Unsecured Forgivable Promissory Note

Description

How to fill out Unsecured Installment Payment Promissory Note For Fixed Rate?

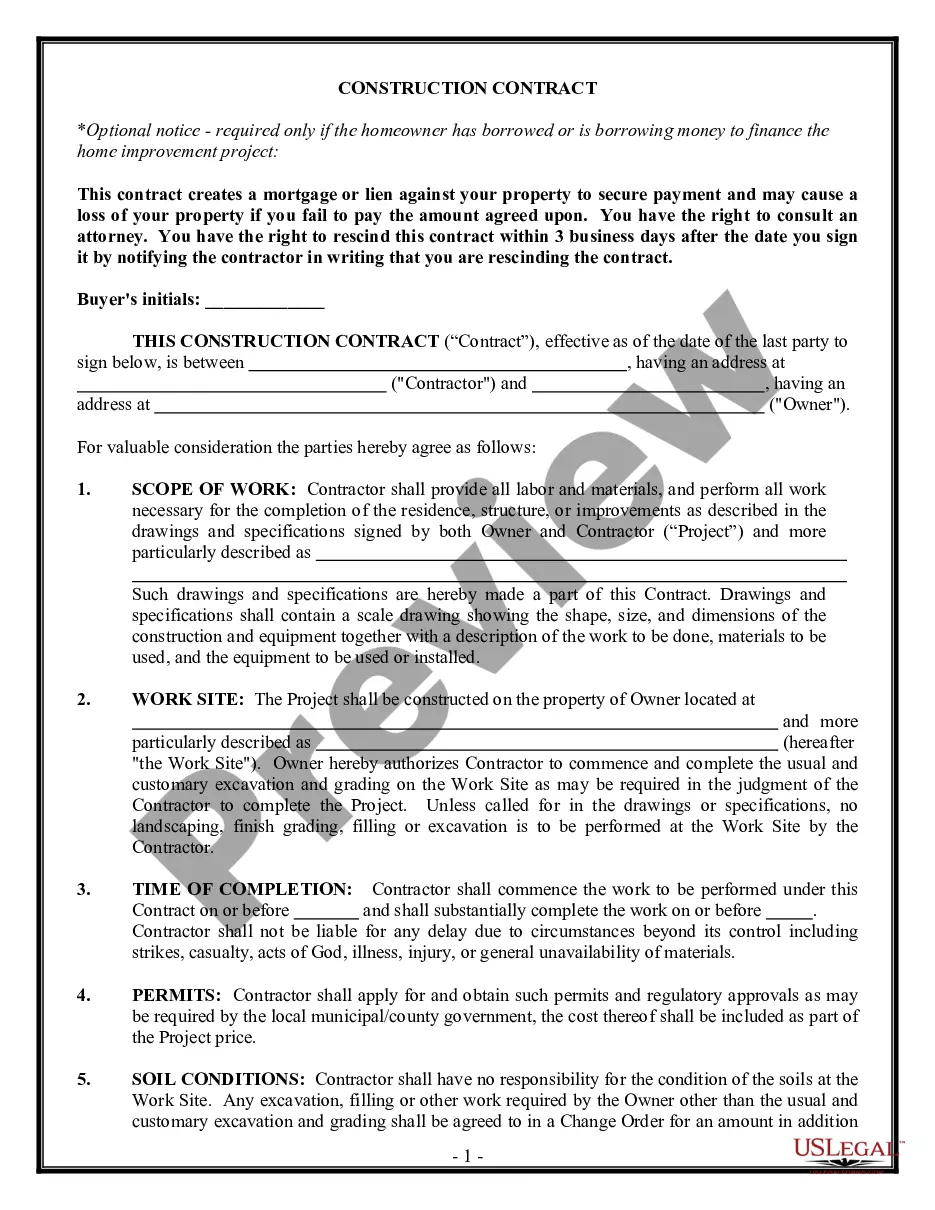

Utilizing legal document examples that adhere to federal and local regulations is crucial, and the internet provides a plethora of choices.

However, what is the use of squandering time looking for the appropriate Unsecured Forgivable Promissory Note example online when the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest virtual legal repository with more than 85,000 editable templates created by lawyers for any professional and personal scenario. They are straightforward to navigate with all documents categorized by state and intended purpose.

Search for another example using the search option at the top of the page if necessary. Click Buy Now once you have found the appropriate form and select a subscription plan. Create an account or Log In and process payment via PayPal or a credit card. Choose the format for your Unsecured Forgivable Promissory Note and download it. All templates accessed through US Legal Forms are reusable. To re-download and complete previously saved forms, visit the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal document service!

- Our experts stay updated with legal modifications, ensuring that your documentation is current and compliant when acquiring a Unsecured Forgivable Promissory Note from our site.

- Acquiring a Unsecured Forgivable Promissory Note is quick and easy for both existing and new users.

- If you already hold an account with an active subscription, Log In and save the document sample you require in the correct format.

- If you are new to our site, follow the steps outlined below.

- Review the template using the Preview feature or through the text outline to confirm it suits your needs.

Form popularity

FAQ

Unsecured promissory notes are promises that a borrower will pay back a lender a certain amount. The promises made in these notes, however, are not backed by anything concrete, meaning the lender is taking the borrower's word that they will actually make the payments described in the note.

Circumstances for release of a promissory note The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Unsecured promissory notes An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.