Personal Loan Document Form For Green Card Holders

Description

How to fill out Personal Loan Agreement Document Package?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more affordable method of preparing Personal Loan Document Form For Green Card Holders or any other documents without unnecessary complications, US Legal Forms is readily accessible.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

However, before you proceed to download the Personal Loan Document Form For Green Card Holders, consider these suggestions: Review the form preview and descriptions to confirm you are looking at the correct form. Verify that the form you choose meets the regulations of your state and county. Select the most appropriate subscription plan to acquire the Personal Loan Document Form For Green Card Holders. Download the form, then complete, authenticate, and print it. US Legal Forms has an impeccable reputation and over 25 years of proficiency. Join us now and transform document handling into a seamless and efficient process!

- With just a few clicks, you can quickly access state- and county-specific templates meticulously crafted for you by our legal professionals.

- Utilize our website whenever you require dependable services through which you can swiftly locate and download the Personal Loan Document Form For Green Card Holders.

- If you're already familiar with our services and have set up an account previously, simply Log In to your account, find the template, and download it or access it again later in the My documents section.

- Not signed up yet? No issue. It only takes a few minutes to register and explore the library.

Form popularity

FAQ

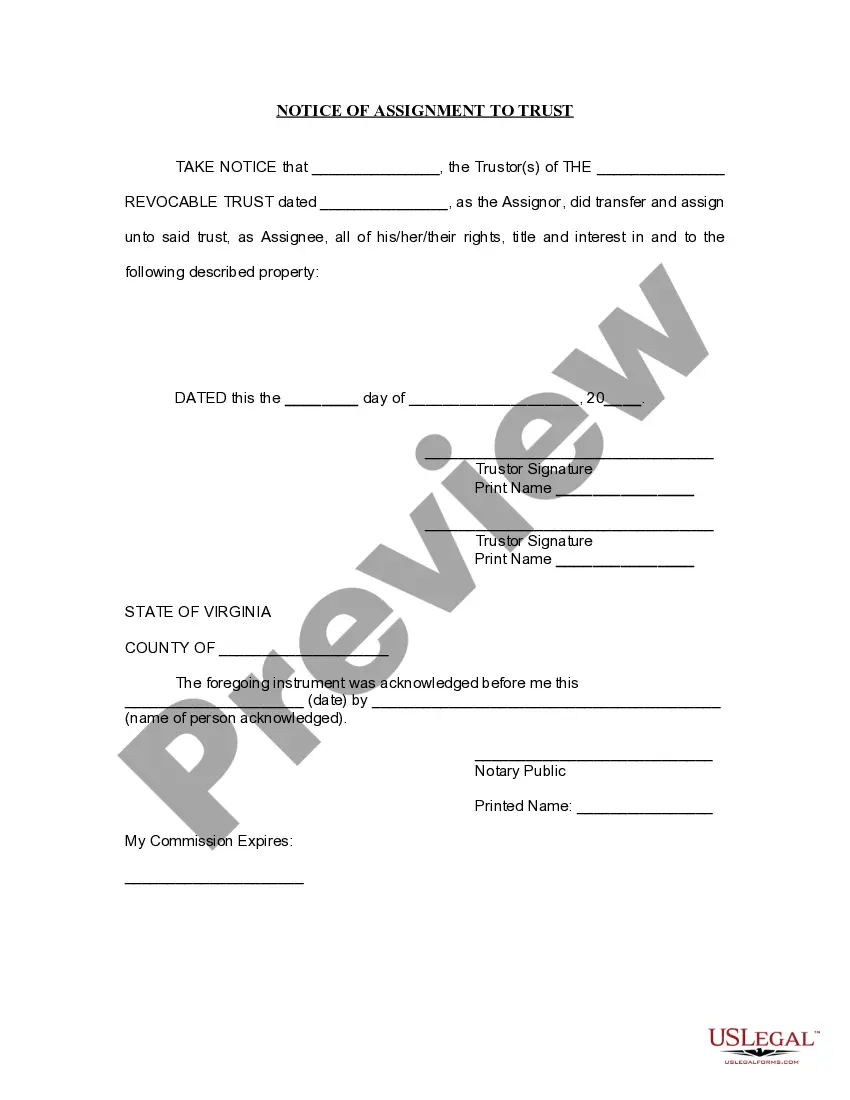

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

However, by assigning the loan the mortgage company will free up capital. This allows the original lender to make more loans and generate additional origination and other fees. At closing, borrowers sign a document granting the original lender the right to assign the mortgage elsewhere.

An assignment of mortgage documents the transfer of a mortgage from an original lender or borrower to another person or entity. Lenders regularly sell mortgages to other lenders. Less often, a borrower transfers the mortgage to someone else who assumes the mortgage.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.