Bond Claim Sample Format

Description

How to fill out Bond Claim Notice?

It’s clear that you cannot become a legal authority instantly, nor can you quickly learn to prepare a Bond Claim Sample Format without possessing a specific skill set.

Drafting legal documents is a lengthy undertaking that necessitates particular training and abilities. So why not entrust the creation of the Bond Claim Sample Format to the experts.

With US Legal Forms, one of the largest libraries of legal documents, you can find everything from court forms to templates for internal business communication. We recognize the significance of compliance with federal and state laws and regulations.

Create a free account and select a subscription plan to purchase the form.

Click Buy now. Once your payment is processed, you can download the Bond Claim Sample Format, complete it, print it, and send or mail it to the appropriate individuals or entities.

- That’s why, on our site, all templates are specific to locations and current.

- Let’s begin with our platform and obtain the form you require in just a few minutes.

- Search for the document you need using the search bar at the top of the page.

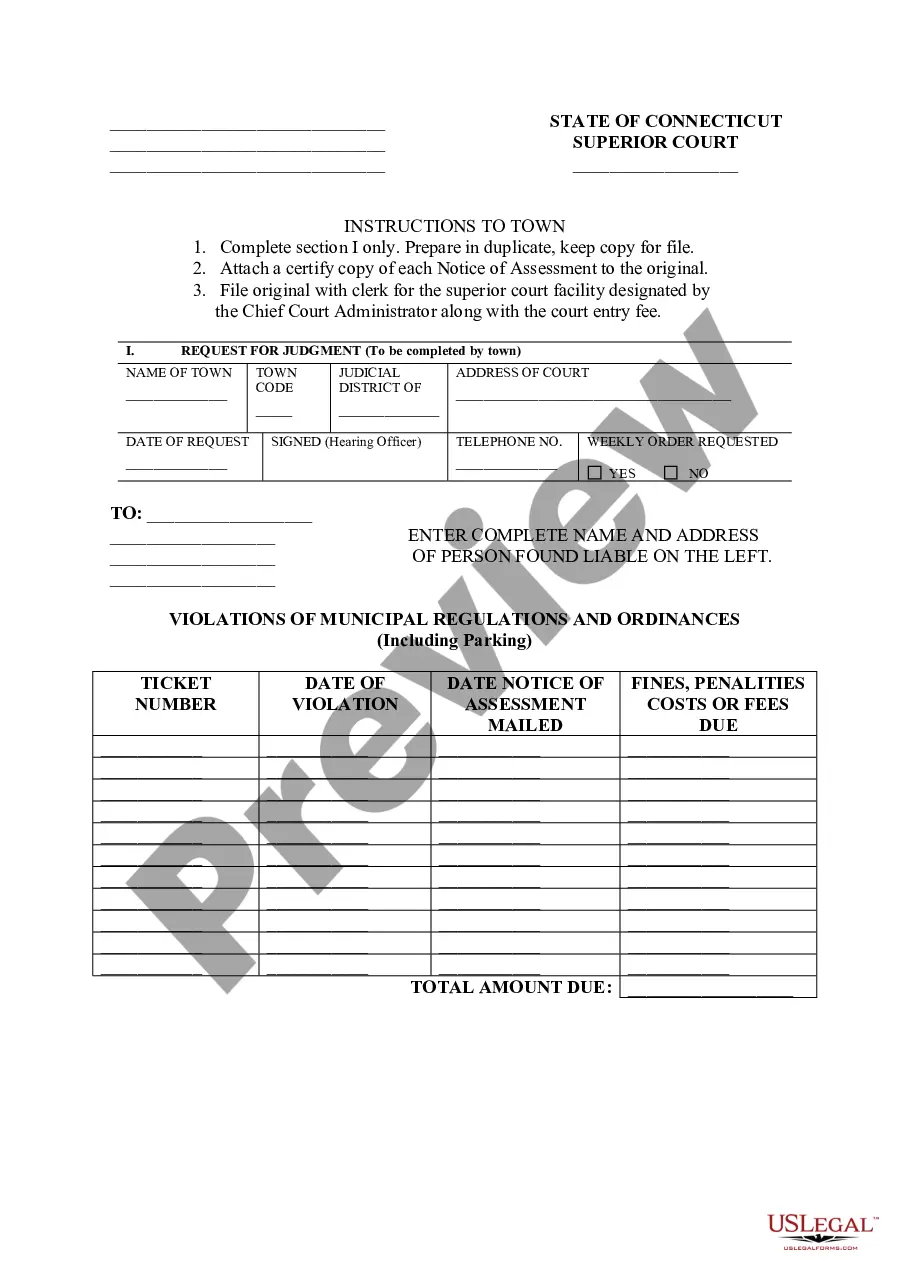

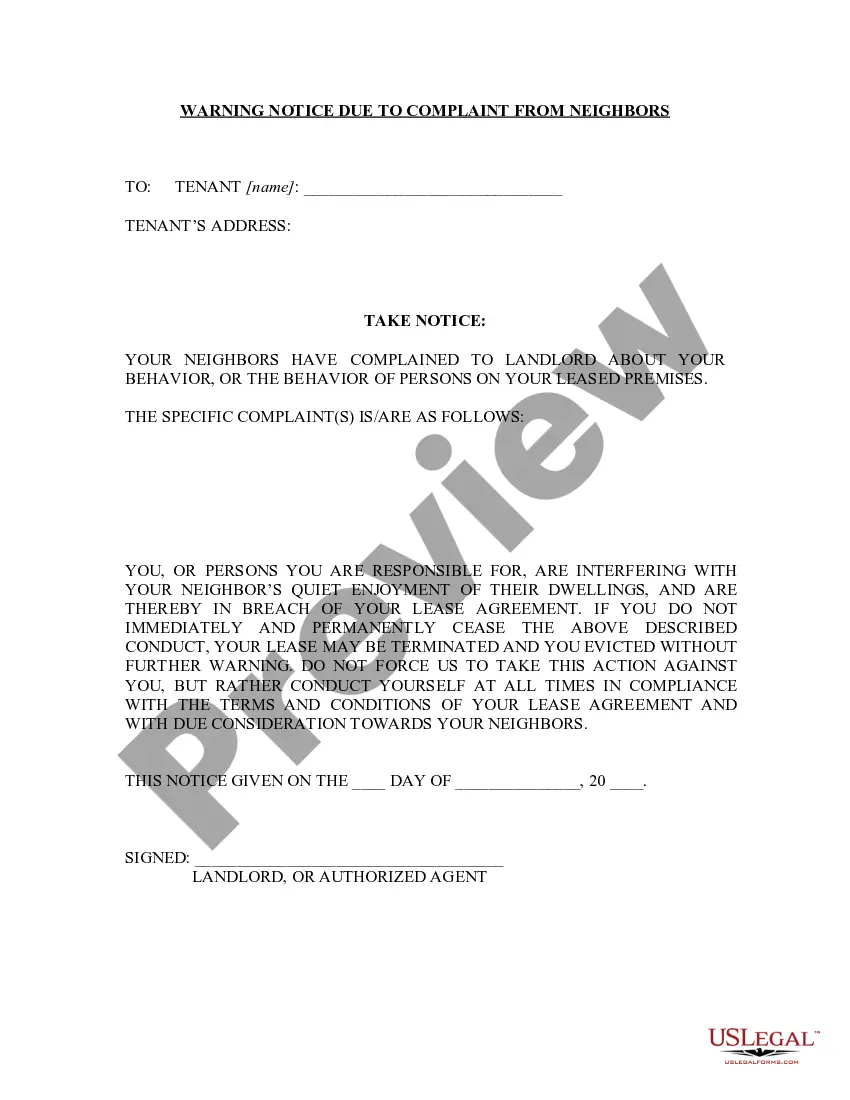

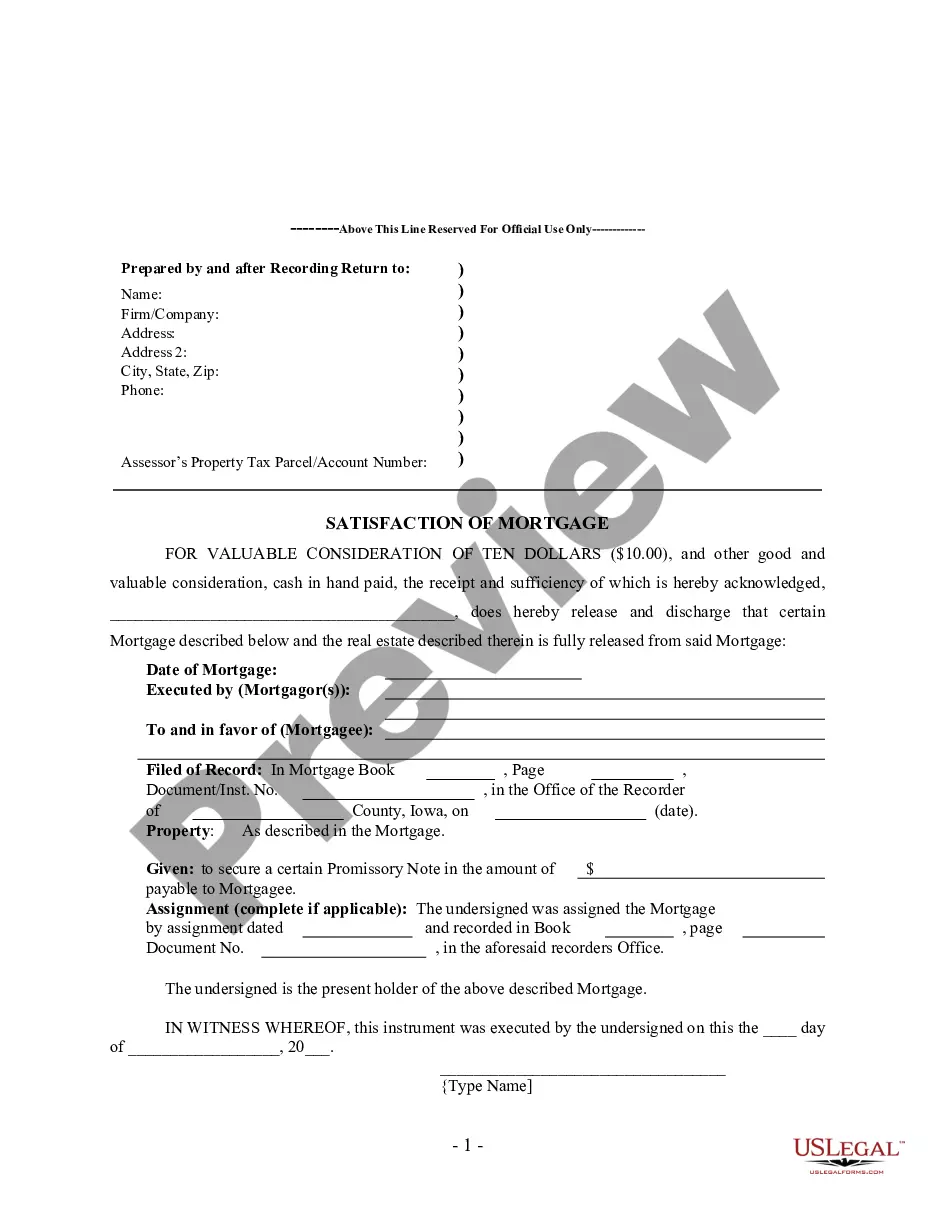

- Preview it (if this option is available) and read the accompanying description to determine if the Bond Claim Sample Format is what you need.

- If you require another form, restart your search.

Form popularity

FAQ

