Sale Of Partnership Interest Example

Description

How to fill out Sample Partnership Interest Purchase Agreement Between Franklin Covey Company, Daytracker.com, Et Al?

Handling legal documents and operations might be a time-consuming addition to your entire day. Sale Of Partnership Interest Example and forms like it typically require that you search for them and navigate the best way to complete them effectively. For that reason, regardless if you are taking care of financial, legal, or individual matters, having a thorough and hassle-free web library of forms on hand will significantly help.

US Legal Forms is the top web platform of legal templates, boasting over 85,000 state-specific forms and numerous resources to assist you complete your documents effortlessly. Explore the library of pertinent documents open to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Protect your papers managing operations with a top-notch services that lets you make any form within a few minutes without any extra or hidden cost. Simply log in to the account, find Sale Of Partnership Interest Example and download it right away from the My Forms tab. You may also access formerly saved forms.

Would it be your first time utilizing US Legal Forms? Register and set up up a free account in a few minutes and you’ll gain access to the form library and Sale Of Partnership Interest Example. Then, stick to the steps below to complete your form:

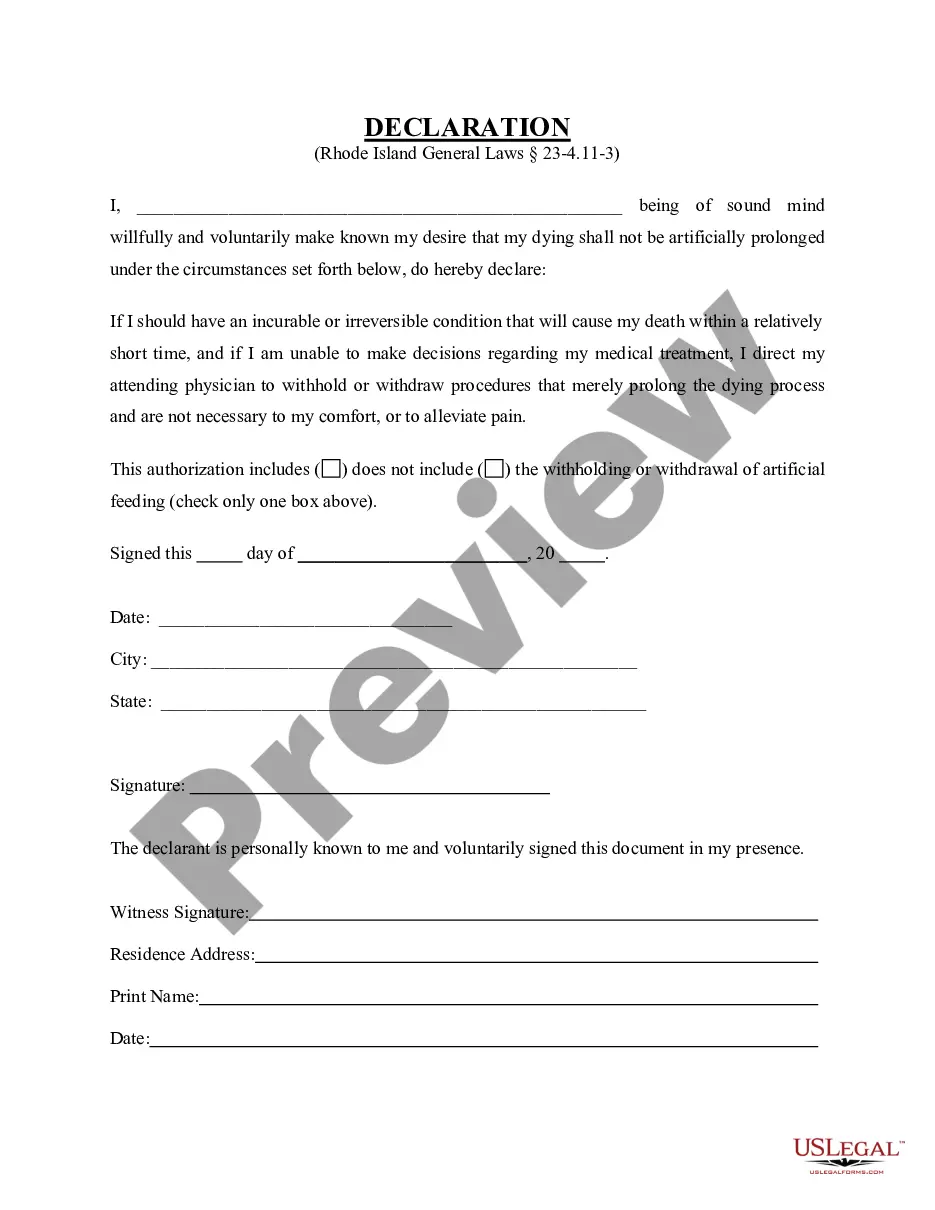

- Ensure you have discovered the correct form by using the Preview feature and looking at the form description.

- Choose Buy Now when all set, and choose the monthly subscription plan that suits you.

- Choose Download then complete, sign, and print the form.

US Legal Forms has 25 years of experience helping users control their legal documents. Discover the form you want right now and improve any operation without having to break a sweat.

Form popularity

FAQ

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

Sale of a partnership interest generally gives the selling partner capital gain. Section 751, however, recharacterizes a portion of the amount realized as ordinary income to the partner, at times even in the absence of realized gain.

To enter a portion of the gain from the sale of a partnership interest, as ordinary income and capital gain, on Form 4797, Sales of Business Property, Part II, Line 10, the sale will need to be entered as two transactions in Screen 17, Dispositions.

Partnerships are generally guided by a partnership agreement, which may allow or restrict transfers of partnership interest. Partners must follow the terms of the agreement. If the agreement allows it, a partner can transfer ownership stakes in terms of profits, voting rights and responsibilities.

A sale of a partnership interest occurs when one partner sells their ownership interest to another person or entity. The partnership is generally not involved in the transaction. However, the buyer and seller will notify the partnership of the transaction.