Independent Contractor Form Document For Accountant And Bookkeeper

Description

How to fill out Research Agreement - Self-Employed Independent Contractor?

There is no longer a necessity to squander time searching for legal documents to comply with your local state laws.

US Legal Forms has gathered all of them in one location and made their accessibility easier.

Our website provides over 85,000 templates for various business and personal legal situations organized by state and area of application.

Using the search field above to look for another template if the previous one wasn't suitable. Click Buy Now next to the template name once you find the right one. Select the most suitable pricing plan and register for an account or Log In. Proceed to payment for your subscription with a credit card or via PayPal. Choose the file format for your Independent Contractor Form Document For Accountant And Bookkeeper and download it to your device. Print your form to complete it manually or upload the sample if you prefer to edit it online. Creating official documents under federal and state regulations is fast and simple with our platform. Experience US Legal Forms today to maintain your paperwork organized!

- All forms are properly drafted and validated for authenticity, ensuring you receive an updated Independent Contractor Form Document For Accountant And Bookkeeper.

- If you are acquainted with our platform and already possess an account, make sure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documentation whenever necessary by accessing the My documents tab in your profile.

- If you are a first-time user of our platform, the process will require a few additional steps to complete.

- Here’s how new users can locate the Independent Contractor Form Document For Accountant And Bookkeeper in our catalog.

