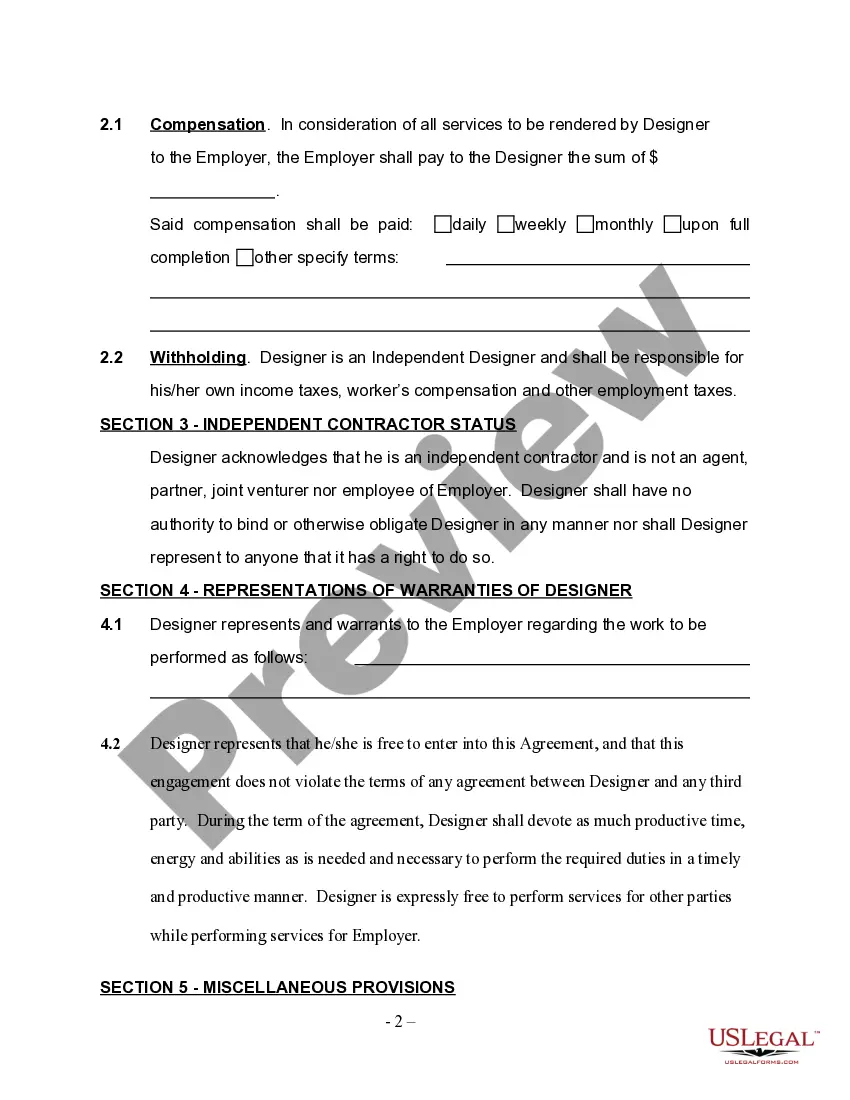

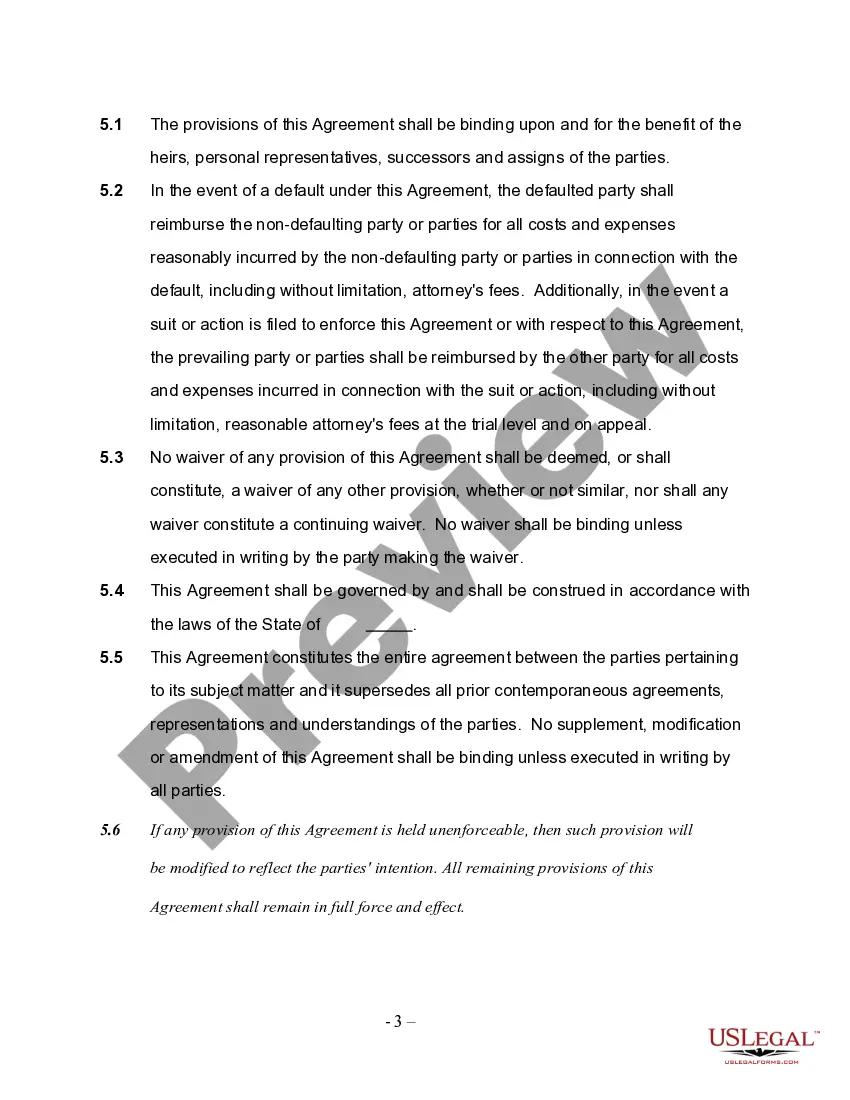

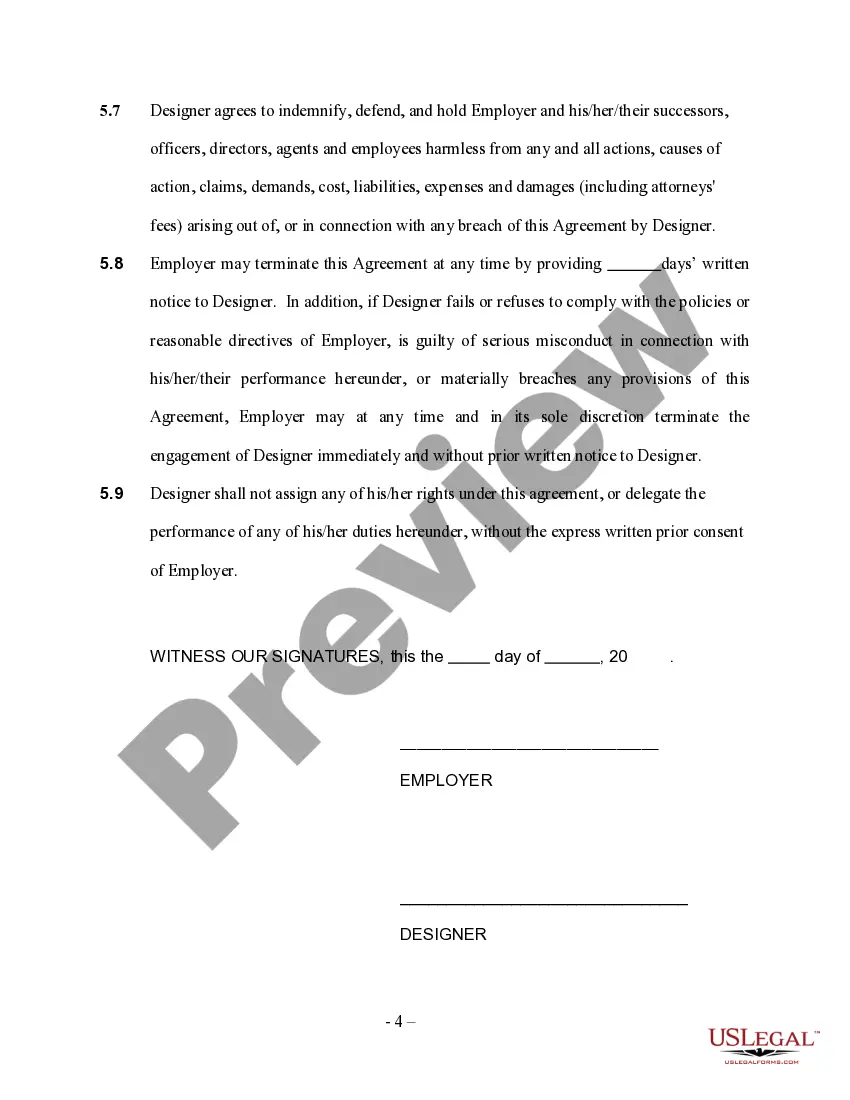

Interior Designers Form Contract With Difficult Clients

Description

How to fill out Self-Employed Interior Designer Services Contract?

Regardless of whether it’s for corporate objectives or individual matters, everyone eventually has to contend with legal issues at some point in their lives.

Completing legal documents requires meticulous care, beginning with selecting the appropriate form template.

With an extensive catalog from US Legal Forms at your disposal, you won’t have to waste time searching the internet for the correct template. Utilize the library's straightforward navigation to find the suitable template for any situation.

- Obtain the necessary template using the search bar or directory navigation.

- Review the document’s details to ensure it aligns with your situation, jurisdiction, and locality.

- Access the form's summary to inspect it.

- If it's the incorrect document, return to the search feature to locate the Interior Designers Form Contract With Difficult Clients template you require.

