Agreement Between Form With Guarantor

Description

How to fill out Agreement Between Form With Guarantor?

There's no longer a requirement to squander time searching for legal documents to fulfill your local state obligations.

US Legal Forms has consolidated all of them in one location and enhanced their accessibility.

Our platform provides over 85,000 templates for any business and personal legal matters categorized by state and purpose.

Utilize the Search bar above to look for another sample if the current one doesn't fit your needs.

- All forms are expertly drafted and authenticated for legitimacy, allowing you to be assured in securing a current Agreement Between Form With Guarantor.

- If you are acquainted with our service and already possess an account, you must verify that your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all stored documents at any time by accessing the My documents tab in your profile.

- If you are new to our service, the process will require a few additional steps to complete.

- Here’s how new users can acquire the Agreement Between Form With Guarantor from our collection.

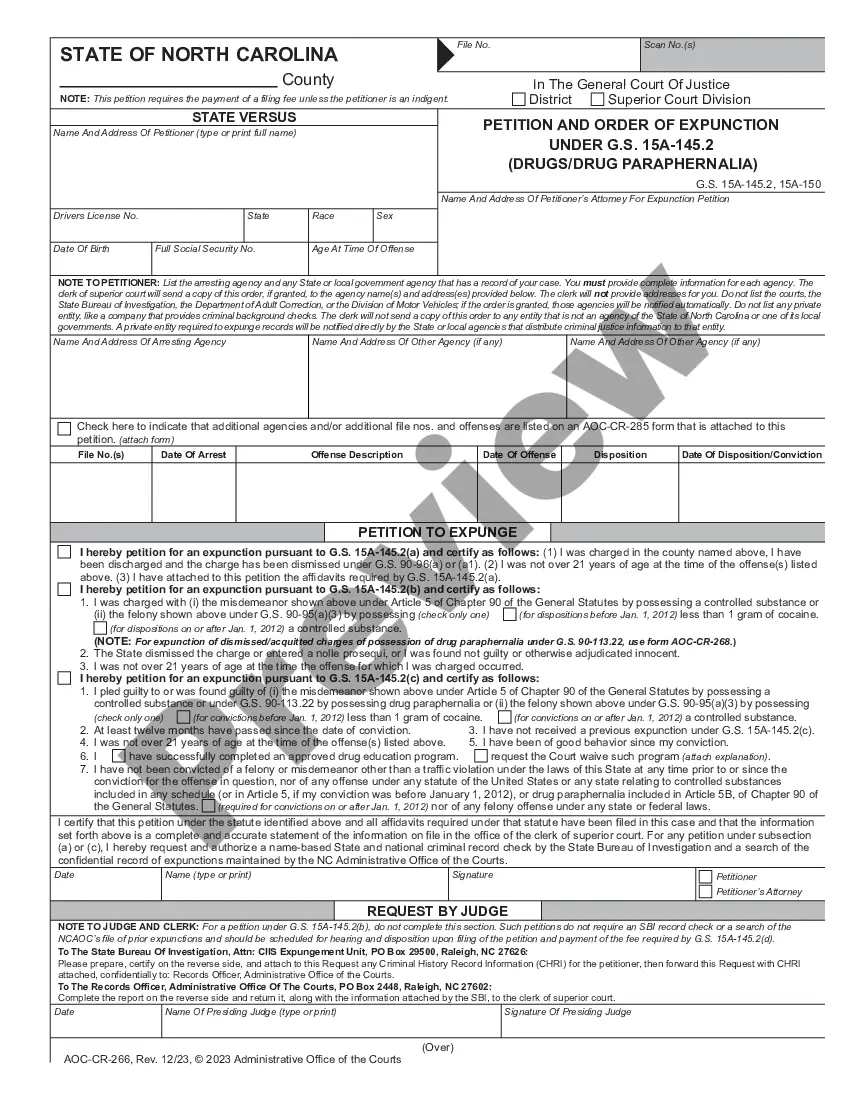

- Review the page content thoroughly to ensure it includes the sample you need.

- To assist, utilize the form description and preview options if available.

Form popularity

FAQ

A guarantor letter is a legally binding document that commits a third-party cosigner to pay a future debt in case a person applying for credit defaults. The cosigner adds his creditworthiness and credentials to the transaction, buttressing the applicant's position so the transaction can be completed.

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.

A guarantor is someone who agrees to take financial responsibility for another person. People who are young or have bad credit will often need a guarantor for things like loans and rental agreements. In order to be a guarantor, it is likely that you will be asked to fill out a guarantor form.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

To write a guarantor letter, start by writing the date at the top of the paper, followed by your full name and address. Below your information, address the letter to the company you're dealing with and begin the letter by identifying yourself and the person you're guaranteeing.