Letter Credit Sample With Thru

Description

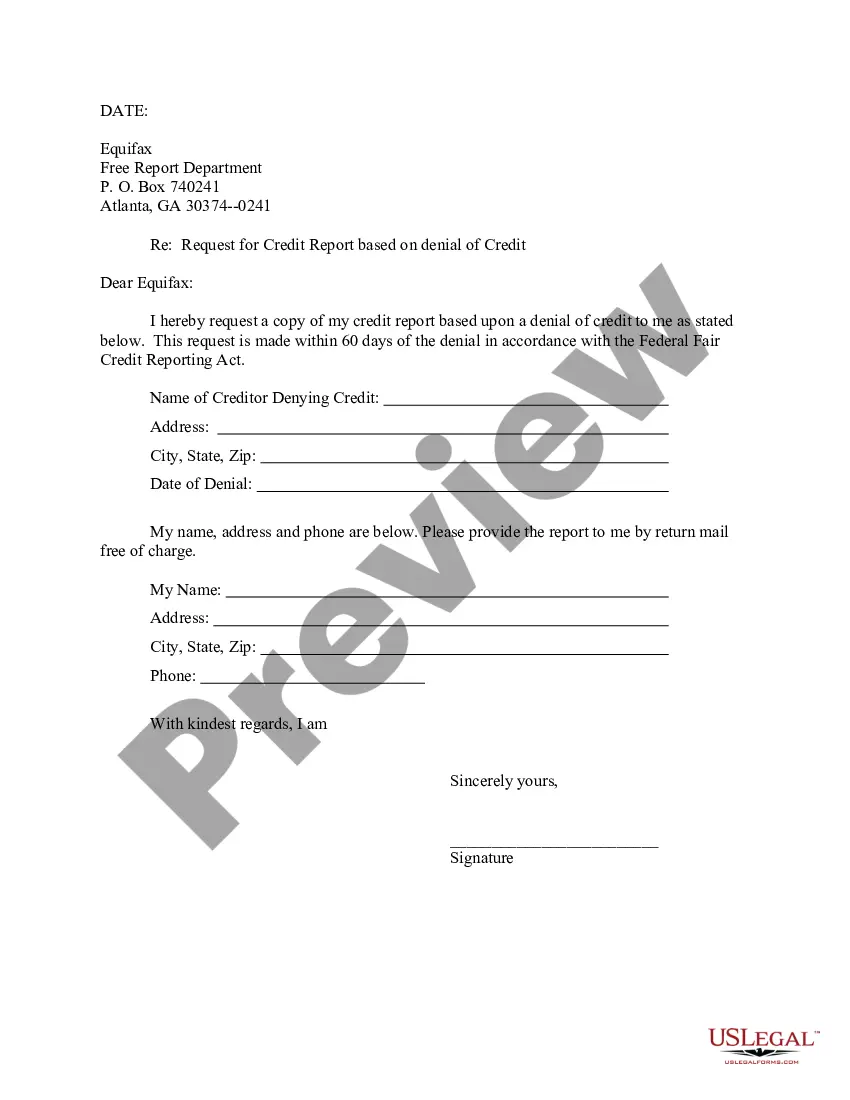

How to fill out Letter To Equifax Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

Legal papers managing might be mind-boggling, even for knowledgeable experts. When you are interested in a Letter Credit Sample With Thru and don’t have the a chance to spend searching for the correct and updated version, the operations might be stressful. A strong web form library might be a gamechanger for anybody who wants to deal with these situations successfully. US Legal Forms is a industry leader in web legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you may:

- Access state- or county-specific legal and business forms. US Legal Forms handles any demands you may have, from personal to business documents, all in one place.

- Employ innovative tools to finish and manage your Letter Credit Sample With Thru

- Access a useful resource base of articles, guides and handbooks and resources connected to your situation and needs

Help save time and effort searching for the documents you need, and make use of US Legal Forms’ advanced search and Review feature to get Letter Credit Sample With Thru and get it. In case you have a monthly subscription, log in in your US Legal Forms account, look for the form, and get it. Review your My Forms tab to see the documents you previously downloaded and to manage your folders as you see fit.

Should it be the first time with US Legal Forms, register a free account and obtain limitless access to all advantages of the library. Listed below are the steps for taking after accessing the form you want:

