Assignment Of Overriding Royalty Interest With Monthly Contributions Formula

Description

How to fill out Assignment Of Overriding Royalty Interest Limited As To Depth?

How to locate professional legal documents that adhere to your state's regulations and formulate the Assignment Of Overriding Royalty Interest With Monthly Contributions Formula without consulting a lawyer.

Numerous online services offer templates to address a variety of legal situations and formalities. However, identifying which of the available samples meet both your specific requirements and legal standards may require some time.

US Legal Forms is a trustworthy service that assists you in locating official documents created in alignment with the latest state legal updates, helping you to economize on legal fees.

If you do not have an account with US Legal Forms, follow the steps below: Examine the webpage you have accessed to ascertain if the form meets your requirements. Utilize the form description and preview options when available. If necessary, search for another sample in the header that specifies your state. When you find the appropriate document, click the Buy Now button. Select the most suitable pricing plan, then Log In or register for an account. Choose your payment method (via credit card or PayPal). Convert the file format for your Assignment Of Overriding Royalty Interest With Monthly Contributions Formula and click Download. The documents you obtain are yours to keep: you can always access them again in the My documents section of your account. Join our platform and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not simply an ordinary web directory.

- It boasts a repository of over 85k validated templates for numerous business and personal scenarios.

- All documents are categorized by area and state to streamline your search experience.

- It also includes robust tools for PDF editing and electronic signatures, enabling users with a Premium subscription to effortlessly complete their paperwork online.

- Acquiring the necessary documents requires minimal effort and time.

- If you possess an account, Log In and verify your subscription status.

- Download the Assignment Of Overriding Royalty Interest With Monthly Contributions Formula by clicking the corresponding button next to the file title.

