Self Employed Bookkeeper Form 1099

Description

How to fill out Bookkeeping Agreement - Self-Employed Independent Contractor?

Legal oversight can be perplexing, even for the most seasoned professionals.

When you require a Self Employed Bookkeeper Form 1099 and don't have the opportunity to spend searching for the accurate and current version, the processes can be stressful.

Access a valuable collection of articles, guides, handbooks, and resources pertinent to your circumstances and requirements.

Save time and effort hunting for the forms you require, and utilize US Legal Forms' advanced search and Review tool to find the Self Employed Bookkeeper Form 1099 and obtain it.

Rely on the US Legal Forms online library, supported by 25 years of expertise and trustworthiness. Streamline your daily document management into an effortless and user-friendly experience today.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and procure it.

- Check your My documents tab to see the documents you have previously preserved and to manage your folders as desired.

- If it's your first experience with US Legal Forms, register a free account and gain unlimited access to all the advantages of the library.

- Here are the actions to take after acquiring the form you need.

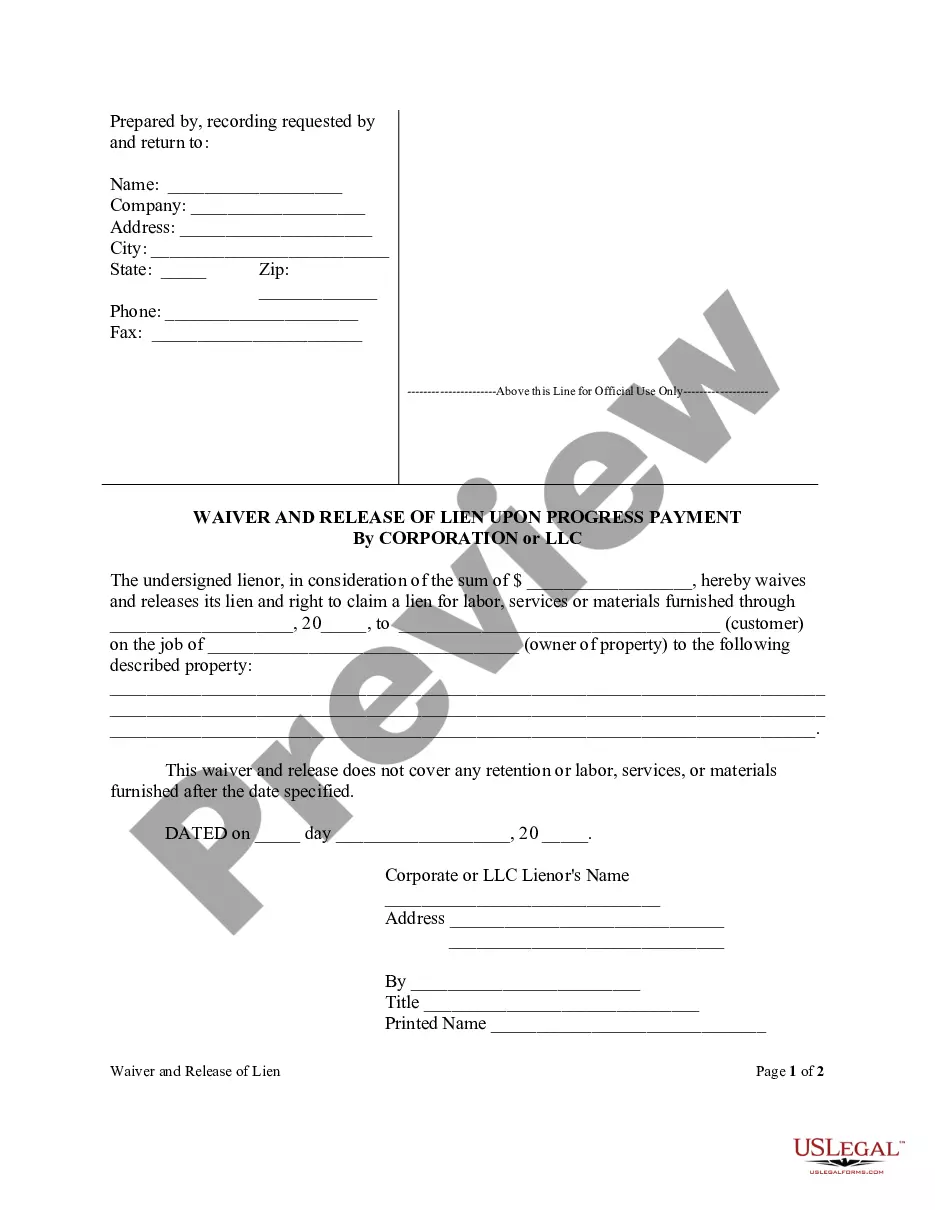

- Verify that it is the right form by previewing it and reviewing its description.

- Gain access to state- or county-specific legal and business documents.

- US Legal Forms caters to all needs you might have, from personal to corporate paperwork, consolidated in one location.

- Utilize innovative tools to fill out and manage your Self Employed Bookkeeper Form 109.

Form popularity

FAQ

While working as a 1099 bookkeeper offers flexibility, it also comes with some downsides. One major concern is the lack of employer-provided benefits, such as health insurance and retirement plans. Additionally, self employed bookkeepers must manage their own taxes, which can be complex and time-consuming without the right resources, like those offered by uslegalforms.

A bookkeeper has limitations on certain financial activities. They cannot provide legal advice, represent clients in audits, or perform services that require a CPA license, such as filing taxes. Understanding these boundaries helps ensure that a self employed bookkeeper form 1099 operates within legal guidelines while providing valuable financial services.