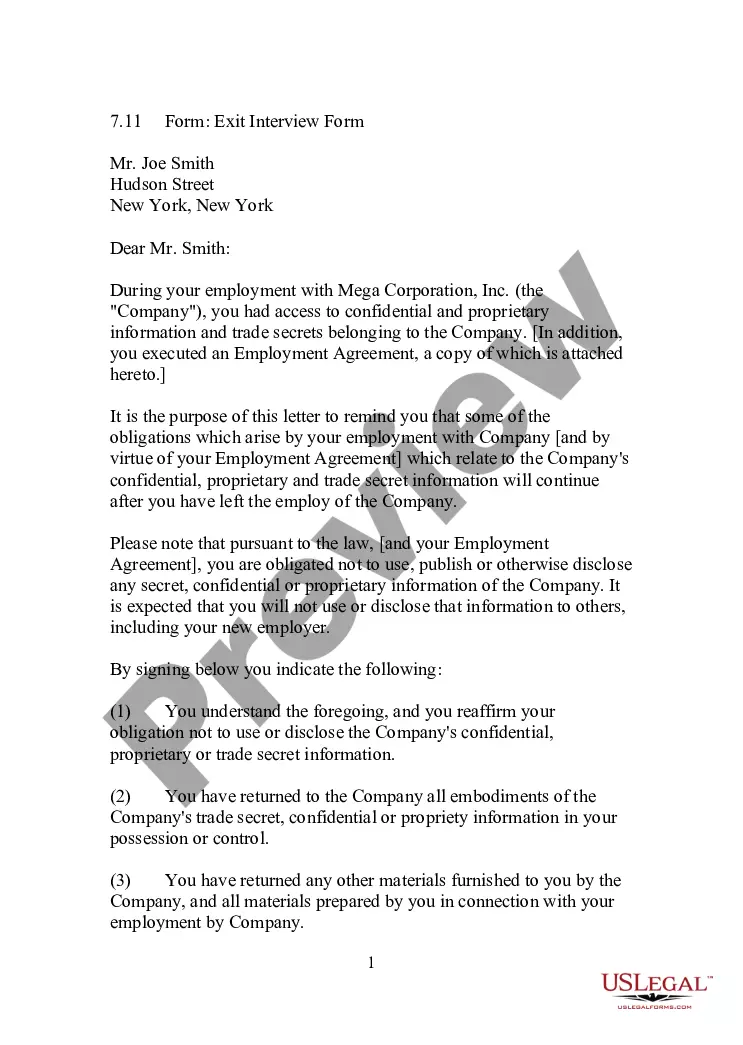

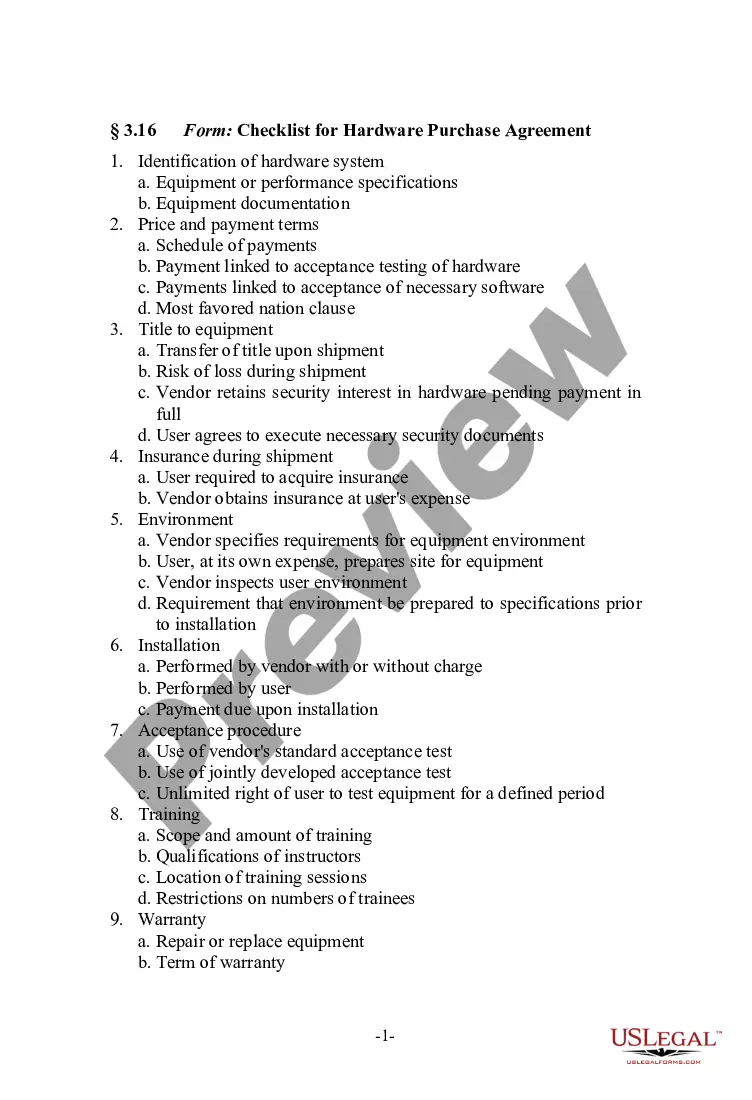

- Confirm it is the proper form by previewing it and looking at its information.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now when you are all set.

- Choose a monthly subscription plan.

- Pick the format you want, and Download, complete, sign, print out and send out your document.

Enjoy the US Legal Forms web library, supported with 25 years of experience and reliability. Enhance your day-to-day document management into a smooth and easy-to-use process today.

Form popularity

FAQ

Pursuant to the request of our customer, ___________________________________________________________ we, (Bank) ___________________________________________________ hereby establish and give to you an irrevocable Letter of Credit in your favour in the total amount of $ _____________ which may be drawn on by you at any ...

The basic letter of credit procedure: Purchase and sales agreement. The buyer and the seller draw up a purchase and sales agreement. ... Buyer applies for letter of credit. ... Issue letter of credit. ... Advise letter of credit. ... Prepare shipment. ... Present documents. ... Payment. ... Document transfer.

Types of letters of credit include commercial letters of credit, standby letters of credit, and revocable letters of credit. Other types of letters of credit are irrevocable letters of credit, revolving letters of credit, and red clause letters of credit.

Send a Dispute Letter to Your Card Company your name and account number. the dollar amount of the disputed charge. the date of the disputed charge. an explanation of why you think the charge is incorrect.

Information to include in your dispute letter Full name. Date of birth. Current address. Driver's license number. Social Security number (optional). The account number of the tradeline you're disputing (e.g., account number found on your utility bill, student loan bill or mortgage statement).