Sale Of Single-member Llc Interest Tax Treatment

Description

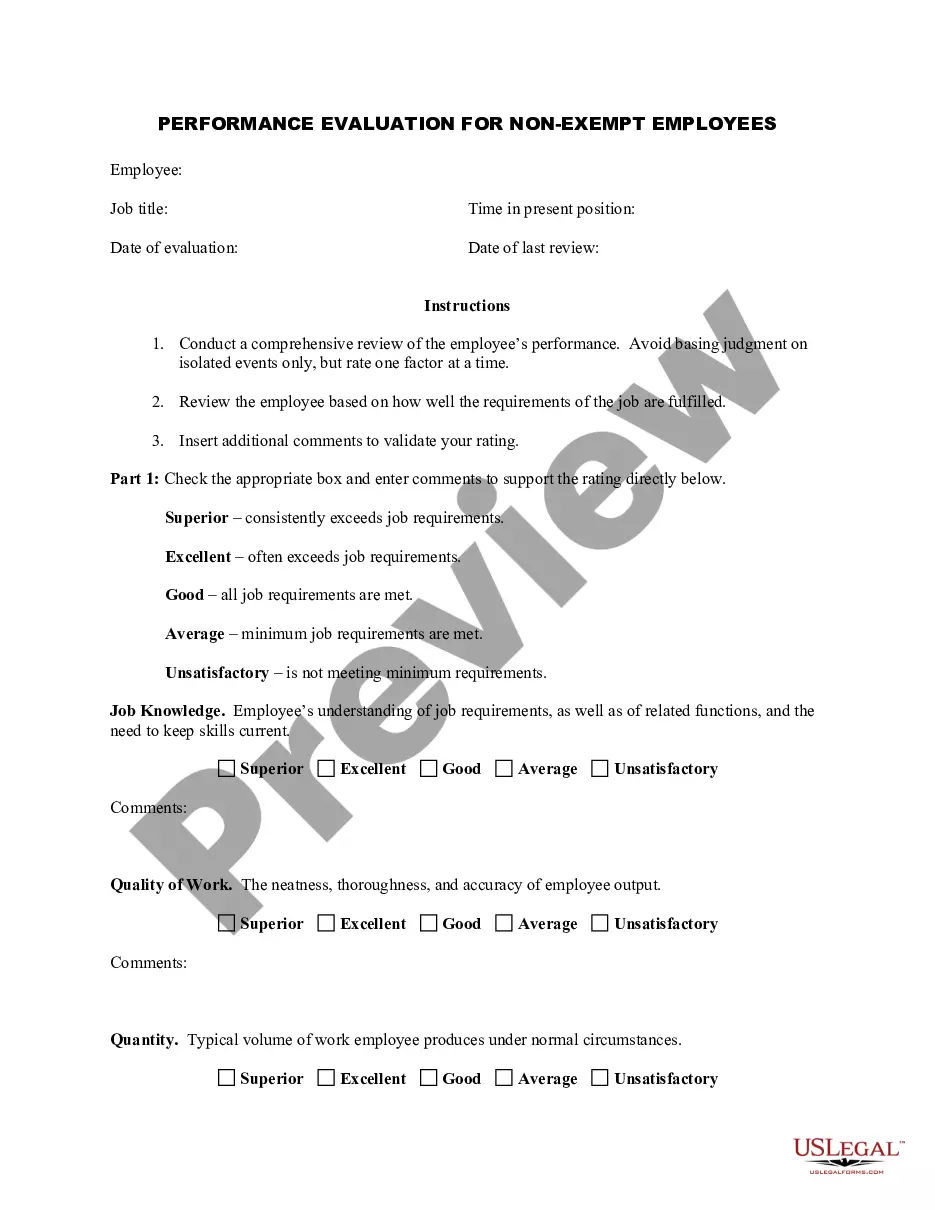

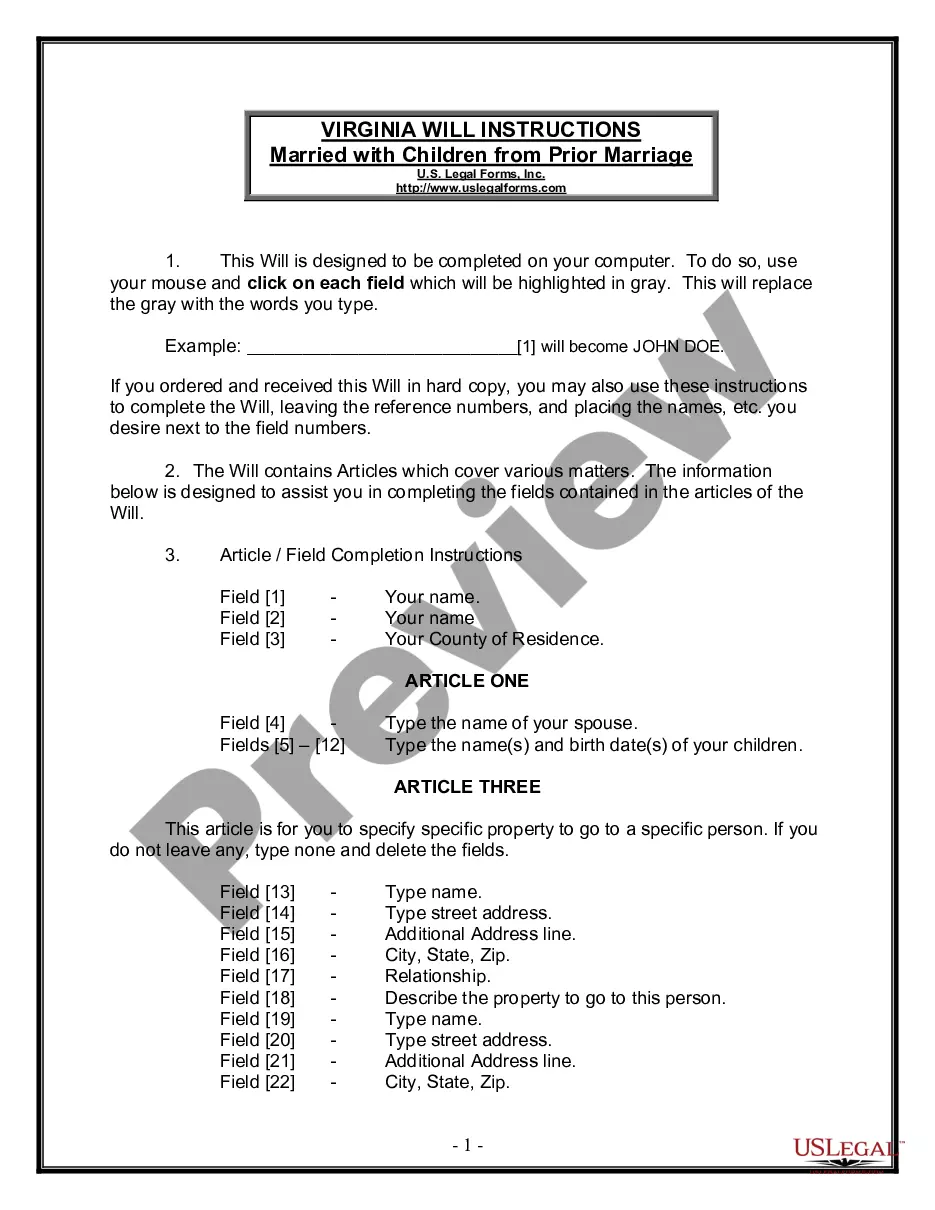

How to fill out Assignment Of Member Interest In Limited Liability Company - LLC?

Managing legal documents can be daunting, even for experienced individuals.

