Trust For Administration

Description

How to fill out Administration Agreement Between EQSF Advisors, Inc. And Third Avenue Trust Regarding Retaining EQSF To Render Administrative Services With Respect To Investment?

Acquiring legal documents that adhere to national and local regulations is crucial, and the web provides a wealth of alternatives to select from.

However, what is the use of squandering time searching for the suitable Trust For Administration template online when the US Legal Forms digital repository already has such documents collected in one location.

US Legal Forms is the most extensive online legal database with more than 85,000 editable documents crafted by lawyers for any professional and personal circumstance. They are straightforward to navigate with all files categorized by state and intended use.

All templates available through US Legal Forms are reusable. To re-download and complete forms you've previously acquired, access the My documents section in your account. Enjoy the most comprehensive and user-friendly legal documentation service!

- Our experts keep up with legislative updates, ensuring that your documents are always current and compliant when you obtain a Trust For Administration from our site.

- Acquiring a Trust For Administration is quick and easy for both existing and new users.

- If you have an account with an active subscription, Log In and download the document template you need in the correct format.

- If you are new to our platform, follow the instructions below.

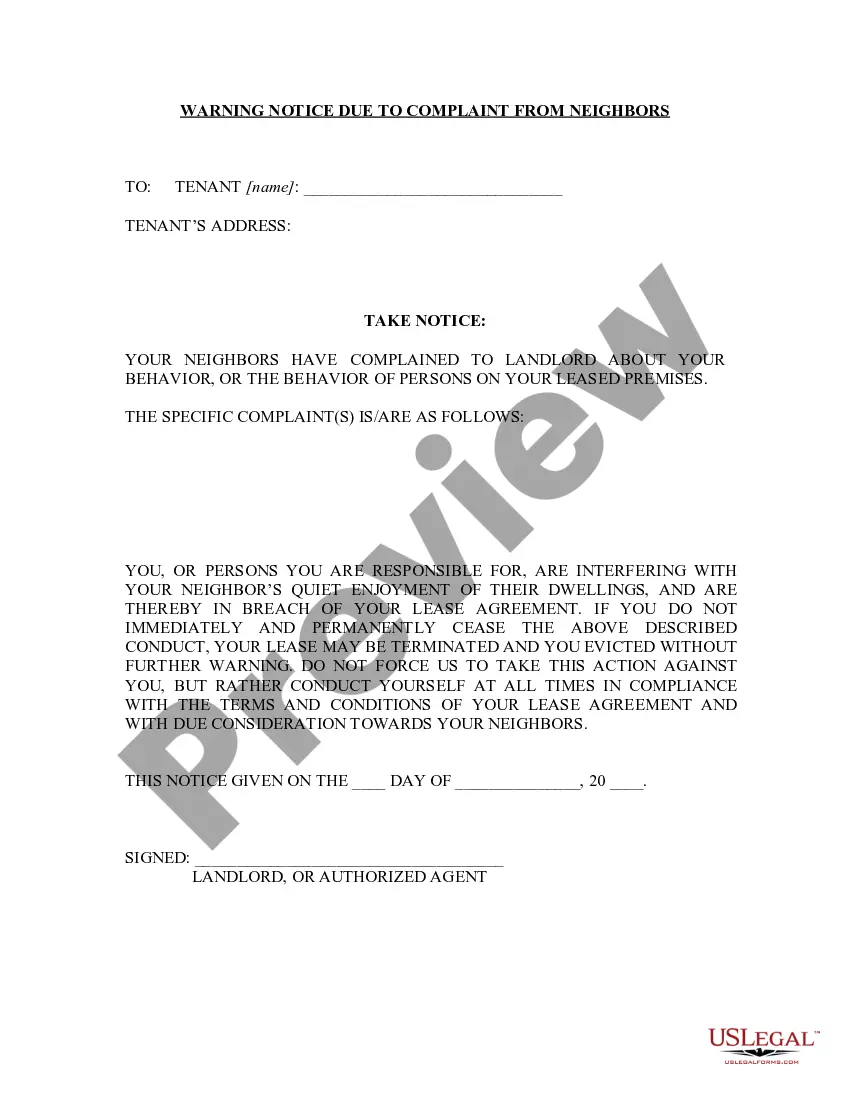

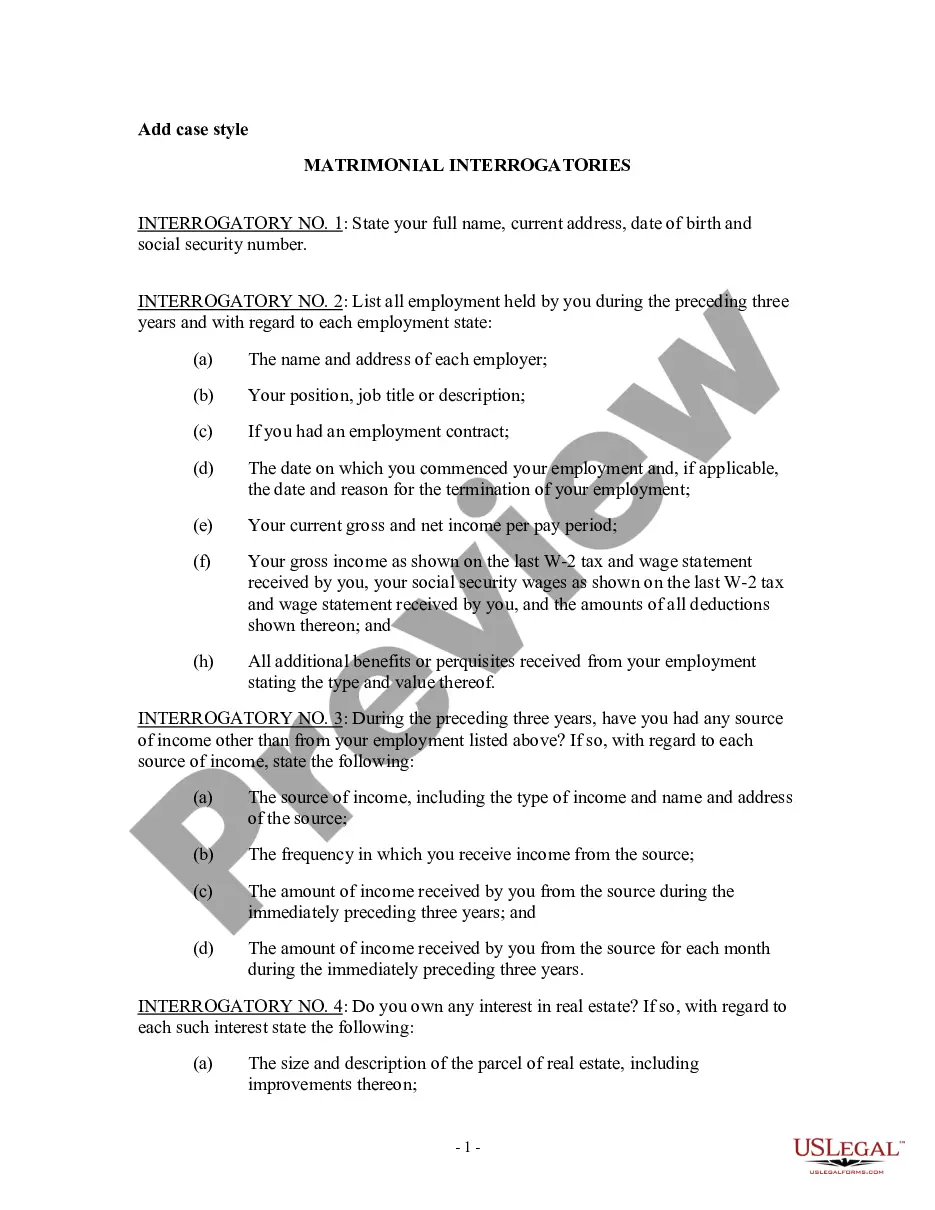

- Review the template using the Preview feature or through the text outline to ensure it suits your needs.

Form popularity

FAQ

The purpose of a trust for administration is to manage and distribute assets according to the wishes of the trust creator. This type of trust ensures that the assets are handled efficiently and that the beneficiaries receive their share without unnecessary delays. By utilizing a trust for administration, you can avoid the probate process, which often takes time and incurs additional costs. Ultimately, this trust offers peace of mind, knowing your estate will be managed according to your desires.

Filling out a trust involves completing essential sections such as the grantor's information, trustee details, and the beneficiaries' names. When preparing a trust for administration, clarity and accuracy are key. You should also specify the assets included in the trust and any specific instructions. Using US Legal Forms can guide you through the process, ensuring you complete the trust accurately and efficiently.

