Defendant Protective Order Fort Wayne

Description

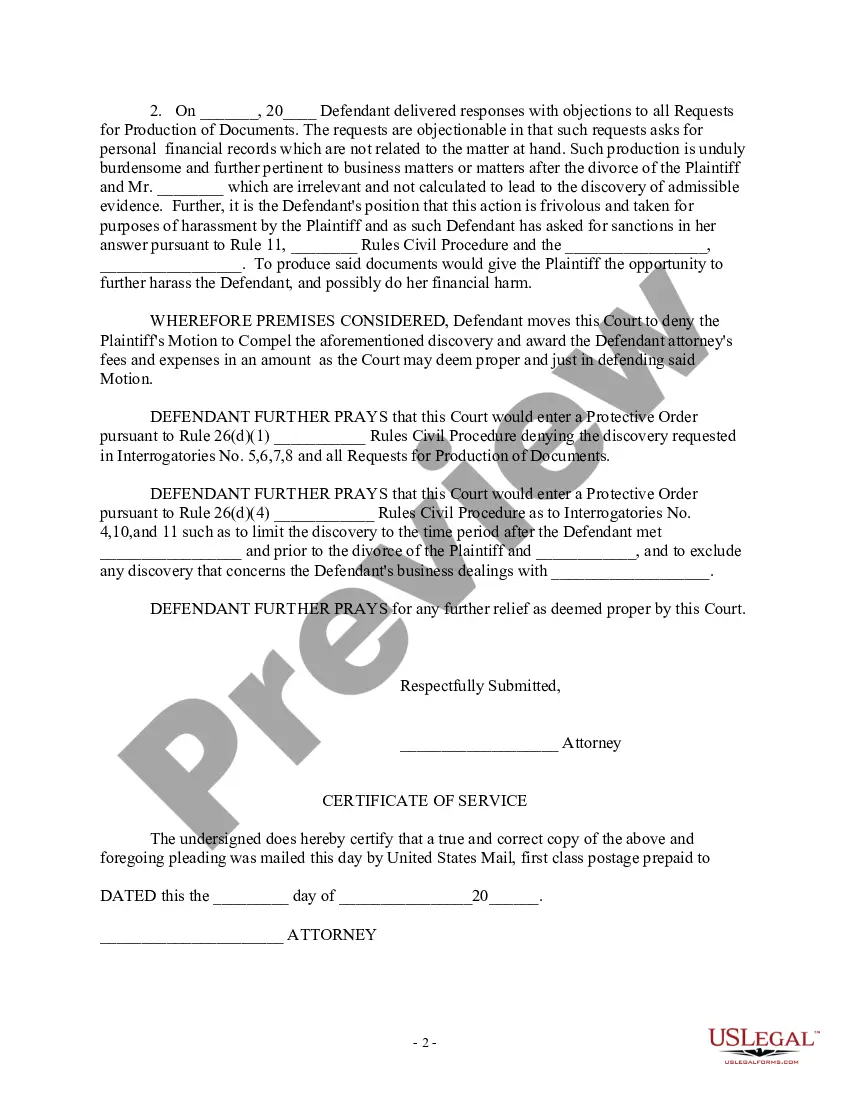

How to fill out Defendant's Motion For Protective Order And Response To Plaintiff's Motion To Compel?

Creating legal documents from the ground up can frequently be overwhelming.

Certain situations may necessitate extensive research and significant financial expenditure.

If you’re looking for a more direct and budget-friendly method of generating Defendant Protective Order Fort Wayne or similar documents without unnecessary complications, US Legal Forms is readily available to you.

Our online library of over 85,000 current legal templates covers nearly every element of your financial, legal, and personal needs.

However, before diving into downloading the Defendant Protective Order Fort Wayne, consider these guidelines: Review the template previews and descriptions to confirm that you have located the document you need. Ensure the template you select meets the criteria of your state and county. Opt for the appropriate subscription choice to acquire the Defendant Protective Order Fort Wayne. Download the document, then fill it out, sign it, and print it. US Legal Forms boasts a solid reputation with over 25 years of experience. Join us today and transform form completion into a straightforward and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-specific templates carefully crafted by our legal experts.

- Utilize our service whenever you require dependable and trustworthy options to find and download the Defendant Protective Order Fort Wayne.

- If you’re familiar with our site and have previously registered an account, simply Log In, select the form, and download it instantly or re-download at any time from the My documents section.

- No account? No worries. It takes minimal time to create one and browse through the catalog.

Form popularity

FAQ

Definition of 'Master Mortgage' The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.

This collateral can take many different forms, but the most common type is real estate. Other security instruments include things like vehicles, jewelry, art, and even patents or copyrights. Basically, anything of value that can be used as collateral can be considered a security instrument.

In Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana and South Dakota, the lender has the choice of either a mortgage or deed of trust. In any other state, you must have a mortgage.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A Wyoming deed of trust is used to secure a borrower's debt to a lender by conveying their real estate to a third party (the ?trustee?) until the loan is returned.

A mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. It includes terms such as: The total amount of the home loan. The down payment amount. Whether monthly or bimonthly payments are required.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateWashingtonYWest VirginiaYWisconsinYWyomingY47 more rows