If you are looking for Tax Treatment of Sale of Single-member LLC Interest and find you lack the time to seek out the correct and current version, the tasks can become stressful.

With US Legal Forms, you can.

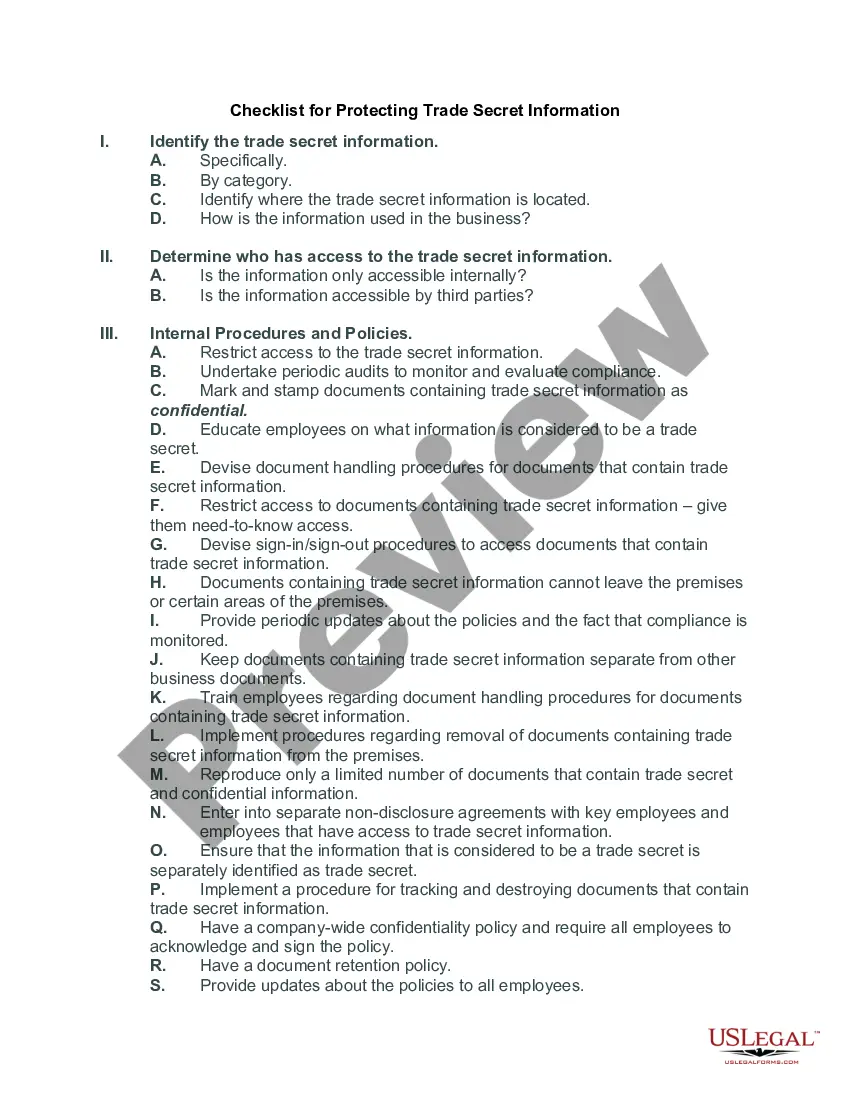

Access a resource center filled with articles, guides, and manuals that pertain to your circumstance and requirements.

Ensure it is the correct form by previewing it and reviewing its description. Confirm that the template is accepted in your state or county, select Buy Now when you’re prepared, choose a subscription plan, opt for the format you require, and then Download, complete, sign, print, and dispatch your document. Leverage the US Legal Forms web library, backed by 25 years of experience and reliability. Transform your routine document management into a straightforward and user-friendly process today.

- Conserve time and energy searching for the documents you require by using US Legal Forms’ sophisticated search and Review feature to locate Tax Treatment of Sale of Single-member LLC Interest and obtain it.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have downloaded previously and to organize your folders as needed.