Form popularity

FAQ

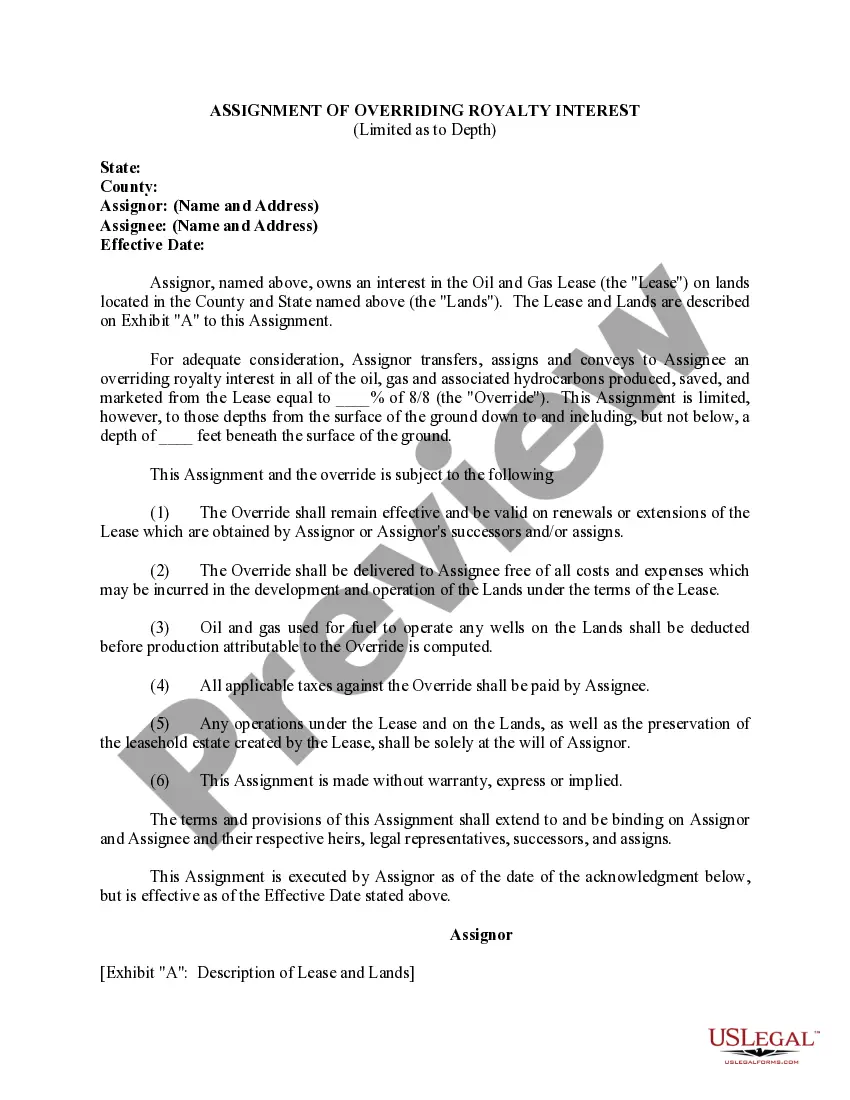

An overriding royalty interest refers to a share of production or revenue from oil and gas leases that is granted to a party without bearing any costs associated with the production. This interest often comes into play when leases are assigned or sold. Understanding the assignment of overriding royalty interest with monthly contributions formula can help you accurately calculate your revenue share over time. Platforms like US Legal Forms can assist you in navigating this complex area, ensuring that your interests are well protected.

The gross overriding royalty (GOR) refers to a type of financial interest that allows a party to receive a set percentage of the revenue before any production costs are deducted. It serves as a crucial element in many oil and gas agreements, ensuring that parties benefit from the production without additional expense responsibilities. Understanding GOR can enhance negotiation positions and lead to more beneficial agreements. To optimize agreements, consider applying the assignment of overriding royalty interest with monthly contributions formula for clear and effective transactions.

The assignment of overriding royalty interest involves transferring the right to collect a share of revenue from resource extraction to another party. This assignment can take place for various reasons, including financial investment, diversification, or strategic partnerships. The process often includes the negotiation of terms that define the percentage and duration of the royalties. By using the assignment of overriding royalty interest with monthly contributions formula, parties can foster clearer agreements that benefit everyone involved.

Overriding royalties represent a portion of oil or gas production revenue that a party receives, even if they do not own the land or resources. This financial interest allows the holder to benefit from a share of the profits without bearing the operational costs. Understanding overriding royalties is crucial for those involved in energy investments, as they can significantly influence profit strategies. The assignment of overriding royalty interest with monthly contributions formula plays a key role in managing these transactions.

A working interest example would be an oil company that invests in drilling wells and pays all related costs. When production occurs, this company receives income, but it also bears the financial risk involved. For someone interested in a more passive income, understanding the assignment of overriding royalty interest with monthly contributions formula could provide options that avoid these operational expenses. This could be a worthwhile alternative for investors looking to minimize risk.

An assignment of overriding royalty interest transfers the rights to a portion of the revenues from oil and gas production. This legal document allows a new party to receive royalties without taking on the operational costs. By utilizing the assignment of overriding royalty interest with monthly contributions formula, both parties can understand the financial implications of this transfer. Engaging with platforms like USLegalForms can simplify the creation of these documents and ensure proper execution.

The primary difference lies in the financial responsibilities attached to each. Working interest holders contribute to the costs of drilling and operating, while overriding royalty interest holders do not incur these costs. Instead, they receive revenue directly from the production based on an agreement. Understanding the assignment of overriding royalty interest with monthly contributions formula can help clarify how these interests yield different financial structures. This distinction is important for investment strategy.

An overriding royalty is calculated based on the percentage specified in the lease agreement, typically a percentage of the gross production income. To apply the assignment of overriding royalty interest with monthly contributions formula, you would take this percentage of the revenues from the oil or gas produced. This means that each month, you can expect a specific amount based on the production and market conditions. Regular updates from your operator can help keep accurate records.

Transferring an overriding royalty interest typically involves drafting a legal document known as an assignment. This document should clearly outline the terms of the transfer and the parties involved. Using the assignment of overriding royalty interest with monthly contributions formula, the new owner can start receiving their share of the royalties. It's crucial to consult with a legal expert to ensure all necessary steps are followed.

A royalty is a payment made to a property owner for the extraction of resources, typically from oil or gas production. An overriding royalty interest, however, is a percentage of the revenue generated from the production that exists above the landowner's royalty. This means that while both involve compensation for resource extraction, overriding royalties are often granted to third parties and derived from the original royalty. Understanding the intricacies of the assignment of overriding royalty interest with monthly contributions formula can help you navigate these financial structures effectively.