Release Of A Home Loan Foreclosure Calculator

Description

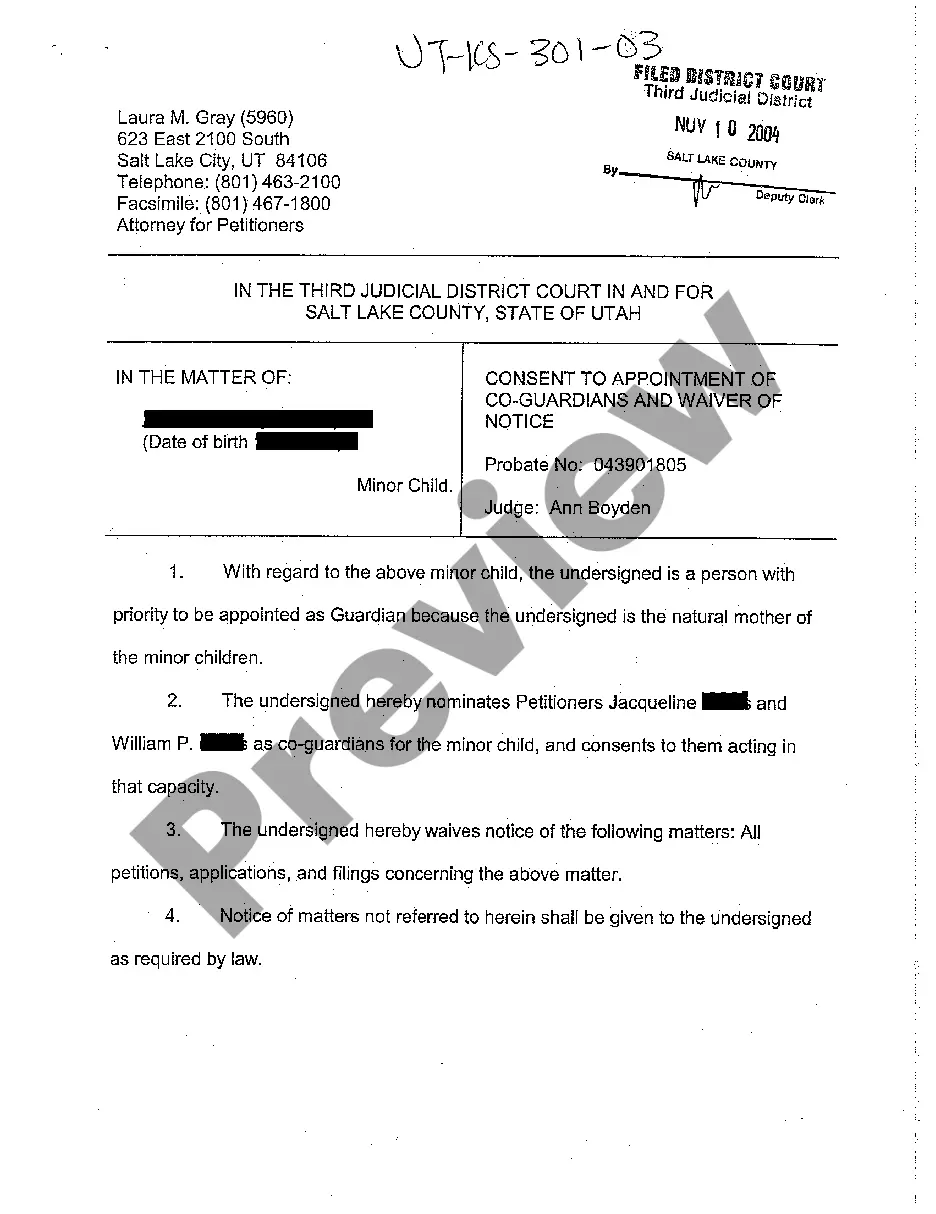

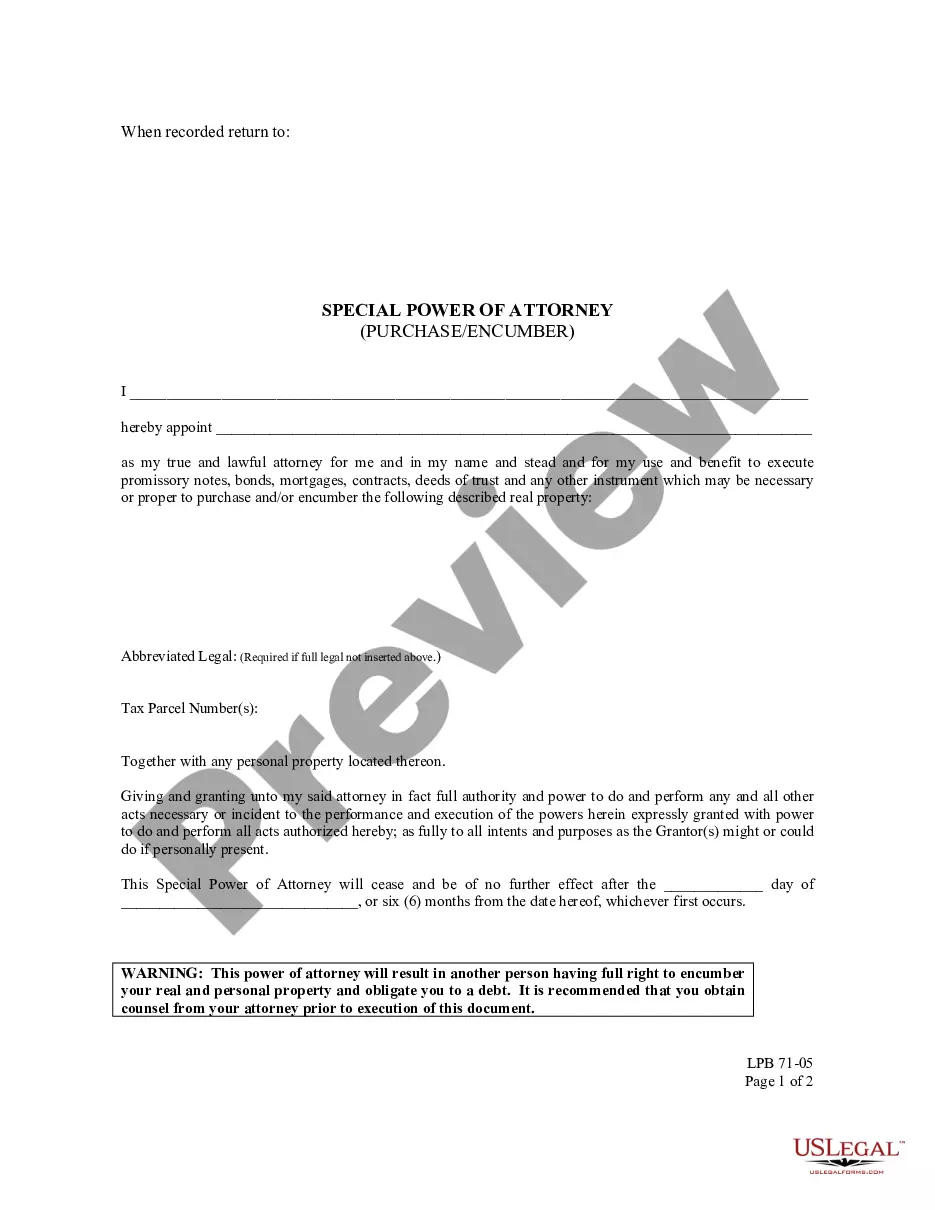

How to fill out Release Of Mortgage / Deed Of Trust - Full Release?

Individuals commonly link legal documentation with something intricate that only an expert can manage.

In a certain sense, this is correct, as drafting a Release of a Home Loan Foreclosure Calculator requires significant knowledge of subject parameters, including state and local laws.

However, with US Legal Forms, everything has become simpler: ready-to-use legal templates for any personal or business circumstance specific to state regulations are consolidated in a single online library and are now accessible to everyone.

Once purchased, all templates in our library are reusable: they remain saved in your profile and can be accessed anytime via the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe now!

- US Legal Forms provides over 85k current documents organized by state and area of use, so locating a Release of a Home Loan Foreclosure Calculator or any other specific sample takes only a few minutes.

- Users with a previous registration and an active subscription must Log In to their account and click Download to receive the form.

- Individuals new to the site will first need to create an account and subscribe before they can retrieve any documentation.

- Here is the step-by-step instruction on how to obtain the Release of a Home Loan Foreclosure Calculator.

- Examine the page content carefully to ensure it meets your requirements.

- Review the form description or check it using the Preview option.

