Kansas Commercial Building or Space Lease

Description

How to fill out Kansas Commercial Building Or Space Lease?

Searching for a Kansas Commercial Property or Space Lease template and completing them may pose a challenge.

To conserve time, expenses, and energy, utilize US Legal Forms to locate the suitable template specifically for your region with just a few clicks.

Our attorneys prepare every document, allowing you to merely fill them in. It's genuinely that straightforward.

Now you can print the Kansas Commercial Property or Space Lease form or complete it using any online editor. There's no need to worry about making errors since your template can be utilized and submitted, and printed as many times as you desire. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log into your account and return to the form's webpage to save the document.

- All your saved templates are kept in My documents and are available at any time for future use.

- If you haven’t registered yet, you should create an account.

- Review our detailed guidelines on how to obtain your Kansas Commercial Property or Space Lease template within minutes.

- To acquire a valid example, verify its legitimacy for your state.

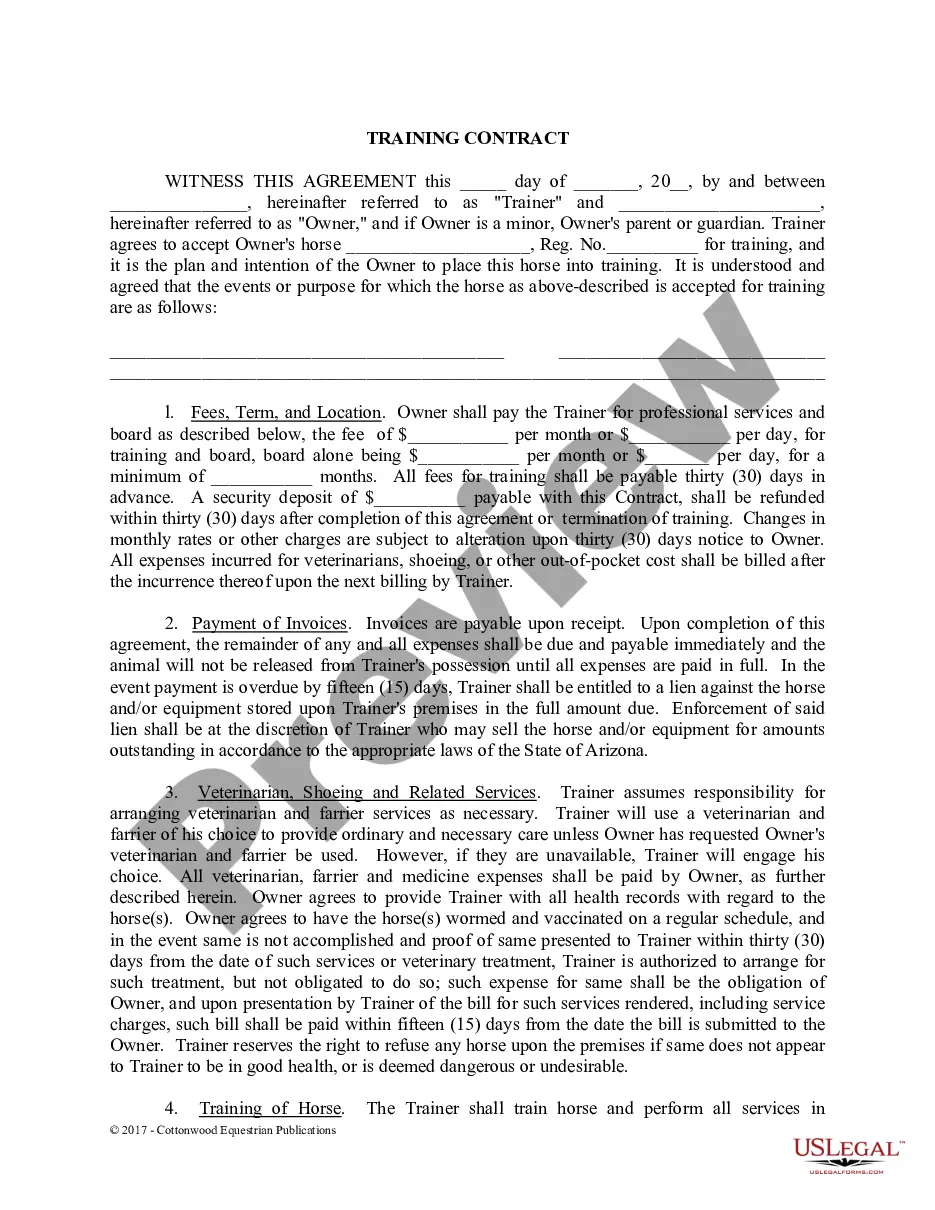

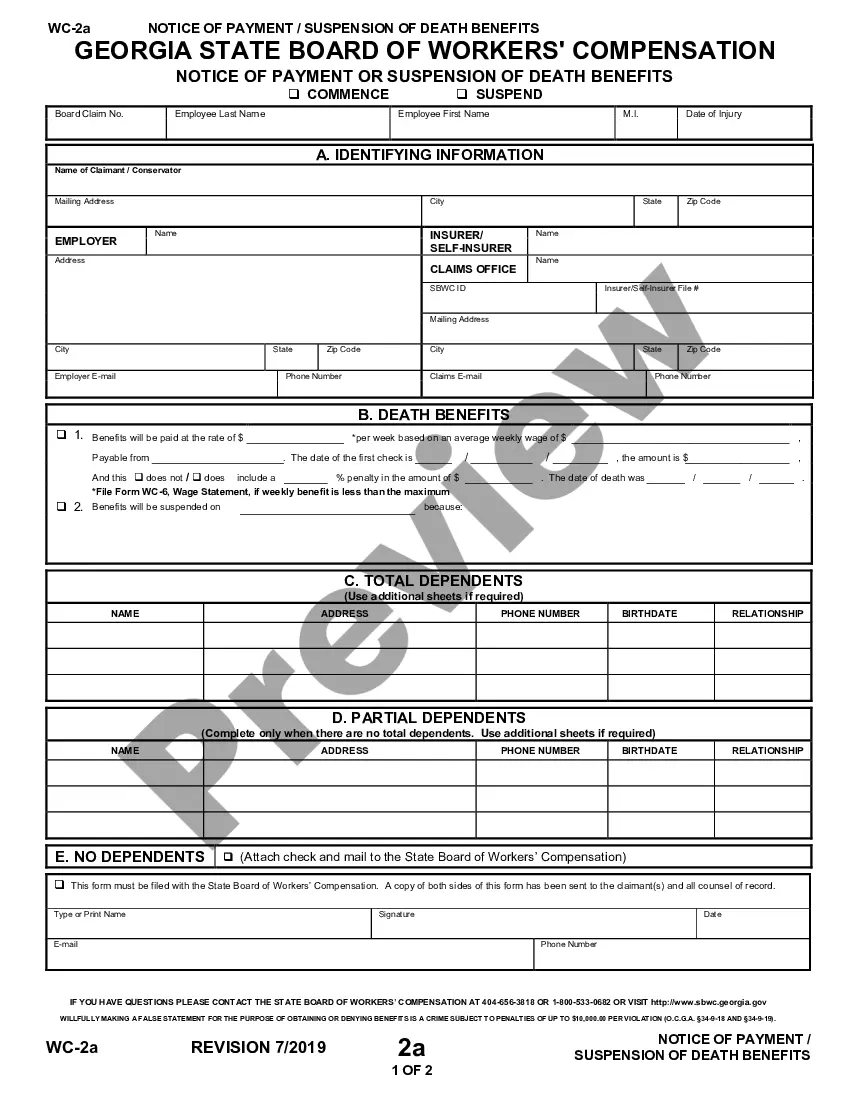

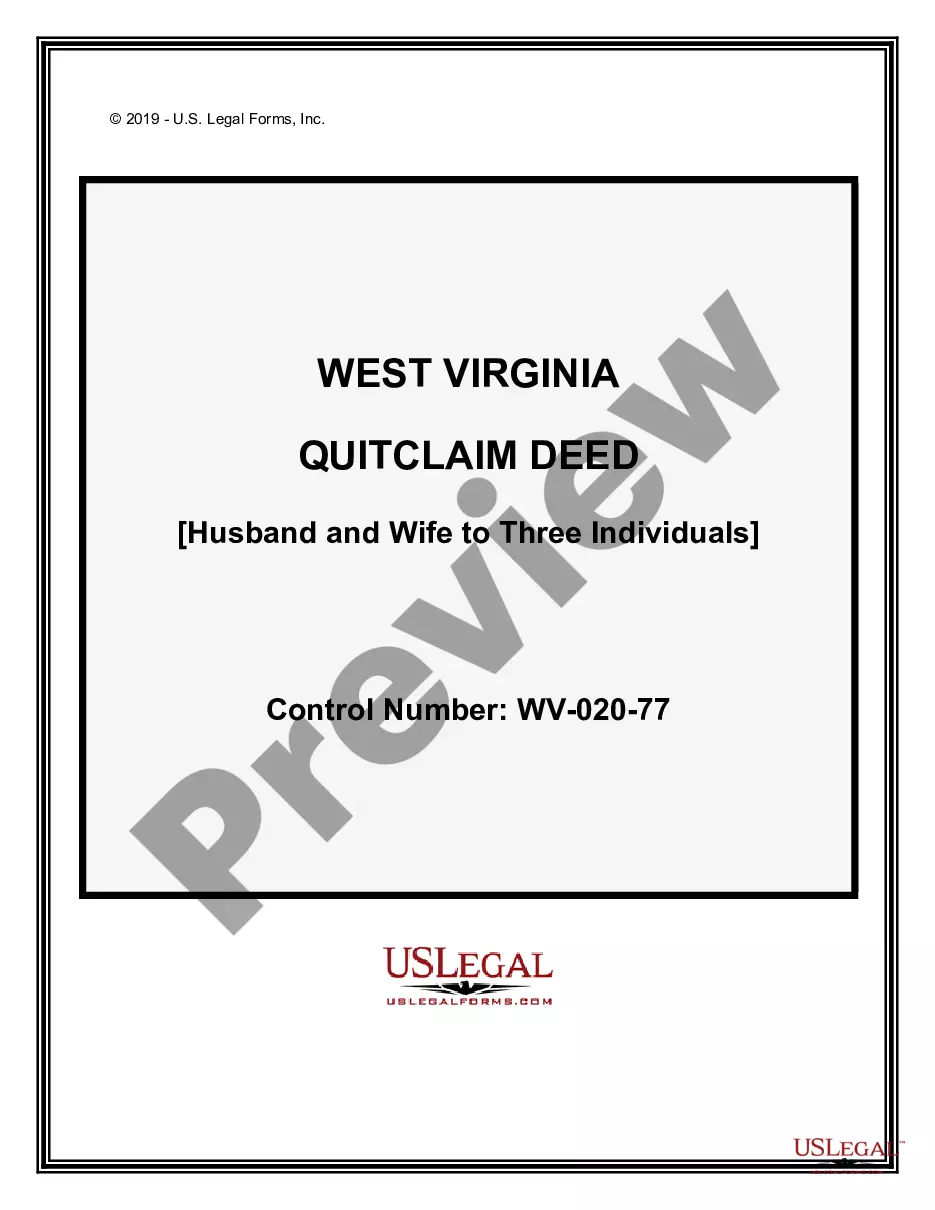

