Self Employed Tutor Contract With No

Description

How to fill out Self Employed Tutor Contract With No?

Red tape necessitates exactness and correctness.

If you do not engage in filling out paperwork like Self Employed Tutor Contract With No daily, it may lead to some misunderstanding.

Selecting the appropriate template from the beginning will ensure that your document submission will proceed smoothly and avert any complications of resending a document or restarting the same task from scratch.

Locating the right and updated templates for your documents is a matter of a few minutes with an account at US Legal Forms. Evade bureaucratic issues and streamline your work with forms.

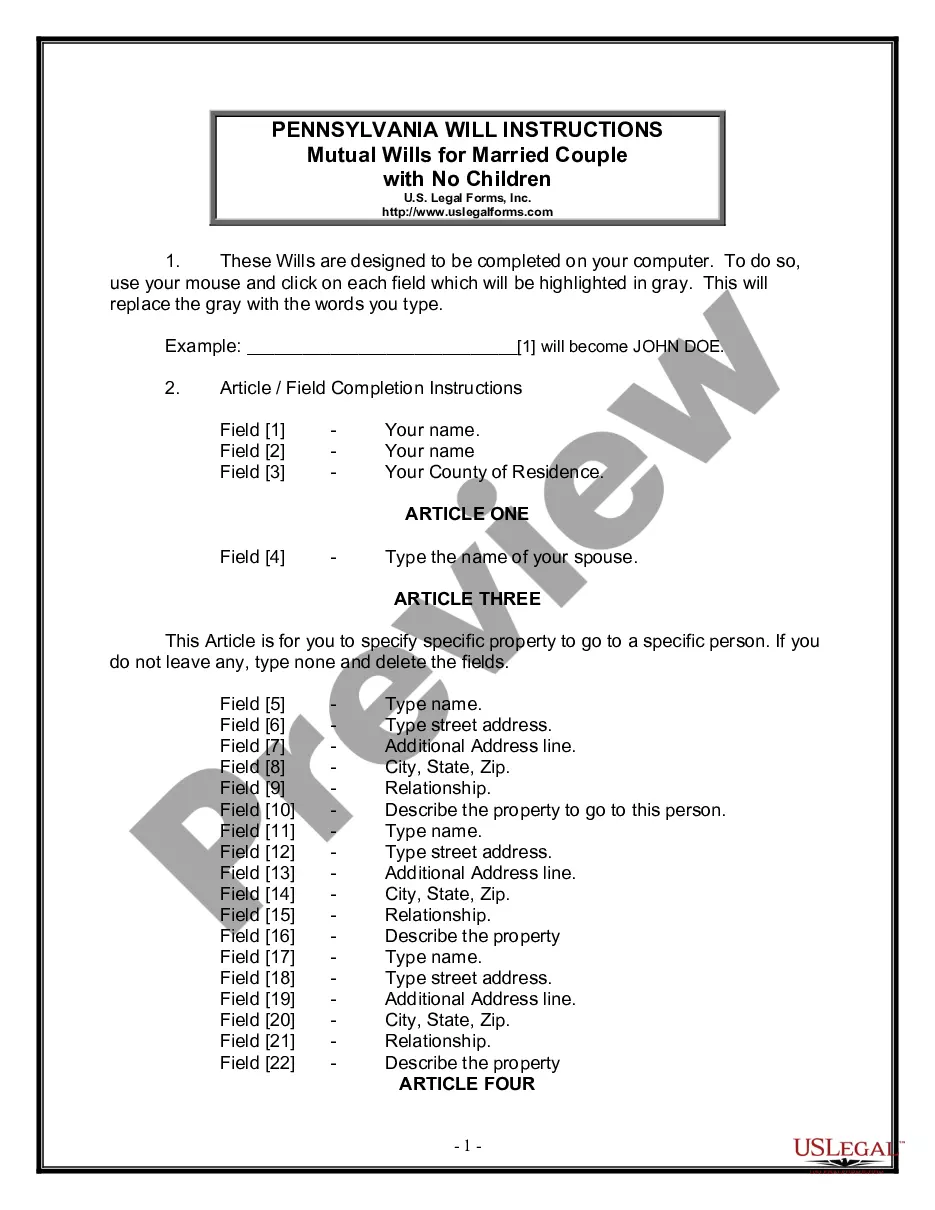

- Identify the template using the search feature.

- Verify that the Self Employed Tutor Contract With No you’ve located is suitable for your state or region.

