Affidavit Of Use And Possession Texas Withholding Tax

Description

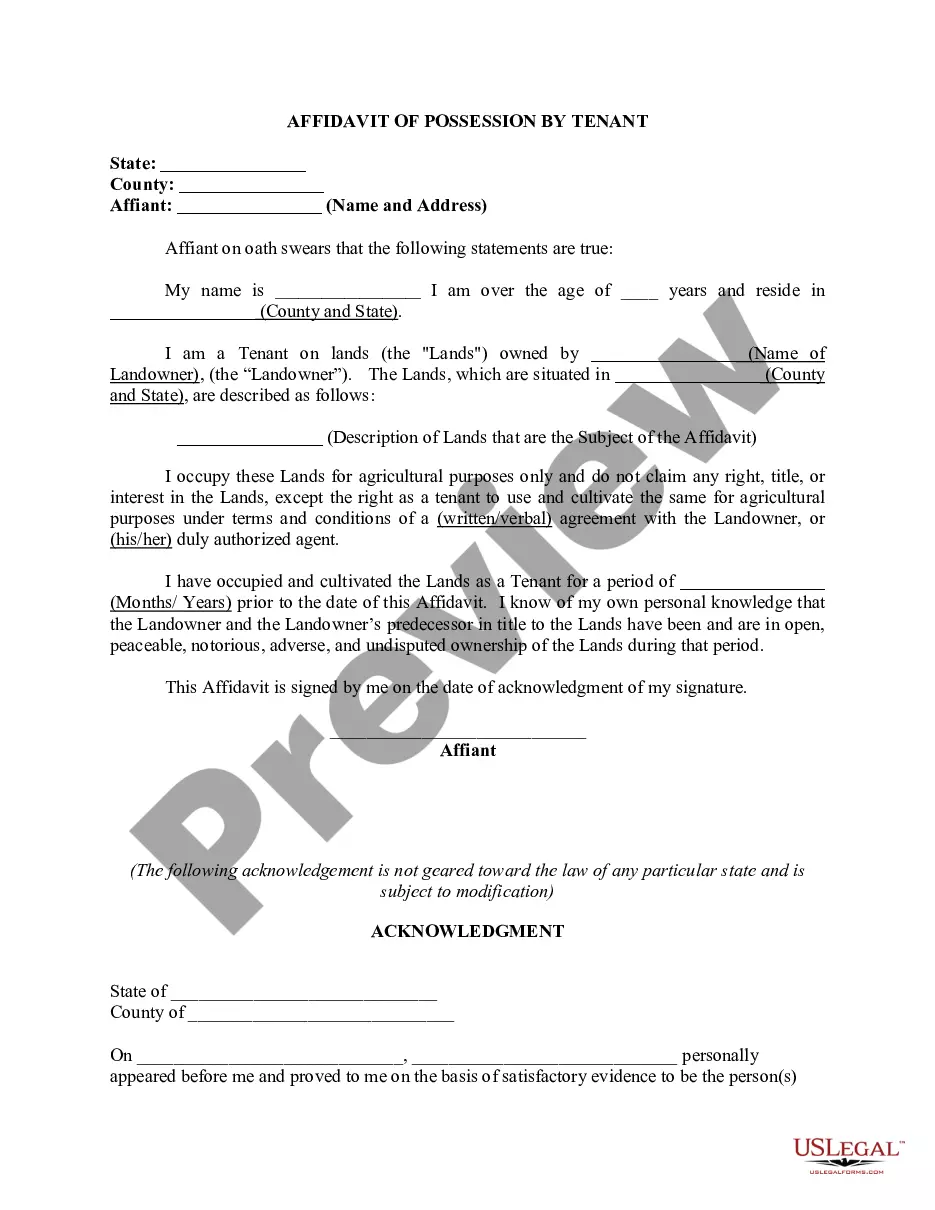

