Payroll Independent Contractor For Walmart

Description

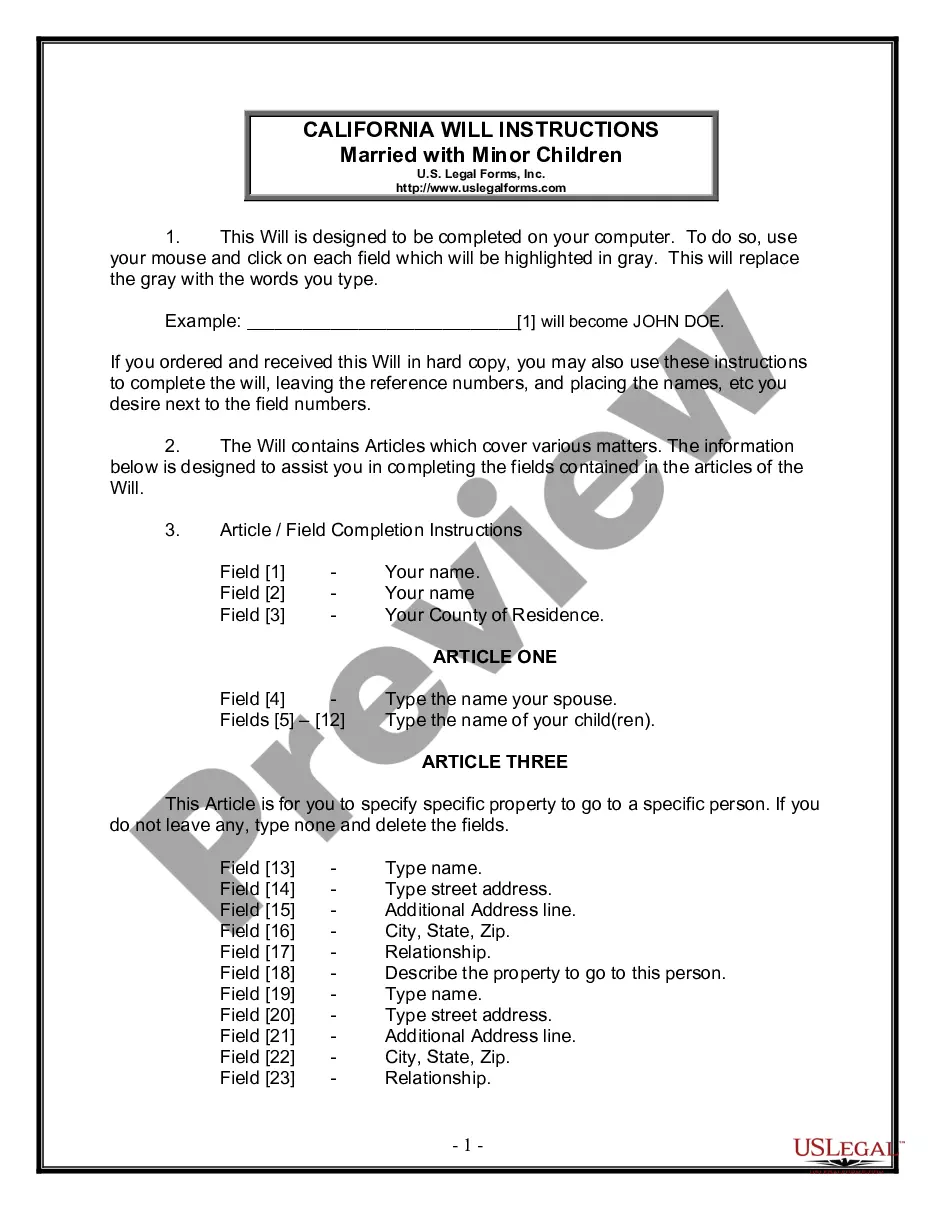

How to fill out Payroll Specialist Agreement - Self-Employed Independent Contractor?

Managing legal matters can be exasperating, even for seasoned professionals.

When searching for a Payroll Independent Contractor for Walmart and lacking the time to commit to finding the correct and updated version, the processes can be taxing.

US Legal Forms fulfills any needs you might have, covering everything from personal to business documentation, all centralized in one location.

Utilize innovative tools to fill out and manage your Payroll Independent Contractor for Walmart.

Outlined below are the steps to follow after downloading the form you require: Validate that this is the right document by previewing it and reviewing its details.

- Access a repository of articles, guides, and materials pertinent to your situation and needs.

- Conserve time and resources searching for the documents you need, and leverage US Legal Forms’ advanced search and Preview feature to locate Payroll Independent Contractor for Walmart and obtain it.

- If you hold a monthly subscription, Log In to your US Legal Forms account, find the document, and retrieve it.

- Check your My documents tab to review the documents you have saved in addition to managing your folders as desired.

- If this is your first engagement with US Legal Forms, establish a complimentary account to gain unlimited access to all platform benefits.

- A powerful web form library could be transformative for anyone looking to navigate these circumstances efficiently.

- US Legal Forms stands as a pioneer in the realm of online legal forms, offering over 85,000 state-specific legal documents at your convenience.

- With US Legal Forms, you can access state or county-specific legal and business forms.

Form popularity

FAQ

Wal-Mart Company code = 10108 Page 2 2. Associate's social security number 3. Your PIN#. Your PIN# is your current earnings from your most recent paycheck stub.

Walmart Benefits Live Better U: Walmart employees get 100% of their college tuition and books covered for college degrees or professional certificates. Discounts: Associates receive 10% off Walmart's produce and general merchandise. Associates also get discounts on gym memberships and phone plans.

Walmart's employer code is 10108. The website will take you through the process of entering in some personal information to confirm your identity, and then you will be given online access to the W2 for this year. You can also access past W2s this way, for a fee.

But there is no law that say's you CAN'T be paid in gift cards, providing both parties are agreeable. If you accepted gift cards in settlement of an invoice, you would record the face value of the cards as a payment.

Walmart is not a federal contractor and thus not under compliance mandates to report on the percentage of its workforce that is comprised of people with disabilities. Based upon anecdotal evidence, Walmart was among the first non-federal contractors to launch a self ID initiative.