- Search for another sample using the Search bar above if the previous one is not suitable.

- Click Buy Now once you identify the appropriate Release of a Home Loan Foreclosure Calculator.

Form popularity

FAQ

A request via email to loan@hdfccredila.com from your registered email ID....For any other queries or to know the status of your request, write to us with the below-mentioned details:HDFC Credila branch where your request was submitted.Date of request submission.Reference ID, if request submitted online.

Most respectfully, I would like to inform you that I do hold a loan account in your branch bearing account number (Account number). I am currently holding a loan of (Amount) for (Purpose) and I am writing this letter to inform you that I am looking forward to the foreclosure of the loan.

Most respectfully, I would like to inform you that I do hold a loan account in your branch bearing account number (Account number). I am currently holding a loan of (Amount) for (Purpose) and I am writing this letter to inform you that I am looking forward to the foreclosure of the loan.

What impact will a foreclosure have on my credit report? It is possible to qualify for a mortgage after a foreclosure. However, foreclosure will hurt your credit. Foreclosure information generally remains in your credit report for seven years from the date of the foreclosure.

What to do:Visit bank with the complete set of documents (as mentioned above).You may be required to fill a form or write a letter requesting pre-closure of the Personal Loan account.Pay the pre-closure amount.Sign the required documents, if any.Take acknowledgement of the balance amount you have paid.More items...