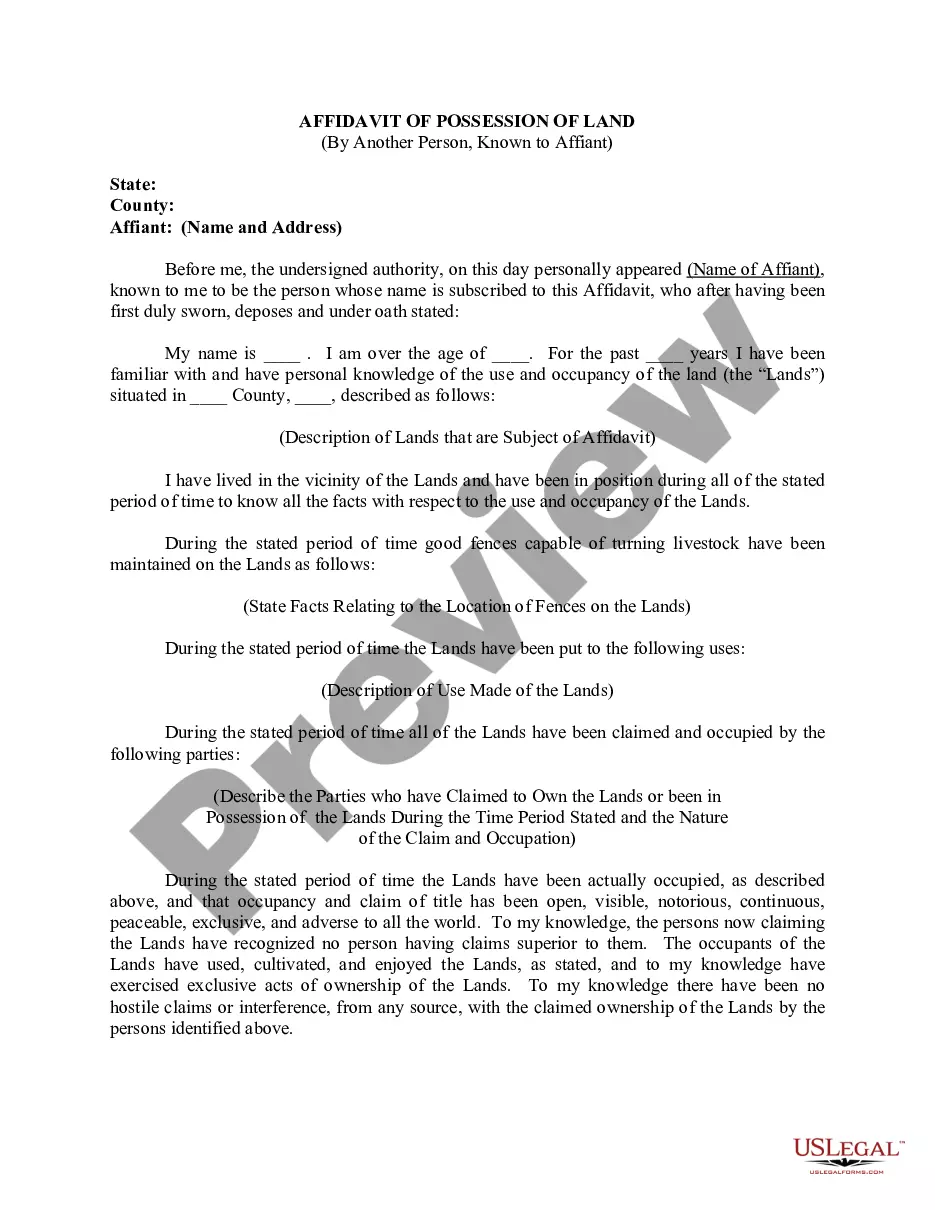

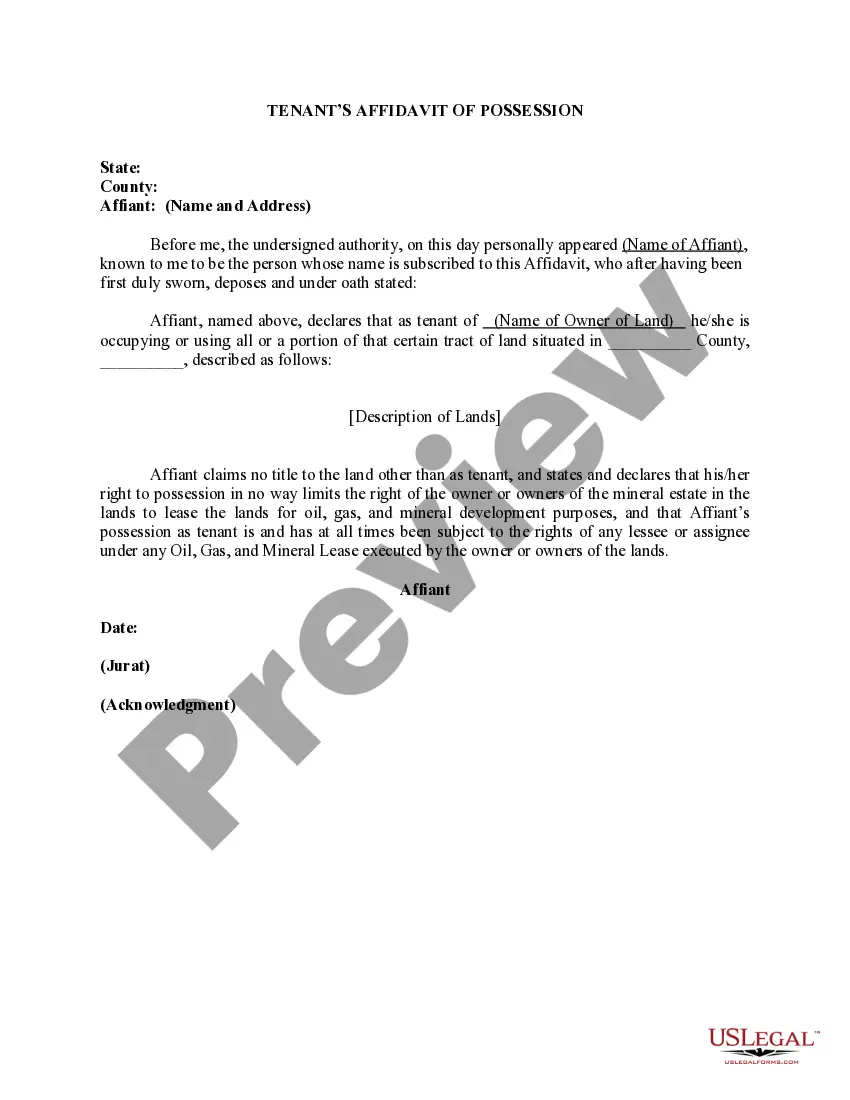

