Personal Loan Document Form For Chase Bank

Description

How to fill out Personal Loan Agreement Document Package?

Creating legal documents from the beginning can frequently be intimidating.

Certain situations might require extensive research and significant financial resources.

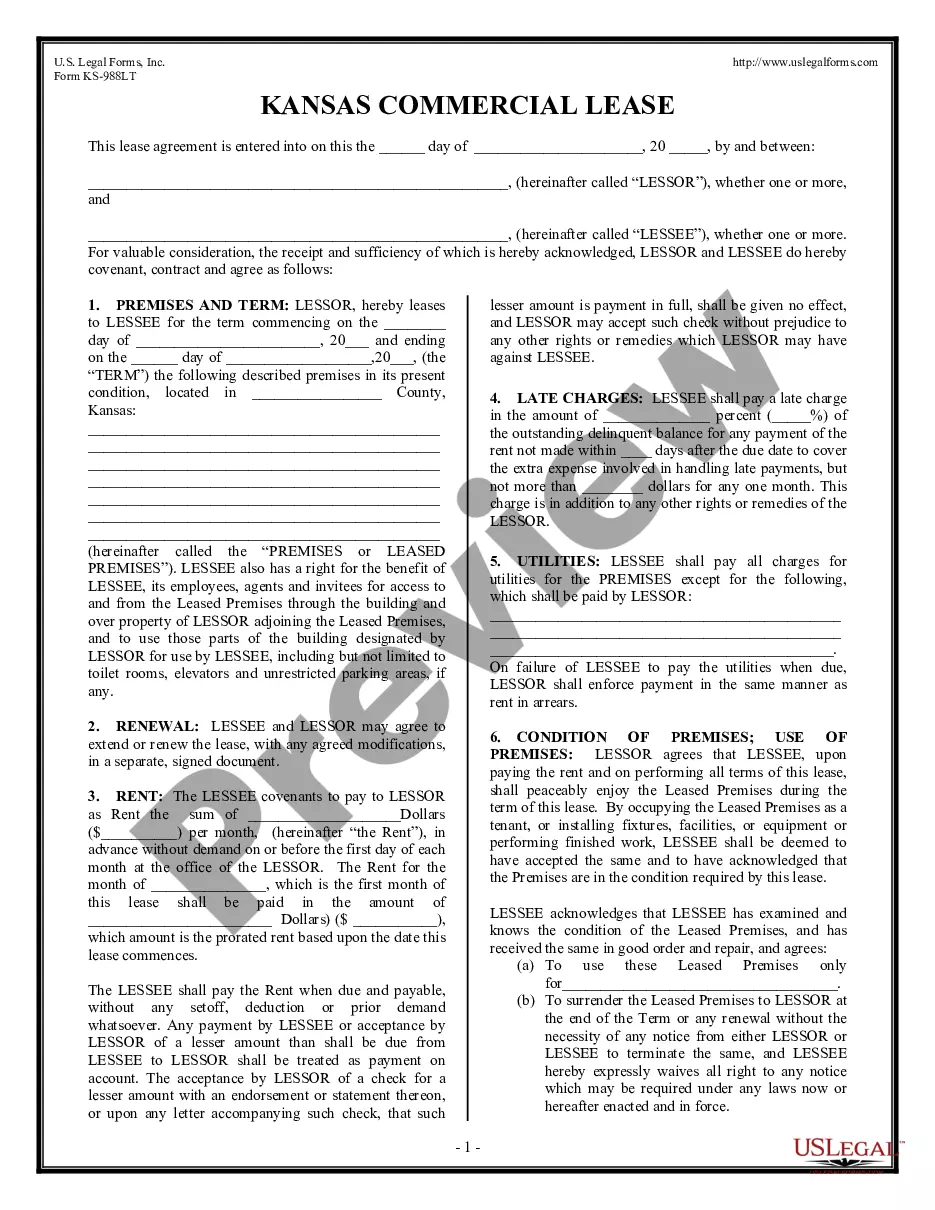

If you’re seeking a simpler and more cost-effective method of generating a Personal Loan Document Form For Chase Bank or other documents without the hassle, US Legal Forms is readily available to assist you.

Our online repository of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal needs. With just a few clicks, you can swiftly retrieve state- and county-compliant forms meticulously crafted for you by our legal experts.

Assess the document preview and details to confirm that you are looking at the form you need. Ensure the template you select complies with your state and county laws. Choose the most appropriate subscription plan to acquire the Personal Loan Document Form For Chase Bank. Download the document, then complete it, sign it, and print it out. US Legal Forms has an impeccable reputation and over 25 years of experience. Join us today and simplify the document completion process!

- Utilize our platform whenever you require dependable services to easily locate and download the Personal Loan Document Form For Chase Bank.

