Employee Retirement With Employer Match

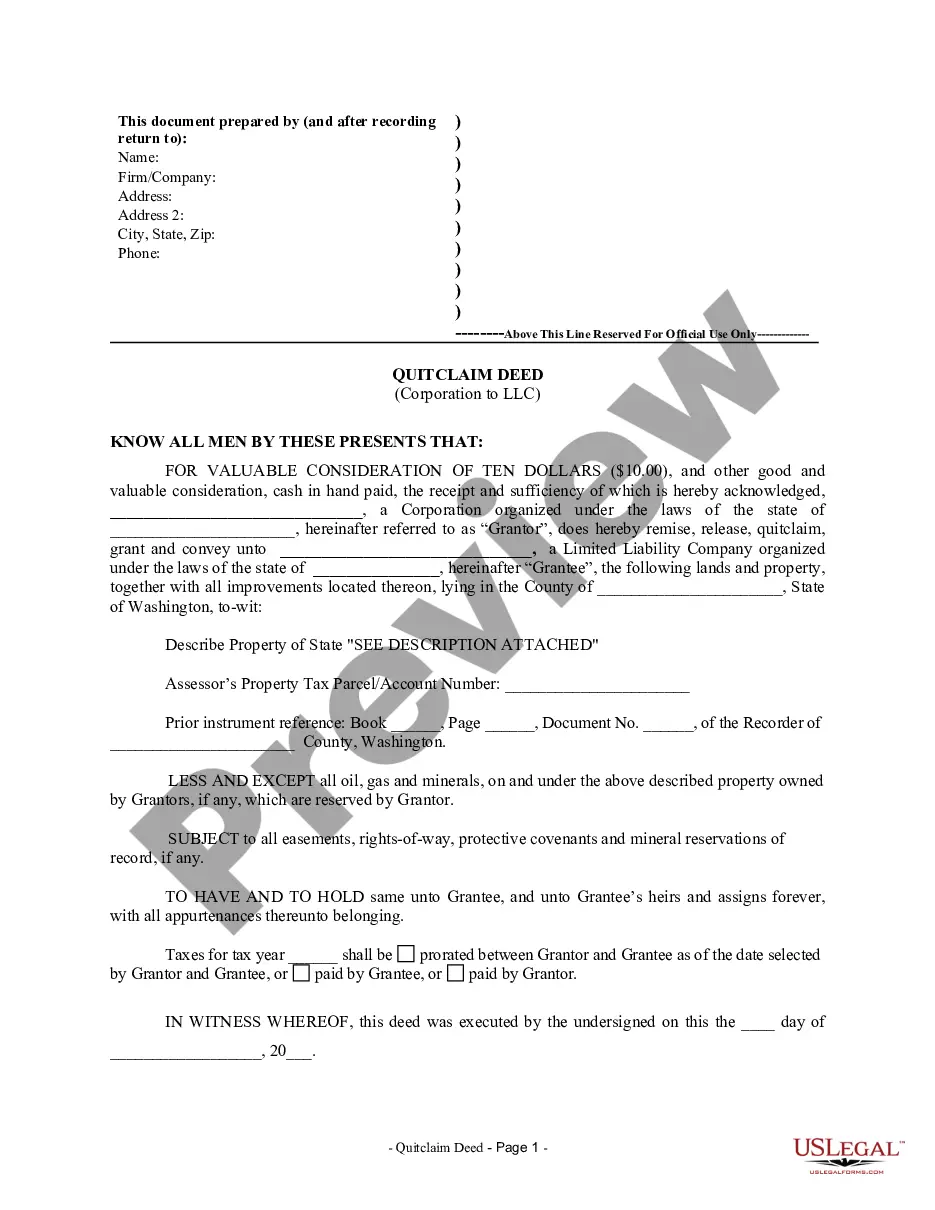

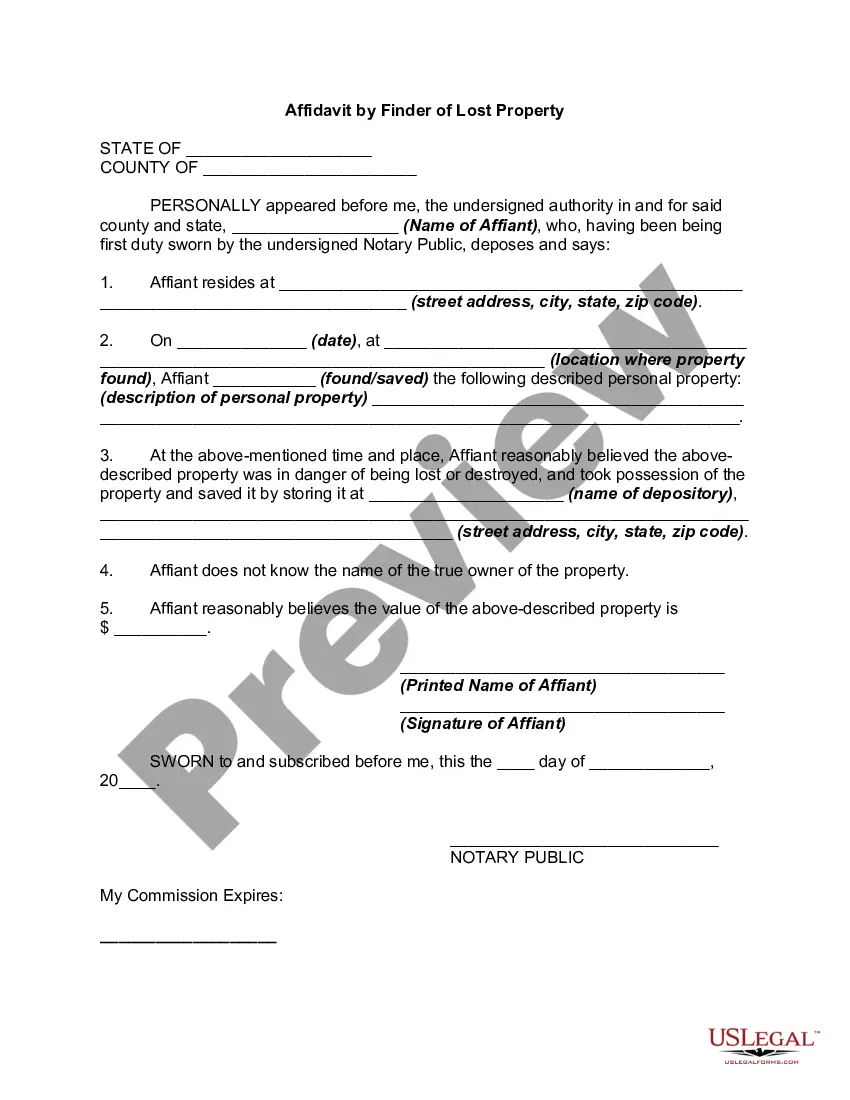

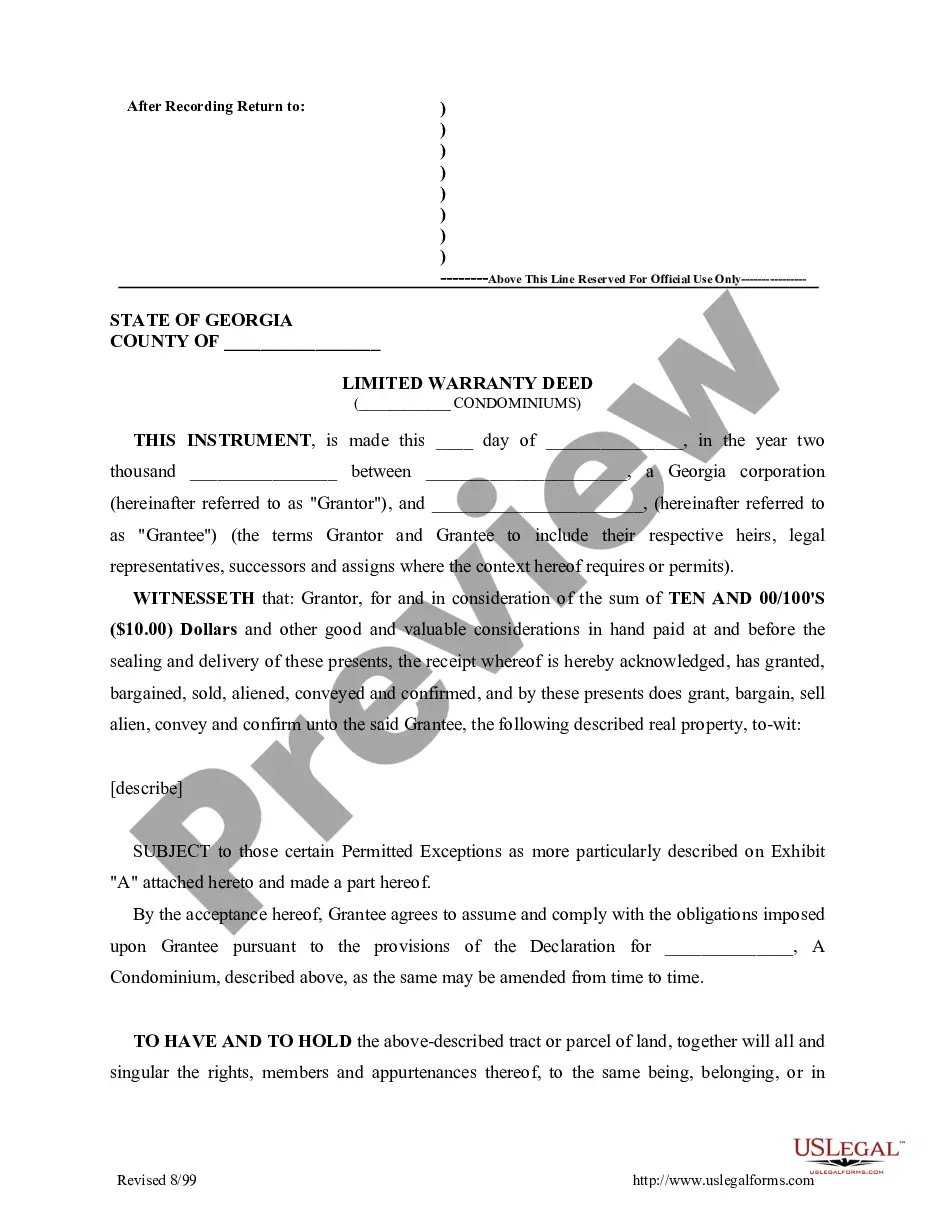

Description

How to fill out Employee Retirement Agreement?

- If you are an existing user, log in to access your account and locate the necessary form template. Ensure your subscription is active; if not, renew it according to your payment plan.

- For new users, begin by exploring the Preview mode and form description. Confirm that the chosen document suits your requirements and meets your state’s legal standards.

- If you require a different template, utilize the Search tab to find suitable options. Proceed only when you find the correct form.

- Purchase your selected document by clicking the Buy Now button and choose your preferred subscription plan. Registration for an account is necessary to unlock the library resources.

- Complete your purchase by providing payment details via credit card or PayPal.

- Download the form to your device, and you can also find it later in your My Forms section.

In conclusion, US Legal Forms empowers users to quickly and effectively manage their retirement paperwork with a large collection of legal documents. With access to expert assistance, you can ensure your forms are filled correctly and remain compliant.

Get started today and take the first step toward securing your financial future!

Form popularity

FAQ