- Acquire the template if it fits your needs.

- If you possess a US Legal Forms account, just click Log in to access previously saved documents in My documents.

- If you haven’t created an account yet, you can procure the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account sign-up form.

- Choose your payment method: you may opt for a credit card or a PayPal account.

- Select your desired file format and download the Interior Designers Form Contract With Difficult Clients.

- Once downloaded, you can fill out the form using editing software or print it out and complete it by hand.

Form popularity

FAQ

Your answer can be a handwritten letter to the court that says you do not agree with the lawsuit. Include your case (cause) number and mailing address and any defenses you may have to the lawsuit; for example, the amount they claim you owe is incorrect, the account isn't yours, or the debt is older than 4 years.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Keep in mind that making a partial payment or acknowledging you owe an old debt, even after the statute of limitations expired, may restart the time period. It may also be affected by terms in the contract with the creditor or if you moved to a state where the laws differ.

If the debt really is too old to be reported, it's time to write to the credit bureau(s) to request its removal. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. If it can't, the debt has to come off your report.

The debt collector has a certain amount of time to file the suit, called the "statute of limitations." In Texas, the statute of limitations for debt is 4 years. After that time passes, they can no longer file a lawsuit to collect the debt.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment.

You'll need to dispute it with any credit reporting agency that's showing it on your credit report. The collections account information is correct, but you've made steps to remedy the situation. In this case, you can write a goodwill letter or pay for delete letter to ask for the account to be removed.

The statute of limitations on debt in Texas is four years. This section of the law, introduced in 2019, states that a payment on the debt (or any other activity) does not restart the clock on the statute of limitations.