- If you’re familiar with our services and have previously established an account with us, simply Log In to your account, find the form, and download it or re-download it later in the My documents section.

- Not registered yet? No problem. It only takes a few minutes to sign up and browse the library.

- However, before directly downloading the Personal Loan Document Form For Chase Bank, consider these suggestions.

Form popularity

FAQ

Upon a filing party's request, an original pleading or document in any civil action, which by law is required to be filed in the clerk of court's office where the action is pending, may be removed from the files for the purpose of serving it either inside or outside the state but must be returned without delay.

Money awarded as part of a judgment may be collected using North Dakota's judgment collection options. Judgments entered on or after August 1, 2023, may be collected for 20 years.

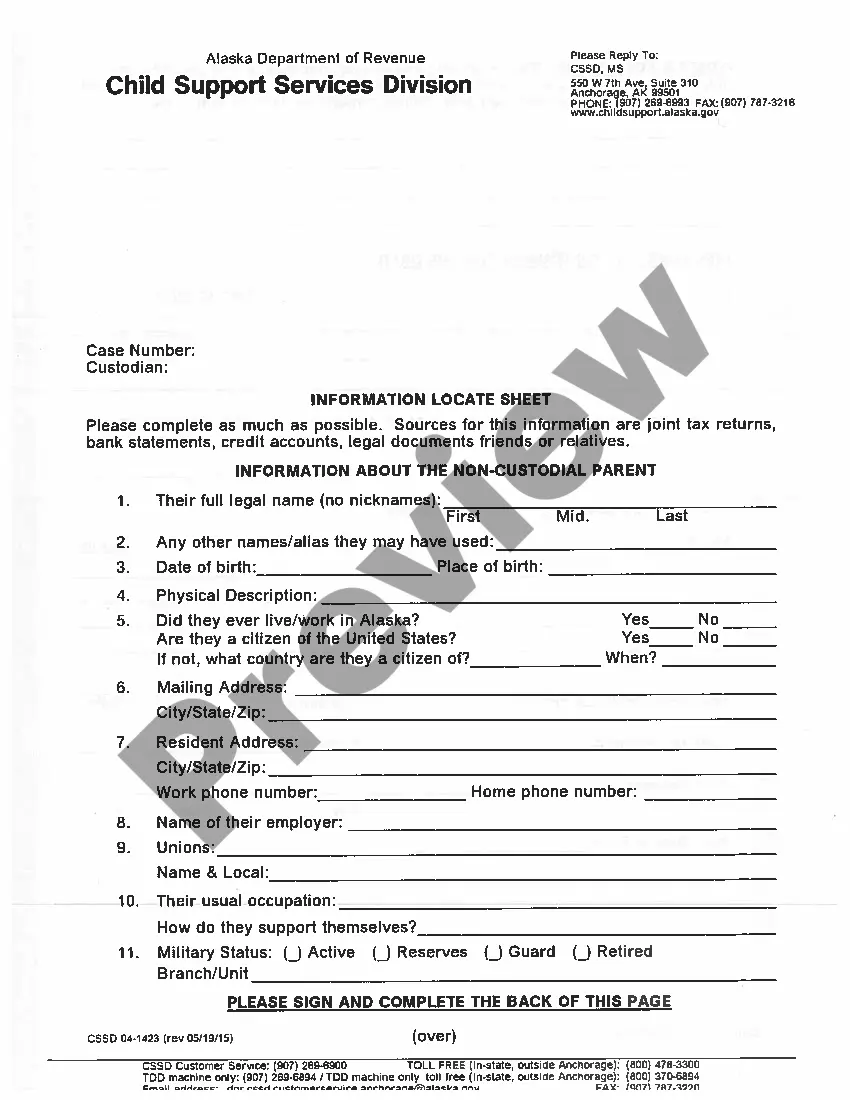

Parents' Rights and Responsibilities in North Dakota Under North Dakota law, each parent has the following rights and responsibilities: the right to see (and get copies of) the child's educational, medical, dental, religious, insurance, and other records. the right to attend educational conferences concerning the child.

Contact information for clerks of district court is available at ndcourts.gov/court-locations. File your completed name change documents with the Clerk of District Court in the North Dakota county where you have resided for at least 6 months before filing the Petition. Note: You'll be asked to pay an $80.00 filing fee.

There are no hard-and-fast rules as to the age at which a child is considered mature enough to testify as to a preference regarding residential responsibility. A court might find a ten year old in one case mature enough to express a preference, but find otherwise regarding a thirteen year old in another case.

An order to show cause issued pursuant to section 27-10-07 may be made in the action or proceeding in or respecting which the offense was committed, either before or after the final judgment or order therein, and is equivalent to a notice of motion.