Common bond disputes often arise from disagreements over the scope of work, performance failures, or claims of insufficient documentation. These disputes can create significant delays and stress for all parties involved. Familiarizing yourself with a bond claim sample format can help clarify expectations and responsibilities, reducing the likelihood of disputes. Platforms like US Legal Forms offer resources to help you navigate these challenges effectively.

To write a bond claim letter, start with your contact information, followed by the surety company's details. Clearly state the reason for your claim, including relevant facts and supporting evidence. Reference the bond claim sample format to ensure you include all necessary components. Using a well-structured letter increases the likelihood of a prompt response from the surety.

A bond claim is a legal request made to recover losses incurred when a party fails to fulfill a contractual obligation. This claim is typically directed at a surety bond, which guarantees that the obligated party will complete their duties. Knowing how to navigate a bond claim sample format is crucial for ensuring your claim meets all necessary requirements. This way, you can increase your chances of a successful resolution.

Filling out a bond form involves entering the necessary details, such as the names of the parties, the bond amount, and any specific conditions. It's essential to review the form thoroughly for accuracy before signing. Utilizing a bond claim sample format can guide you through the process, making it easier to understand what information is required. Platforms like US Legal Forms provide user-friendly templates to simplify this task.

An example of a bond claim occurs when a contractor fails to complete a project, leading the project owner to file a claim against the contractor's bond. This claim seeks compensation for financial losses incurred due to the contractor's default. Understanding the bond claim sample format can help you structure your claim effectively. Always ensure you have supporting documents to strengthen your case.

To fill a bond of indemnity form, start by clearly stating the parties involved, including their names and contact information. Next, specify the purpose of the bond and the amount covered. Be sure to include any relevant dates and sign the document. For a reliable bond claim sample format, consider using templates available on the US Legal Forms platform.

A notice of intent to file a claim on a bond is a formal notification sent to the surety company, indicating your intention to pursue a claim. This notice often includes a bond claim sample format, detailing the reasons for the claim and relevant project information. Sending this notice is an important step in the claims process, as it establishes your position and allows for the surety company to prepare for the potential claim. For those seeking clarity, US Legal Forms offers guidance and templates to help you draft an effective notice.

To make a claim on a performance bond, you should first gather all relevant documentation, including the bond itself and any contracts related to the project. Next, prepare your claim by using a bond claim sample format to ensure you include all necessary details. Submit your claim to the surety company, and be sure to keep copies of everything for your records. If you need assistance, platforms like US Legal Forms provide templates and resources to help you navigate this process smoothly.