This guide provides an overview on garnishment law and how a person can stop a garnishment. Topics covered include general information and restrictions on garnishments of wages and bank accounts, as well as alternatives for stopping enforcement of a garnishment order.

Wage Earnings Garnishment For Child Support

Description

How to fill out Wage Earnings Garnishment For Child Support?

Finding a go-to place to take the most recent and appropriate legal templates is half the struggle of dealing with bureaucracy. Finding the right legal papers demands precision and attention to detail, which is the reason it is crucial to take samples of Wage Earnings Garnishment For Child Support only from reputable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You can access and view all the information concerning the document’s use and relevance for your situation and in your state or county.

Take the following steps to complete your Wage Earnings Garnishment For Child Support:

- Use the library navigation or search field to find your sample.

- View the form’s description to check if it matches the requirements of your state and county.

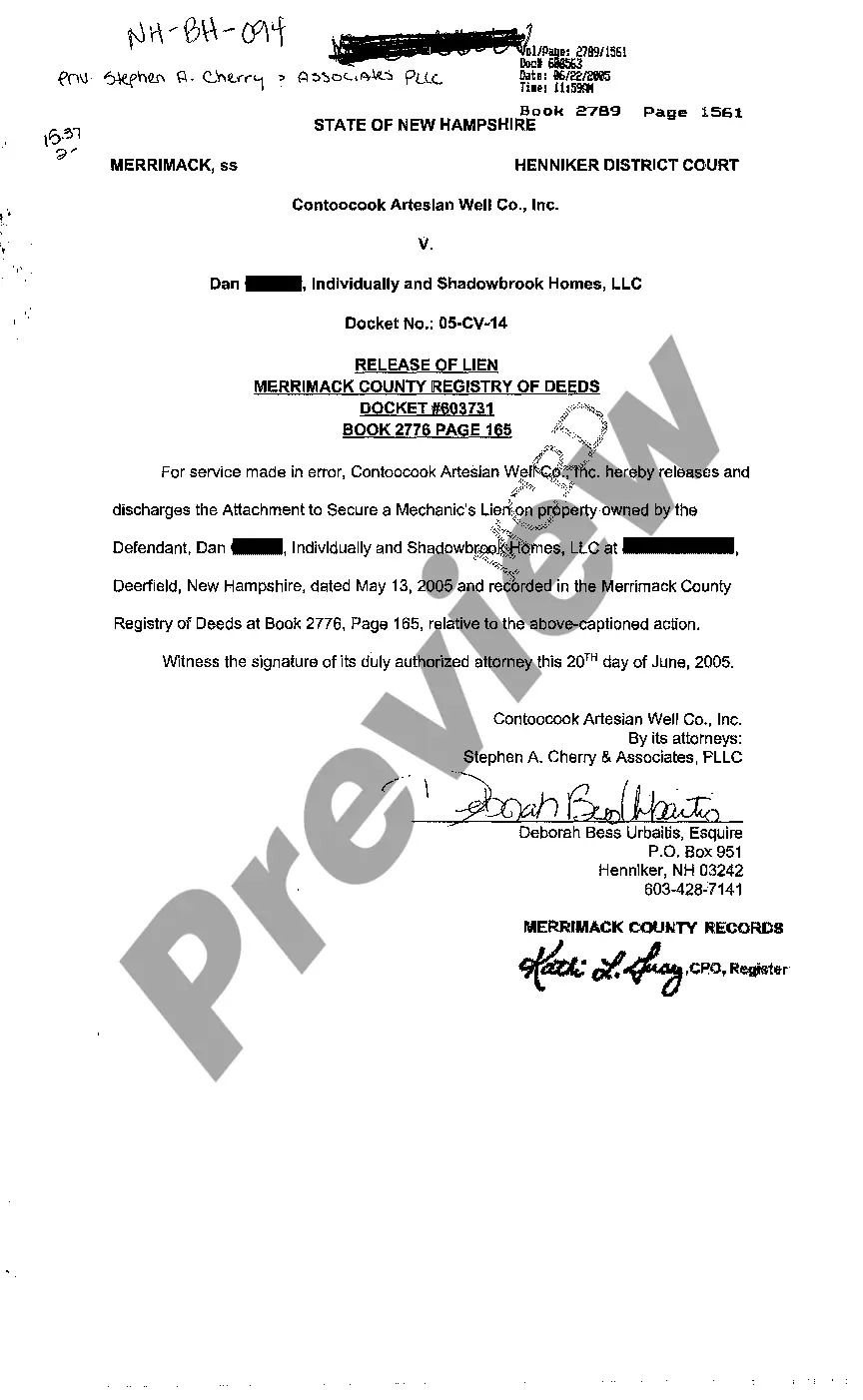

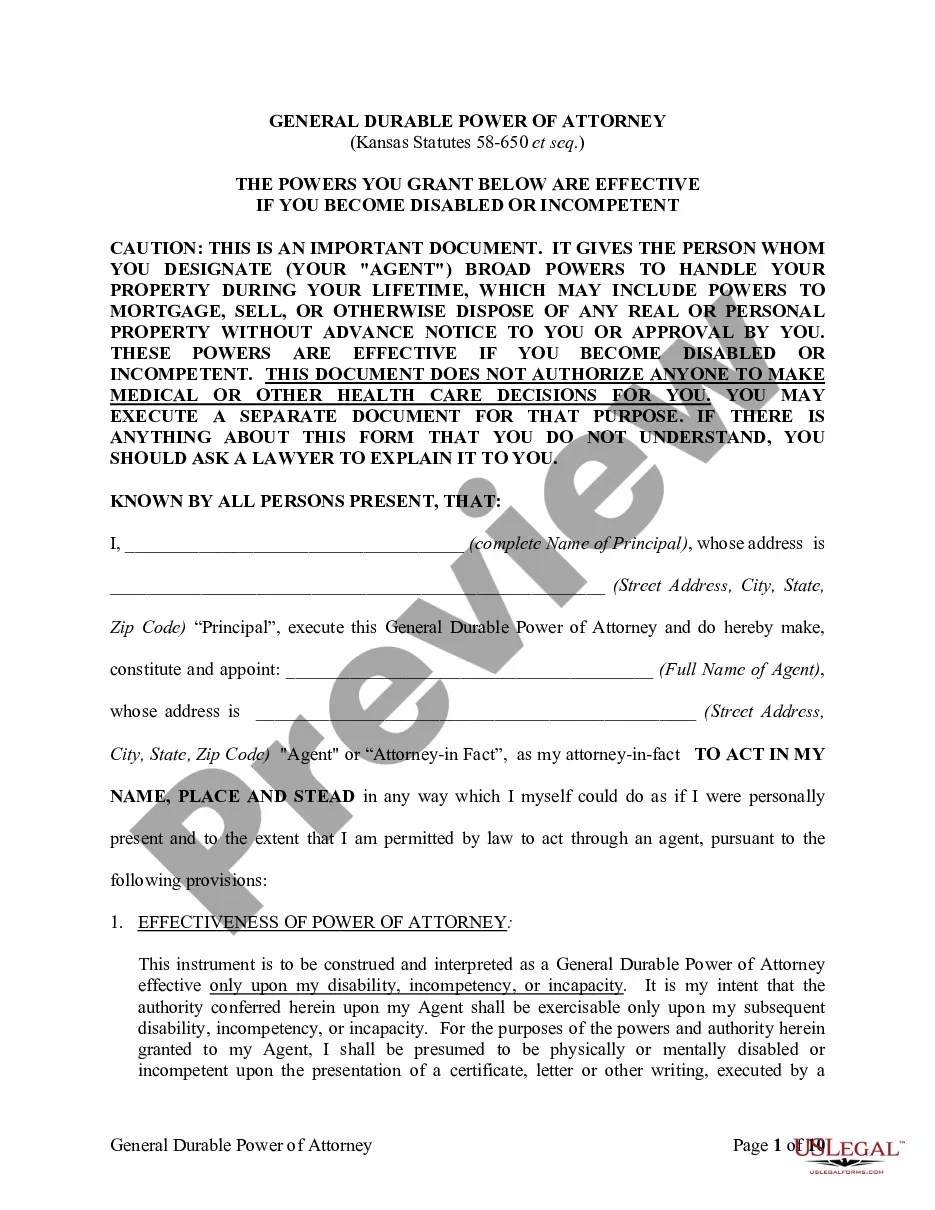

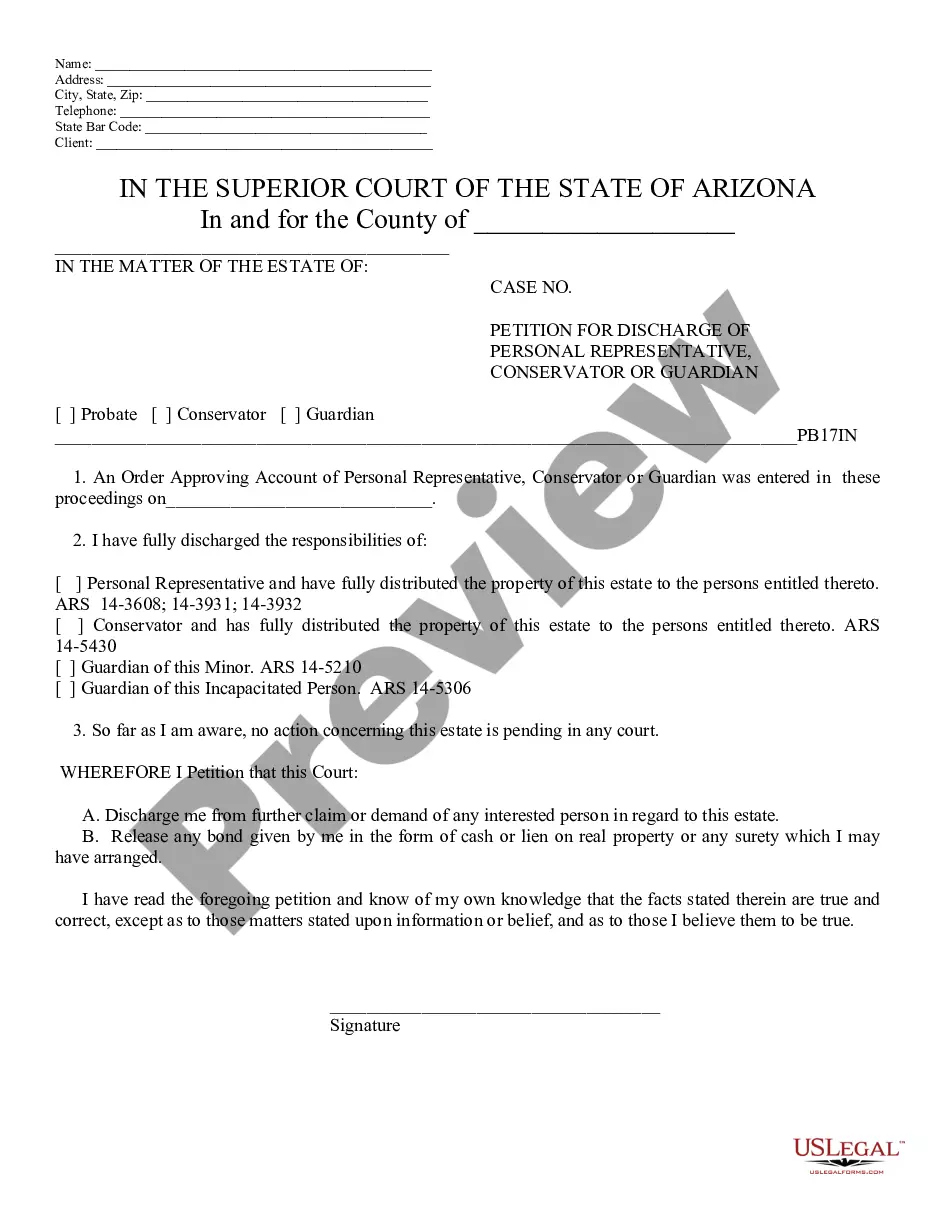

- View the form preview, if there is one, to ensure the template is the one you are interested in.

- Return to the search and locate the proper template if the Wage Earnings Garnishment For Child Support does not suit your needs.

