Split Income With Spouse

Description

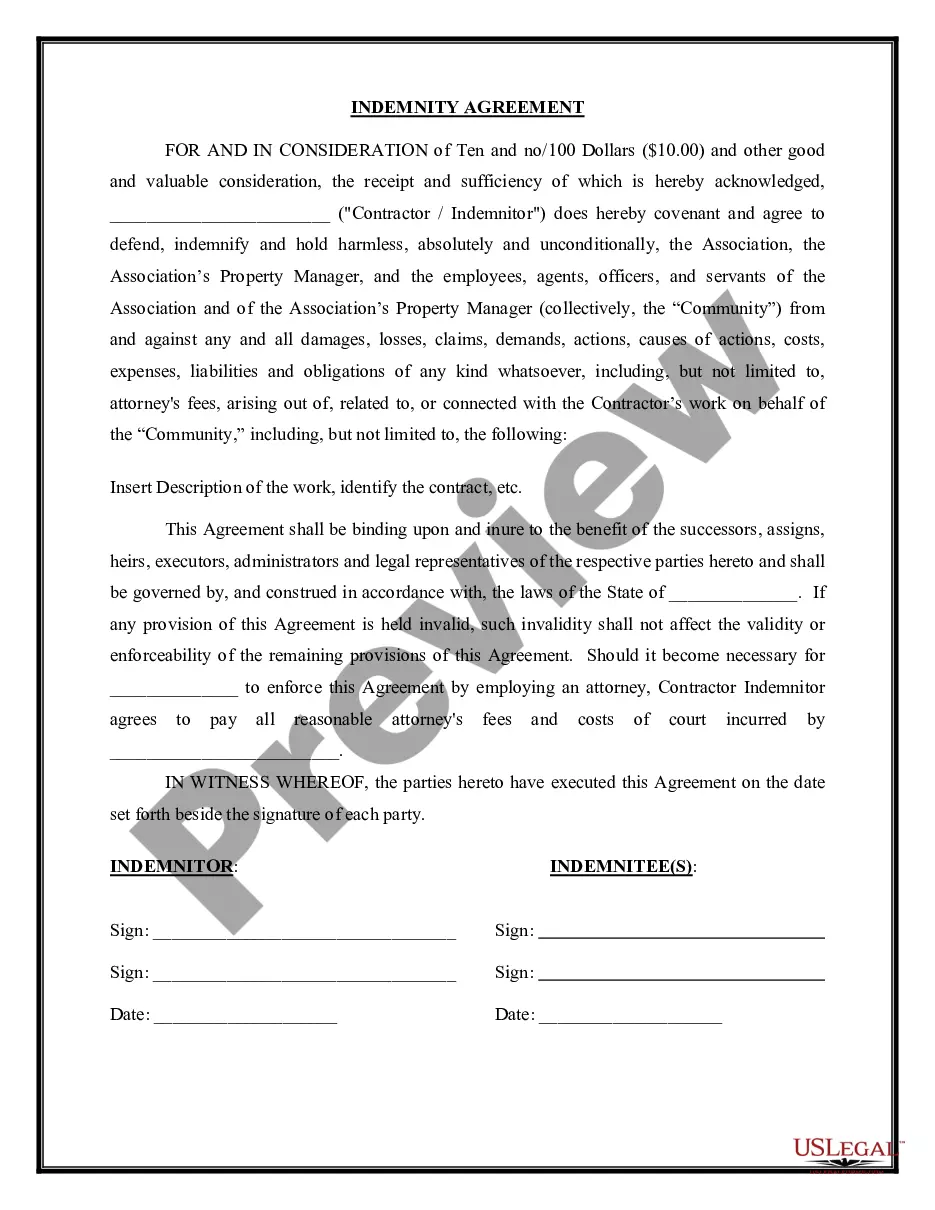

How to fill out Complex Will - Income Trust For Spouse?

Managing legal documentation and processes can be a lengthy addition to the day.

Split Income With Spouse and similar forms frequently necessitate that you search for them and navigate how to finish them effectively.

As a result, if you are handling financial, legal, or personal affairs, using a thorough and accessible online directory of forms at your disposal will be very beneficial.

