Release Of Judgment Lien Withdrawal

Description

How to fill out Release Of Judgment Lien?

How to locate professional legal documents that comply with your state's regulations and prepare the Release Of Judgment Lien Withdrawal without hiring a lawyer.

Numerous online services provide templates to address different legal scenarios and formal requirements.

However, it may take time to determine which available samples meet both your usage needs and legal stipulations.

If you do not possess an account with US Legal Forms, follow the instructions below.

- US Legal Forms is a trusted site that assists you in locating official documents created per the latest updates in state law and helps you save money on legal services.

- Unlike a typical web library, US Legal Forms features a database of over 85,000 verified templates for various business and personal circumstances.

- All documents are organized by area and state, streamlining your search process and eliminating unnecessary stress.

- Additionally, it connects with robust tools for PDF editing and electronic signing, allowing Premium subscribers to efficiently finalize their paperwork online.

- Obtaining the necessary documents requires minimal effort and time.

- If you already have an account, Log In and verify that your subscription is active.

- Download the Release Of Judgment Lien Withdrawal using the associated button next to the file name.

Form popularity

FAQ

Taxpayers generally request the withdrawal using Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien; however, any written request that provides sufficient information may by used. Requests for withdrawals should be considered regardless of the date the NFTL was filed.

On the form, say that you want to have the court "Enter Satisfaction of Judgment." File your form with the clerk. The clerk may schedule a court date and let you and all other parties know. If the court is convinced that you have paid, the court will enter the satisfaction of judgment.

If there is no response, Property Code Section 52.0012 provides that a judgment debtor may file a Homestead Affidavit as Release of Judgment Lien which serves as a release of record of a judgment lien established under this chapter. The affidavit must be in proper form, meeting all requirements of the statute.

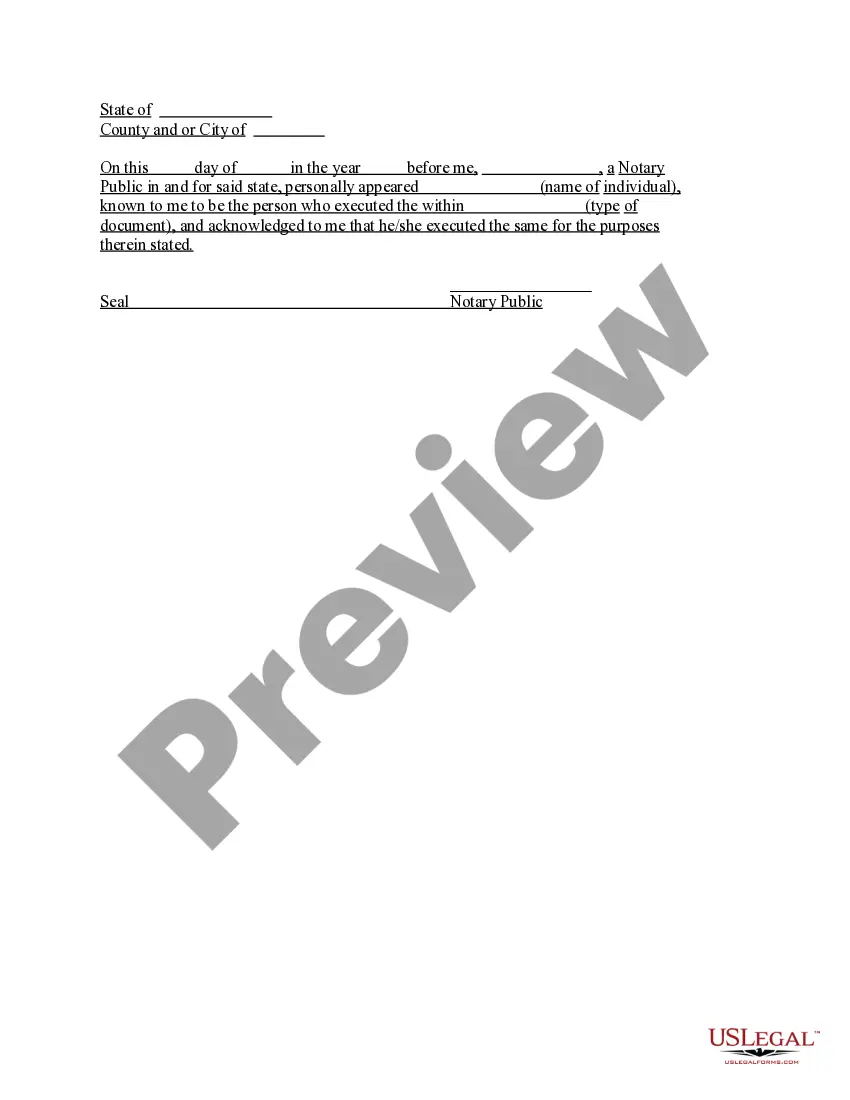

Step 1: Complete the Form. The Judicial Council form commonly used in this procedure is:Step 2: Make Copies. Make photocopies of your unsigned Acknowledgment of Satisfaction of Judgment (EJ-100).Step 3: Notarize Your Forms.Step 4: Have your Acknowledgement Served.Step 5: Filing.

A lien withdrawal removes your tax lien from public record. You can request lien withdrawal: After you've paid your tax balance, or.