- When you are positive regarding the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the template.

- Pick the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (credit card or PayPal).

- Pick the file format for downloading Wage Earnings Garnishment For Child Support.

- Once you have the form on your gadget, you can modify it using the editor or print it and complete it manually.

Eliminate the inconvenience that accompanies your legal documentation. Check out the extensive US Legal Forms catalog to find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

When wage earnings garnishment for child support occurs, your paystub will reflect a specific deduction labeled as a 'child support garnishment.' This deduction will appear under the section for withholdings or deductions, distinctly showing the amount being taken out. Understanding your paystub helps ensure you know how much is being garnished and why. If you have questions about interpreting your paystub, uslegalforms can provide the necessary information.

Wage earnings garnishment for child support does not directly affect your credit score. However, failing to make payments can lead to other financial consequences that might impact credit. For example, if a court issues a judgment due to non-payment, this may show up on your credit report. To maintain your credit health, it’s crucial to stay current with your child support payments and utilize tools like uslegalforms to manage your finances effectively.

No, an employer cannot ignore a legally issued wage garnishment for child support. They are obligated to comply with the order and deduct the specified amount from your paycheck. If your employer fails to implement the garnishment, you may face serious consequences, including additional legal action. If you need assistance managing a garnishment order, consider using resources from uslegalforms to ensure compliance.

In general, federal law allows for up to 25% of your disposable earnings to be garnished unless specific conditions apply. For child support, this limit can be higher depending on your situation, which underscores the importance of understanding each case’s parameters. If you need assistance with garnishment limits, consider leveraging resources like US Legal Forms to access necessary information.

A garnishment can be deemed invalid for several reasons, including lack of proper court documentation or failure to notify the debtor. If the creditor does not follow legal procedures, the garnishment may not hold up in court. Knowing your rights and how to contest a garnishment can be vital in ensuring that it is lawful.

In Alabama, garnishments must follow specific legal requirements to be valid. Generally, creditors need a court order to initiate garnishment, and the garnishment cannot exceed legal limits based on your disposable income. For issues regarding specific garnishments, the US Legal Forms platform provides useful resources to help guide you through Alabama's rules.

Generally, in Alabama, up to 50% of your disposable income can be garnished for child support if you are supporting another child. If you are not supporting another child, this percentage can increase to 60%. Understanding these percentages is essential, as proper calculations ensure compliance with wage earnings garnishment for child support.

Yes, you can stop a garnishment once it starts in Alabama, but specific conditions apply. You can file a motion in court to challenge the garnishment or settle the underlying debt. Engaging with the right legal resources can help you navigate this process effectively, ensuring that your rights are protected.

The garnishment rule allows creditors to collect debts directly from an individual's earnings. In the context of wage earnings garnishment for child support, this means that a portion of your paycheck can be withheld to ensure that child support obligations are met. This legal process helps secure funds for dependents while providing a structured method for collection.

Stopping wage earnings garnishment for child support generally involves addressing the underlying support order. You may need to file a motion with the court if your financial situation has changed significantly. Working with legal resources, such as UsLegalForms, can provide you the necessary forms and guidance to navigate this process. Remember, acting quickly and informed is key to potentially halting the garnishment.