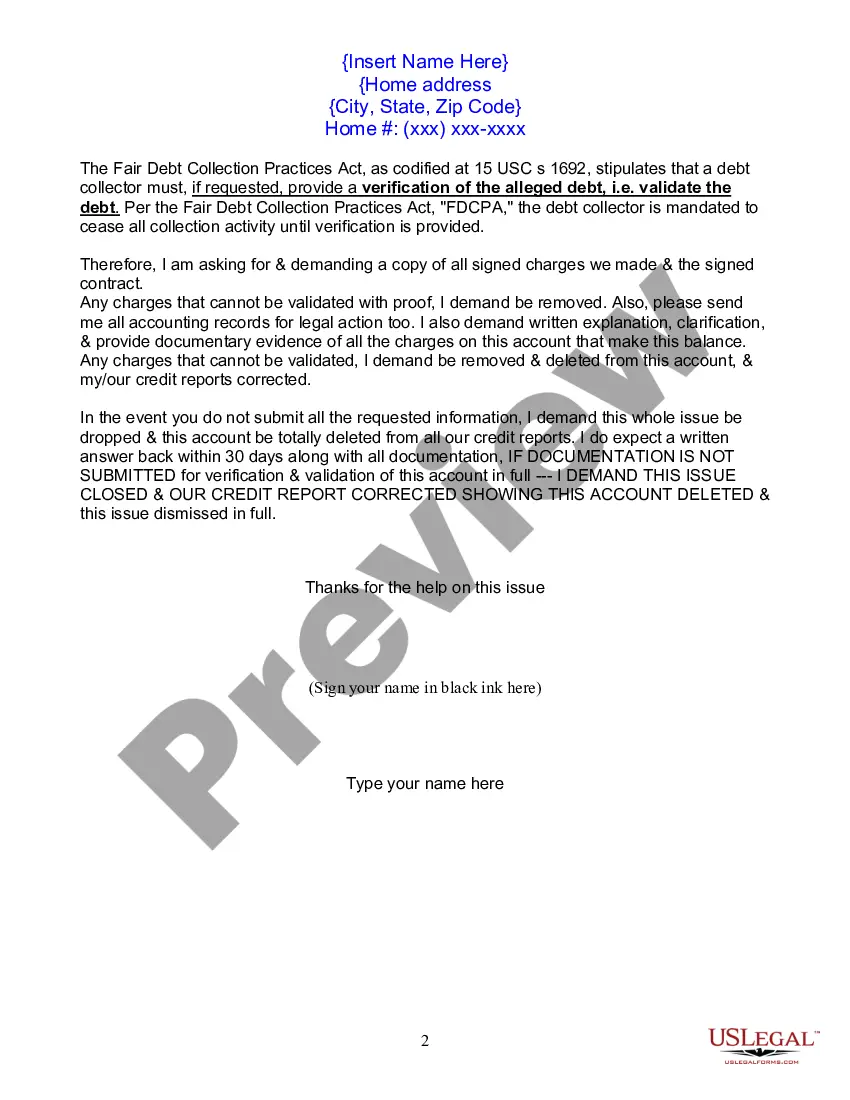

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Dispute Letter For Hard Inquiries

Description

How to fill out Letter Of Dispute - Complete Balance?

Bureaucracy necessitates exactness and correctness.

If you do not manage completing paperwork like Dispute Letter For Hard Inquiries on a daily basis, it may lead to some miscommunications.

Choosing the appropriate sample from the outset will ensure that your document submission proceeds without issues and avert any troubles of re-sending a file or starting the same task from the beginning.

Explore the descriptions of the forms and save those you need at your convenience. If you are not a subscribed user, finding the required sample will involve a few additional steps.

- You can consistently find the suitable sample for your documentation at US Legal Forms.

- US Legal Forms is the largest online collection of forms that houses over 85 thousand templates across various domains.

- You can discover the most current and pertinent version of the Dispute Letter For Hard Inquiries by simply searching on the platform.

- Identify, store, and save templates in your profile or consult the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can effortlessly gather, store in one location, and navigate the templates you save to access them with just a few clicks.

- When on the site, click the Log In button to authenticate.

- Then, continue to the My documents page, where your form history is kept.

Form popularity

FAQ

A 609 letter is a type of dispute letter used to challenge inaccuracies or unauthorized hard inquiries on your credit report. This letter is based on Section 609 of the Fair Credit Reporting Act, which allows consumers to request verification of information on their credit files. Writing a dispute letter for hard inquiries can aid in improving your credit score. For guidance and templates, check out USLegalForms to ensure your letter meets the necessary standards.

When writing a letter to remove hard inquiries, start by addressing the credit bureau accurately and including your personal information. Clearly state the inquiries you wish to dispute and provide details regarding their inaccuracies or unauthorized nature. Utilize a clear and professional tone throughout your dispute letter for hard inquiries. If you need assistance, platforms like USLegalForms offer helpful templates that simplify the writing task.

Generally, a 609 letter does not need to be notarized. The primary requirement is to ensure that the information in the letter is accurate and clearly states your case for disputing hard inquiries. You can simply sign your letter when sent to credit bureaus. For a smooth letter creation process, consider using services like USLegalForms.

You can obtain a 609 letter by creating one yourself or utilizing resources available online. Many legal websites, including USLegalForms, offer templates for such letters, making the process simpler for you. Once you have the template, customize it to fit your specific circumstances regarding hard inquiries. This ensures your dispute letter for hard inquiries is tailored to your needs.

609 letters have gained attention for their potential effectiveness in disputing hard inquiries. However, their success largely depends on the validity of the claims being made. A well-crafted dispute letter for hard inquiries can prompt credit bureaus to investigate the claims further. Remember, if you are not confident in your writing abilities, using platforms like USLegalForms can provide templates that guide you along the way.

To dispute a hard inquiry, start by obtaining your credit report from a major credit bureau. Next, identify the inquiries you believe are inaccurate or unauthorized. You should draft a dispute letter for hard inquiries highlighting the errors, and send it to the credit bureau handling those inquiries. For added assistance with the letter-writing process, consider using resourceful platforms like USLegalForms.

When writing a dispute letter for hard inquiries, include your personal information and a clear statement identifying the inquiry you wish to dispute. Explain why you believe the inquiry is incorrect and attach any relevant documentation. Be concise but comprehensive, and send the letter via certified mail for trackable delivery. Utilizing platforms like US Legal Forms can simplify this process by providing templates that help you structure your letter effectively.

To dispute a hard credit inquiry, start by reviewing your credit report for inaccuracies. If you find any errors, gather supporting documents and write a clear dispute letter for hard inquiries, explaining the issue. Send this letter to the credit bureau that reported the inquiry, requesting removal. Keep records of your correspondence for your files.

The best reason to include when disputing a collection is if it is reported inaccurately or if you never owed the debt in the first place. Supporting your claim with relevant documentation enhances the chance for a favorable outcome. Using a precise dispute letter for hard inquiries can help streamline this process and clarify your position.

When disputing a collection, clearly explain the reason for your dispute in your letter. Mention any inaccuracies and provide evidence that supports your case. This approach can strengthen your position and aid in the effective removal of the collection from your credit report.