Small Business Partnership For Students

Description

How to fill out Small Business Startup Package For General Partnership?

Whether for commercial reasons or personal affairs, everyone must handle legal matters at some stage in their life.

Completing legal documents necessitates meticulous focus, starting with selecting the appropriate form template.

With a vast catalog of US Legal Forms available, you can avoid wasting time searching for the correct template online. Utilize the library’s user-friendly navigation to find the suitable form for any circumstance.

- For instance, if you select an incorrect version of a Small Business Partnership For Students, it will be rejected upon submission.

- Thus, it is crucial to have a reliable source for legal documents like US Legal Forms.

- If you wish to acquire a Small Business Partnership For Students template, adhere to these straightforward steps.

- 1. Obtain the template you want by utilizing the search bar or the catalog navigation.

- 2. Review the form’s summary to ensure it aligns with your circumstances, state, and locality.

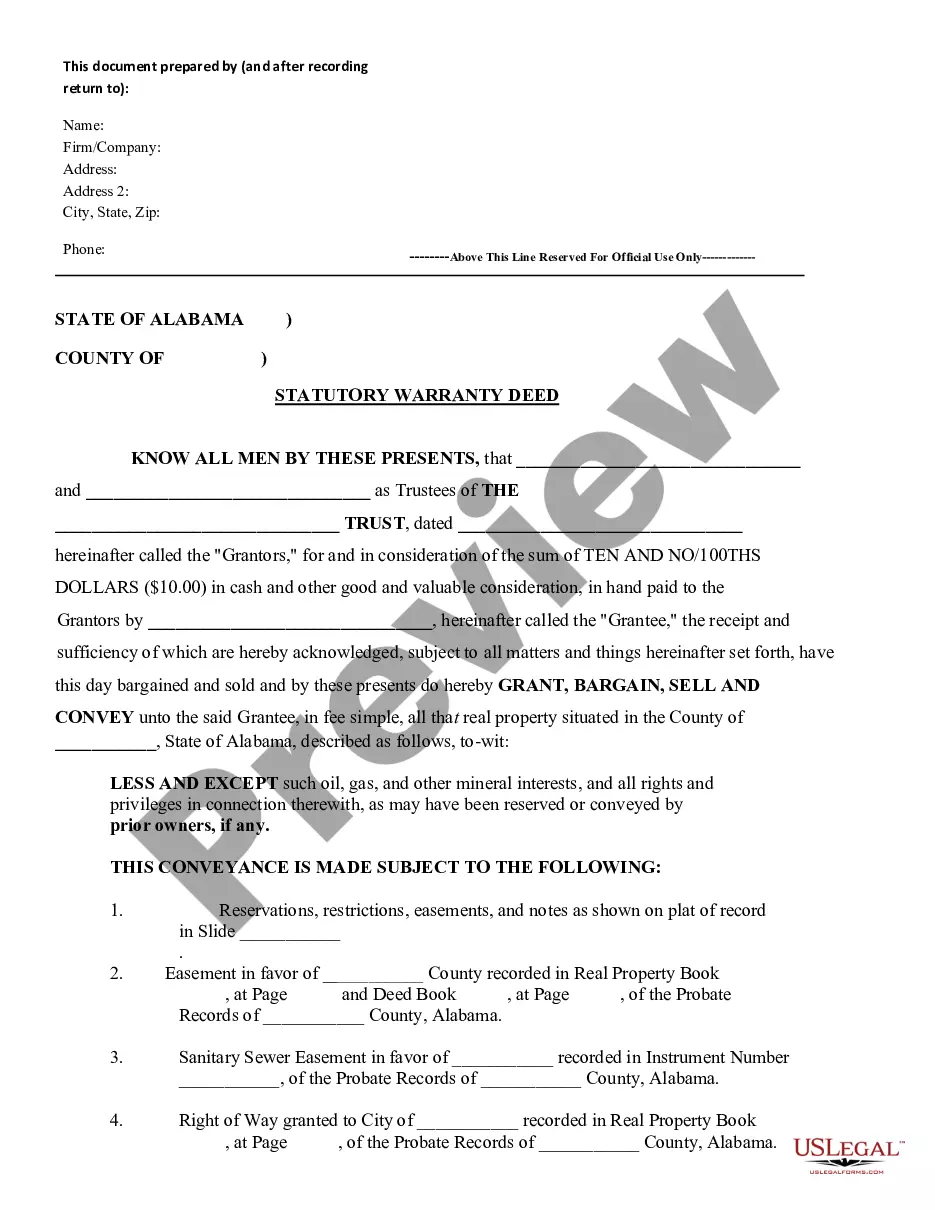

- 3. Click on the form’s preview to view it.

- 4. If it is the wrong document, return to the search function to locate the appropriate Small Business Partnership For Students sample.

- 5. Download the file once it corresponds to your requirements.

- 6. If you have an existing US Legal Forms account, simply click Log in to access documents previously saved in My documents.

- 7. If you do not yet have an account, you can acquire the form by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Complete the account registration form.

- 10. Choose your payment method: use a credit card or your PayPal account.

- 11. Select the document format you prefer and download the Small Business Partnership For Students.

- 12. Once it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

If you need to change or amend an accepted Arkansas State Income Tax Return for the current or previous Tax Year, you need to complete Form AR1000F (residents) or Form AR1000NR (nonresidents and part-year residents). Forms AR1000F and AR1000NR are Forms used for the Tax Amendment.

You can request copies of your IRS tax returns from the most recent seven tax years. To obtain copies of your tax return from the IRS, download file Form 4506 from the IRS website, complete it, sign it, and mail it to the appropriate IRS address. As of 2023, the IRS charges $43 for each return you request.

You'll be able to access your most recent 3 tax returns (each of which include your Form 1040?the main tax form?and any supporting forms used that year) when sign into 1040.com and go to the My Account screen. If you filed through a tax preparer or CPA, they can provide a printed or electronic copy of your tax return.

If you choose to electronically file your State of Arkansas tax return by using one of the online web providers, you are required to complete the form AR8453-OL.

Get the current filing year's forms, instructions, and publications for free from the IRS. Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Get a federal tax return transcript You can get transcripts of the last 10 tax years. Transcripts are free. Online orders can be downloaded immediately. Phone and mail orders take 5-10 days.

You can get IRS forms and instructions quickly and easily by visiting the IRS.gov website 24 hours a day 7 days a week. They often appear online before they are available on paper. To view and download tax products, select ?Forms and Pubs.?

Yes, you can print the tax forms you download for free from the IRS website.