Bond Claim Letter Example For Construction

Description

How to fill out Bond Claim Notice?

Handling legal documents and tasks can be a labor-intensive addition to your overall day.

Bond Claim Letter Sample for Construction and similar forms typically require you to search for them and comprehend the optimal way to fill them out correctly.

Thus, whether you are addressing financial, legal, or personal issues, possessing a comprehensive and efficient online directory of forms at your disposal will greatly assist you.

US Legal Forms is the leading online platform for legal documents, offering over 85,000 state-specific forms and an array of tools to facilitate the completion of your paperwork effortlessly.

Simply Log In to your account, locate Bond Claim Letter Sample for Construction, and secure it immediately in the My documents section. You can also retrieve previously saved forms.

- Explore the collection of pertinent documents accessible to you with just one click.

- US Legal Forms provides you with state- and county-specific documents available at any time for downloading.

- Protect your document management processes with a high-quality service that enables you to create any form in minutes without additional or hidden fees.

Form popularity

FAQ

Filling out a bond application requires attention to detail. First, gather all necessary information about the project, including the legal names of parties involved and the project location. Then, clearly state the purpose of the bond. For a practical reference, consider reviewing a bond claim letter example for construction as it can guide you through the necessary components of your application.

The purpose of bonding in construction is to protect project owners from financial loss due to contractor failure to complete the work as promised. It acts as a safety net, ensuring that funds are available to hire another contractor if needed. Utilizing a bond claim letter example for construction can help clarify the claims process and ensure all parties are aligned on the bond requirements.

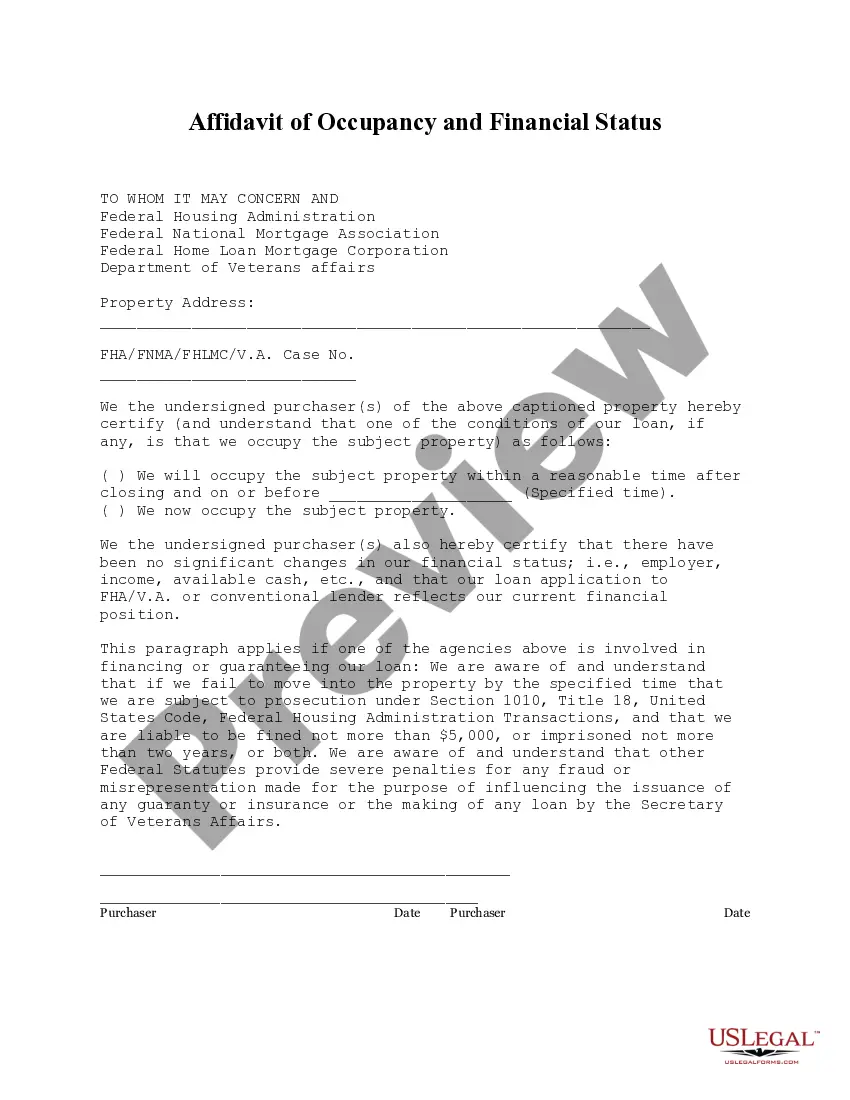

A bonding letter is a formal document provided by a surety company that guarantees payment or performance related to a construction project. It serves as a promise that the contractor will fulfil their obligations. For those needing a bond claim letter example for construction, this document outlines the terms and conditions of the bond, ensuring all parties understand their responsibilities.

To file a claim against a broker's bond, gather all pertinent documents that support your claim. This includes records of transactions and communications. Write a formal bond claim letter, clearly stating the reasons for the claim and referring to any contractual agreements. Once your letter is ready, submit it to the surety company that issued the bond, keeping a copy for your records.

A bonding letter in construction serves as documentation that a contractor is backed by a surety company. This letter assures project owners that the contractor is financially stable and capable of fulfilling the terms of the contract. By understanding the importance of a bonding letter, contractors can enhance their credibility and secure more projects. It's often recommended to have a bond claim letter example for construction as a reference for future claims.

To write a bond claim letter, begin by addressing the correct surety company. Include essential details such as names, project information, and specific breaches of contract. Reference your bond claim letter example for construction to illustrate your point clearly. Conclude with a request for compensation, ensuring that your contact information is easy to find for follow-up.

To write a good claim letter, be clear and concise in your communication. Start with a formal greeting and state the purpose right away. Provide specific details, including dates, amounts, and references to the contract terms. Always end with a call to action or a request for response, making it easy for the recipient to understand the next steps.

An example of a bond claim could involve a contractor failing to complete a project according to the agreed terms. In such a case, the project owner can use a bond claim letter example for construction to file a claim with the surety company. This letter outlines the breach of contract and requests compensation for the financial loss incurred due to the contractor's failure.

To obtain a bond for a construction project, first identify the type of bond you need, such as a performance bond or a payment bond. Next, gather necessary documentation, including financial statements and project details. Once you have your paperwork in order, approach a licensed surety company or an insurance broker. They can assist you in securing the bond, ensuring you meet the requirements.

To prepare a letter of claim, start by clearly stating the reason for the claim. Include important details such as the project name, contract number, and relevant dates. Follow this with a concise explanation of the issue and any supporting documentation, such as a bond claim letter example for construction. Lastly, ensure that you provide your contact information for further discussion.