- If this is your first encounter with US Legal Forms, create an account to gain unlimited access to all the benefits of the library.

- Here are the steps to follow once you have found the form you need.

- A comprehensive web form library can significantly aid anyone aiming to effectively oversee these matters.

- US Legal Forms is a frontrunner in online legal documentation, boasting over 85,000 state-specific legal forms accessible at any time.

- Utilize advanced tools to complete and manage your Tax Treatment of Sale of Single-member LLC Interest.

Form popularity

FAQ

Capital gains in an LLC are generally taxed based on the type of gain and how you structure the LLC. If you sell your interest, you may incur capital gains corresponding to the profit from that sale. Understanding the sale of single-member LLC interest tax treatment is vital since these taxes can influence your net gain significantly. For in-depth guidance, consider leveraging resources like US Legal Forms to navigate the complexities of capital gains taxation.

Selling a partnership interest can lead to various tax consequences that reflect your share in the partnership's profit and loss. Typically, taxes can be triggered on any gain realized from the sale, with capital gains tax applying to the profit. For a thorough understanding of the sale of single-member LLC interest tax treatment, consulting a tax professional can help clarify potential liabilities and reporting requirements.

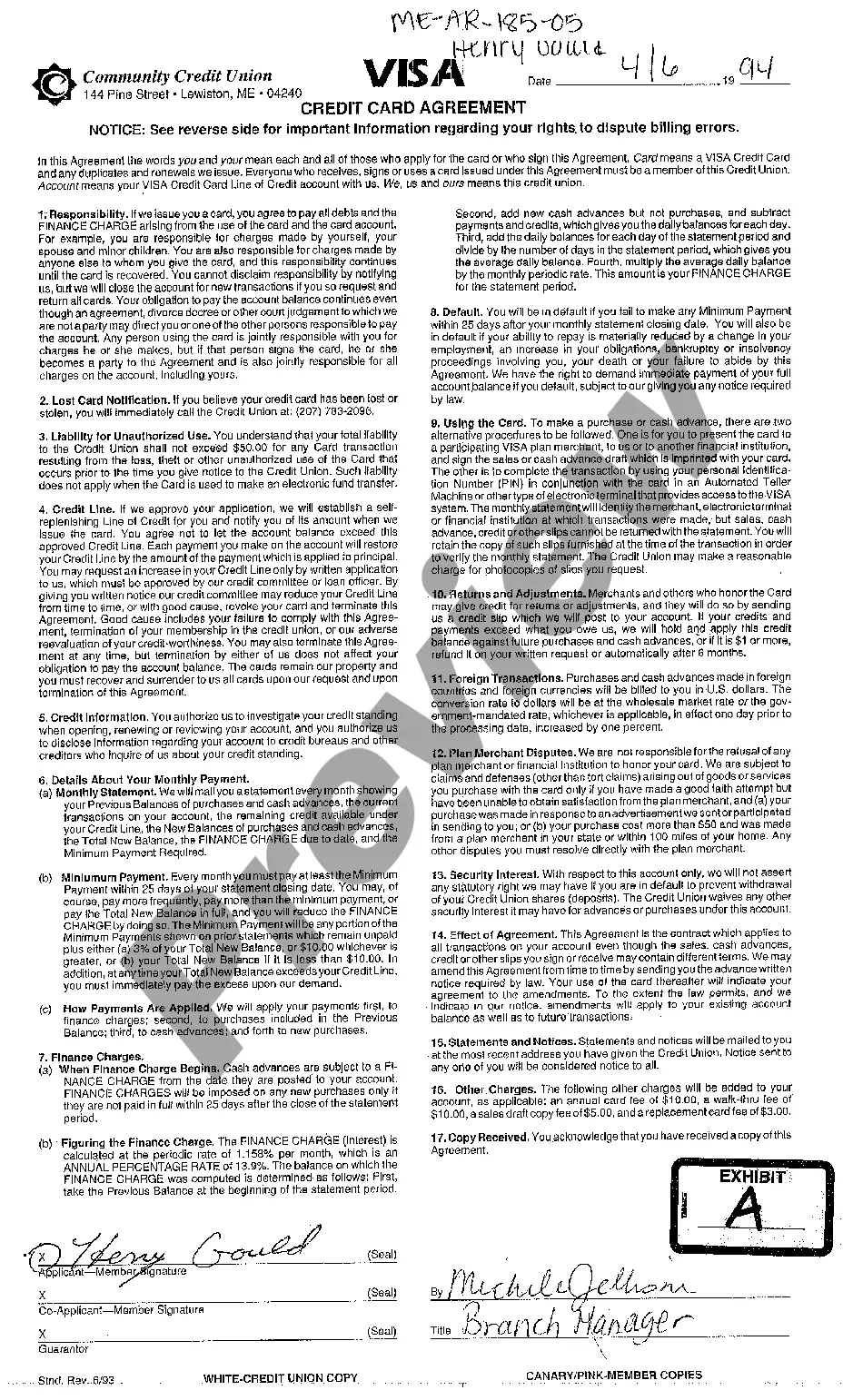

To sell your membership interest in an LLC, start by reviewing your operating agreement, which may include specific procedures for selling interests. Next, communicate your intention to sell to other members, if applicable, and negotiate the terms of the sale. It is also wise to document the sale properly to ensure compliance with the sale of single-member LLC interest tax treatment. Platforms like US Legal Forms can provide essential documents to facilitate this process smoothly.

When you sell your membership interest in an LLC, the tax implications can vary based on your ownership percentage and the structure of the LLC. Generally, the sale of single-member LLC interest tax treatment depends on whether the LLC has elected to be taxed as a corporation or a partnership. You may face capital gains tax on any profit from the sale. Therefore, it's crucial to understand how this decision impacts your overall tax liability.