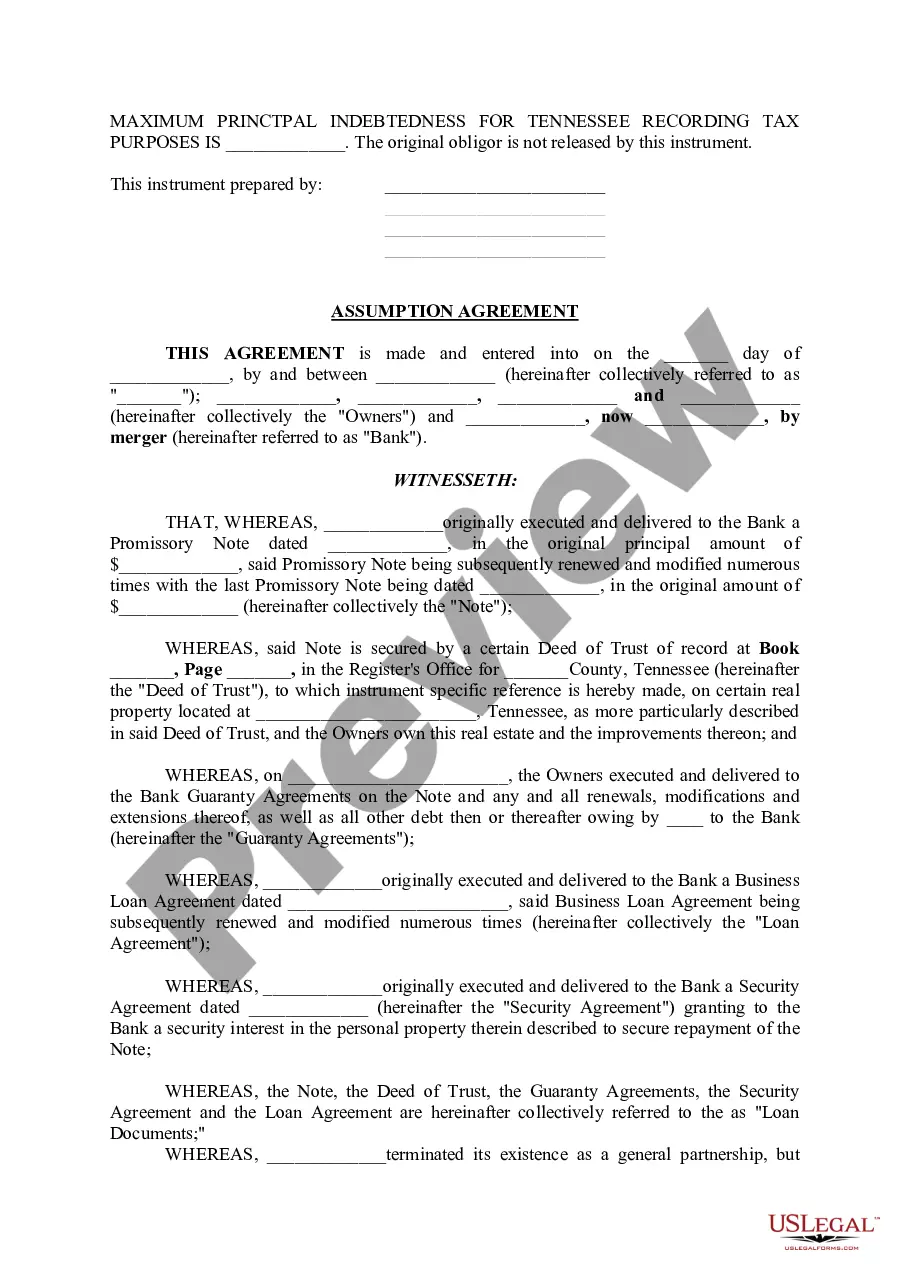

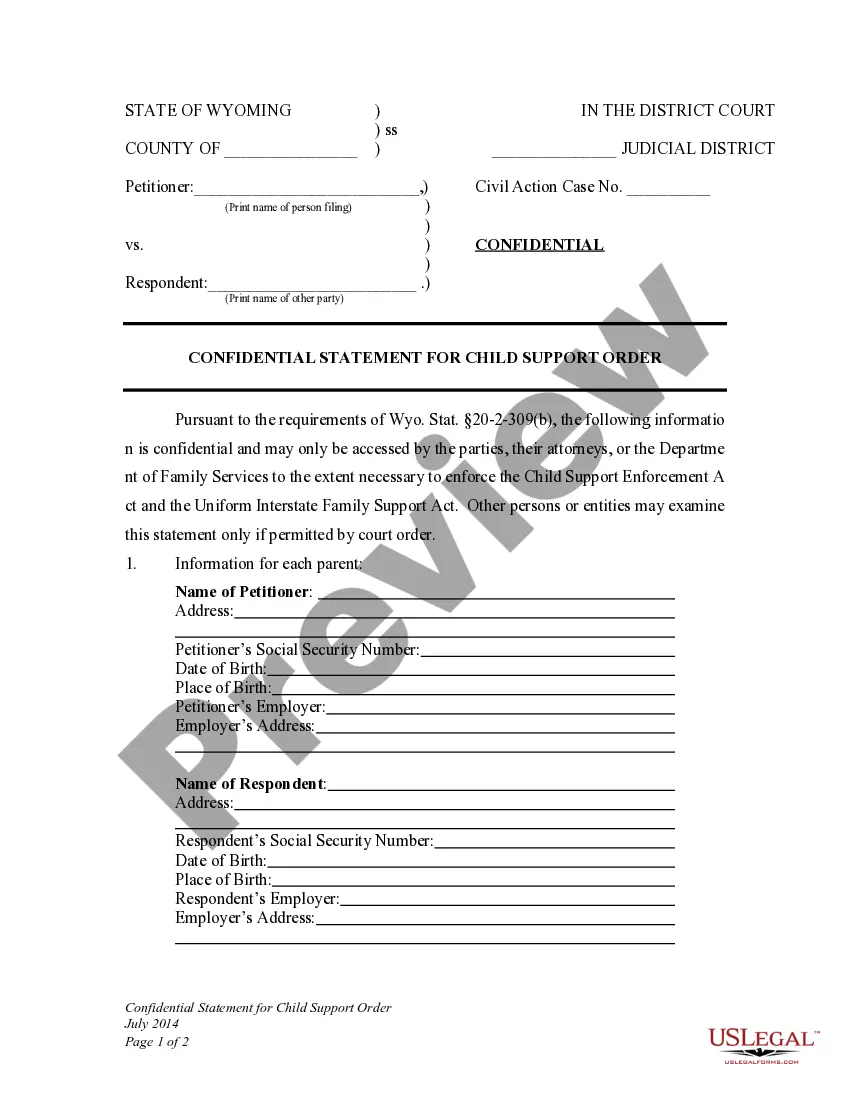

- Examine the page content meticulously to ensure it holds the sample you require.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

On a day-to-day basis, Bookkeepers complete data entry, collect transactions, track debits and maintain and monitor financial records. They also pay invoices, complete payroll, file tax returns and even maintain office supplies.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

Key takeaway: Bookkeepers handle the day-to-day tasks of recording financial transactions, while accountants provide insight and analysis of that data and generate accounting reports.