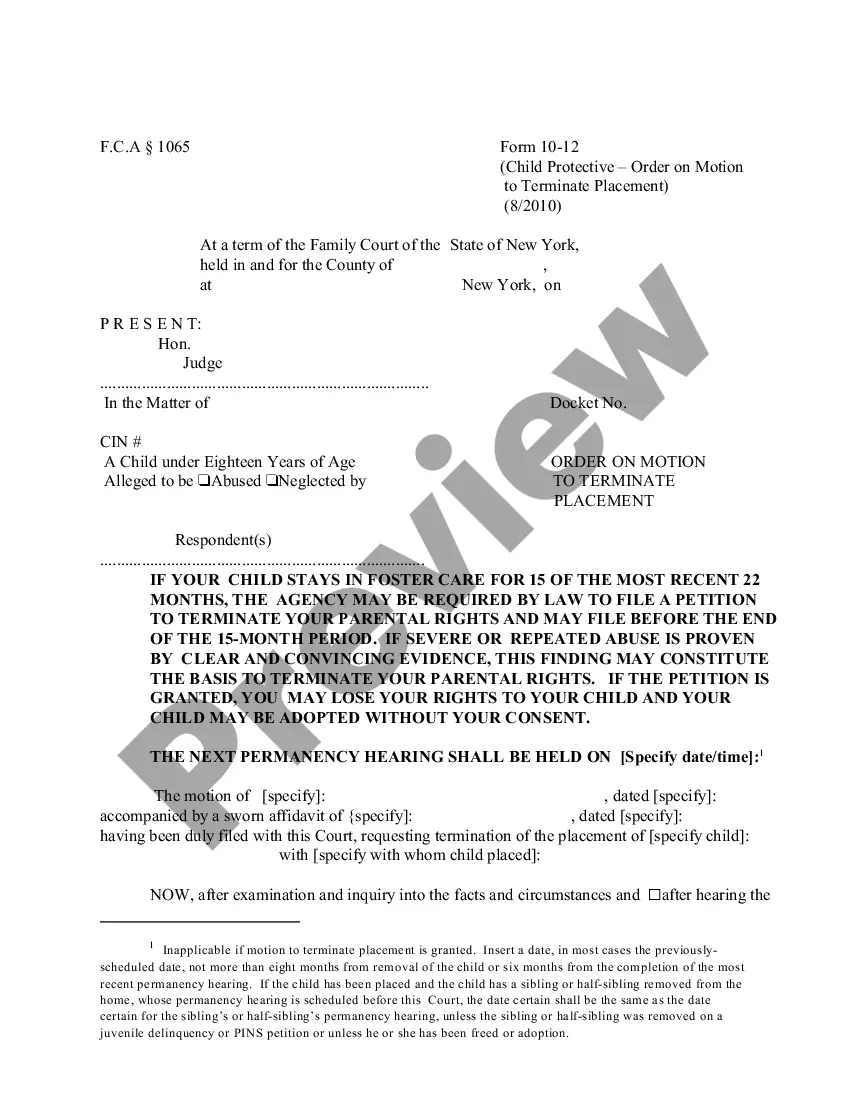

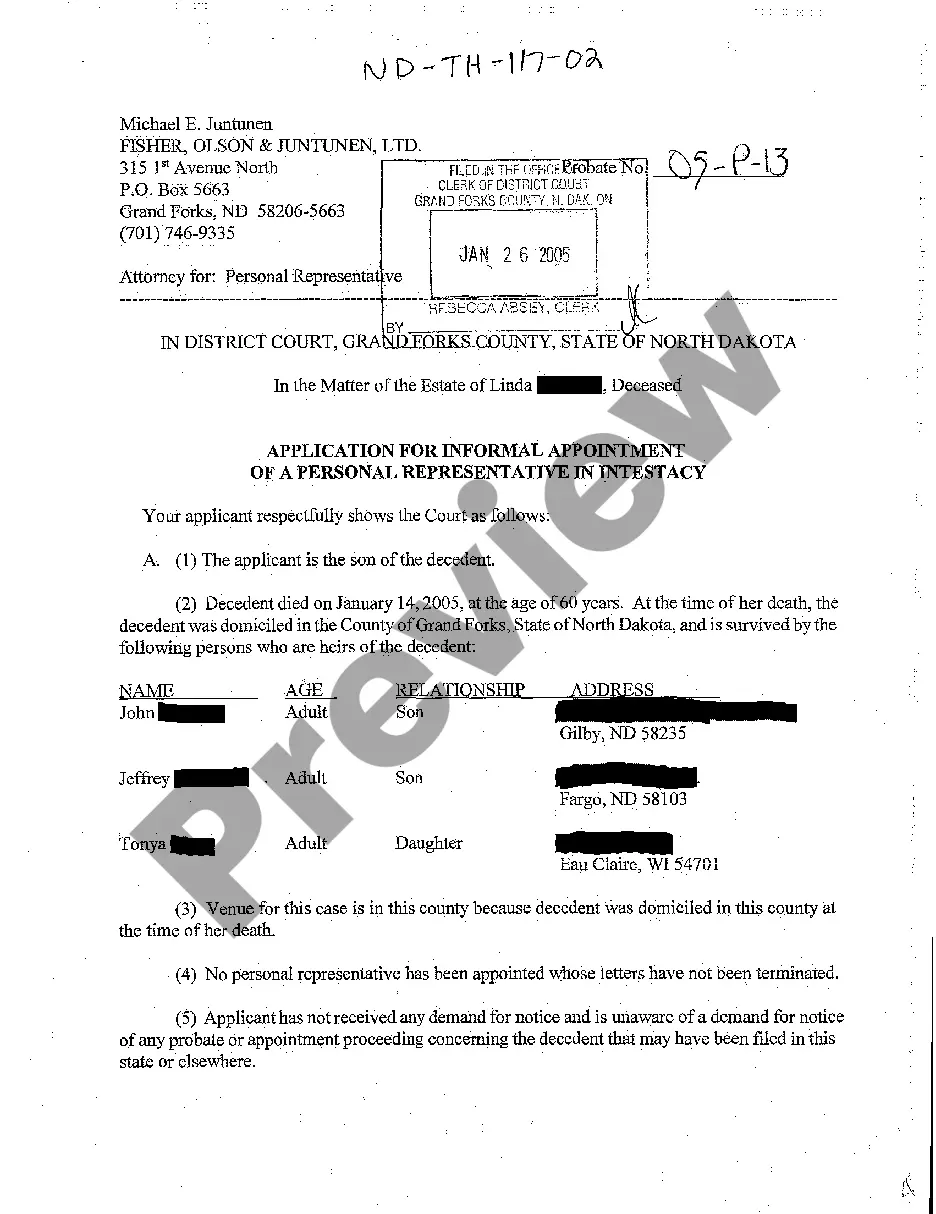

- View the preview or read the description that provides details on the use of the template.

- If the result corresponds with your query, click the Buy Now button.

- Choose the suitable option among the proposed subscription plans.

- Sign into your account or create a new one.

- Finalize the purchase using a credit card or PayPal account.

- Download the form in your preferred format.

Form popularity

FAQ

To effectively sell yourself as a private tutor, focus on marketing your expertise and successes. Establish an engaging profile that highlights your skills, teaching methods, and past results. Leverage social media, local advertising, and platforms like US Legal Forms to create a professional image that includes a clear self employed tutor contract with no hidden terms. Building a strong reputation will help attract clients.

Tutoring can qualify as business income, especially if it is a consistent and profitable venture. As a self-employed tutor, you report your income on your tax return, which may also open opportunities for deductions. Making a self employed tutor contract with no specific duration can further strengthen your business status. Consulting a tax professional can help clarify your unique situation.

Yes, tutoring is often categorized as freelancing. When you work as a self-employed tutor, you operate independently, providing services based on your expertise. Unlike traditional employment, you set your own hours and choose your clients, giving you greater flexibility. This approach allows you to create a self employed tutor contract with no long-term commitments.

Yes, tutoring can be considered self-employment income. Any earnings you generate from tutoring services will typically be reported as such for tax purposes. If you’re navigating this, using a self employed tutor contract with no complexities can help manage your financial records more effectively.