- Examine the template using the Preview option (if available).

- If there's a summary, read it to understand the key points.

- Click Buy Now if you located what you're looking for.

Form popularity

FAQ

Residential real estate can be purchased with far less money largely due to its lower price points, while commercial real estate requires a lot more money up front and has stricter lending requirements to obtain financing. Both residential and commercial investing take knowledge and experience.

For office buildings that include retail space, the 2019 edition of Chain Store Age's annual survey of retail build-outs put the average cost at $56.53 per square foot.

To calculate the value of a commercial property using the Gross Rent Multiplier approach to valuation, simply multiply the Gross Rent Multiplier (GRM) by the gross rents of the property. To calculate the Gross Rent Multiplier, divide the selling price or value of a property by the subject's property's gross rents.

To calculate the value of a commercial property using the Gross Rent Multiplier approach to valuation, simply multiply the Gross Rent Multiplier (GRM) by the gross rents of the property. To calculate the Gross Rent Multiplier, divide the selling price or value of a property by the subject's property's gross rents.

Any type of property, whether it's commercial or residential, can be a good investment opportunity. For your money, commercial properties typically offer more financial reward than residential properties, such as rental apartments or single-family homes, but there also can be more risks.

Commercial properties are good investment opportunities to earn regular income as they offer high rental rates compared to residential properties.However, rental income and price appreciation depends on many factors such as current market trends, location, social and physical infrastructure.

Because commercial properties are usually larger, in more central locations and often with more extensive services and resources than residential properties, they are more valuable than houses where people live.Location is the prime determinant of the cost to lease a commercial property.

For commercial property investors, yields are typically much higher than residential property. Yields from commercial property can be anywhere from 5% to 10%. Meanwhile, residential property is known for yields between about 1% and 3%. The main reason for the difference is found in the lease agreement.

Typically, commercial space is evaluated at $X per square foot, and that rate times the rentable square feet for your space determines your monthly rent.