Employee Retention

Description

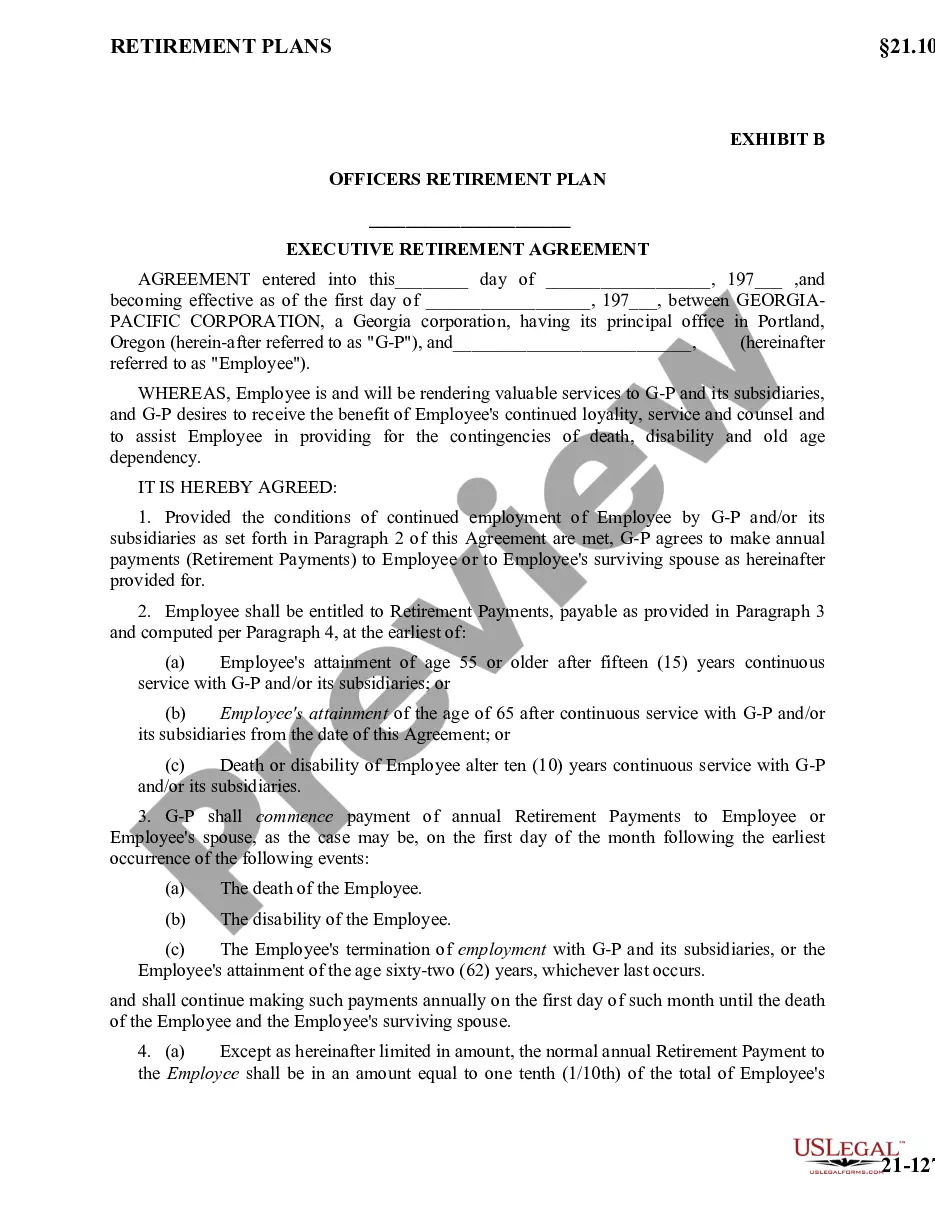

How to fill out Employee Retirement Agreement?

- Log in to your US Legal Forms account using your credentials. Ensure your subscription is active; renew it as needed to maintain access.

- Browse the extensive library of over 85,000 templates. Check the Preview mode to find the document that aligns with your requirements and complies with local laws.

- If the initial template doesn't suit your needs, utilize the Search tab to find the correct one for your situation. Select the appropriate document to proceed.

- Purchase the selected document by clicking 'Buy Now' and picking your preferred subscription. You'll need to create an account for full access.

- Complete your payment with your credit card or PayPal. Ensure the transaction is successful to gain access to the resources.

- Download your legal form for future use. You can find it in the 'My Forms' section of your profile, allowing you quick access whenever necessary.

By following these steps, you can streamline the process of obtaining legal documents that will aid in employee retention efforts. US Legal Forms simplifies this task, giving you peace of mind and keeping your legal work organized.

Start using US Legal Forms today to enhance your document management and contribute to effective employee retention.

Form popularity

FAQ

To put Employee Retention Credit on your tax return, you need to complete Form 941 and indicate the credit on the appropriate line. Ensure that all calculations are accurate and reflect your eligible payroll expenses. If you're unsure about this process, consider using resources from US Legal Forms to help you complete your returns correctly.

Yes, you can file the Employee Retention Credit yourself, but it's recommended to have a clear understanding of the eligibility criteria and documentation required. Many business owners find navigating the process complex, and platforms like US Legal Forms can provide guidance and templates to ease your filing experience.

Common red flags for Employee Retention Credit claims include discrepancies in employee counts, businesses that have dramatically altered operations without documentation, or inconsistent payroll records. Being aware of these pitfalls can help you avoid potential audits and make your claiming process smoother.

To report Employee Retention Credit, you need to file IRS Form 941, Employer's Quarterly Federal Tax Return. This form allows you to claim the ERC and reduce your tax liability accordingly. Be sure to retain all supporting documentation for your records, as this is crucial during IRS audits.

To qualify for the Employee Retention Credit (ERC), a business must either experience a significant decline in gross receipts or be fully or partially suspended due to government orders related to COVID-19. It's essential to keep accurate records and provide necessary documentation to claim this credit effectively.

Yes, there is a worksheet available for the Employee Retention Credit (ERC). This worksheet helps you calculate eligibility and potential credits for your business. By using our resources, you can streamline the process and ensure you capture all necessary information. This approach not only supports compliance but also enhances your overall employee retention strategy.

The 3 R's of HR stand for recruitment, retention, and relationship management. Effective recruitment strategies ensure you hire the right people from the start. Focusing on retention helps you maintain a stable workforce, which is essential for growth. Relationship management enhances employee satisfaction and loyalty, both of which are vital for boosting employee retention within your organization.

The three most important factors for employee retention are job satisfaction, employee engagement, and clear communication. When employees find their work fulfilling, they are far less likely to leave. Engagement initiatives, such as team-building events, can create a sense of belonging. Lastly, maintaining open lines of communication strengthens relationships and helps address concerns early, thus supporting employee retention.

To achieve good employee retention, focus on building strong relationships and fostering an inclusive atmosphere. Regular feedback and recognition from management play crucial roles in making employees feel valued. Additionally, providing ongoing training and development opportunities not only aids personal growth but also boosts overall satisfaction, leading to improved employee retention.

The $26,000 employee retention credit is a tax incentive designed to encourage businesses to keep employees on payroll during challenging times. This refundable tax credit significantly reduces the financial burden for businesses, allowing them to invest in their workforce. Utilizing the Employee Retention Credit can enhance your employee retention strategy by enabling you to allocate resources more effectively.