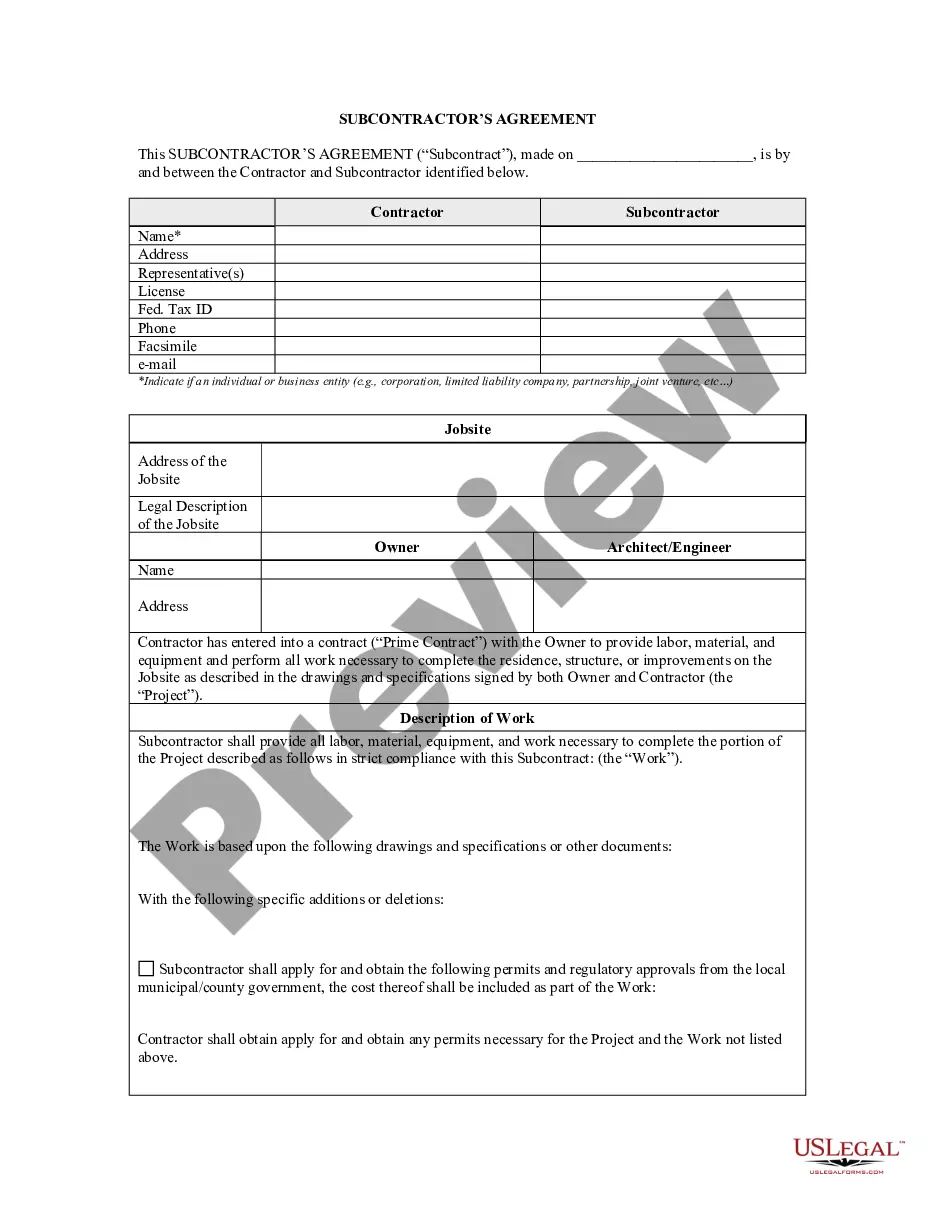

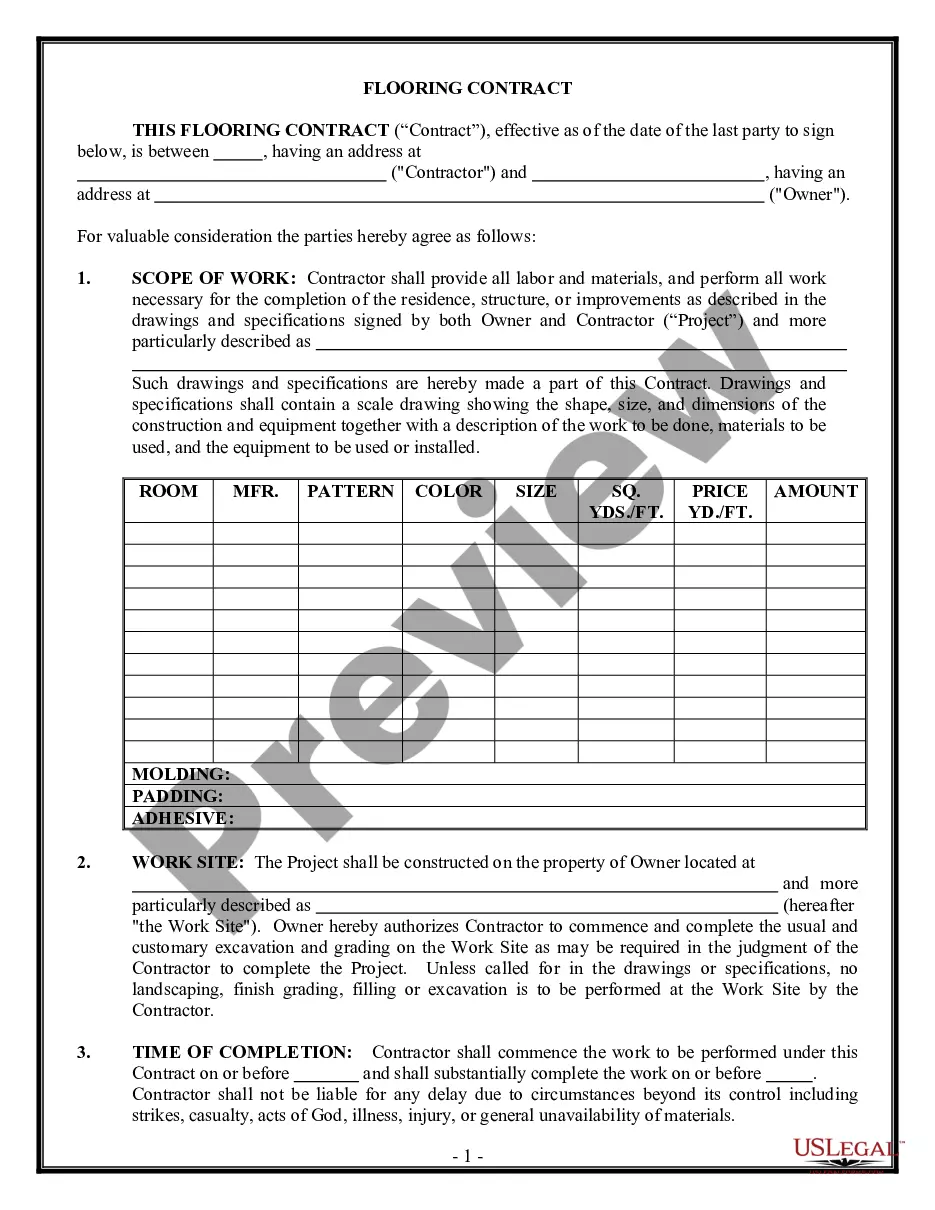

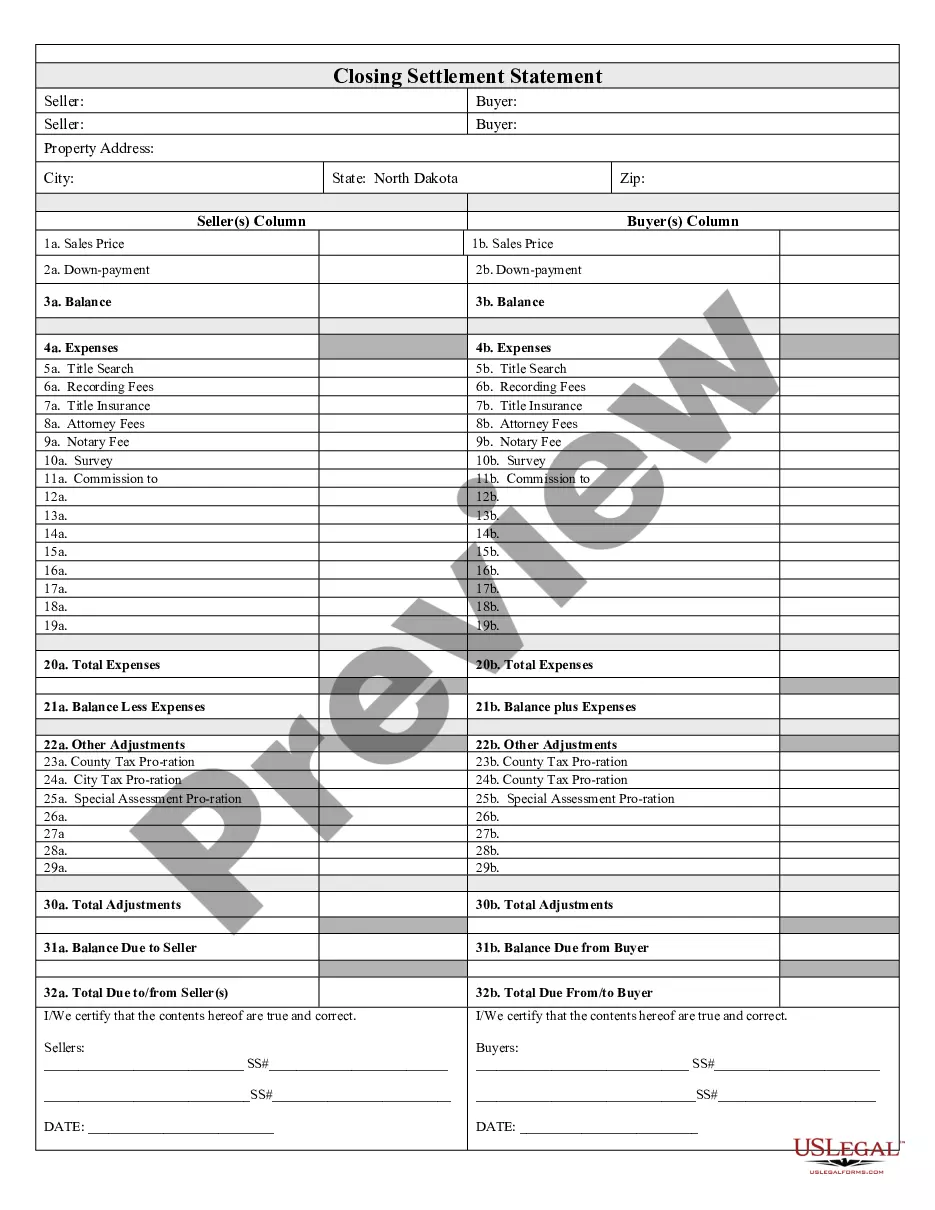

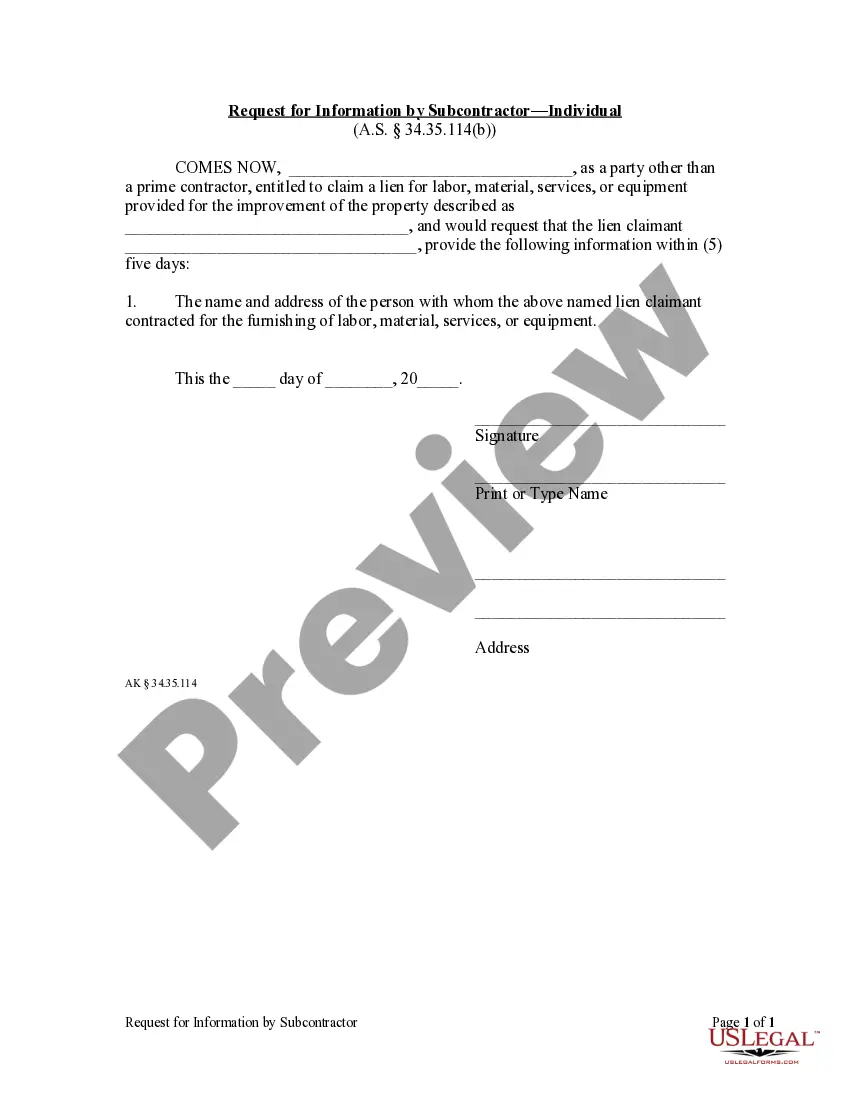

US Legal Forms is the leading online resource for legal templates, offering over 85,000 state-specific documents and a variety of tools to help you complete your paperwork effortlessly.

Is this your first time using US Legal Forms? Sign up and establish your account in just a few minutes to access the form directory and Split Income With Spouse. Then, follow the steps outlined below to complete your form: Confirm you have the correct form by utilizing the Preview feature and reviewing the form details. Click Buy