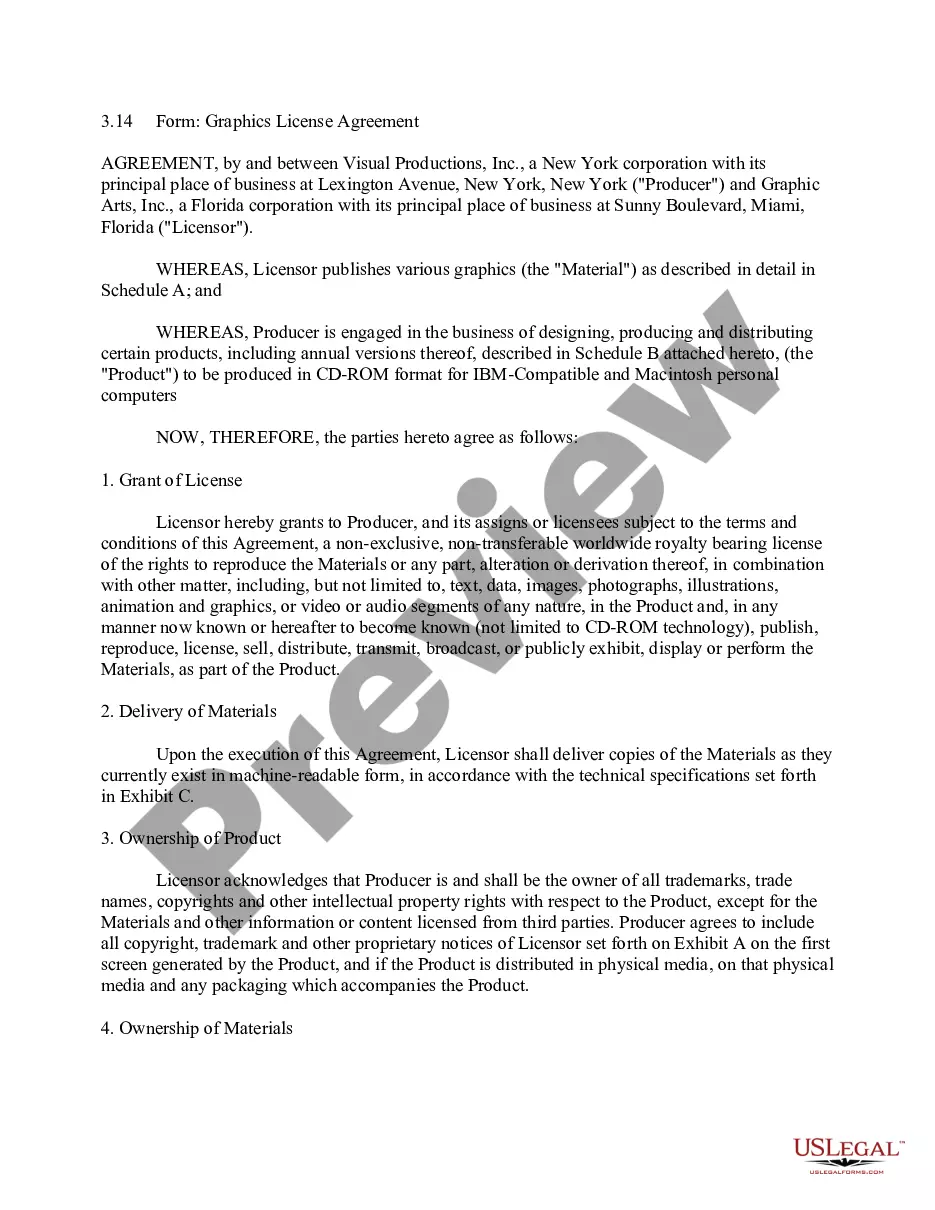

Unsecured Notes Example

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

It’s widely known that you can’t transform into a legal expert in a day, nor can you swiftly learn how to prepare Unsecured Notes Example without possessing specialized knowledge.

Drafting legal documents is an exhaustive process that demands specific training and expertise. Hence, why not entrust the drafting of the Unsecured Notes Example to the professionals.

With US Legal Forms, one of the most comprehensive libraries for legal documents, you can find everything from court documents to templates for workplace communication.

You can regain access to your forms from the My documents tab at any time. If you are an existing client, you can simply Log In and find and download the template from the same tab.

Regardless of the reason for your forms—be it financial, legal, or personal—our website is here to assist you. Experience US Legal Forms today!

- Identify the form you require by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine whether Unsecured Notes Example is what you are looking for.

- Initiate your search again if you need any additional template.

- Create a free account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is processed, you can download the Unsecured Notes Example, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

South Carolina Code §12-6-3587 allows a taxpayer a credit against income taxes equal to 25% of the costs incurred in the purchase and installation of a solar energy system, including a small hydropower system or ?geothermal machinery and equipment? for heating water, space heating, air cooling, energy efficient ...

CHAPTER 6 - SOUTH CAROLINA INCOME TAX ACT. SECTION 12-6-2290. Apportionment of remaining net income from principal profits or income derived from sources not otherwise described by this chapter.

South Carolina Code §12-6-2210 provides for the determination of whether taxable income of a business will be apportioned. A taxpayer whose entire business is transacted or conducted in South Carolina is subject to income tax based on the entire taxable income of the business for the taxable year.

South Carolina considers anyone domiciled in South Carolina to be a resident individual for income tax purposes. ( Sec. 12-6-30, S.C. Code ) A part-year resident is someone who is a resident for only a portion of the tax year.

South Carolina taxpayers ages 65 and older do not need to file a state income tax return in most cases. If your gross income is less than the federal gross income filing requirement, you shouldn't be required to file a SC state return. In addition, Social Security benefits are not taxed by the state of South Carolina.

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

Give us a call at 1-844-898-8542 or email forms@dor.sc.gov so we can direct you to the proper form, or discuss the online filing option that best fits your needs. Filing online using MyDORWAY makes finding the right form easy!

Code Section 12-6-3360(C)(1) provides a job tax credit for a qualifying taxpayer, regardless of size, creating and maintaining a minimum monthly average increase of new, full time jobs in South Carolina. For most taxpayers, the minimum monthly average increase for the tax year is 10.