Yes, you can sell a single-member LLC, but the process may vary based on your operating agreement and state laws. Selling could involve transferring assets, liabilities, and any relevant agreements to the new owner. You should also keep in mind the sale of single-member LLC interest tax treatment, which may affect your tax situation during the sale. Using resources like uslegalforms can streamline this process and ensure compliance with all legal requirements.

To sell your LLC membership interest, begin by reviewing your operating agreement for any specific requirements regarding sales. Once you confirm your ability to sell, you can find potential buyers and negotiate terms. It is also vital to consider the sale of single-member LLC interest tax treatment, as this can impact your overall tax liability. For further assistance, uslegalforms offers tools to facilitate this process effectively.

Yes, a single-member LLC provides a layer of protection for your personal assets from business liabilities. This means that if your LLC faces debts or lawsuits, your personal property typically remains safe. However, it's crucial to follow proper legal protocols to maintain this protection. Considering the sale of single-member LLC interest tax treatment can also help you understand how asset protection applies during such transactions.

When a single-member LLC is dissolved, its assets must be distributed to the owner after settling any outstanding debts and obligations. This process ensures all financial responsibilities are met and any remaining assets belong solely to the member. Understanding the sale of single-member LLC interest tax treatment can help you navigate potential tax implications during this transition. You may want to consult a tax professional for personalized advice.

member LLC reports interest income on Schedule C of the owner's tax return, as the LLC is usually treated as a disregarded entity. This means that any interest income flows directly to the owner's personal income tax returns. Understanding where to report this income is part of grasping the sale of singlemember LLC interest tax treatment. To ensure accurate reporting, utilizing resources like USLegalForms can be beneficial.

Yes, assigning LLC interest may trigger tax consequences, potentially leading to a taxable event. When an LLC member assigns their interest, it may be treated as a sale depending on the specific circumstances. Therefore, knowing the sale of single-member LLC interest tax treatment is essential. A tax professional can provide tailored guidance on assignments and their implications.