Now when ready, and choose the subscription option that suits your requirements. Select Download, then complete, eSign, and print the document. US Legal Forms has 25 years of experience assisting users with their legal documentation. Locate the form you need today and simplify any process without exerting much effort.

- Browse the collection of relevant documents available with just one click.

- US Legal Forms provides you with state- and county-specific forms available anytime for download.

- Protect your document management tasks by utilizing a premium service that allows you to create any form within minutes without additional or concealed fees.

- Simply Log In to your account, locate Split Income With Spouse, and obtain it instantly in the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Under the married filing separately status, each spouse files their own tax return instead of one return jointly. Instead of combining income, each person separately reports income and deductions.

When it comes to money, couples face a big question: Combine finances, keep them separate or do a combination of both? Now, research finds that those who do pool their money are more likely to stay together.

3 Simple steps First, work out your annual after-tax income and divide by 12 to get a monthly figure. Next, add your individual after-tax incomes (net income) together to calculate a joint income. Now divide each individual's income by this joint income figure and multiply by 100 to get a percentage.

It's as simple as completing the Joint Election to Split Pension Income form when filing both of your tax returns. This allows the higher-income earner to deduct some of their pension income from their own, higher tax bracket income to include it in their spouse's lower tax bracket income.

Make a list of all your combined expenses: housing, taxes, insurance, utilities. Then talk salary. If you make $60,000 and your partner makes $40,000, then you should pay 60 percent of that total toward the shared expenses and your partner 40 percent.