Personal Loan Document Form Without The Action Of

Description

How to fill out Personal Loan Agreement Document Package?

Regardless of whether it’s for corporate objectives or personal issues, everyone must handle legal matters at some point in their lives.

Filling out legal documents requires precise focus, starting with selecting the correct form template.

With a vast US Legal Forms collection available, you don’t have to waste time searching for the suitable template across the web. Utilize the library’s straightforward navigation to find the correct form for any circumstance.

- Obtain the template you require through the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your circumstances, state, and county.

- Click on the form’s preview to examine it.

- If it is the wrong document, return to the search feature to find the Personal Loan Document Form Without The Action Of sample you need.

- Retrieve the template if it satisfies your criteria.

- If you possess a US Legal Forms account, simply click Log in to retrieve previously stored templates in My documents.

- In case you don’t have an account yet, you can acquire the form by clicking Buy now.

- Select the relevant pricing option.

- Fill out the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you desire and download the Personal Loan Document Form Without The Action Of.

- Once it is downloaded, you can complete the form using editing software or print it out and fill it in manually.

Form popularity

FAQ

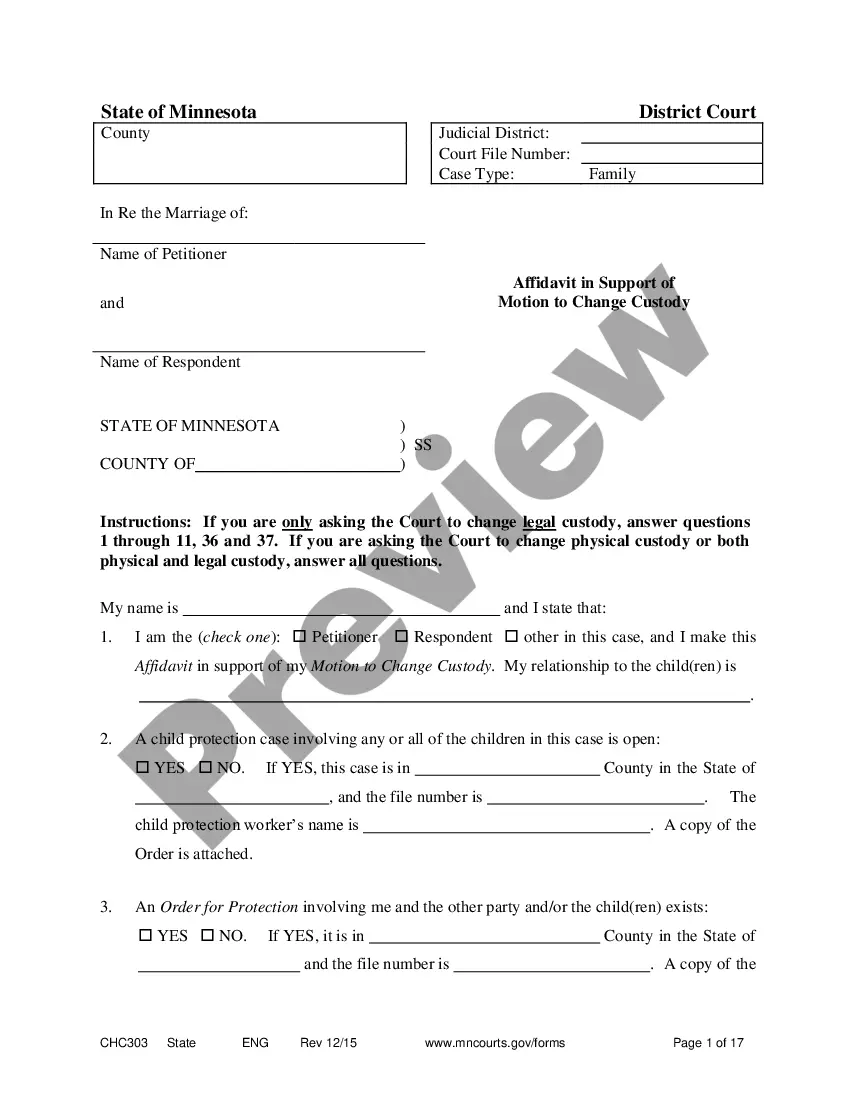

In Minnesota, there is not set age limit on when a child can decide which parent to live with. The court will consider the child's wishes to the extent that the child is sufficiently mature to express reasoned and independent preferences as to the parenting time schedule.

Contact information for clerks of district court is available at ndcourts.gov/court-locations. File your completed name change documents with the Clerk of District Court in the North Dakota county where you have resided for at least 6 months before filing the Petition. Note: You'll be asked to pay an $80.00 filing fee.

A court hearing is not required for name changes in North Dakota, but if the court decides that one is necessary for your case, you will need to attend it with copies of all your documents. If your petition is approved, the judge will sign your Order Granting Name Change.

The North Dakota Department of Human Services says they recommend a child must be at least 9 years old before he or she is left alone. North Dakota says ages 0-8 must not be left alone under any circumstances.

In North Dakota, custody is called ?parental rights and responsibilities.? When a judge makes an order for parental rights and responsibilities, s/he will decide two basic things: ?decision-making responsibility? and ?residential responsibility.?

There are no hard-and-fast rules as to the age at which a child is considered mature enough to testify as to a preference regarding residential responsibility. A court might find a ten year old in one case mature enough to express a preference, but find otherwise regarding a thirteen year old in another case.

Contrary to common belief, in Minnesota there is no particular age at which a child gets to decide which parent he wants to live with.