Yes, you can write up a trust yourself. Creating a trust for administration allows you to customize the terms to suit your specific needs. However, it is important to include all required elements to ensure its validity and effectiveness. US Legal Forms provides user-friendly templates that help you draft a comprehensive trust while minimizing the risk of errors.

Yes, a trust can be set up without an attorney. Many people prefer DIY options for trust for administration, particularly when they feel comfortable navigating the necessary paperwork. It is essential to ensure that the trust document complies with state laws and accurately reflects your intentions. Platforms like US Legal Forms offer templates and guidance to help you create a valid trust without legal assistance.

Yes, you can administer a trust without a lawyer. Many individuals choose to manage their own trust for administration, especially when the trust terms are clear and straightforward. However, it is crucial to understand the responsibilities involved in trust administration, including managing assets and ensuring compliance with relevant laws. Utilizing resources like US Legal Forms can help simplify the process and provide the necessary documents for effective administration.

The 5 Steps to Administer a Trust Collect and Review All Documents, Including the Trust Document. The first step is to get a full picture of the assets and wishes of the grantor. ... Custody the Assets. ... Notify Beneficiaries & Creditors. ... Pay Any Debts, Taxes, and Final Expenses. ... Distribute the Assets Per the Trust Document.

It is a widely used method of setting aside assets for beneficiaries. Through trust administration, your assets are managed so that their value is protected and preserved for your intended beneficiaries.

Assets that should not be used to fund your living trust include: Qualified retirement accounts ? 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

For a revocable living trust to take effect, it should be funded by transferring certain assets into the trust. Often people fund a living trust with real estate, financial accounts, life insurance, annuity certificates, personal property, business interests, and other assets.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.