Personal Loan Document Form Without The Lines

Description

How to fill out Personal Loan Agreement Document Package?

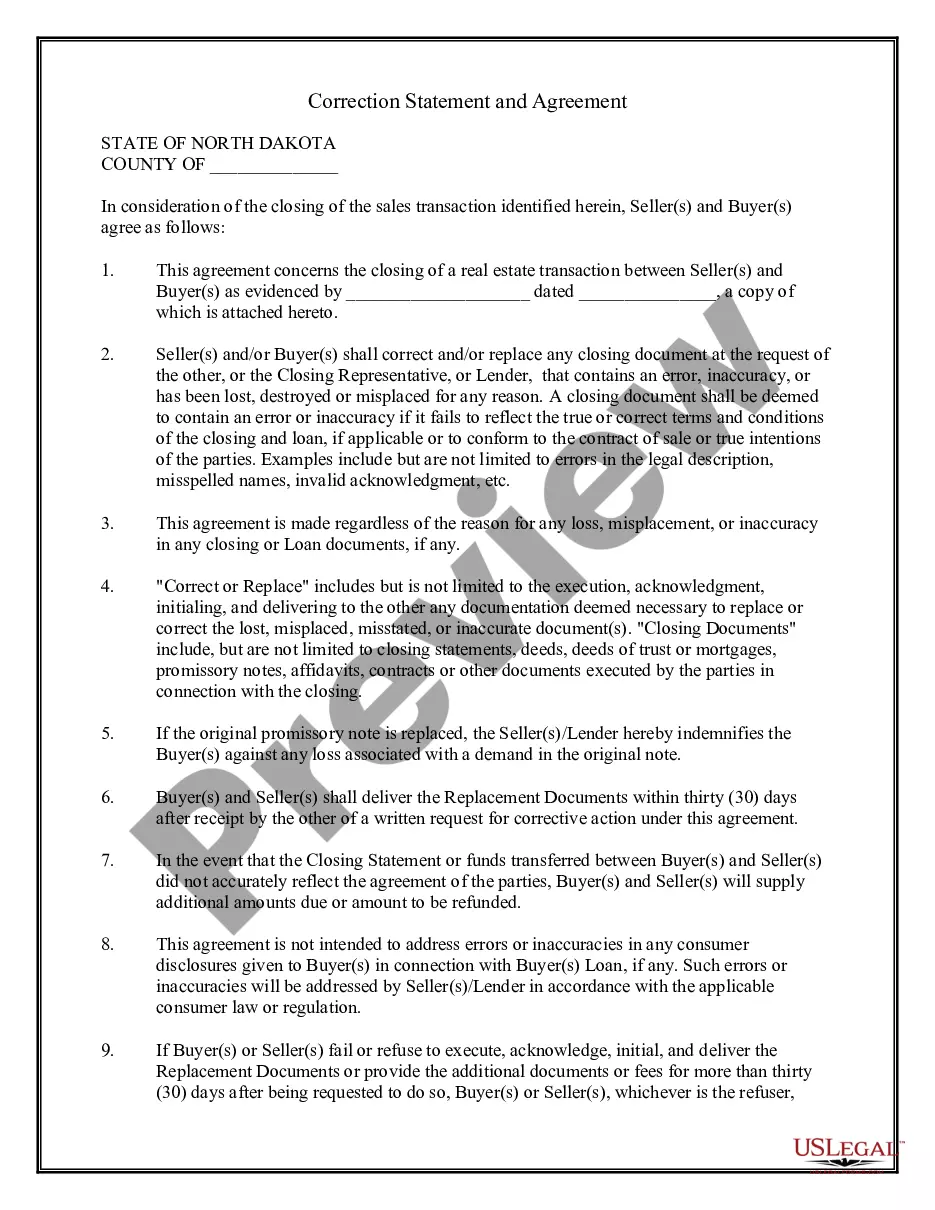

The Personal Loan Document Template Without The Lines you observe on this page is a versatile official blueprint crafted by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, corporations, and legal practitioners with more than 85,000 authenticated, state-specific documents for any commercial and personal circumstances. It is the quickest, easiest, and most dependable method to acquire the paperwork you require, as the service ensures the highest degree of data protection and anti-virus safeguards.

Subscribe to US Legal Forms to have verified legal templates for every situation in life readily available.

- Search for the document you require and review it.

- Browse through the sample you requested and preview it or check the document description to confirm it meets your requirements. If it doesn't, use the search functionality to find the suitable one. Click Buy Now when you have located the document you need.

- Register and Log In.

- Choose the pricing option that best fits you and set up an account. Use PayPal or a credit card to perform a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the editable template.

- Pick the format you desire for your Personal Loan Document Template Without The Lines (PDF, DOCX, RTF) and download the document to your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multifunction PDF editor to swiftly and precisely complete and sign your form with an eSignature.

- Redownload your documents again.

- Reutilize the same document whenever required. Access the My documents tab in your profile to redownload any previously stored forms.

Form popularity

FAQ

Presumed paternity ? If a child is born during a marriage or within 300 days after a marriage is terminated (divorce, death, annulment) the husband is presumed to be the father of the child. Court Adjudication ? legal action that begins with a summons and complaint.

Statute Of Limitations Effective April 2, 1999, past-due support is not subject to a statute of limitations. 2.

If the child has a presumed father, an action to adjudicate paternity must be brought no later than two years after the birth of the child. (See Section 14-20-42 for the limited exception to the two year deadline.)

In North Dakota, for children who are born out of wedlock, the paternity of the biological father can be established in two ways. The biological father may voluntarily establish his paternity by completing an Acknowledgment of Paternity form or any legal parent may be added to the birth record by way of a court order.

The North Dakota Acknowledgment of Paternity form allows a biological father to establish paternity when he's not married to the mother. The mother and biological father must both sign the form.

If the child already has an adjudicated father, only an individual who wasn't a party in the original paternity adjudication case can bring their own paternity adjudication action. The action must be brought no later than two years after the effective date of the paternity adjudication.