Filling out a 1099 form for self-employed bookkeeping requires careful attention to detail. You need to report your total earnings for the tax year, including all income received from clients. Many find it helpful to use platforms like uslegalforms to navigate the process seamlessly, ensuring they accurately complete the self employed bookkeeper form 1099 without missing critical information.

Yes, a bookkeeper can absolutely be classified as a 1099 worker. This classification means they are self employed and manage their own business operations. As a self employed bookkeeper form 1099, they enjoy greater flexibility in their schedules and the potential for increased earnings compared to traditional employment.

The income of a 1099 bookkeeper can vary widely, influenced by factors such as experience, location, and the complexity of the work. On average, self employed bookkeepers can earn between $25 and $75 per hour. By utilizing the self employed bookkeeper form 1099, they can set their rates based on the services they provide and the value they offer to their clients.

Indeed, a bookkeeper can serve as a contractor. In this role, they work on a project basis and are not tied to a specific company. Being a self employed bookkeeper form 1099 allows them to take on multiple clients, giving them the opportunity to diversify their income and gain experience across various industries.

Yes, a bookkeeper can work as a 1099 employee. This arrangement means that the bookkeeper operates as an independent contractor rather than a traditional employee. As a self employed bookkeeper form 1099, the individual is responsible for their own taxes and benefits, which can offer more flexibility in how they manage their work and income.

If you are self-employed and have not received a 1099, you still need to report your income when filing taxes. You can use your records such as invoices, bank statements, or payment receipts to substantiate your earnings. Tools like US Legal Forms can help you with documentation to ensure you meet tax obligations even without a 1099.

A 1099 requirement is triggered when a business pays an independent contractor, like a self-employed bookkeeper, $600 or more during the tax year. Various payments, including fees, commissions, and rents, can also lead to a 1099 issuance. Understanding these triggers is essential for both clients and self-employed individuals to maintain compliance.

If you need to prove your self-employment status without a 1099 form, you can use bank statements, invoices, or contracts that showcase your income. Additionally, maintaining a detailed record of your work helps establish your self-employment in case of inquiries. Tools like US Legal Forms can help you create contracts that serve as valid proof.