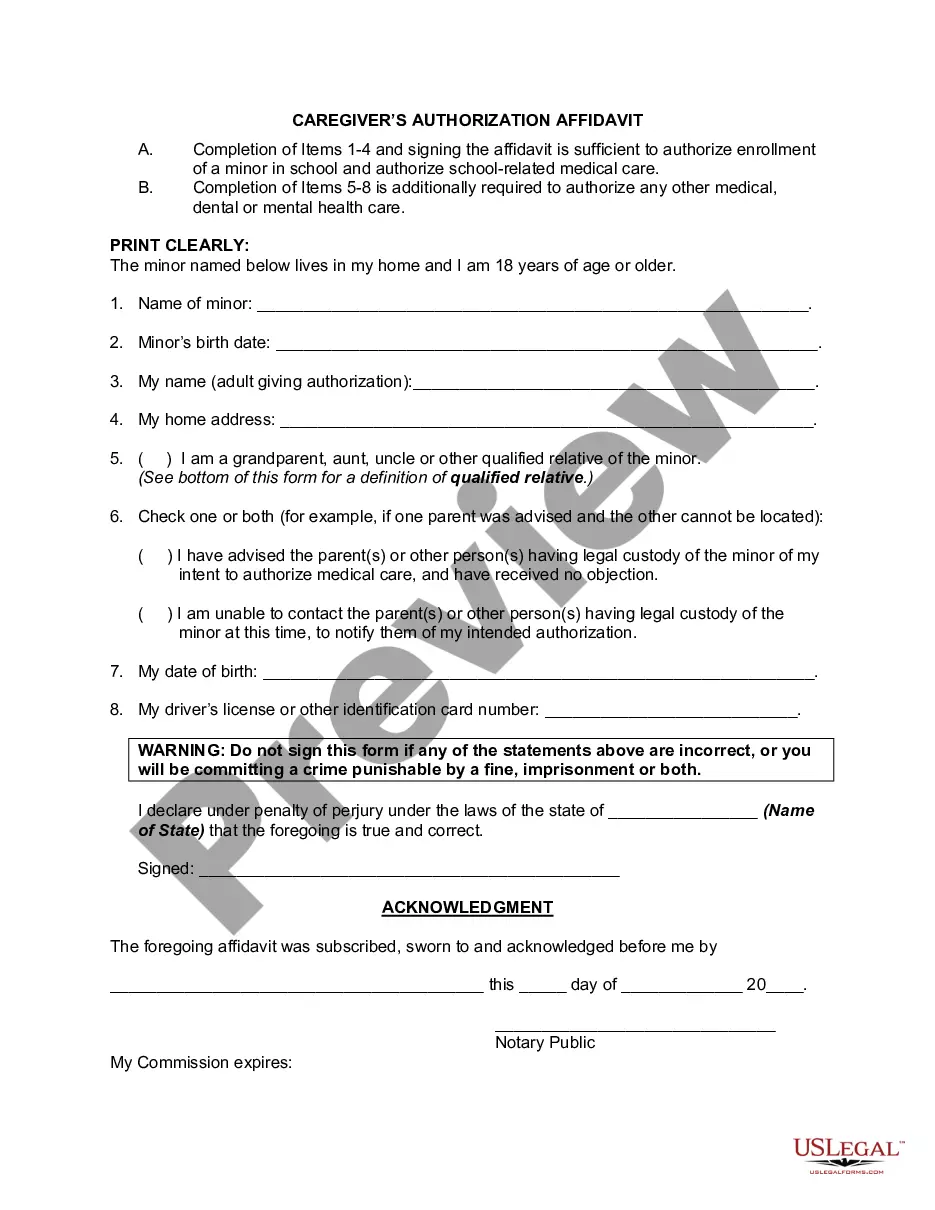

How to fill out Affidavit Of Possession, Use, And Occupancy Of Lands?

