Project Information Sheet Template

Description

How to fill out Construction Project Information Sheet?

Creating legal documents from the ground up can frequently be daunting.

Certain situations may entail extensive research and significant expenses.

If you’re looking for a simpler and more economical method of preparing the Project Information Sheet Template or any other documents without the hassle, US Legal Forms is continually accessible at your disposal.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can rapidly obtain state- and county-specific forms meticulously prepared for you by our legal experts.

US Legal Forms has established a strong reputation and possesses over 25 years of expertise. Enroll with us today and make document handling straightforward and efficient!

- Utilize our website whenever you require dependable and trustworthy services to swiftly locate and download the Project Information Sheet Template.

- If you're already familiar with our site and have established an account with us, simply Log In, find the template, and download it or access it again later in the My documents section.

- Not signed up yet? No problem. Setting it up and exploring the library only takes a few minutes.

- However, before diving directly into downloading the Project Information Sheet Template, consider these recommendations.

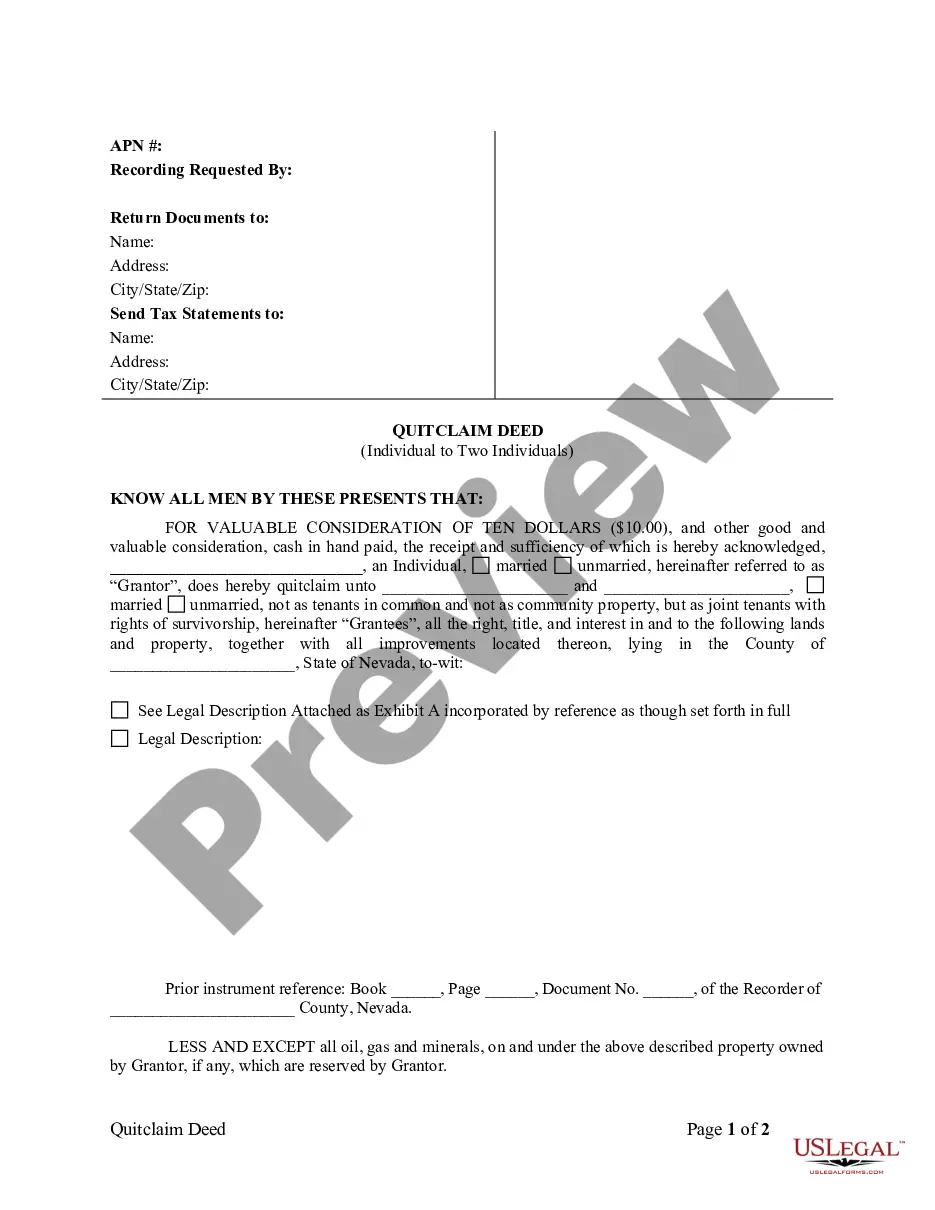

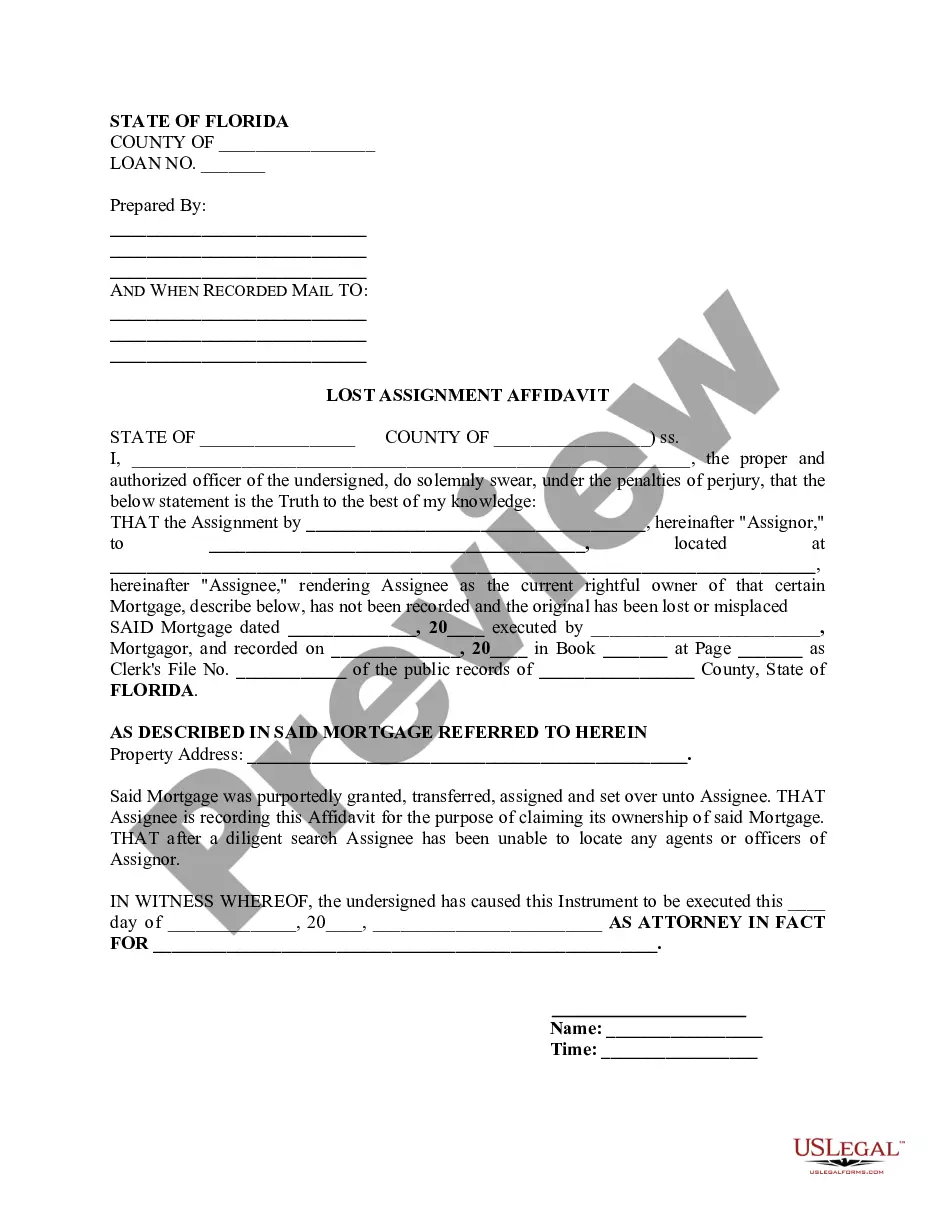

- Review the form preview and descriptions to confirm that you have located the document you need.

Form popularity

FAQ

A project information sheet is a comprehensive document outlining the essential aspects of a project. This sheet provides clarity on objectives, resources, stakeholders, and risk assessments. Using a project information sheet template helps maintain consistency and professionalism across all projects. By having a standard format, everyone involved can stay aligned toward the project goals.