The employer match for retirement accounts varies by company, but it generally falls between 3% to 6% of your salary. This is an incentive for employees to save more for their retirement. By understanding and making the most of the employee retirement with employer match programs, you can greatly enhance your long-term financial outlook.

A 6% 401k match means that your employer will contribute an amount equal to 6% of your salary when you contribute to your retirement plan. This matching contribution significantly boosts your retirement savings over time, allowing you to maximize your employee retirement with employer match benefits. Always be sure to take full advantage of this generous offer.

No, the employer 401k match does not count as taxable income until you withdraw it in retirement. This allows you to grow your retirement savings without immediate tax implications. Thus, the employee retirement with employer match option is an effective means of enhancing your long-term financial security.

Yes, a 3% retirement match is generally considered good, as it is on the lower end of the typical matching scale. While it may not be the highest match available, this contribution still helps you accumulate savings over time. When coupled with your own contributions, a solid strategy for employee retirement with employer match can lead to substantial long-term benefits.

A 401k match is typically a pre-tax contribution made by your employer. This means that these contributions occur before taxes are applied, allowing your retirement savings to grow tax-deferred until withdrawal. Utilizing the employee retirement with employer match strategy benefits you by maximizing your tax efficiency.

Yes, employer 401k match contributions are reported on your W-2 form. They will be listed in the box labeled 'pensions and annuities,' providing a clear record of your employer contributions. This transparency supports your understanding of the full benefits of your employee retirement with employer match.

The IRS retirement limit does not include employer contributions when calculating your individual contribution limits. For tax year 2023, you can contribute up to $22,500 to your 401k, while any employer match is in addition to this limit. This makes the employee retirement with employer match option quite valuable, as it allows you to save even more for your future.

No, you do not need to include employer 401k contributions on your tax return. These contributions are made on your behalf and are not considered taxable income. Thus, your employee retirement with employer match remains a beneficial way to save without affecting your current tax obligations.

Companies typically match retirement contributions anywhere from 3% to 6% of an employee's salary. However, some companies may offer a matching contribution up to a specific limit, often depending on their policies. Understanding your company's matching offer can help you maximize your employee retirement with employer match benefits effectively.

Yes, contributing to a 401k can reduce your taxable income for the year. This is because your contributions are made with pre-tax dollars, lowering your overall income tax bill. Consequently, this can enhance your employee retirement with employer match strategy, allowing you to save both for retirement and on taxes.