Creating legal documents from the ground up can occasionally be somewhat daunting.

Specific situations may require extensive research and considerable financial investment.

If you seek a more straightforward and budget-friendly method of generating Affidavit Of Use And Possession Texas Withholding Tax or any other forms without unnecessary complications, US Legal Forms is readily available to assist you.

Our digital library of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can swiftly access state- and county-specific templates meticulously designed for you by our legal professionals.

Examine the document preview and descriptions to confirm that you have located the form you need. Ensure that the form you choose complies with the regulations and laws applicable to your state and county. Select the most appropriate subscription plan to obtain the Affidavit Of Use And Possession Texas Withholding Tax. Download the document, then complete, validate, and print it out. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us now and transform form filling into a simple and efficient process!

- Utilize our platform whenever you require a trustworthy and dependable service to quickly find and retrieve the Affidavit Of Use And Possession Texas Withholding Tax.

- If you’re familiar with our services and have already registered an account with us, simply sign in to your account, choose the template, and download it or retrieve it later from the My documents section.

- Don’t possess an account? No worries. Setting one up is quick and easy, allowing you to browse the library.

- However, before diving directly into downloading the Affidavit Of Use And Possession Texas Withholding Tax, consider these suggestions.

Form popularity

FAQ

An affidavit serves as a written statement that is confirmed by oath or affirmation, providing factual information that may be used in legal proceedings. It helps establish facts in various contexts, such as property claims or inheritance disputes. Additionally, an affidavit can support claims regarding taxes, such as the affidavit of use and possession texas withholding tax, making it an important document in legal and financial matters. Utilizing a platform like uslegalforms can streamline the creation and submission of affidavits.

In Texas, there are five key requirements for adverse possession. First, the possession must be actual, meaning you physically occupy the land. Second, the possession must be open and notorious, allowing others to see that you are using the property. Third, it must be exclusive, where you possess the property without sharing it. Fourth, the possession must be hostile, meaning without permission from the true owner. Lastly, it must be continuous for a specified period. Understanding these requirements is crucial, especially when dealing with an affidavit of use and possession texas withholding tax.

To fill out an affidavit of heirship in Texas, you need to start by gathering personal information about the deceased, such as their full name, date of birth, and date of death. Next, include details about the heirs, including their relationship to the deceased and their contact information. It's essential to sign the affidavit in front of a notary public, ensuring that all required signatures are present. For those interested, an affidavit of use and possession texas withholding tax can simplify aspects of property ownership and tax obligations.

An affidavit must include several key elements such as the affiant's name, a clear statement of facts, and a declaration of belief in the truth of those facts. Additionally, it needs to be signed in front of a notary public. When drafting an affidavit of use and possession Texas withholding tax, ensure all details are precise and accurately reflect the circumstances to avoid potential legal issues.

The rules for affidavits in Texas require that the document be written, signed, and notarized for validity. It must clearly articulate the facts and intentions of the individuals involved. Adhering to these regulations is crucial, especially when filing an affidavit of use and possession Texas withholding tax, to ensure that your claims are legally accepted.

To prepare an affidavit in Texas, you typically need basic information such as the names of the parties involved, a statement of facts, and the purpose of the affidavit. Additionally, it must be signed in front of a notary public. For a comprehensive understanding, particularly when dealing with an affidavit of use and possession Texas withholding tax, consider using the resources provided by USLegalForms to simplify the process.

The Texas limited sales excise and use tax is a tax applied to the sale, use, or consumption of certain tangible personal property and some services. This tax is crucial for funding various state services and infrastructure. If you’re preparing an affidavit of use and possession Texas withholding tax, understanding this tax can help you make informed decisions regarding your financial responsibilities.

An affidavit of possession in Texas is a formal document that establishes ownership of property. This document can be important in legal proceedings involving property disputes or tax assessments. When you file an affidavit of use and possession Texas withholding tax, you are asserting your rights and ensuring that your interests are legally recognized.

An affidavit serves as a written statement confirmed by oath, often required in legal situations. It provides verified details that can hold up in court or during transactions. In the context of an affidavit of use and possession Texas withholding tax, having a clear and documented statement can ensure compliance with tax laws and regulations.

To record sales and use taxes, maintain accurate records of all taxable sales and related transactions. You should document these details in your accounting software or financial records. This documentation is vital for fulfilling your obligations regarding the Affidavit of Use and Possession Texas Withholding Tax.