To establish yourself as a tutor, start by identifying your strengths and targeting your desired audience. Create a marketing plan that includes online and local outreach. A well-crafted self employed tutor contract with no strict stipulations can also reinforce your professionalism and credibility while you build your brand.

Indeed, you can be a self-employed tutor if you possess knowledge in a subject and the ability to teach. This path offers significant flexibility and can lead to fulfilling opportunities. To get started, consider a self employed tutor contract with no binding agreements to outline professional boundaries.

employed tutor is someone who offers educational support independently, rather than through a school or agency. They have the freedom to choose their clients, subjects, and hours, creating a flexible work environment. Engaging in this role often involves drafting a self employed tutor contract with no longterm commitments.

Typically, you do not need a license to become a private tutor. However, certain subjects or specific states may have regulations that require certification. It's wise to check local laws, and if you need guidance, a self employed tutor contract with no licensing obligations could provide clarity on expectations.

Yes, tutors can absolutely be self-employed. This means they run their own tutoring services independently, setting their own schedules and rates. If you're considering this path, a self employed tutor contract with no specific commitments can help establish clear terms with your clients.

Yes, tutoring is typically classified as self-employed work. If you set your own rates and schedules, you operate as an independent contractor. A self employed tutor contract with no constraints can clarify your role and responsibilities. This arrangement allows flexibility and autonomy, aligning with the needs of most tutors.