Documents Required For Proprietorship Registration

Description

How to fill out Small Business Startup Package For Sole Proprietorship?

Utilizing legal document templates that comply with federal and state laws is vital, and the web provides numerous choices to choose from.

However, what is the benefit of spending time searching for the suitable Documents Required For Proprietorship Registration template online when the US Legal Forms digital library already consolidates such forms in one location.

US Legal Forms stands as the premier online legal repository featuring over 85,000 customizable templates created by attorneys for various business and personal needs.

Explore the template using the Preview function or through the text structure to confirm it suits your requirements.

- They are easy to navigate with all documents organized by state and intended use.

- Our experts stay updated with legal amendments, ensuring your documents are current and adhere to regulations when obtaining a Documents Required For Proprietorship Registration from our site.

- Acquiring a Documents Required For Proprietorship Registration is straightforward for both existing and new users.

- If you possess an account with an active subscription, Log In and store the document template you require in your desired format.

- If you are a newcomer to our site, follow the steps outlined below.

Form popularity

FAQ

It is simple to form a sole proprietorship. You do not need to register, and it is easier to manage and file taxes. However, your personal assets are not protected from business liability. To learn more about starting a sole proprietorship in Pennsylvania, check out our complete guide.

You don't have to file a document to ?form? your Sole Proprietorship in California, you're already a business owner. However, there are a few things you may need to (or want to) do in order to operate legally. For example, your business may need a license or permit to operate.

Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name. File a Fictitious Business Name Statement with your county. Apply for licenses, permits, and zoning clearance.

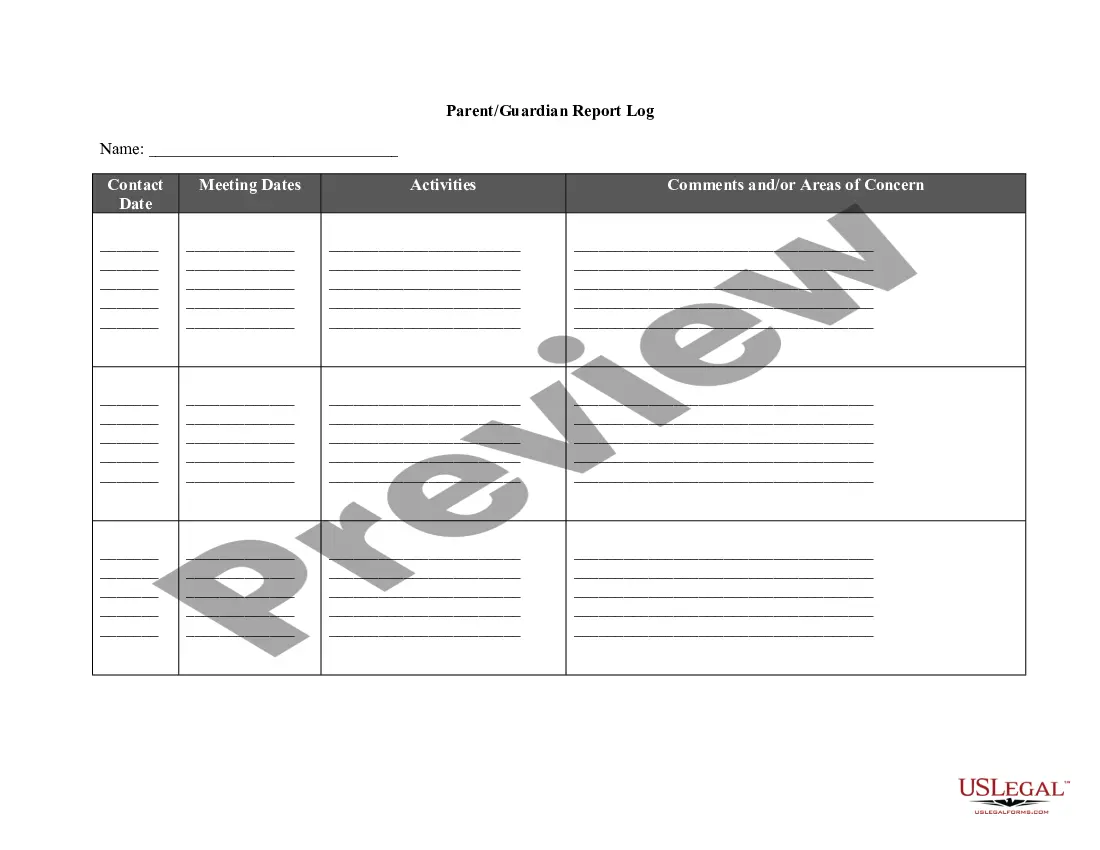

Step-By-Step Startup StructureCostTimePennsylvania Sole Proprietorship Click for step-by-step instructionsDBA Name: $70 DBA Publishing: ~$200 EIN: $0 PA-100: $0 + fees for needed licensesDBA Name: ~10-15 business days EIN: Immediately online PA-100: varies based on needed tax accounts/licenses4 more rows

How to start a sole proprietorship: 7 steps to take Choose a business name. ... Register your business name. ... Purchase a website domain name. ... Obtain a business license and other permits. ... File for an employer identification number (EIN) ... Open a business bank account. ... Get insurance coverage.