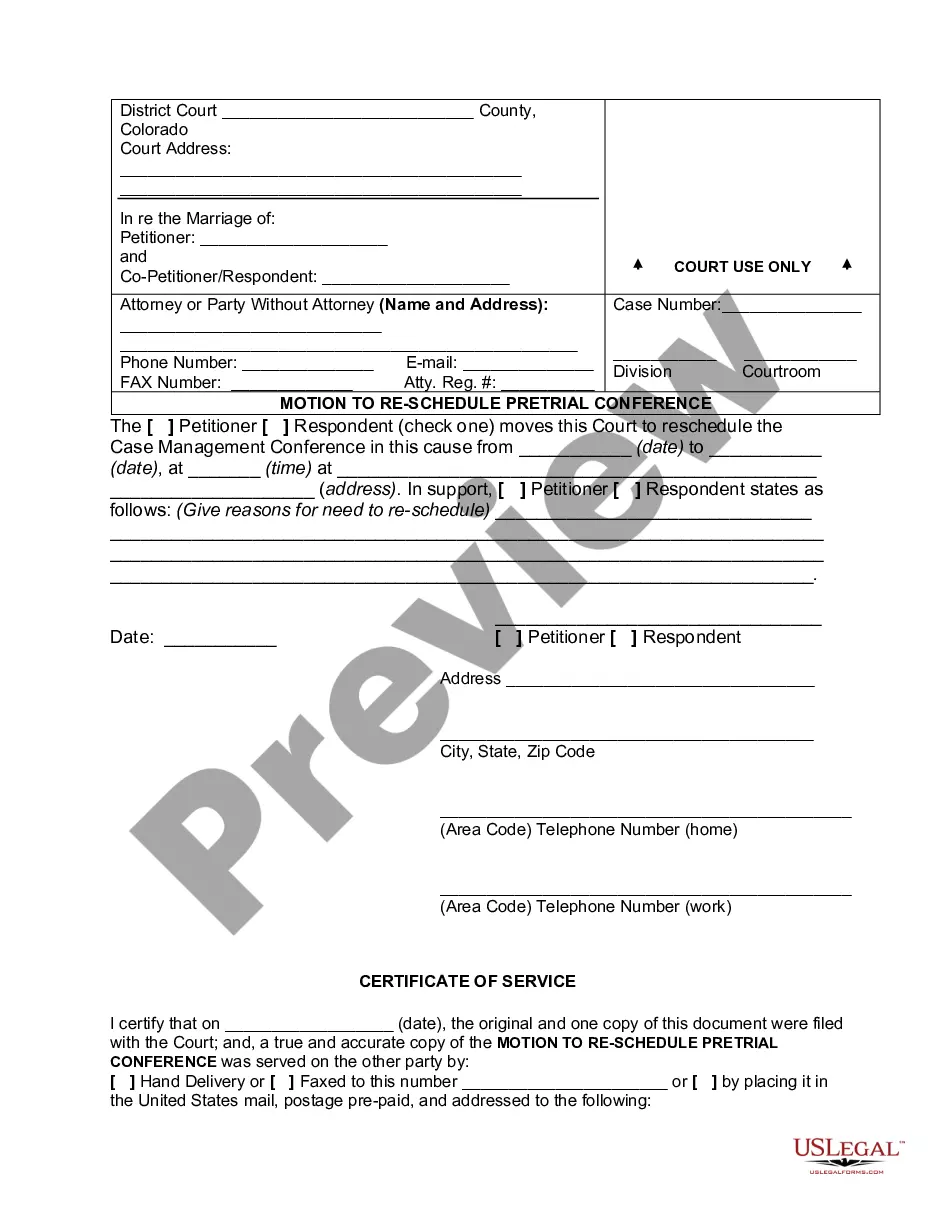

- Preview the form, if available, to confirm it aligns with your needs.

- If the Application For S Corporation is not suitable, return to the search to look for the correct template.

- Once confident in the form's applicability, proceed to download it.

- If you are a registered user, click Log in to verify your identity and access your chosen forms in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select a pricing plan that suits your needs.

- Complete the registration to finalize your transaction.

- Conclude your purchase by choosing a payment method (credit card or PayPal).

- Choose the file format for downloading the Application For S Corporation.

- After obtaining the form on your device, you can modify it with the editor or print it out to fill it in by hand.

Form popularity

FAQ

Unlike a will, you don't need to sign a trust in front of witnesses to make it legally enforceable in North Carolina. Instead, you simply need to draft a trust document (doing this with the help of an attorney is advisable), assign enough property to the trust to fund it, and sign the trust in front of a notary public.

When creating a living trust in North Carolina, you complete the trust document and sign it in front of notary. You then must take the final step of transferring ownership of the assets into the trust for it to be effective. A living trust provides a variety of benefits.

The cost of creating a trust in North Carolina varies, but a basic Revocable Living Trust generally ranges from $1,000 to $3,000. The cost may be higher for more complex trusts or if you require the assistance of an attorney. Online legal services can offer more affordable alternatives for creating trusts.

In the case of a will or trust, they define how your estate will be managed and distributed after your death. In North Carolina, the cost for comprehensive estate plan drafting can range from $1,500 to $4,250 or more, depending on the complexity of your estate and the attorney's experience.

Furthermore, there are recurring administrative costs such as trustee fees, tax preparation fees, and legal fees. Ongoing Record-Keeping: Trusts also require meticulous record-keeping and can be complex to understand and manage. There is a strict legal framework that must be adhered to, which can be daunting for many.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Draw up the trust document: You can do this either by yourself or with a lawyer. Get the document notarized: Sign the trust document in front of a notary. Fund the trust: This means putting your property into the trust. This requires some paperwork, so while you can do it by yourself, getting a lawyer might be helpful.

To make a living trust in North Carolina, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.