All owners are allocated Refundable Credits for their pro-rata share of Maryland PTET filed and paid on their behalf to be applied against their state-sourced PTE taxable income claimed on their respective Maryland income tax returns.

Hear this out loud PauseBusinesses in Maryland are required to collect Maryland's 6 percent sales tax and or 9 percent alcoholic beverage tax from you whenever you make a taxable purchase.

How to File and Pay Sales Tax in Maryland File online ? Visit the Maryland Department of Revenue's Comptroller's Office. ... File by mail ? You can use Form 202 and file and pay through the mail, though you must file and pay online if your tax liability in the previous year was $1,000,000 or more.

Initially, your sales and use returns are due on a quarterly basis. Depending on the amount of your actual payment, your filing schedule may be changed to monthly, quarterly, bi-annual or annual. The Comptroller's office will notice you in advance of any change in your filing frequency.

Hear this out loud PauseA sales and use tax, withholding tax, admissions and amusement tax or tire recycling fee return that is filed late is subject to a 10 percent penalty and interest at a rate of not less than 1 percent per month.

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

Hear this out loud PauseEvery time you purchase taxable tangible goods or alcoholic beverages, whether in person, over the phone, or on the Internet, the purchase is subject to Maryland's 6 percent sales and use tax on goods and 9 percent alcoholic beverages tax on alcohol if you use the merchandise in Maryland.

Every Maryland pass-through entity must file a return on Form 510, even if it has no income or the entity is inactive. Every other pass-through entity that is subject to Maryland income tax law must also file on Form 510.

Hear this out loud PauseCertificates are renewed every five (5) years. If your organization does not receive a Renewal Notice by June 15, 2022, you may contact Taxpayer Services Division for more information by phone at 410-260-7980 or toll-free 1-800-638-2937 from elsewhere in Maryland, Monday - Friday, a.m. - p.m.