Claim Construction On Taxes

Description

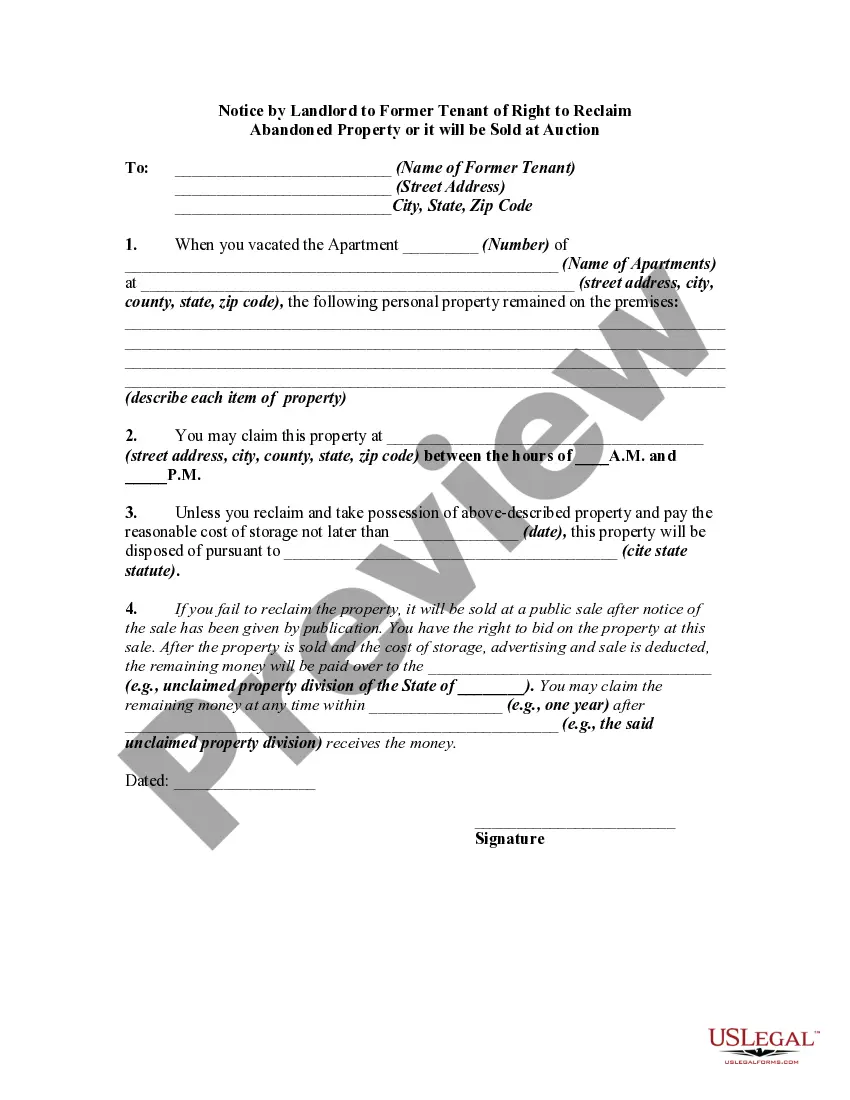

How to fill out Bond Claim Notice?

Identifying a reliable location to obtain the latest and pertinent legal templates is part of the challenge when dealing with bureaucracy.

Selecting the appropriate legal documents requires accuracy and focus, which is why it's essential to acquire samples of Claim Construction On Taxes solely from trustworthy sources, such as US Legal Forms.

Once you have the form saved on your device, you can edit it using an editor or print it out and fill it in manually. Alleviate the stress associated with your legal documents. Explore the vast US Legal Forms library to discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Review the form’s details to confirm if it aligns with the criteria of your state and county.

- Preview the form, if available, to verify it is what you are looking for.

- Continue searching and locate the appropriate document if the Claim Construction On Taxes does not meet your expectations.

- When you are confident about the form’s suitability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you haven't created an account, click Buy now to acquire the form.

- Choose the pricing option that best suits your requirements.

- Proceed with the registration to complete your order.

- Conclude your transaction by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Claim Construction On Taxes.

Form popularity

FAQ

The new $6000 tax deduction allows individuals to deduct eligible expenses directly from their taxable income. This deduction is particularly beneficial for those who may not itemize their deductions, as it simplifies the filing process. Understanding the claim construction on taxes is essential, as it ensures you maximize your savings while staying compliant. By leveraging tools like US Legal Forms, you can easily navigate the necessary forms and ensure you correctly apply this deduction.

You can typically claim building materials as a tax-deductible expense when they are used for business purposes. This is important for your claim construction on taxes, as these costs can accumulate significantly. It's beneficial to keep all receipts and documentation related to these materials. Platforms like uslegalforms can assist you in understanding how to properly claim these expenses.

Yes, many construction expenses are tax deductible, which can significantly lower your taxable income. This includes costs for materials, labor, and other project-related expenses. When you know what to include, it streamlines your claim construction on taxes. To ensure you're maximizing your deductions, consider using uslegalforms for guidance.

Expenses that are 100% tax-deductible often include certain business-related entertainment and travel costs. Additionally, some educational expenses may qualify as well. Understanding these deductions is crucial for effective claim construction on taxes. For clarity, check resources available through uslegalforms, which can help you identify eligible expenses.

Common tax mistakes include failing to keep proper records, underreporting income, and not claiming all eligible deductions. These errors can negatively impact your claim construction on taxes, leading to potential audits or penalties. To avoid these pitfalls, stay organized and informed about tax laws. Utilizing resources from uslegalforms can help you navigate these challenges.

Certain expenses, such as business meals, office supplies, and specific travel costs, may be 100% tax-deductible. These deductions can lead to significant savings and simplify your claim construction on taxes. It's essential to keep detailed records of these expenses to support your claims. Consider consulting uslegalforms for a clear understanding of what qualifies.

Deductible construction expenses include costs related to labor, materials, and equipment needed for a project. Additionally, expenses for permits, inspections, and contractor fees can often be claimed. Knowing what qualifies as deductible helps when you make your claim construction on taxes. Using platforms like uslegalforms can provide guidance on what expenses you can include.

The $2500 expense rule allows businesses to deduct expenses for items costing less than $2,500 each in the year they are purchased. This rule simplifies the process of claim construction on taxes, as it eliminates the need to capitalize and depreciate smaller expenses. Understanding this rule can help you maximize your deductions efficiently. Always consult a tax professional to ensure compliance with IRS regulations.

Deciding whether to claim yourself or 0 on your taxes can influence your overall tax liability. Claiming yourself typically results in a higher personal exemption, which can lower your taxable income. However, if you're unsure, utilizing resources from US Legal Forms can clarify the best approach based on your situation. This way, you can make an informed decision about how to claim construction on taxes and optimize your financial outcome.

Yes, you can claim construction costs on your taxes, provided they meet the necessary criteria. If the construction improves or adds value to your property, you may qualify for deductions. Keep thorough records of all expenses and consult resources from US Legal Forms for guidance on specific forms and requirements. This ensures you accurately claim construction on taxes and take advantage of available benefits.